Signal Analysis Report on Insider Selling of Nuvalent (NUVL)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive data analysis above, I will provide you with an in-depth signal analysis of insider selling at Nuvalent (NUVL).

| Metric | Value |

|---|---|

Current Stock Price |

$106.82 |

Market Capitalization |

$7.777 Billion |

52-Week Range |

$55.53 - $112.88 |

Analyst Ratings |

100% Buy (13 Analysts) |

Consensus Target Price |

$132.00 (+23.6%) |

Beta Coefficient |

1.32 (Higher than market volatility) |

According to SEC filings, NUVL saw intensive insider trading activity between December 23, 2025, and January 6, 2026 [0]:

| Date | Filing Type | Transaction Nature |

|---|---|---|

| 2025-12-23 | Form 4 | Insider Stock Sale |

| 2025-12-30 | Form 144 | Notice of Proposed Sale of Securities |

| 2026-01-02 | Form 4 | Insider Stock Sale |

| 2026-01-05 | Form 4 | Insider Stock Sale |

| 2026-01-06 | Form 144 (6 filings) | Proposed Sales by Multiple Executives , including the Chief Legal Officer |

The Chief Legal Officer’s sale of approximately

- Insider selling occurred shortly after the completion of the company’s public equity offering(completed $500 million financing on November 20, 2025)

- The selling period coincided with the window for key clinical data release(key data for ALK-positive NSCLC expected to be released by the end of 2025)

- Executive selling may reflect a conservative outlook on short-term stock performance

- 6 Form 144 filingssubmitted within a short period (two weeks), indicating synchronized selling intentions among multiple insiders

- Such collective actions usually convey a coordinated signal, rather than being driven by individual financial needs

- Clinical-stage biopharmaceutical companies highly rely on the scientific insights and execution capabilities of their core management teams

- Executive selling may trigger market doubts about the certainty of pipeline progress

- Most Form 144 filings are pre-planned 10b5-1 trading arrangements, not immediate judgments on stock prices

- Insiders may simply be diversifying their holdings after exercising options in accordance with established plans

- The company’s Q3 financial report shows cash reserves of $943 million, which can support operations until2028[0]

- Rolling NDA for ROS1-positive NSCLC has been fully submitted, with smooth regulatory progress

- 13 analysts have given a 100% Buy rating, indicating continued optimism from professional institutions [0]

- Based on the current market capitalization of $7.777 billion, the $676,000 selling scale accounts for approximately 0.009%

- The relatively small selling proportion is not sufficient to constitute a major negative signal for the company’s fundamentals

| Indicator | Value | Signal Interpretation |

|---|---|---|

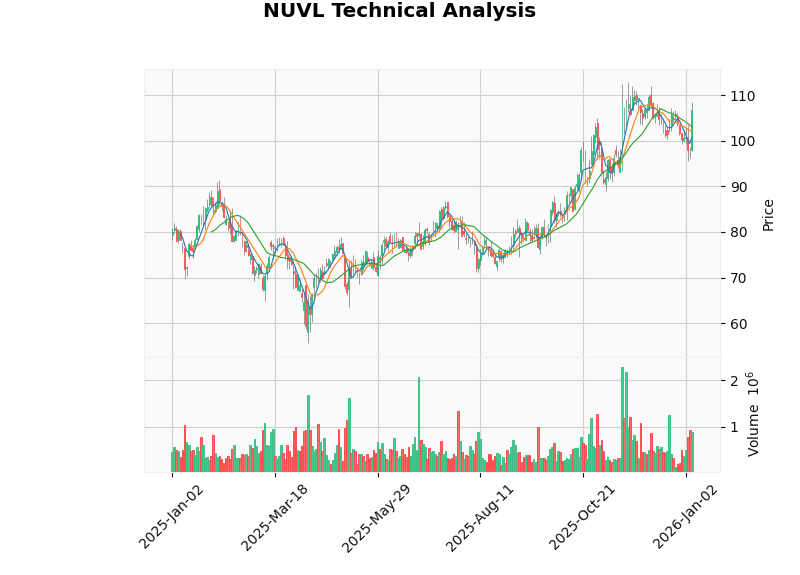

| MACD | No Crossover | Neutral/Slightly Bearish |

| KDJ | K:42.8, D:31.9, J:64.8 | Bullish |

| RSI | Normal Range | No Overbought/Oversold |

Trend Judgment |

Sideways Trading |

No Clear Direction |

- Support Level: $103.08

- Resistance Level: $108.90

- Current price ($106.82) is in the upper-mid range of the interval

| Risk Factors | Opportunity Factors |

|---|---|

| Collective executive selling conveys a conservative signal | 100% Buy rating, consensus target price with +23.6% premium |

| Beta=1.32, relatively high volatility | ROS1 NDA fully submitted, clear regulatory progress |

| Still in a loss-making state (EPS: -$5.33) | Sufficient cash reserves, operations secured through 2028 |

| Selling occurred during the window for key data release | Key data for ALK-positive NSCLC to be released soon |

For biopharmaceutical companies, the signal significance of insider selling needs to be

| Scenario | Signal Strength | Explanation |

|---|---|---|

Selling + Pipeline Clinical Failure |

Strong Bearish |

Insider information confirms a pessimistic outlook |

Selling + Post-Financing Plan Execution |

Neutral-Bearish |

Likely a routine disposal |

Selling + Strong Fundamentals + Institutional Buying |

Mildly Bearish |

Requires comprehensive judgment based on scale and timing |

- Maintain a Cautious Stance: The sideways trading pattern remains unbroken, but collective insider selling and the slightly bearish MACD signal indicate insufficient short-term upward momentum

- Key Catalyst: Focus on the release of key data for ALK-positive NSCLC by the end of 2025 (guidance from Q3 2025 earnings report on October 30, 2025) [0]

- Accumulate on Dips: Consider initiating positions if the stock price falls below $100

- Target Price Reference: $132.00 (consensus target price) [0]

- Due to Beta=1.32, it is recommended to limit biotech exposure to within 5% of the portfolio

- Set stop-loss levels in the $95-98 range(close to the 50-day moving average)

-

Signal Strength: Moderately Bearish (⭐⭐☆☆☆)

- The selling behavior conveys a partial conservative outlook from executives on short-term stock performance

- However, the selling scale is relatively limited, and it occurred during the routine disposal window after the public equity offering

-

Divergence from Fundamentals: A certain degree of divergence exists

- 100% Buy rating from 13 professional analysts vs. collective executive selling

- Investors are advised to focus more on fundamental factors such as the company’s clinical progressandregulatory approvals

-

Final Judgment: The insider selling signaldoes not constitute a sell recommendation, but should be included as arisk warningin investment decision-making. In the biopharmaceutical sector, the interpretation of insider trading requires comprehensive consideration of pipeline progress, financing cycles, and industry environment, and should not be blindly followed.

[0] Gilin AI Brokerage API Data (NUVL real-time quotes, company profile, technical analysis, SEC filings)

[1] SEC EDGAR - Nuvalent, Inc. Form 144 Filings (https://www.sec.gov/Archives/edgar/data/1861560/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.