Venezuela's Political Instability: Impact on Oil Prices and Energy Sector Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Recent dramatic developments have fundamentally altered Venezuela’s political landscape. In a significant military operation, the Trump administration has removed President Nicolás Maduro from power, with Maduro now captured[1]. Venezuela’s acting president has extended an invitation for dialogue with the U.S. government[2], while SpaceX’s Starlink has begun offering free internet access to Venezuelans through February 3, 2026[3].

This regime change represents a pivotal moment for global energy markets, as Venezuela holds the

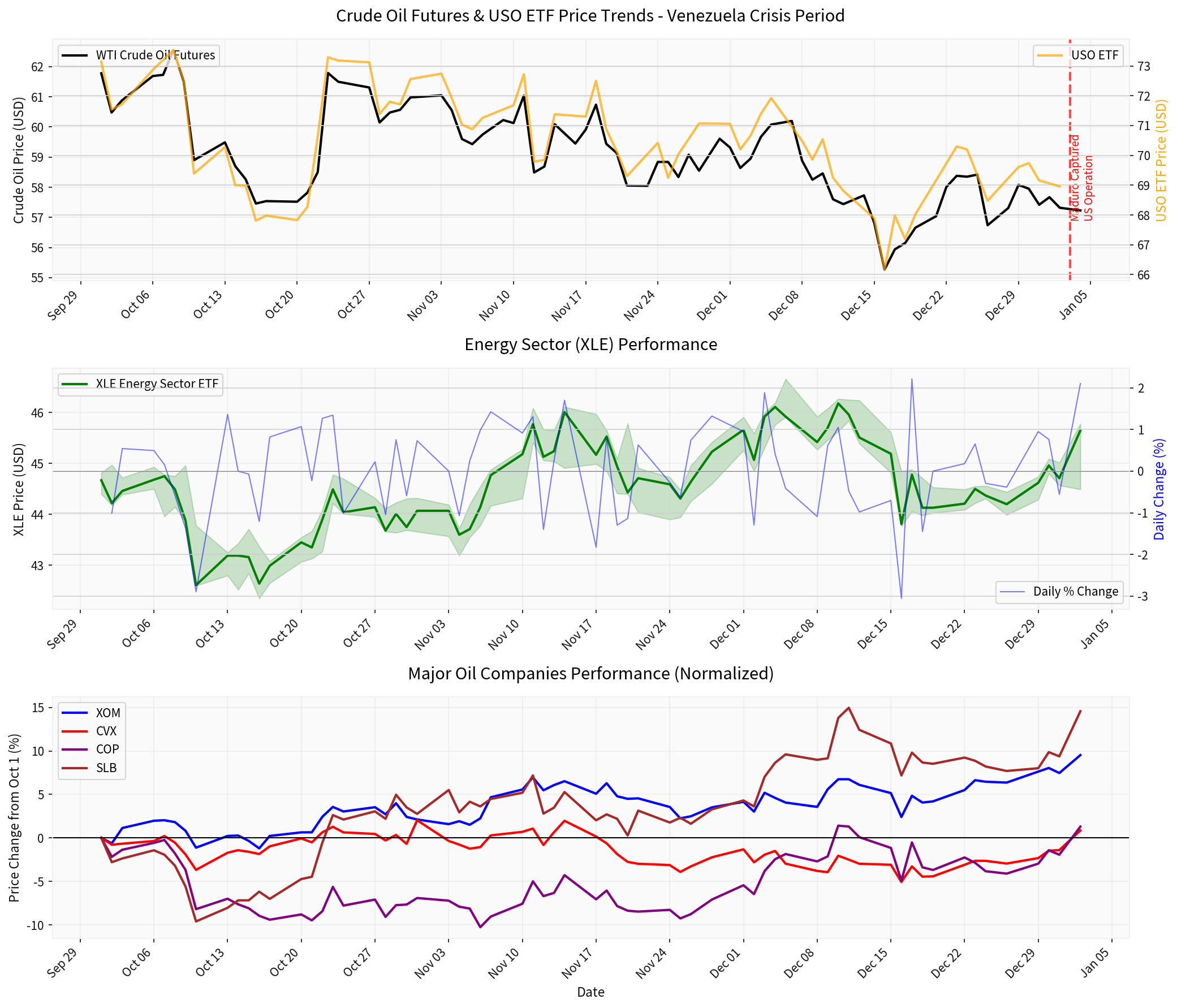

Based on market data[0], crude oil futures have demonstrated notable resilience:

