Venezuela-Russia Political Cooperation's Impact on Global Oil Supply and Energy Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest market data and geopolitical information, I will systematically analyze the potential impact of sustained political cooperation between Venezuela and Russia on the global oil supply pattern and energy markets.

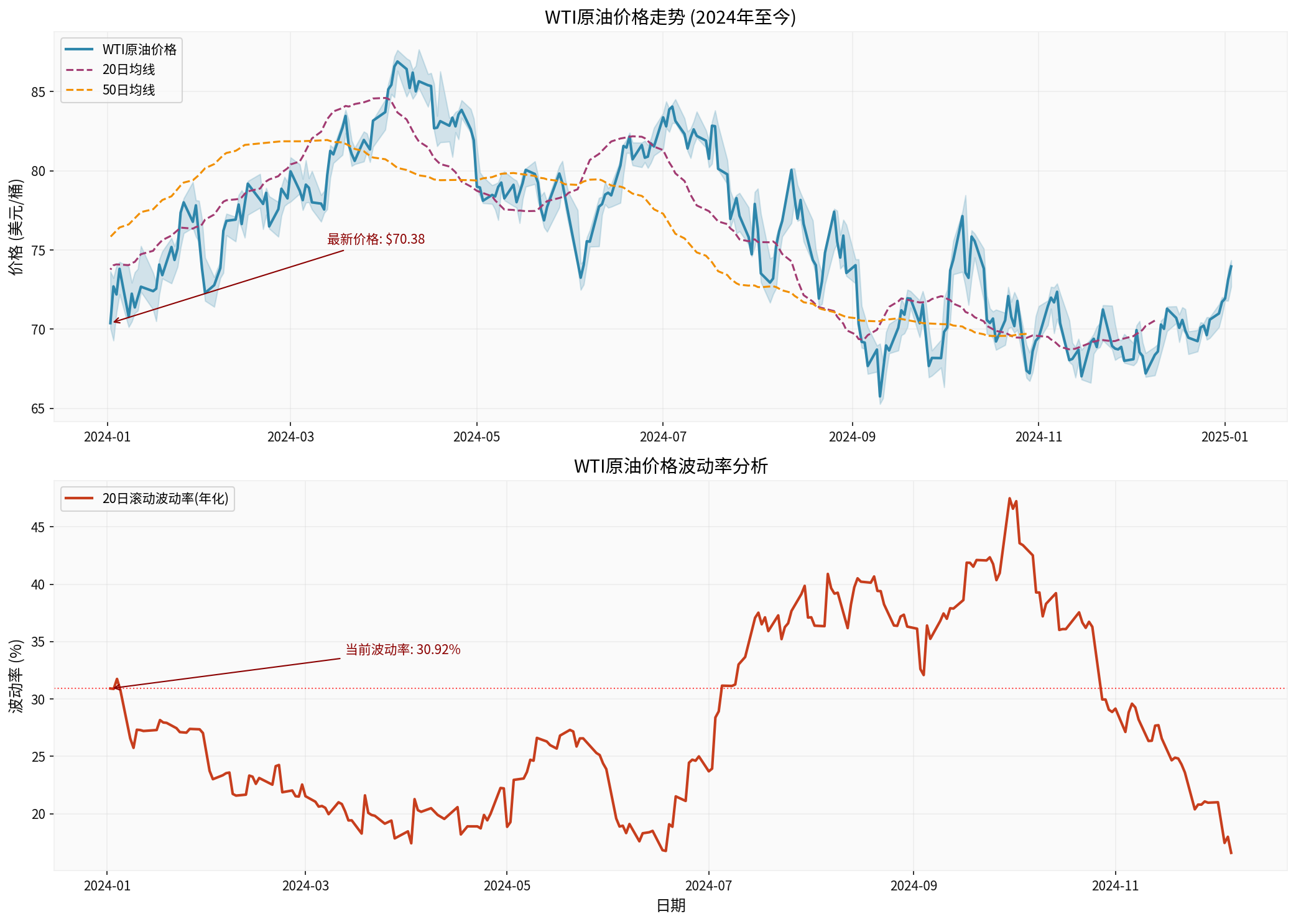

According to the latest market data [0], the WTI crude oil price is $70.38 per barrel, down 4.84% year-to-date. Brent crude has fallen by approximately 18% cumulatively in 2025, marking the largest annual decline since the outbreak of the COVID-19 pandemic in 2020 [1]. The annualized volatility reached 30.92%, indicating significant uncertainty in the market.

The chart shows the WTI crude oil price trend and 20-day rolling volatility since 2024. The latest price is $70.38 per barrel, which has fallen by about 20% from the year’s high of $87.67.

The global oil market was in a state of oversupply in 2025. Both the International Energy Agency (IEA) and the U.S. government predicted that crude oil production would exceed consumption by more than 2 million barrels per day in 2025, and this surplus would further worsen in 2026 [2]. Strong production growth from non-OPEC countries (the U.S., Brazil, Guyana, Argentina) outpaced uneven global demand growth [3].

