Hot Analysis of Yangtze Optical Fibre and Cable (06869.HK): AI Computing Power Drives 7.57% Single-Day Surge for Optical Communication Concept Stock

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On January 7, 2026, Yangtze Optical Fibre and Cable (06869.HK) saw a strong 7.57% increase in its stock price to HK$52.75, becoming one of the most watched optical communication concept stocks in the Hong Kong stock market on that day [1]. This rally was mainly driven by the surging demand for AI computing infrastructure construction, and the company’s concurrently disclosed Q1 results exceeded expectations, with net profit growing 161.9% year-on-year to RMB152 million [3]. As a global leader in the optical fibre and cable industry, the company has made breakthroughs in cutting-edge technology fields such as hollow-core optical fibre, and its market capitalization has exceeded the HK$100 billion mark. However, the current relatively high valuation of around 60 times contrasts with the fundamentals of a 47.9% year-on-year decline in full-year net profit, so investors need to carefully assess the risk of chasing the rally [1][3].

On the day, Yangtze Optical Fibre and Cable significantly outperformed the broader market. It opened at HK$50.00, reached an intraday high of HK$54.30 and a low of HK$49.80, and closed at HK$52.75, with a full-day gain of 7.57% [1]. Notably, the trading volume on the day was approximately 21.0381 million shares, slightly lower than the average daily trading volume of 25.584 million shares, but the transaction value still indicated active market participation. From a technical analysis perspective, indicators such as RSI may be approaching the overbought zone, and the stock price is approaching the 52-week high of HK$65.00, so the risk of a technical pullback deserves attention [0].

From a long-term perspective, the stock has delivered a cumulative return of 302.65% over the past year, far exceeding the 35.66% increase of the Hang Seng Index over the same period; its three-year return is 325.04%, and its five-year return has reached 507.29%, while the five-year return of the Hang Seng Index is only 4.23% [3]. This excess return reflects both the market’s optimistic expectations for the prospects of the optical communication industry and partially discounts the future earnings growth potential.

The company’s fundamentals show obvious quarterly differentiation. In 2025, the full-year net profit fell 47.9% year-on-year to RMB676 million; in the first three quarters, the net profit attributable to shareholders fell 18.02% year-on-year to RMB470 million, with a profit margin remaining at a low level of 4.16% [3][7]. However, the strong rebound in Q1 2025 injected a shot in the arm into the market – net profit was RMB152 million, surging 161.9% year-on-year, and revenue in the first three quarters was RMB10.275 billion, growing 18.18% year-on-year [3][7]. This performance reversal was mainly driven by the recovery in demand for data center-related optical fibre products and the growth in orders driven by AI computing infrastructure construction.

From the business structure perspective, the company has issued a risk warning stating that the current global optical fibre and cable industry market environment is normal, but the demand for optical fibre and cable related to the telecom market is still under pressure, while the proportion of new products related to data centers in total demand is small [8]. This means that the sustainability of the company’s performance recovery still needs to be observed based on the actual implementation of AI computing power demand.

The supply and demand pattern of the optical communication industry is undergoing profound changes. A research report from Kaiyuan Securities pointed out that the expansion capacity of global manufacturers is limited, and the optical fibre and cable market may form a supply shortage pattern [4]. With the surge in global AI large model training and inference demand, the demand for optical fibre and cable for internal interconnection of data centers continues to rise, which provides structural growth opportunities for leading enterprises in the industry [4][5].

The company’s competitive advantage in the industry is particularly prominent: it has ranked first in global sales of optical fibre preforms, optical fibres, and optical cables for 9 consecutive years since 2016, and is the only enterprise in the world that has mastered and industrialized the three mainstream preform preparation technologies of PCVD, OVD, and VAD [4][5]. This technological moat provides the company with a sustainable competitive advantage.

