Risk Analysis of Leadrive Technology's Business Model with 94% Customer Concentration

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the information obtained, I will provide you with a detailed analysis of the business model risks of Leadrive Technology with a 94% customer concentration.

The company’s main products include:

- Motor Controllers

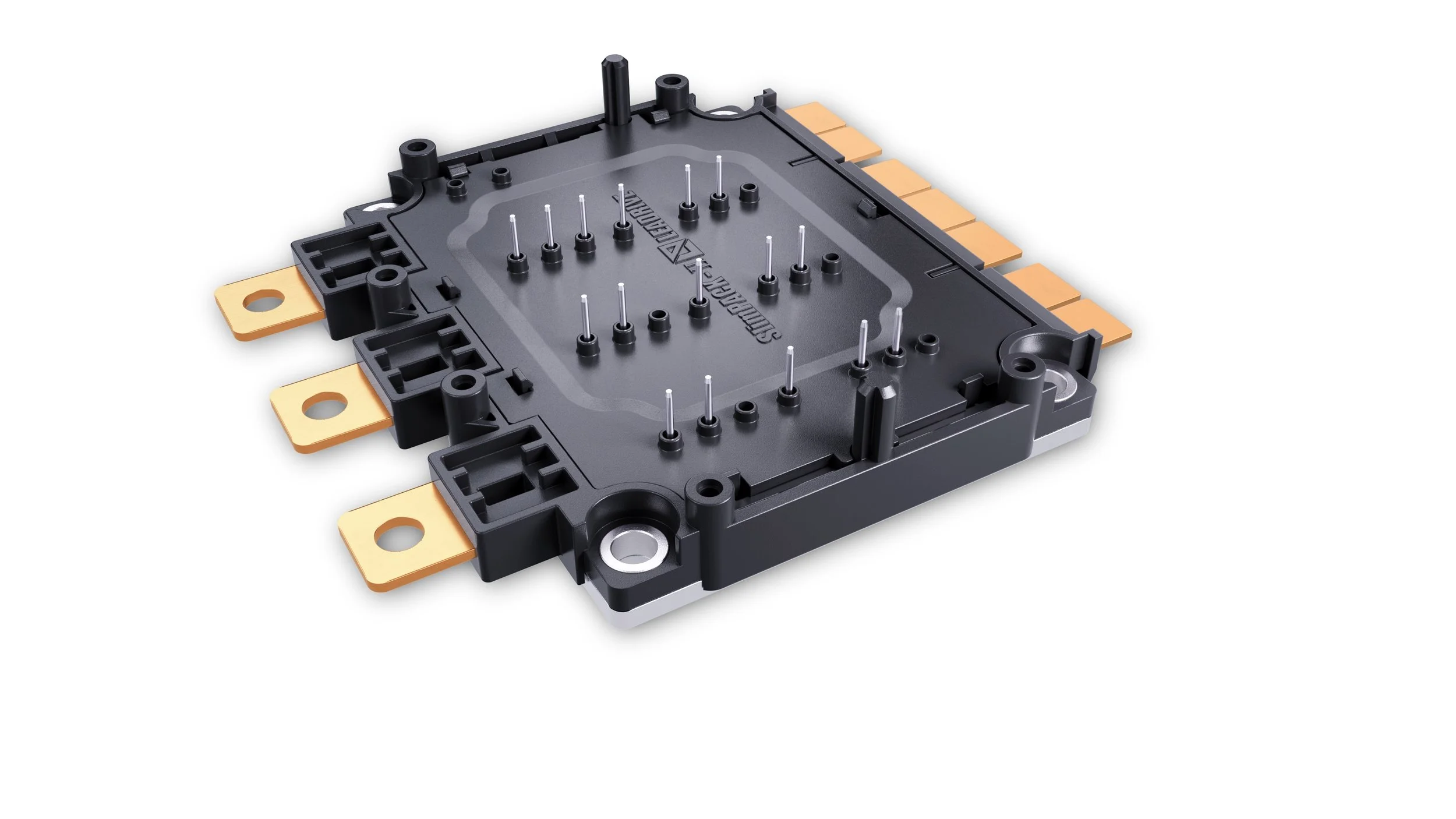

- Power Semiconductor Modules

- Electric Drive System Solutions

Its products have been matched with dozens of mainstream domestic and foreign vehicle models, and are sold in markets such as China and Europe. The cumulative shipments of motor controllers exceed 1 million units, and power modules exceed 2.7 million pieces[2].

