Shanghai Electric (02727.HK) Hot Stock Analysis Report - Intra-Day Surge Over 5% Driven by Breakthrough in Controlled Nuclear Fusion Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is compiled from multiple reports from Sina Finance[1], Investing.com[2], Shanghai State-owned Assets Supervision and Administration Commission[3], and The Paper[4], released on January 7, 2026. In the Hong Kong stock market, Shanghai Electric (02727.HK) saw significant unusual activity today, with an intraday gain of over 5%. As of press time, it traded at HK$4.32-HK$4.37, with a full-day gain of 3.35%-4.55% and a turnover of HK$126 million-HK$163 million. Among companies related to Hang Seng Index components, Shanghai Electric’s strong performance against the trend is particularly prominent, indicating high capital attention to the nuclear fusion theme[1][2].

From a technical analysis perspective, the stock’s trading volume today is significantly higher than usual, with obvious signs of capital inflow. Amid the overall pressure on the Hong Kong stock market, Shanghai Electric’s ability to rise against the trend reflects the market’s optimistic expectations for the development prospects of its nuclear fusion business[0]. Short-term technical charts show that there is initial support around HK$4.20, while HK$4.50 and HK$4.80 form key resistance levels above.

The fundamental reason why Shanghai Electric has become a market favorite today is its substantive breakthrough in the field of controlled nuclear fusion. The company has been deeply integrated into the national fusion engineering chain, and has achieved multiple “from 0 to 1” breakthroughs at the critical stage where controlled nuclear fusion transitions from scientific feasibility to engineering feasibility[1][2][3].

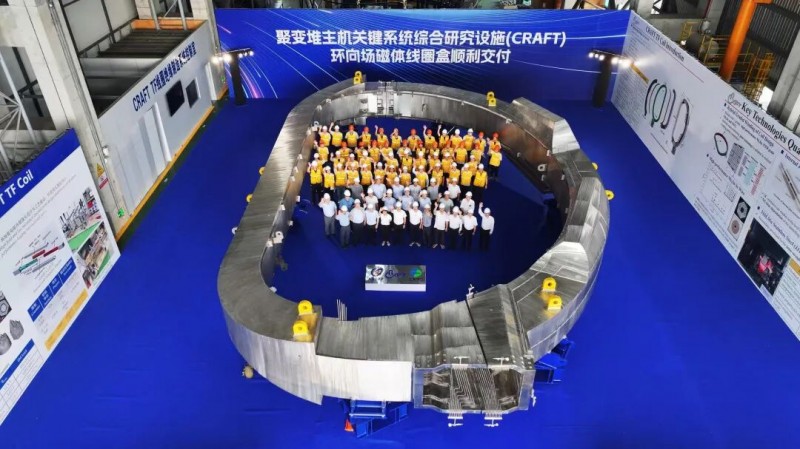

The most iconic achievement is the company’s successful development of the world’s largest TF coil cassette for the Comprehensive Research Facility for Fusion Reactor Host Key Systems (CRAFT). The size and performance of this coil cassette surpass those of similar structures in the international ITER project, fully demonstrating the extreme manufacturing capabilities of China’s high-end equipment manufacturing industry[1][3]. This breakthrough not only verifies Shanghai Electric’s core technical strength in the nuclear fusion field, but also establishes its irreplaceable strategic position in the national fusion engineering chain.

From the perspective of business development stage, since 2025, Shanghai Electric has entered a peak period for delivering nuclear fusion components, covering core components such as coil cassettes, cold screens, and dewars. According to market forecasts, this delivery boom will continue or even accelerate in 2026, indicating that the company’s nuclear fusion business is transitioning from a technology reserve phase to a harvest phase[4]. Notably, the company not only serves national team projects, but also supplies main equipment such as vacuum chambers and low-temperature cold screens to private fusion enterprises like Energy Singularity and Hebei ENN, demonstrating a diversified customer structure and market expansion capabilities[3].

In terms of traditional nuclear power business, Shanghai Electric also has strong competitive advantages. As an absolute leader in China’s nuclear power equipment manufacturing sector, the company has ranked first in the industry in cumulative comprehensive market share of nuclear power equipment during the “14th Five-Year Plan” period, with a comprehensive market share of 40% in nuclear island main equipment[2][3]. More importantly, Shanghai Electric is the only domestic supplier with the capability to provide complete sets of third-generation pressurized water reactor nuclear island main equipment and key materials, and this unique qualification has built a deep competitive barrier.

In the layout of next-generation nuclear energy technology, the company has demonstrated forward-looking strategic vision. Shanghai Electric has achieved full coverage of all fourth-generation nuclear power technology routes, including thorium-based molten salt reactors, sodium-cooled fast reactors, and high-temperature gas-cooled reactors[2][3]. In the field of thorium-based molten salt reactors (TMSR), the company provided key equipment such as main vessels and heat exchangers for the world’s first liquid-fuel thorium-based molten salt experimental reactor built by the Shanghai Institute of Applied Physics, Chinese Academy of Sciences. This experimental reactor achieved thorium-uranium fuel conversion for the first time in 2025, and is currently the only operating liquid-fuel molten salt reactor in the world[2][3]. This technological breakthrough not only verifies the feasibility of thorium-based molten salt reactor technology, but also lays a solid foundation for Shanghai Electric to seize opportunities in the next-generation nuclear energy market.

From a policy perspective, the development of nuclear fusion energy and the nuclear energy industry has received clear support at the national strategic level. In 2025, nuclear fusion energy was clearly listed as a future industry and new economic growth point in the national “15th Five-Year Plan” proposal, providing a clear top-level design for industry development[4]. The Atomic Energy Law for the first time included nuclear fusion in national basic laws, establishing the strategic status of nuclear fusion at the legal level and providing stable policy expectations for long-term investment[4].