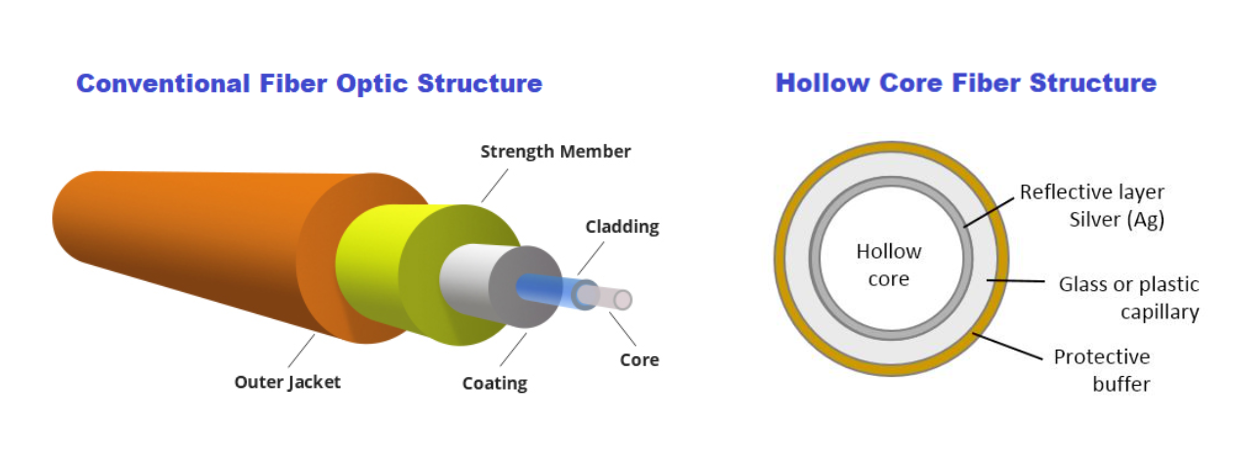

The company’s breakthroughs in hollow-core optical fibre and space-division multiplexing optical fibre fields are of milestone significance. In 2025, the company completed the laying of the world’s first seven-core optical fibre submarine test cable, setting a world record for the longest space-division multiplexing submarine cable laying [6]. Compared with traditional solid-core optical fibres, hollow-core optical fibres have physical characteristics of lower latency and higher bandwidth, making them more suitable for high-density interconnection scenarios in AI data centers. The annual investment of approximately 5% of operating revenue in research and development ensures the company’s continuous leadership in cutting-edge technology fields [5]. This technological advantage is expected to be converted into orders and market share in the wave of AI computing infrastructure construction.

The current stock price corresponds to a trailing P/E ratio of approximately 56-60 times, while the rolling P/E ratio of the company’s A-share once reached as high as 169 times, indicating significant overvaluation risk [1][3]. Goldman Sachs maintains a “Neutral” rating, with a 12-month target price of HK$48.13, which is about 9% lower than the current stock price [1][2]. This reflects the cautious attitude of institutional investors towards the company’s current valuation level. However, the market’s enthusiasm for the company’s AI computing power theme seems to have exceeded the support of fundamentals, forming a pattern of “expectations running ahead of performance”. Investors need to be alert to the risk of valuation correction due to unmet expectations.

DeBang XinXing Value A (001412) newly entered the top 10 tradable shareholders, holding 3.7323 million shares, while Hong Kong Securities Clearing Company Limited held 3.1874 million shares, a decrease of 2.7622 million shares from the previous period [7]. This pattern of “new entry and reduction coexisting” indicates that institutional investors have obvious divergences on the company’s prospects. Some funds chose to take profits, while others are optimistic about the AI computing power theme and laid out positions on dips.

Short-term (1-3 months): Driven by the popularity of the AI computing power theme, the stock price may maintain high-level fluctuations, but the risk of chasing the rally is significant. Medium-term (3-6 months): It is necessary to pay attention to subsequent financial reports to verify the sustainability of performance recovery and the implementation of AI computing power orders. Long-term (more than 6 months): The extent to which technological breakthroughs are converted into performance contributions will determine the space for valuation re-rating.

As a global leader in the optical fibre and cable industry, Yangtze Optical Fibre and Cable (06869.HK) has structural growth opportunities in the wave of AI computing infrastructure construction. On January 7, 2026, it became a hot stock due to the rebound of the optical communication concept, with a single-day gain of 7.57%, and its market capitalization exceeded HK$100 billion. The main catalysts are the better-than-expected Q1 performance (161.9% year-on-year growth in net profit) and the technological breakthrough of laying the world’s first seven-core optical fibre submarine test cable [1][3][6]. However, the current relatively high valuation of around 60 times contrasts with the fundamentals of a 47.9% year-on-year decline in full-year net profit, and the company has issued a risk warning to remind investors of performance uncertainty [1][3][8]. Goldman Sachs maintains a “Neutral” rating, with a target price of HK$48.13 slightly lower than the current stock price, and institutional investors have divergences on the company’s prospects [1][2][7]. Investors should closely monitor the actual implementation of AI computing power demand and the performance of subsequent financial reports, and carefully assess the risk of chasing the rally.

| ID | Source | Date | Title |

|---|---|---|---|

| [0] | Jinling Analysis Database | — | Technical Indicators and Quantitative Analysis Data |

| [1] | Yahoo Finance | 2026-01-07 | Real-time Quotes of Yangtze Optical Fibre and Cable (6869.HK) |

| [2] | Moomoo | 2026-01-07 | News and Ratings of Yangtze Optical Fibre and Cable (06869) |

| [3] | Yahoo Finance | 2026-01-07 | Financial Data and Historical Performance of Yangtze Optical Fibre and Cable |

| [4] | Sina Finance | 2025-12-24 | Yangtze Optical Fibre’s Market Cap Exceeds HK$100 Billion, Industry Supply Shortage Pattern Takes Shape |

| [5] | Sina Finance | 2025-12-24 | Technical Analysis of Yangtze Optical Fibre: The Only Global Enterprise Mastering Three Preform Technologies |

| [6] | Jingchu News | 2026-01-03 | 2025 Top 10 Enterprise News in Wuhan: Technological Breakthrough of Yangtze Optical Fibre |

| [7] | Sina Finance | 2026-01-07 | Analysis of Main Capital and Institutional Holdings of Yangtze Optical Fibre |

| [8] | Securities Times | 2025-12-24 | Risk Warning Announcement of Yangtze Optical Fibre |

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.