Analysis of the Impact of Geopolitical Risks on Investment Strategies in Latin American Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest reports, on January 3, 2026, the U.S. government launched a military operation against Venezuela and carried out strikes on military and political targets in Caracas. This action has triggered strong reactions in Latin America:

- Brazilian President Lulaposted on social media X: “The bombing of Venezuelan territory and the arrest of its president cross an unacceptable line.” These actions constitute a serious violation of Venezuela’s sovereignty and set an extremely dangerous precedent for the entire international community [1][2][3]

- Other Latin American countriesincluding Colombia, Mexico, and Argentina have also expressed concern and called for an emergency meeting of the UN Security Council [3]

- The U.S. side stated that this operation is the result of months of pressure on the Maduro government, including a series of measures such as a previous $50 million bounty and the seizure of Venezuelan oil tankers [2]

As an important oil-producing country, Venezuela’s situation directly affects the global energy market:

- In November 2025, Venezuela’s oil production reached 1.165 million barrels per day, a 20% year-on-year increase [4]

- U.S. oil blockades against Venezuela have led the country to begin shutting down oil wells [4]

- Despite geopolitical risks, the oil market remained in surplus in 2025, and OPEC+ expects to continue facing oversupply issues in 2026 [4][5]

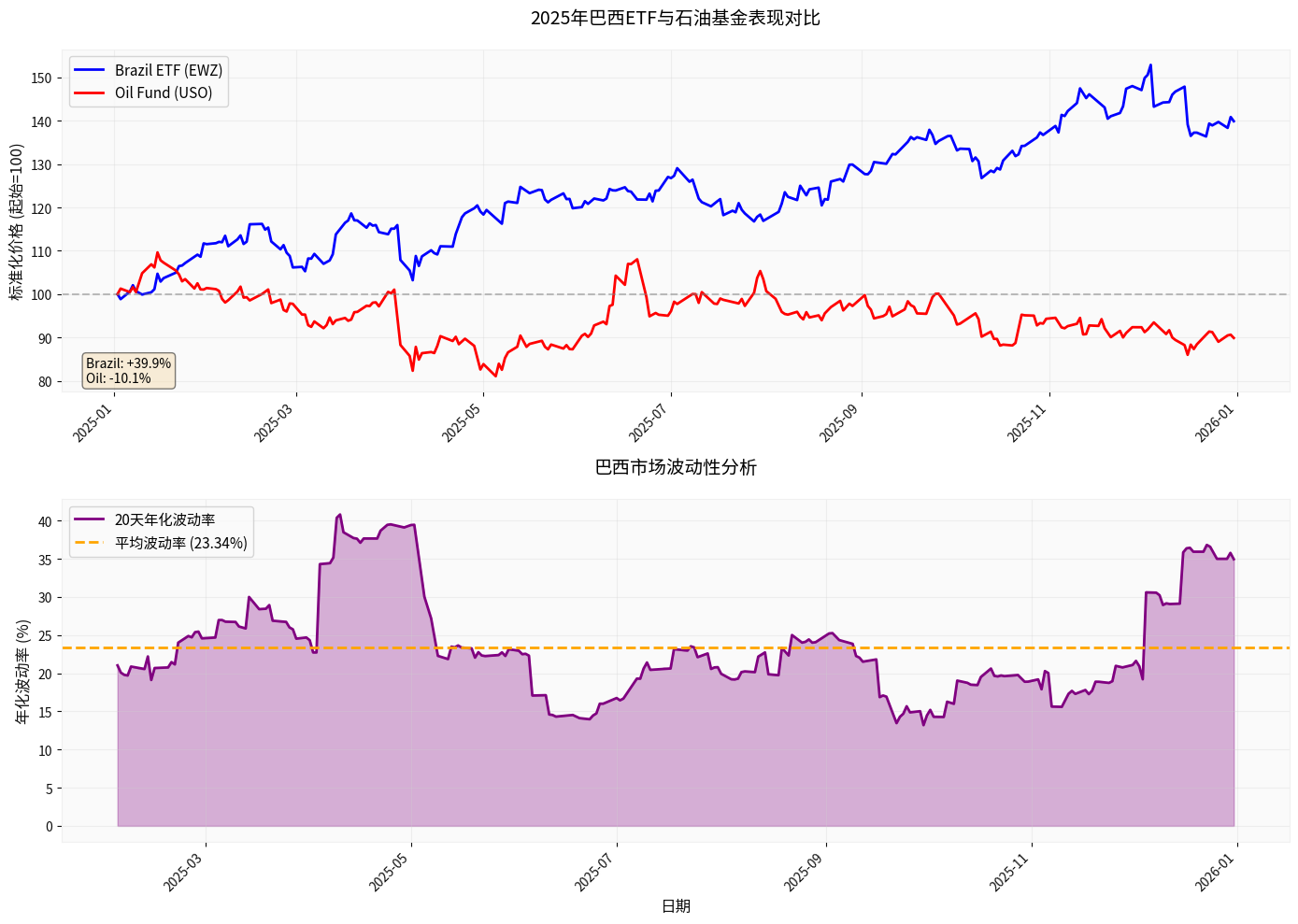

Chart Description: The top chart shows the normalized price trend comparison between the Brazilian ETF (EWZ, blue line) and the oil fund (USO, red line) in 2025. The bottom chart shows the 20-day annualized volatility of the Brazilian market, with an average volatility of 24.36%.

