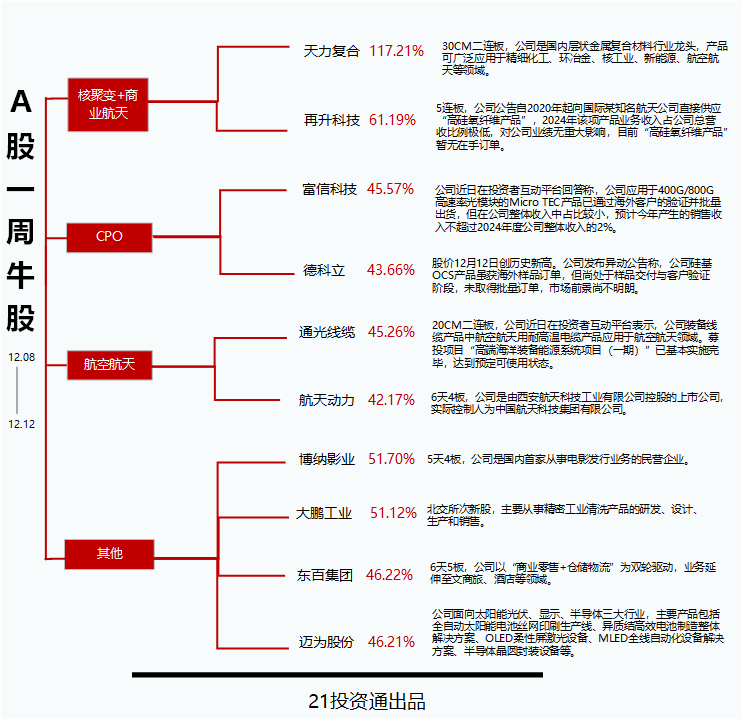

Tianli Composite (920576.BJ) Investment Value Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Tianli Composite is a Beijing Stock Exchange-listed company specializing in the R&D, production, and sales of

- Commercial Aerospace: Key structural material for satellites and rocket engines

- Nuclear Industry: Composite materials for nuclear power equipment, first wall material for fusion devices

- Semiconductor: High-end metal composite materials for chip manufacturing equipment

- New Energy: Applications of corrosion-resistant and high-temperature-resistant materials

Tianli Composite showed significant market heat in 2025:

| Indicator | Data |

|---|---|

| December monthly increase | 142.84%[1] |

| 9-trading-day increase | 194%[2] |

| Full-year cumulative increase | 242.13%[3] |

| Historical highest price | 94.20 yuan (Dec 25)[3] |

Driven by the dual concepts of commercial aerospace and controlled nuclear fusion, the company’s stock became one of the top gainers on the Beijing Stock Exchange in 2025 [1][2][3].

Despite the impressive stock price performance, the company’s fundamentals show a

- Operating revenue: 404 million yuan, down 11.26% year-on-year[2]

- Net profit attributable to parent company: 22.4693 million yuan, down 49.34% year-on-year[2]

The third quarter performance showed a clear recovery; operating revenue and net profit attributable to parent company increased by

Current valuation level deviates significantly from performance:

- Parent company Western Materials’ P/E ratio climbed from 112.33xon Dec 5 to206.49xon Dec 19 [4]

- P/B ratio rose from 3.44x to 5.74x, an increase of 66.9%[4]

Tianli Composite has made substantial progress in its commercial aerospace layout:

- Technical qualification: Participated in drafting the military standard (GJB3797A-2015) “Specification for Titanium-Stainless Steel Explosive Composite Transition Joint Rods for Satellites” [4]

- Supply capacity: As an important part of Western Materials’ subsidiary matrix, it has mass supply capacity for key materials of satellites and rocket engines

- Market background: Commercial aerospace was included in the strategic emerging industry cluster in 2025, and the industry entered a rapid development period [3]

The company’s breakthrough in the nuclear industry is its core value point:

- Project winning: In June 2025, as a consortium member, it won the bid for the first wall heat sink project for internal component transformation of the device of the Institute of Plasma Physics, Chinese Academy of Sciences Hefei Institute of Physical Science [3][4]

- Supply capacity: Currently hasmass supply capacityfor materials related to the first wall of fusion devices [3][4]

- Industry prospect: Controlled nuclear fusion is regarded as the “ultimate energy source”, and the acceleration of commercialization brings long-term demand growth

The company’s layout in the semiconductor field opens up new growth space:

- Demand for high-end metal composite materials for semiconductor equipment continues to grow

- Under the domestic substitution trend, domestic suppliers face development opportunities

-

Clear policy support:

- Commercial aerospace and nuclear fusion are included in the national strategic emerging industry plan

- Domestic substitution policies continue to advance, and the demand for localization of high-end materials is urgent

-

High technical barriers:

- High technical threshold for layered metal composite materials

- Participation in drafting military standards demonstrates leading technical position

- Mass supply capacity means technology and production capacity have been certified

-

Parent company synergy:

- Western Materials supplies niobium alloy materials to SpaceX through Xinuo Xigui (the only supplier in mainland China) [4]

- Tianli Composite is expected to expand international markets via the parent company’s channels

-

Performance fulfillment pressure:

- Current valuation fully reflects expectations; whether performance can be fulfilled is key

- Short-term stock price increase is too large, with correction risk

-

Order confirmation cycle:

- Long order cycle for nuclear power and aerospace projects

- Uncertainty in the commercialization process of cutting-edge projects like fusion devices

-

Intensified market competition:

- More competitors in the high-end metal composite material field

- Technological iteration may affect existing advantages

- Delivery progress of fusion device projects

- Acquisition of new orders in commercial aerospace

- Whether the third-quarter performance recovery trend can continue

- Valuation risk: Current valuation is divorced from fundamentals, with large correction risk

- Performance risk: Order execution is below expectations, and performance continues to decline

- Concept risk: Market sentiment fades, and concept speculation corrects

- Technical risk: Changes in technical routes affect existing advantages

[1] Lanfu Finance - “Lanfu Year-end Data Inventory: All Monthly ‘Monster Stocks’ in 2025 Bought, 10,000 Becomes 27 Billion” (https://emcreative.eastmoney.com/app_fortune/article/index.html?artCode=20251231145027702053640)

[2] Global Tiger Finance - “Tianli Composite Surges 194% in Nine Trading Days, Western Materials ‘Enjoys’ Capital Carnival” (https://caifuhao.eastmoney.com/news/20251218200850392217070)

[3] Securities Times Online - “2025 Beijing Stock Exchange: Technology Empowers Growth, 33 Stocks Double in Price!” (https://stcn.com/article/detail/3566970.html)

[4] 21st Century Business Herald - “Valuation Gap Under the ‘Starlink’ Halo: Western Materials’ ‘Space Dream’ and ‘Performance Difficulty’” (https://www.21jingji.com/article/20251219/herald/e242fcdfc6085b6354413ad2dfc742d8.html)

北方长龙军工复合材料订单增长及国防预算提升影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.