Regarding the timeline for nuclear fusion commercialization, the industry generally believes that it still requires a development cycle of 20 to 30 years. However, the “pickaxe-selling” business model adopted by Shanghai Electric enables it to realize the value of its technology in advance before that[3]. By supplying core equipment to various domestic and international fusion research projects, the company can share the phased dividends of industry growth without waiting for the commercialization of nuclear fusion. This business model effectively reduces the risk of investment cycles, allowing investors to participate in the value creation process of the nuclear fusion industry chain earlier.

Shanghai Electric’s breakthrough in the nuclear fusion field is not an isolated event, but a concentrated manifestation of its 50 years of experience and technological accumulation in nuclear power equipment manufacturing. In the process of developing the world’s largest TF coil cassette for CRAFT, the company involved a number of key technologies such as ultra-large special metal component processing, high-precision assembly, and non-magnetic material application, and these capabilities are directly derived from its technological precipitation in the traditional nuclear power equipment manufacturing field[3]. Similarly, the development of special non-magnetic stainless steel materials for the BEST burning plasma experimental device, as well as the supply of vacuum chambers and low-temperature cold screens to private fusion enterprises like Energy Singularity and Hebei ENN, all reflect the company’s comprehensive technical strength in fields such as materials science, manufacturing processes, and system integration[3].

This technology synergy effect means that Shanghai Electric’s nuclear fusion business is not a cross-border layout starting from scratch, but a natural extension based on deep technological accumulation. Compared with pure nuclear fusion startups, Shanghai Electric has a more mature quality control system, more complete supply chain management capabilities, and richer experience in executing major projects, and these advantages are particularly important in national major scientific and technological infrastructure projects.

As a large state-owned enterprise directly supervised by the Shanghai State-owned Assets Supervision and Administration Commission, Shanghai Electric’s deep participation in the national fusion engineering chain has important strategic implications. As a disruptive technology related to the future of human energy, nuclear fusion research and development requires long-term, large-scale capital investment and continuous policy support. The state-owned holding background enables Shanghai Electric to obtain more stable resource support, a more relaxed R&D cycle, and a clearer national strategic orientation[3]. Against the background of the Atomic Energy Law incorporating nuclear fusion into the national legal framework, the first-mover advantage of state-owned enterprises in this strategic field is expected to be further consolidated.

Notably, while serving national team projects, Shanghai Electric also actively supplies main equipment to private fusion enterprises such as Energy Singularity and Hebei ENN[3]. This business model reflects that China’s nuclear fusion industry is forming a benign ecosystem of division of labor and cooperation between state-owned and private enterprises: the national team undertakes cutting-edge scientific exploration and major infrastructure construction, private capital conducts commercial exploration in specific technical routes and application scenarios, and Shanghai Electric, as a high-end equipment manufacturer, provides key equipment and technical support for the entire industrial chain. This division of labor pattern is conducive to dispersing technical risks, accelerating innovation iteration, and ultimately promoting the realization of nuclear fusion commercialization.

| Risk Type | Short-Term Risk | Medium-Term Risk | Long-Term Risk | Urgency |

|---|---|---|---|---|

| Valuation Pullback | High | Medium | Low | High |

| Technical Route Change | Low | Medium | High | Medium |

| Policy Approval | Medium | Medium | Low | Medium |

| Intensified Competition | Low | Medium | High | Low |

From the perspective of risk levels, in the short term, focus should be on the risk of valuation pullback and technical adjustment pressure; in the medium term, track the delivery progress and order status of nuclear fusion components; in the long term, pay attention to the evolution of technical routes and changes in the competitive landscape. The current stock price is at a relatively high level after a rapid rise, and it is recommended that investors remain rational and wait for layout opportunities after a pullback.

Shanghai Electric (02727.HK) became a hot stock in the Hong Kong stock market today, with an intraday gain of over 5%, trading at HK$4.32-HK$4.37, and a turnover of HK$126 million-HK$163 million. The core driving force for the stock price increase stems from the company’s business breakthrough in the field of controlled nuclear fusion: successfully developing the world’s largest TF coil cassette with performance surpassing that of the international ITER project, deeply participating in the national fusion engineering chain, and entering a peak period for nuclear fusion component delivery which is expected to remain booming in 2026.

The company is a leader in China’s nuclear power equipment manufacturing, with a 40% comprehensive market share in nuclear island main equipment, and is the only domestic supplier with the capability to provide complete sets of third-generation pressurized water reactor nuclear island main equipment and key materials. In terms of fourth-generation nuclear power technology, the company has achieved coverage of all technical routes including thorium-based molten salt reactors, sodium-cooled fast reactors, and high-temperature gas-cooled reactors, and provided key equipment for the world’s first liquid-fuel thorium-based molten salt experimental reactor.

The overall policy environment is favorable, with nuclear fusion energy included in the national “15th Five-Year Plan”, and the Atomic Energy Law for the first time included nuclear fusion in national laws, providing clear long-term expectations for industry development. The “pickaxe-selling” business model adopted by the company enables it to realize the value of its technology before the commercialization of nuclear fusion, effectively reducing the risk of investment cycles.

Major risks include: the large short-term stock price increase may trigger a valuation pullback, nuclear fusion commercialization still requires a long time, policy approval and project progress may affect performance release, and governance uncertainties brought by the special shareholders’ meeting on January 26. Investors should pay attention to the support level around HK$4.20 and the resistance level at HK$4.50; if the turnover continues to expand to more than HK$200 million, the upward trend may continue.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.