- WTI Crude Oil: Currently trading at $61.78, up 7.95% since October 1, 2025

- USO ETF: Trading at $68.96 (though down 5.72% over the period)

- Price range: $54.98 (low) to $62.92 (high) during the monitoring period

Chart: Crude oil futures and USO ETF price trends (top), XLE Energy Sector performance (middle), and normalized performance of major oil companies (bottom) during the Venezuela crisis period. The red dashed line marks the Maduro capture event on January 3, 2026.

Analysts present competing scenarios for oil prices:

- Rystad Energy warns of “elevated risks of civil unrest and near-term supply disruptions”during the political transition[5]

- OPEC+ has paused production increases for Q1 2026, maintaining December 2025 levels, signaling caution[6]

- Venezuelan exports have already been impacted, with operations halting in some areas[7]

- Allianz Global Investors projects that a pro-Western government could see sanctions eased and attract $80-100 billion in international investment

- This could potentially increase production by 1-2 mbpd over a multi-year horizon, effectively adding a mid-sized OPEC producer to global supply[4]

- Such an increase would “intensify competition among producers and lower energy prices after an initial period of volatility”[4]

The energy sector has demonstrated

- Current Price: $45.65 (+0.94, +2.11% on the day)

- Period Performance (Oct 1 - Present): +2.19%

- 52-Week Range: $37.24 - $47.41

- Market Cap: $27.03 billion

- P/E Ratio: 17.95

- Current Price: $122.65 (+2.31, +1.92% today)

- Period Return: +9.52% since October 1

- Market Cap: $517.24 billion

- 52-Week High: $122.68 (at or near today’s levels)

- Recent News: Analysts suggest ExxonMobil is“positioned for growth with enhanced targets”[8]

- Period Return: +14.56% (best performer among major oil companies)

- This outperformance reflects Schlumberger’s leverage to oilfield services demand recovery

- Period Return: +1.30%

- Exposure: One of three majors (with XOM and CVX) potentially recovering billions in nationalized assets[9]

- Period Return: +0.85%

- Operations: Chevron has maintained limited shipments amid Venezuela tensions[10]

- Notably: Major energy companies“didn’t receive advance notice”of the U.S. operation[11]

- Supply disruption risk: Production could fall further during the transition period

- Volatility: Oil markets may experience significant price swings

- Civil unrest: Potential for internal conflict affecting oil infrastructure

- Risk premium: Energy stocks may trade at elevated multiples due to geopolitical uncertainty

- Sector rotation: Energy’s current outperformance (+2.00%) suggests investor positioning for higher oil prices

- Infrastructure plays: Oilfield services (SLB +14.56%) benefiting from anticipation of production recovery

- Asset recovery: U.S. companies (ExxonMobil, ConocoPhillips, Chevron) may recover billions in previously nationalized assets[9]

- Production recovery: Investment of $80-100 billion could increase Venezuelan output by 1-2 mbpd

- Infrastructure spending: Trump announced plans for “our very large United States oil companies” to“spend billions of dollars, fix the badly broken infrastructure”[11]

- OPEC+ quota constraints: Any production increase requires OPEC+ negotiation, which may limit supply growth[4]

- Commodity price pressure: Additional supply could weigh on long-term oil prices

