Impact Analysis of the Proposed Up-to-3% Share Reduction by a Shareholder of Yinbang Co., Ltd. (300337.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the obtained data and research, I will systematically analyze the impact of a shareholder’s proposed up-to-3% share reduction on a small-cap GEM (Growth Enterprise Market) stock.

- Shareholder Conducting Reduction: Huaibei Public Utility Asset Operation Co., Ltd. (a shareholder holding more than 5% of the company’s shares)

- Reduction Quantity: No more than 24,658,100 shares, accounting for3%of the total share capital

- Reduction Method: 1% via concentrated bidding transactions + 2% via block transactions

- Reduction Period: January 28, 2026 to April 27, 2026 (3 months)

- Reason for Reduction: Self-funded capital needs [0]

| Indicator | Value | Assessment |

|---|---|---|

| Current Stock Price | RMB 17.45 | Skyrocketed +7.72% today |

| Market Capitalization | RMB 14.34 billion | Mid-small cap on GEM |

| P/E Ratio (TTM) | 1180.60x | Extremely High Valuation |

| P/B Ratio | 8.18x | Relatively High |

| Gain in the Past Month | +54.29% | Short-term Skyrocketing |

| Gain in the Past 3 Months | +68.93% | Substantial Increase |

| 5-Year Cumulative Gain | +205.60% | Long-term Strong Trend |

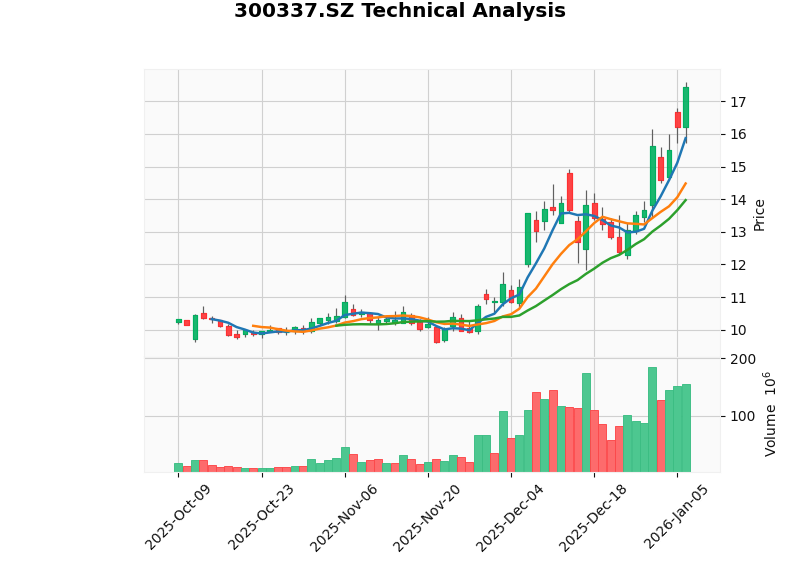

- Trend Status: Uptrend (to be confirmed), today is a breakout day

- KDJ Indicator: K value 83.1,has entered the overbought zone

- Resistance Level: RMB 17.59 (today’s highest price has touched this level)

- Support Level: RMB 14.48

Based on financial analysis data [0]:

- 2024 Operating Revenue: RMB 5.352 billion (YoY growth of 20.10%)

- 2024 Net Profit Attributable to Parent Company: RMB 57.6901 million (YoY decrease of 10.54%)

- Asset-Liability Ratio: 71.66% (a significant increase from 61.19% in 2022)

- ROE (Return on Equity): Only 0.71%,Weak Profitability

- Net Profit Margin: 0.20%,Extremely Low Profit Margin

Based on research data on GEM and STAR Market [1]:

- Average reduction ratio of major shareholders on GEM: 1.48%

- Average reduction ratio of major shareholders on STAR Market: 1.65%

- Yinbang Co., Ltd.'s 3% reduction is significantly higher than the market average

Based on research from CITIC Construction Investment Securities [2]:

| Time Window | Relative Index Performance | Probability of Outperforming |

|---|---|---|

| 1 Month After Announcement | Underperformed the CSI 300 Index by 24.5 percentage points |

Only 37% |

| 2 Months After Announcement | Underperformed the CSI 300 Index by 25.3 percentage points |

Only 38% |

For constituent stocks of the CSI 1000 (small-cap stocks), the average underperformance against the CSI 1000 Index is about 2-3 percentage points in the month after the reduction announcement [2].

Based on research from Haitong Securities [2]:

- Impact Cycle of Reduction News: Approximately14 calendar days(2 weeks)

- The excess returns of both share increase and reduction stock portfolios peak on the 14th day

- After two weeks, the impact of the reduction newsdiminishes significantly

Research indicates [1]:

- **\

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.