Kelun Pharmaceutical (002422) Investment Value Analysis of the RMB 35 per Share Repurchase Plan

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

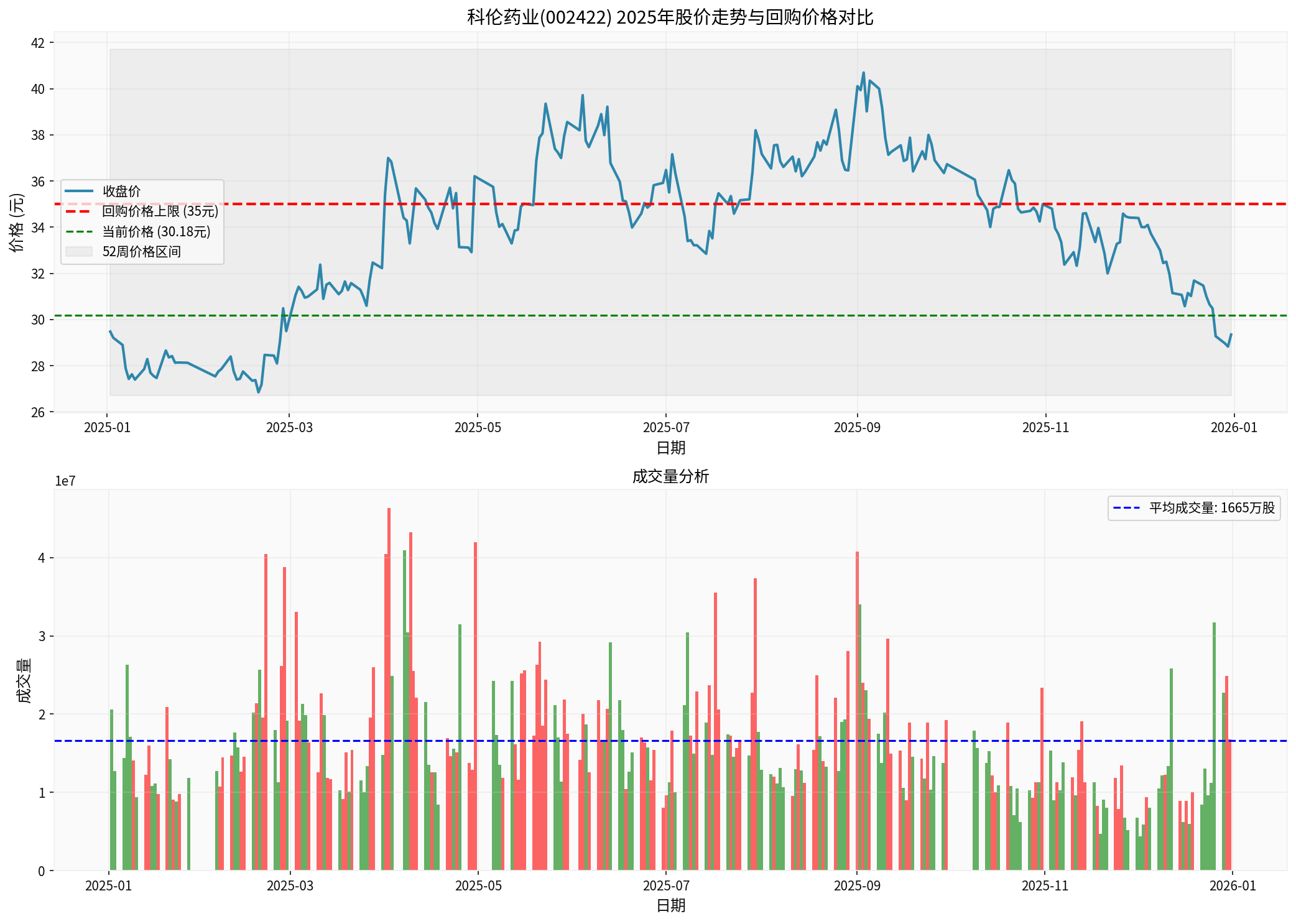

Based on brokerage API data [0], the key elements of Kelun Pharmaceutical’s share repurchase plan are as follows:

