Analysis of the Strategic Intent Behind Tuojing Technology's Acquisition of a 16% Stake in Xinfeng Precision

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the announcement, Tuojing Technology (688072) released an announcement on the evening of December 5, 2025, planning to jointly invest in Ningbo Xinfeng Precision Technology Co., Ltd. with its related party Fengquan Venture Capital [1][2]. Among them, Tuojing Technology intends to acquire RMB 9.9838 million of registered capital in Xinfeng Precision for no more than RMB 270 million, accounting for 16.42% of the registered capital after this round of financing; Fengquan Venture Capital will acquire RMB 1.1093 million of registered capital for RMB 30 million, accounting for 1.82% [1][2]. This transaction constitutes a related-party transaction because Lü Guangquan (Chairman of Tuojing Technology), Liu Jing (Director), and other senior executives of the company serve as limited partners in Fengquan Venture Capital [1].

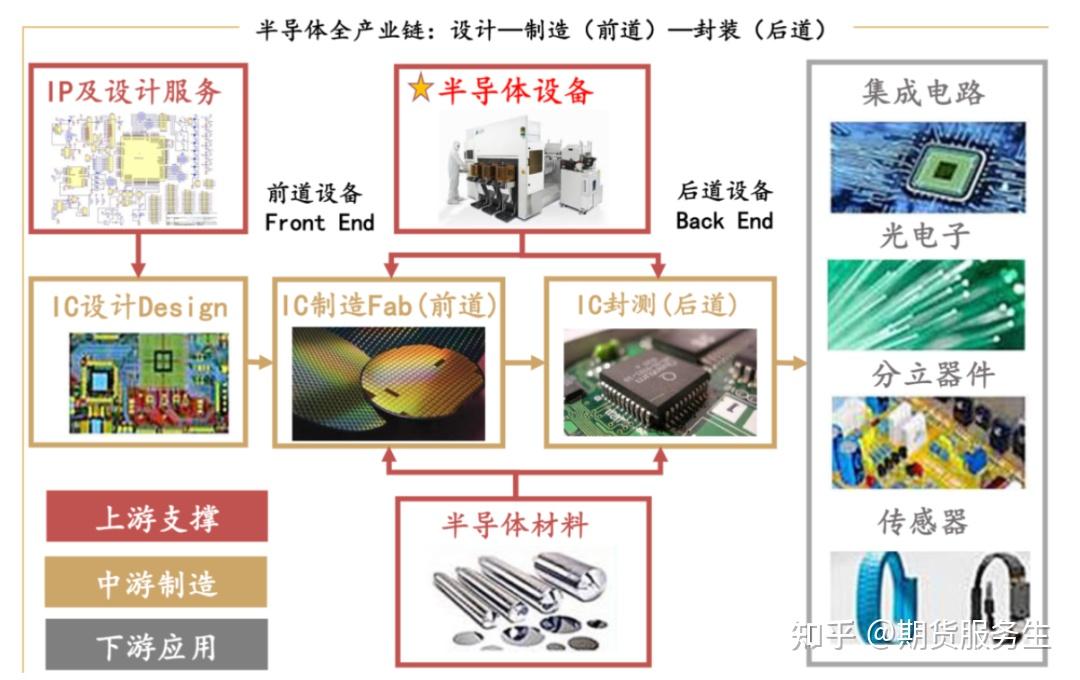

Xinfeng Precision is a semiconductor equipment enterprise focusing on the R&D and production of

From the perspective of financial data, Xinfeng Precision is in the early stage of development: as of the end of the first half of 2025, the company’s total assets were RMB 388 million, but the net asset was a deficit of RMB 8.286 million; in 2024, it achieved revenue of RMB 56.3508 million and a net loss of RMB 30.8849 million; in the first half of 2025, revenue was RMB 15.8657 million and net loss was RMB 7.1851 million [1]. The pre-investment valuation for this investment (for the capital increase part) is RMB 1.8 billion, while the pre-investment valuation for the equity transfer part is RMB 1.566 billion because it does not enjoy special shareholder rights [1].

Tuojing Technology focuses on the R&D and industrial application of

Tuojing Technology stated that this investment aims to “further enhance industrial layout and industrial synergy” [1]. Xinfeng Precision’s thinning and ring cutting equipment form an

According to industry data, the global 3D integration manufacturing market size is expected to grow from USD 22.49 billion in 2023 to USD 98.79 billion in 2028, with a compound annual growth rate (CAGR) of 34% [3]. This rapidly growing market provides huge development space for domestic semiconductor equipment enterprises. Through strategic investment in Xinfeng Precision, Tuojing Technology can better seize this market opportunity and share the industry growth dividends.

Against the background of domestic substitution in the current semiconductor industry, Tuojing Technology’s investment in Xinfeng Precision, which has independent R&D capabilities for core components, helps

Although this investment is a financial investment, the 16.42% shareholding ratio makes Tuojing Technology an important shareholder of Xinfeng Precision, laying the foundation for

The valuation of this investment reflects the market’s recognition of Xinfeng Precision’s technical value and development potential. Although the company is currently in a state of loss, considering the high growth of the 3D integration and advanced packaging equipment track it is in, as well as its core technical capabilities, the pre-investment valuation of RMB 1.8 billion has certain rationality. Tuojing Technology’s acquisition of equity at a lower valuation (RMB 1.566 billion) also reflects its grasp of the current investment timing.

The strategic intent of Tuojing Technology’s acquisition of a 16% stake in Xinfeng Precision is

[1] Phoenix News - Tuojing Technology plans to jointly invest in Xinfeng Precision with related parties to increase semiconductor industry layout (https://i.ifeng.com/c/8oqXIM2jehB)

[2] Sina Finance - Tuojing Technology plans to jointly invest in Xinfeng Precision with related parties (https://finance.sina.com.cn/roll/2025-12-08/doc-inhaarpa3600956.shtml)

[3] Eastmoney.com - Global 3D integration manufacturing market growth forecast data (https://gbres.dfcfw.com/Files/iimage/20251229/B2EF833EB5165D2D8B5075911D1331F8_w639h369.png)

西藏矿业(000762.SZ)深度研究报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.