- Execution risk: Rebuilding Venezuela’s oil infrastructure faces significant technical and financial challenges

| Metric | Current Valuation | Interpretation |

|---|---|---|

| XLE P/E Ratio | 17.95x | Reasonable relative to market |

| USO P/E Ratio | 20.87x | Slightly elevated, reflecting volatility premium |

| XOM P/E Ratio | 17.83x | Attractive for quality large-cap |

| XLE vs. S&P 500 | Outperforming | Energy leading market rotation |

- Maintain selective exposure: Focus on high-quality integrated majors (XOM, CVX) with balance sheet strength and diversification

- Consider oilfield services: Schlumberger’s 14.56% outperformance demonstrates the leverage to production recovery

- Monitor OPEC+ decisions: February 1, 2026 OPEC+ meeting will be critical for production quota negotiations[6]

- Watch for asset recovery announcements: Specific developments on compensation for nationalized assets could be catalysts

- Hedge oil price exposure: Consider options strategies given the binary outcome scenarios

- Diversify across energy subsectors: Balance between integrated majors, independents, and services

- Maintain liquidity: Geopolitical events can create both opportunities and rapid drawdowns

Venezuela’s political instability and subsequent regime change represents a

The market’s initial reaction—energy stocks rising 2.0% as the second-best performing sector—suggests investors are positioning for a

- OPEC+ meeting on February 1, 2026 (production quotas)[6]

- Progress on U.S. oil company asset recovery[9]

- Signs of civil unrest or supply disruptions

- Infrastructure investment announcements

Investors should maintain

[0] 金灵API数据 (Market data, price quotes, sector performance, chart analysis)

[1] Bloomberg - “Big Take: What Maduro’s Ouster Means for World Economy” (https://www.bloomberg.com/news/audio/2026-01-05/big-take-what-maduro-s-ouster-means-for-world-economy-podcast)

[2] New York Times - “Venezuela’s acting president calls for dialogue and ‘coexistence’ with the U.S.” (https://www.nytimes.com/live/2026/01/04/world/trump-us-venezuela-maduro/venezuelas-acting-president-calls-for-dialogue-and-coexistence-with-the-us)

[3] CNBC - “Elon Musk’s Starlink offers free internet access in Venezuela” (https://www.cnbc.com/2026/01/05/elon-musk-spacex-starlink-free-internet-venezuela-us-raid-maduro.html)

[4] Allianz Global Investors - “Venezuela instability: market implications” (https://www.allianzgi.com/en/insights/outlook-and-commentary/venezuela-instability-market-implications)

[5] Reuters - “Oil prices likely to move higher on Venezuelan turmoil” (https://www.reuters.com/business/energy/oil-prices-likely-move-higher-venezuelan-turmoil-ample-supply-cap-gains-2026-01-04/)

[6] TASS - “Eight OPEC+ countries discuss oil production plan” (https://tass.com/economy/2068489)

[7] GuruFocus - “Chevron (CVX) Operations Halt as Venezuela’s Oil Exports Grind to a Halt” (https://www.gurufocus.com/news/4093509/chevron-cvx-operations-halt-as-venezuelas-oil-exports-grind-to-a-halt)

[8] GuruFocus - “Exxon Mobil (XOM) Positioned for Growth with Enhanced Targets” (https://www.gurufocus.com/news/4093491/exxon-mobil-xom-positioned-for-growth-with-enhanced-targets)

[9] Forbes - “Trump To Help Oil Companies ‘Take Back’ Some Of The Billions Venezuela Owes Them” (https://www.forbes.com/sites/christopherhelman/2026/01/04/trump-to-help-oil-companies-take-back-some-of-the-billions-venezuela-owes-them/)

[10] GuruFocus - “Chevron (CVX) Continues Limited Oil Shipments Amid Venezuela Tensions” (https://www.gurufocus.com/news/4093497/chevron-cvx-continues-limited-oil-shipments-amid-venezuela-tensions)

[11] Yahoo Finance - “Chevron and Other Energy Companies Didn’t Receive Advance Notice, Sources Say” (https://finance.yahoo.com/m/54cfcaa4-3f74-39a4-be80-c6c5e4d90d2c/chevron-and-other-energy.html)

双重驱动因素对亚洲外汇市场的系统影响分析与配置策略

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.