| Item | Content |

|---|---|

Repurchase Amount |

RMB 50 million - 100 million |

Maximum Repurchase Price |

RMB 35.00 per share |

Current Share Price |

RMB 30.18 |

Premium Space |

15.97% |

Purpose |

Employee Stock Ownership Plan or Equity Incentive |

Based on 2025 full-year transaction data [0]:

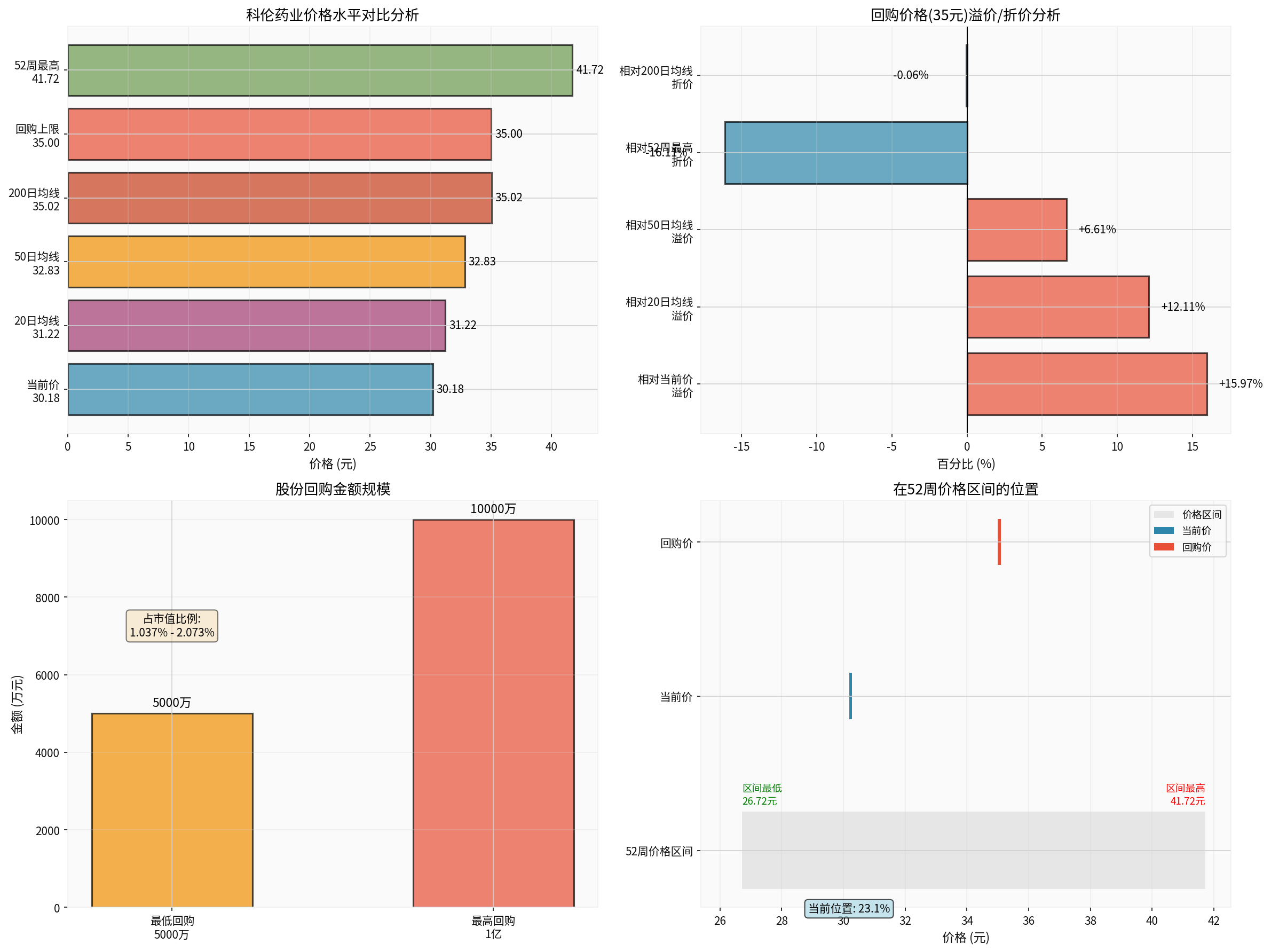

- 52-Week Price Range: RMB 26.72 - 41.72

- Current Price Position: 23.1% (at a relatively low position in the 52-week range)

- Repurchase Price Position:55.2% (at a medium to upper position in the 52-week range)

| Comparison Indicator | Price | Relationship with Current Price of RMB 30.18 |

|---|---|---|

| 20-day MA | RMB 31.22 | Current price is below the 20-day MA |

| 50-day MA | RMB32.83 | Current price is below the50-day MA |

| 200-day MA | RMB35.02 | Repurchase price is roughly equal to the200-day MA |

Technical Trend |

- | Sideways consolidation, no clear direction |

###3. Risk-Reward Ratio Calculation (Tool Data [0])

- Upside Potential: Up to the repurchase price of RMB35, potential gain of +15.97%

- Downside Risk: Down to the52-week low of RMB26.72, potential loss of -11.46%

- Risk-Reward Ratio:1.39 (For every unit of downside risk taken, there is approximately1.39 units of upside potential)

###4. DCF Valuation Reference (Explanation and Qualitative Reminder)

- Scenario valuation using DCF model as of Dec31,2024 [0]:

- Conservative Scenario: RMB96.81 (+220.8%)

- Base/Neutral Scenario: RMB208.99 (+592.5%)

- Optimistic Scenario: -RMB1,431.01 (-4,841.6%)

- Important Note: The above DCF is based on historical data and hypothetical deductions, mainly used for reference in qualitative trends and long-term growth space; since the base valuation is significantly higher than the realized price in2025, this result should not be directly