- Annual total return: +39.89%

- Annualized volatility: 24.27%

- Beta value: 1.41 (relative to SPY), indicating high volatility in the Brazilian market

- Current price: $31.77 (as of December 31, 2025)

- Trend: Sideways consolidation, trading range $31.47-$32.29

- Support level: $31.47

- Resistance level: $32.29

- KDJ indicator: Bullish signal

- MACD: Bearish signal

In sharp contrast to the Brazilian stock market, the oil market performed weakly in 2025 [0]:

- Annual total return: -10.10%

- Annualized volatility: 30.72% (higher than the Brazilian market)

- Market status: Oversupply, price fluctuates in the range of $50-$70 [5]

The Latin America 40 ETF (ILF) currently has a price of $30.83 and has performed relatively stably this year, reflecting the overall economic resilience of the region [0].

Escalating geopolitical tensions will lead to:

- Increased market volatility: The current average annualized volatility of the Brazilian market is 24.36%, which may rise further amid intensified geopolitical risks [0]

- Rising risk premium: Investors demand higher risk compensation for Latin American assets, which may put short-term pressure on asset prices

- Volatile capital flows: Geopolitical uncertainty may trigger short-term capital outflows

- Negative impact: Disruptions in Venezuela’s oil production may put pressure on Latin American energy stocks

- Positive impact: If oil supply disruptions lead to higher oil prices, Brazil, as an oil-producing country, may benefit

- Utilities: Currently the best performer (+2.10%), may continue to attract safe-haven funds in an uncertain environment [0]

- Consumer staples: Relatively stable, suitable for defensive allocation

- Reduce risk exposure: Appropriately reduce high-risk exposure to Latin American markets, especially assets directly exposed to geopolitical risks

- Increase hedging tools: Consider using derivatives such as options and futures to hedge downside risks

- Focus on currency hedging: The Brazilian Real may depreciate due to geopolitical pressure; currency hedging is recommended

- Focus on defensive sectors: Increase allocation to defensive industries such as utilities and healthcare

- Opportunities to accumulate on dips: The Brazilian market’s fundamentals remain strong; if geopolitical concerns lead to an overcorrection in the market, it may provide buying opportunities

- Diversified investment: Do not concentrate all funds in a single country; consider diversifying through Latin American regional ETFs such as ILF

- Focus on structural opportunities: Long-term trends such as Brazil’s economic reforms and agricultural and mining exports are not affected by short-term geopolitical factors

- Adhere to a long-term perspective: Geopolitical risks are usually short-term, and the long-term growth potential of Latin American markets still exists

- ESG investment considerations: Geopolitical and governance risks highlight the importance of ESG (Environmental, Social, Governance) factors

- Focus on U.S. election cycles: The October 2025 Brazilian election and changes in U.S. policies may bring new investment opportunities [0]

- Limited trade impact: Brazil’s exports to the U.S. account for a relatively small proportion of its total exports, so the direct economic impact is manageable

- Risk of escalating diplomatic friction: If diplomatic disputes continue to escalate, it may affect bilateral investment agreements and trade negotiations

- Role of multilateral institutions: Multilateral institutions such as the UN and the Organization of American States may play a mediating role

- Risk of overreaction: The market may overreact to geopolitical news, leading to short-term volatility

- Reference from historical experience: Similar geopolitical events have often led to short-term volatility in the past, but long-term impacts are limited

- Monitoring investor sentiment: Closely monitor investor sentiment indicators to find contrarian investment opportunities

- Allocation weight to Latin American markets: 0-5%

- Prioritize U.S. market ETFs (e.g., SPY, VOO) as core allocations

- Increase allocation to safe-haven assets such as bonds and gold

- Allocation weight to Latin American markets:5-10%

- Achieve regional diversification through ILF (Latin America 40 ETF)

- Allocate part of Brazilian stocks in defensive sectors

- Allocation weight to Latin American markets:10-15%

- Accumulate Brazilian ETFs such as EWZ on dips during market panics

- Focus on trading opportunities in cyclical industries such as Petrobras and mining companies in Brazil

- Further developments in U.S. policy toward Venezuela

- Diplomatic responses and positions of the Brazilian government

- Reactions of the UN Security Council and other international organizations

- Volatility of the Brazilian Real exchange rate

- VIX panic index (measures the degree of global market panic)

- Capital flow data (EPFR, etc.)

- Brazil’s inflation rate and central bank policy

- Brazil’s GDP growth data

- Commodity prices (especially iron ore, soybeans, and oil)

Tensions between Brazil and the U.S. over the Venezuela issue

- The high Beta characteristic(1.41) of the Brazilian market makes it sensitive to changes in global risk sentiment [0]

- Rising geopolitical risks usually lead to increased volatility in emerging markets

- Instability in Venezuela as an oil-producing country may affect energy pricesand the regional economy

However, from a

- Brazil’s economy still has solid fundamentals, and the stock market performed strongly in 2025 (+39.89%) [0]

- Geopolitical risks are often short-term eventsand are unlikely to change the long-term growth trajectory of Latin American markets

- The current market valuation is relatively reasonable, with a P/E ratio of 10.85 times [0]

[1] Gilin API Data - Includes real-time quotes, historical price data, technical analysis, and volatility calculations for Brazilian ETFs (EWZ)

[2] Politico - “World leaders largely express concern, some praise, about US capture of Maduro” (https://www.politico.com/news/2026/01/03/maduro-captured-world-reaction-00709580)

[3] Axios - “World leaders denounce U.S. operation to capture Maduro” (https://www.axios.com/2026/01/03/maduro-capture-venezuela-world-leaders)

[4] Yahoo Finance - “Holiday Markets Eye War Risks but Oil Refuses to Break Out” (https://finance.yahoo.com/news/holiday-markets-eye-war-risks-153000144.html)

[5] Bloomberg - “Latest Oil Market News and Analysis” (https://www.bloomberg.com/news/articles/2025-12-29/latest-oil-market-news-and-analysis-for-dec-30)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.