-

November 2025: Venezuela approved a 15-year extension of oil joint ventures related to Russia, consolidating the long-term cooperation between the two countries in the oil sector [4].

-

December 2025: During the U.S. comprehensive blockade of Venezuela, Venezuelan Vice President Delcy Rodriguez visited Russia to seek support [5]. A sanctioned tanker carrying 300,000 barrels of Russian naphtha entered Venezuelan waters [6].

-

Cooperation Foundation: The oil companies of the two countries (PDVSA and Rosneft) established cooperative relations as early as the late 1990s, and Russia has been an important investor and technical supporter of Venezuela’s oil industry [7].

- Sanction Pressure: Both countries face severe U.S. sanctions and need to cooperate to respond

- Dependence on “Shadow Fleet”: Both rely on informal shipping networks for oil exports

- Heavy Crude Complementarity: The crude oil types of the two countries are similar, with synergies in refining

- Economic Difficulties: Both need oil export revenue to maintain economic operations

According to industry statistics [8]:

- Approximately 40-50% of Russia’s seaborne oil exports are transported via the “shadow fleet”

- In October 2025, about 44% of Russia’s oil exports used shadow fleet tankers

- More than a quarter of the oil transported by sea globally comes from sanctioned countries such as Russia, Iran, and Venezuela

- Enhanced Transport Network Resilience: Cooperation between Venezuela and Russia provides more cargo sources and destination options for the shadow fleet, improving the network’s resilience

- Cost Rise Risk: U.S. law enforcement actions have led to a significant increase in shipping, insurance, and compliance costs. Analysts refer to these increased costs as a “de facto tax” imposed on sanctioned supplies [9]

- Systemic Risk: Since the same tankers, insurance institutions, and intermediary traders are often involved in transportation, disruptions to Venezuelan transportation will also affect Russian oil trade

- The U.S. was once the main buyer of Venezuelan oil, but since the 2019 sanctions were imposed, China has become the main destination [10]

- After Russia’s oil exports were restricted in the European market, they shifted to the Asian market (mainly China and India)

- Cooperation between Venezuela and Russia enables the two countries to coordinate export strategies to avoid excessive competition in the Asian market

- The two countries share logistics networks, refining facilities, and buyer resources, improving market bargaining power

Venezuela’s current oil production is only slightly above 1 million barrels per day, far below the 3.5 million barrels per day in the late 1990s, dropping from 10% of global crude oil production to only 1% [11].

- Underinvestment: Long-term sanctions have led to aging equipment and brain drain

- Technical Barriers: Lack of advanced extraction technology, especially for extra-heavy crude oil

- U.S. Blockade Policy: In December 2025, the Trump administration ordered a comprehensive blockade of all sanctioned tankers entering and leaving Venezuela [12], forcing Venezuela to cut production

- Provide technical support and equipment

- Share experience in evading sanctions

- Joint investment in oil field development

- Venezuela’s current production accounts for a small share of the global market (about 1%), so changes in its production have limited direct impact on global oil prices

- The 2025 phenomenon of “war without price increase” indicates that the market has gradually desensitized to geopolitical risks [13]

- Systemic Risk Premium: If Venezuela-Russia cooperation successfully expands the scale of the shadow fleet and improves efficiency, it may reduce the effect of sanctions, thereby reducing the geopolitical risk premium

- Supply Elasticity: Cooperation between the two countries may improve the resilience of the oil export network and increase the elasticity of global supply

- OPEC+ Coordination: Venezuela is a member of OPEC, while Russia is an important participant in OPEC+, so cooperation between the two countries may affect the policy coordination of OPEC+

- Weaken Venezuela’s oil exports and increase the strategic costs of China, Russia, and Iran [14]

- Force China to switch to more expensive Russian and Middle Eastern oil [15]

- Isolate “hostile forces” in Latin America

- Strengthen bilateral cooperation to jointly respond to sanctions

- Seek support from third parties (such as China and India)

- Develop alternative payment and trade mechanisms

China is the largest buyer of Venezuelan oil, which provides discounted prices for China’s heavy crude oil demand [16].