used as an anchor for the “current fair value” in the late2025 period, nor can it be used to assert that the “market is significantly undervalued”. Specific valuation still needs to be comprehensively judged in combination with the latest financial, industry, and macroeconomic environments.

###5. Cross-Sectional Perspective of Valuation Multiples (Tool Data [0])

- P/E Ratio (TTM):28.96x

- P/B Ratio (TTM):2.03x

- ROE (TTM):7.17%

- Judgment: In the pharmaceutical manufacturing industry, with an ROE of about7% and a P/E ratio of about29x, the valuation is relatively expensive; the P/E ratio corresponding to the RMB35 repurchase price is about33.7x, with average valuation attractiveness, requiring comprehensive assessment in combination with fundamentals and growth expectations.

###1. Repurchase Scale and Impact Scope (Tool Calculation [0])

- Calculated based on the current price of RMB30.18:

- Minimum repurchase of RMB50 million: approximately1.6567 million shares

- Maximum repurchase of RMB100 million: approximately3.3135 million shares

- Equity Proportion:

- From the perspective of repurchase amount as a percentage of total share capital, it accounts for approximately0.625%of total share capital (estimated based on the RMB100 million upper limit)

- From the perspective of repurchased shares as a percentage of total share capital (for cancellation or employee incentives), the dilution at the total share capital level is approximately1.04%–2.07%

- From the perspective of repurchase amount as a percentage of total share capital, it accounts for approximately

- Cash Flow Impact:

- Financial analysis shows that the company’s cash flow is healthy [0], with a current ratio of 2.02 and a quick ratio of1.68; the RMB50 million -100 million repurchase has limited impact on overall liquidity