According to search results, Leadrive Technology’s sales to its top few customers account for as high as 94% of total revenue, which means the company’s revenue is heavily dependent on a small number of customers. Such a highly concentrated customer structure is somewhat common in the new energy vehicle electronic control industry, but it also brings significant business risks.

When customer concentration exceeds 50%, customers have strong bargaining power; when it reaches 94%, customers almost hold full pricing power:

- Customers may suppress purchase prices, compressing the company’s gross profit margin

- Customers may demand longer credit periods, affecting the company’s cash flow

- Customers may put forward more stringent technical standards and delivery requirements

The company’s performance is highly tied to the operational status of a small number of customers:

- Customer performance decline → Order reduction → Revenue drop: If major customers’ sales decline, Leadrive Technology will be directly affected

- Customer strategic adjustment → Supplier replacement risk: Customers may replace suppliers due to cost, technology and other reasons

- Customer capital chain problems → Accounts receivable risk: If major customers encounter financial difficulties, the company’s accounts receivable may face bad debts

Customer churn is a fatal blow to enterprises highly dependent on customers:

- Losing one major customer may lead to a revenue decline of over 30%-50%

- After customer churn, the vacant production capacity is difficult to fill quickly

- It may trigger a chain reaction, causing concerns among other customers

The new energy vehicle industry has obvious cyclical characteristics:

- During industry boom periods: Customer demand is strong, and the company’s performance grows rapidly

- During industry downturns: Customers cut orders, and the company’s performance declines sharply

A 94% customer concentration means that the amplitude of the company’s cyclical fluctuations will be significantly amplified.

High dependence on customers means:

- The direction of technological development is dominated by customer demands

- R&D resources need to be allocated around customer projects

- Space for independent innovation is limited

For Leadrive Technology seeking a listing in Hong Kong, high customer concentration may affect investor confidence:

- Investors may assign lower valuation multiples

- Stock prices may be more severely impacted during market fluctuations

- Refinancing capacity may be restricted

The power semiconductor and new energy vehicle electronic control industries have the following characteristics, which make high customer concentration a common phenomenon in the industry:

-

High concentration of downstream customers: The new energy vehicle industry itself shows a trend of head concentration, with a few enterprises such as BYD and Tesla occupying a large market share

-

Long supplier certification cycle: The certification cycle for automotive-grade products is long, and once entering the supply chain, it has strong stickiness

-

Technology and capital intensive: There are a small number of downstream manufacturing enterprises with large scales

Despite the high customer concentration, there are also some positive factors:

-

First-mover advantage: Having passed strict certifications to enter customers’ supply chains, with certain entry barriers

-

Technological strength: The company has more than 450 patents and over 360 R&D personnel, with continuous innovation capabilities[2]

-

Customer stickiness: The replacement cost of power semiconductors and electronic control systems is relatively high, so customers will not easily replace suppliers

-

Market expansion: The company’s products have successfully expanded to cutting-edge fields such as electric aviation[2]

| Risk Type | Impact Level | Focus Areas |

|---|---|---|

| Customer Bargaining Power | High | Trend of Gross Profit Margin Changes |

| Customer Churn Risk | High | Stability of Customer Relationships |

| Industry Cycle Risk | Medium-High | New Energy Vehicle Market Trends |

| Accounts Receivable Risk | Medium | Credit Status of Top 5 Customers |

| Technological Iteration Risk | Medium | R&D Investment and Technical Routes |

- Order stability and cooperation sustainability of major customers

- The company’s ability and progress in expanding new customers

- Trends in changes in gross profit margin and cash flow

- Changes in the industry competition pattern

[1] NE Time - “【NE News Flash】Leadrive Technology Submits IPO Prospectus for Intended Listing in Hong Kong” (https://ne-time.cn/web/article/37510)

[2] Leadrive Technology Official Website - “Leadrive Technology (Shanghai) Co., Ltd.” (http://www.leadrive.com/about/show.php?lang=cn&id=106)

邦泽创科跨境电商平台依赖风险与应对策略分析

华夏银行资产质量分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.