- If Venezuela’s oil exports are blocked, China will turn to the Russian and Middle Eastern markets at higher costs

- Cooperation between Venezuela and Russia may provide China with more stable and preferential oil supplies

- The U.S. blockade may create negotiation space in U.S.-China diplomacy [17]

- Drivers: Sustained U.S. sanctions and survival needs of the two countries

- Market Impact: Improved efficiency of the shadow fleet, weakened sanctions effect, and diversified oil supply networks

- Price Impact: Geopolitical risk premium decreases, but logistics costs rise; the net effect may be slightly bearish

- Drivers: Strengthened U.S. law enforcement and domestic political changes in the two countries

- Market Impact: Further restricted Venezuelan exports and greater pressure on Russia

- Price Impact: Short-term supply tightness supports prices, but may be filled by other supply sources in the long term

- Drivers: U.S. policy shift and geopolitical detente

- Market Impact: Gradual recovery of Venezuela’s capacity and increased global supply

- Price Impact: Bearish for oil prices, but may take several years

-

Energy Sector: The current energy sector performance is relatively good (+2.0% daily gain) [18], but sustained geopolitical risks and oversupply fundamentals may limit upside space

-

Oil Price Expectation: Analysts predict that oil prices will fluctuate in the range of $50-$70 per barrel [19], and the risk of supply disruptions from Venezuela or Russia will provide support

-

Key Focus Areas:

- Enforcement intensity of the U.S. blockade on Venezuela

- Scale of Russia’s investment in Venezuela’s oil sector

- Operational efficiency and scale changes of the shadow fleet

- Policy adjustments of China in Venezuela’s oil sector

The sustained political cooperation between Venezuela and Russia is reshaping the global oil supply pattern, mainly reflected in:

- Diversification of Supply Networks: The shadow fleet has become an important channel for oil exports from sanctioned countries, enhancing the resilience of global oil supply

- Complexity of Geopolitics: The game between the U.S., China, and Russia in Latin America has intensified, and energy has become an important tool for strategic games

- Increased Adaptability of Market Mechanisms: The market’s sensitivity to geopolitical risks has decreased, and more attention is paid to fundamental factors

- Increased Long-Term Uncertainty: The game between sanctions and anti-sanctions will continue, increasing the uncertainty of the global energy market

Although Venezuela’s current production scale is not enough to directly change the global supply-demand balance, its cooperation with Russia has important strategic significance and may have a profound impact on the global oil trade pattern, price formation mechanism, and geopolitical balance in the next few years.

[0] Gilin API Data - WTI crude oil price and volatility data

[1] Yahoo Finance - “Oil slips as Brent heads for longest stretch of annual losses in 2025” (https://finance.yahoo.com/news/oil-slips-brent-heads-longest-021806745.html)

[2] Jinshi Data - “Global oversupply is hard to solve! Crude oil will end 2025 dismally” (https://xnews.jin10.com/details/205408)

[3] Bloomberg - “Oil Posts Deepest Annual Loss Since 2020 on Surplus” (https://www.bloomberg.com/news/oil-heads-deepest-annual-loss-100329871.html)

[4] Leverage Shares - “U.S. versus Venezuela: The Oil Angle” (https://leverageshares.com/en-eu/insights/u-s-versus-venezuela-the-oil-angle/)

[5] New York Times - “Maduro’s Inner Circle Appears to Survive U.S. Strikes on Venezuela” (https://www.nytimes.com/2026/01/03/world/americas/maduro-venezuela-strikes-delcy-rodriguez.html)

[6] Marine News Magazine - “Sanctioned Naphtha Tanker Enters Venezuelan Waters While Others Reroute” (https://www.marinelink.com/news/sanctioned-naphtha-tanker-enters-533762)

[7] Reuters - “Venezuelan oil industry: world’s largest reserves, decaying infrastructure” (https://www.reuters.com/business/energy/venezuelan-oil-industry-worlds-largest-reserves-decaying-infrastructure-2026-01-03/)

[8] Sina Finance - “Mr. Poison Mushroom: How will the U.S. comprehensive blockade of tankers entering and leaving Venezuela affect Moscow?” (https://finance.sina.com.cn/roll/2025-12-18/doc-inhcfkvi8477594.shtml)

[9] Ibid

[10] Reuters - “Venezuelan oil industry: world’s largest reserves, decaying infrastructure”

[11] El País - “Venezuelan oil, the ultimate prize coveted by the United States” (https://english.elpais.com/international/2025-12-18/venezuelan-oil-the-ultimate-prize-coveted-by-the-united-states.html)

[12] DW - “U.S. seizes another tanker in Venezuela; Venezuela calls it serious international piracy” (https://www.dw.com/zh/美国再在委内瑞拉扣押一艘油轮-委严重国际海盗行为/a-75259011)

[13] Huxiu - “Geopolitical Immunity Era: Why Oil Prices Kept Falling in 2025” (https://www.huxiu.com/article/4821332.html)

[14] BBC Chinese - “Trump’s paramilitary action to blockade Venezuela: Will cleaning up the backyard of Latin America endanger China’s oil supply?” (https://www.bbc.com/zhongwen/articles/cy47zx35lx1o/simp)

[15] Ibid

[16] Ibid

[17] Ibid

[18] Gilin API Data - Sector performance data (2026-01-03)

[19] Jinshi Data - “Global oversupply is hard to solve! Crude oil will end 2025 dismally”

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.