- Q32025 single-quarter performance was below expectations (both EPS and revenue were lower than consensus expectations) [0]; it is recommended to pay attention to the repair progress in subsequent quarters and the rhythm of expense investment

###2. Long-Term Value Boost Pathways (Qualitative Framework, Non-Quantitative Prediction)

- Equity incentives/employee stock ownership help bind the interests of the core team and improve long-term operational efficiency

- Reminder: The incentive effect highly depends on the design of exercise/unlocking conditions and the implementation of corporate governance; there are large differences between historical and industry cases, and linear extrapolation to Kelun Pharmaceutical is not possible

- If the company’s fundamentals (such as profit growth rate, product pipeline, order/capacity recovery, etc.) improve, combined with the repair of market sentiment, there may be room for valuation repair

- Reminder: The current P/E and P/B ratios indicate that the valuation is not low, and the fact that the DCF base valuation is higher than the actual price reflects more differences in models/assumptions; it should not be directly used as evidence of “market undervaluation”; continuous tracking of business implementation and policy environment is required

- The repurchase itself conveys management’s confidence in the company’s prospects, but against the background of limited scale (capital investment of approximately0.625% of market value), the marginal impact on liquidity and price is relatively mild

- Continuously pay attention to subsequent supporting measures such as whether to expand repurchase, dividend distribution, or capital expenditure optimization

- In the pharmaceutical industry, the impact of incentive plans on long-term value varies significantly; comprehensive assessment in combination with corporate governance, strategic execution, and industry cycle is required, and history does not guarantee the future

- Price Position: Current price is at a relatively low position in the52-week range, with an upside potential of approximately16% to the repurchase price and a risk-reward ratio of about1.39

- Financial Stability: Cash flow and short-term solvency indicators are good [0]

- Industry Track: Pharmaceutical manufacturing has long-term demand support

- Valuation Level: Current valuation (P/E≈29x) is not cheap; valuation repair requires profit growth or industry prosperity improvement

- Performance Verification: Q32025 performance was below expectations; need to track subsequent quarter repair [0]

- Policy Risk: The pharmaceutical industry is greatly affected by policy disturbances

- Incentive Effect: Depends on plan design and implementation; historical cases do not guarantee results

- Value Investors: It is recommended to wait for a better valuation safety margin (lower P/E or clearer performance inflection point signal)

- Growth Investors: May consider allocating under position control, combining the company’s pipeline/order progress and industry prosperity, and closely tracking the rhythm of performance realization

- Risk Preference: The RMB35 repurchase price provides a reference for a phased upper limit of approximately16%, but it is recommended to dynamically assess in combination with valuation and performance rhythm

- There is certain room from the perspective of price position and risk-reward ratio, but both valuation multiples and DCF scenarios suggest that cost-effectiveness needs to be weighed

- Equity incentives help bind interests, but the effect depends on condition design and implementation; comprehensive assessment in combination with fundamental improvement and industry environment is required

- Against the background of relatively limited repurchase scale, long-term value depends more on the evolution of the company’s fundamentals and industry trends

- This report uses public data and model tools for scenario reference; historical and industry cases do not represent inevitable results; investment decisions should be made in combination with one’s own risk tolerance and more dimensional information, and professional advisors should be consulted

[0] Gilin AI Data (Brokerage API)

- Real-time quote: RMB30.18 (Jan5,2026)

-52-week price range: RMB26.72–41.72 (2025) - Technical analysis (Oct1 to Dec31,2025)

- Financial analysis (2020–2024 fiscal years)

- DCF scenario valuation (based on Dec31,2024)

- Q32025 performance (both EPS and revenue were below consensus expectations)

- Price statistics, repurchase scale and equity proportion calculation (based on tool data)

- The data and model results cited in this report have assumptions and timeliness, and do not constitute investment advice

- The pharmaceutical industry is greatly affected by policy and market environment; historical cases do not guarantee future performance

- Investors should make independent judgments based on their own situation and bear corresponding risks

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.