In-Depth Analysis of Competitive Landscape and Investment Value of Silicon Carbide Semiconductor Enterprises

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data and industry trends, I have prepared this investment analysis report on the silicon carbide semiconductor industry for you.

On January 5, 2026, Zhizhan Technology (Shanghai) Co., Ltd. successfully completed a nearly RMB 300 million Series C financing, with investors including well-known institutions such as Zhejiang State-owned Assets Fund, Nanjing Venture Capital Group, Hua Ying Capital, and industrial player Silan Microelectronics [1]. Founded in 2019, Zhizhan Technology is a high-tech company focusing on silicon carbide power modules and advanced electric drive systems. It has a R&D center in Nanjing that focuses on the development of designated projects for new energy vehicle OEMs. Its products have been mass-produced and widely used in hydrogen fuel cell systems, electric air conditioning compressor drives for passenger vehicles, main drive systems, and other fields of several leading OEMs [1].

This financing is a typical representative of the investment boom in the silicon carbide industry chain. Recently, Corelink Power completed a new round of strategic financing (4 rounds in total), and Chenxin Technology secured a 100-million-yuan strategic financing, with capital enthusiasm for the SiC track remaining high [2].

In 2026, wide bandgap semiconductor silicon carbide (SiC) and gallium nitride (GaN) power devices are facing unprecedented market opportunities, at the critical point from technology verification to large-scale volume production [3]. The core growth drivers mainly come from three sectors:

- New Energy Vehicles: The 800V high-voltage platform is accelerating its popularization, and the penetration rate of SiC MOSFETs in main drive inverters is rising rapidly. SiC devices can reduce energy loss by 50%, increase the range of electric vehicles by 5%-10%, and support the popularization of 350kW ultra-fast charging technology. The penetration rate of 800V+SiC solutions in whole vehicles exceeded 15% in 2025, and the global new energy vehicle SiC power semiconductor market size will approach USD 3.5 billion in 2026 [3].

- Energy Infrastructure: In the photovoltaic inverter sector, the penetration rate of SiC devices increased from 5% in 2020 to over 25% in 2025, with system efficiency exceeding 99% [3].

- AI Data Centers: The power of data center server racks has rapidly climbed from kilowatt (kW) level to megawatt (MW) level, and the power supply mode is shifting to 800V HVDC architecture. SiC/GaN are key materials to realize this transformation [4].

According to Frost & Sullivan, the compound annual growth rate (CAGR) of China’s SiC power module market reached 32.9% from 2020 to 2024, and is expected to reach 36.6% from 2025 to 2029 [5]. The growth drivers come from the shift from IGBT to SiC MOSFET in new energy vehicle electric drives, penetration of 800V platforms, energy efficiency improvement in photovoltaic energy storage and industrial frequency conversion, and enhanced demand for high efficiency in data centers.

This indicates that SiC is not a short-cycle industry, but a structural industry with continuous medium- to long-term volume growth. Especially in the new energy vehicle sector, the penetration rate of automotive-grade SiC in China is expected to rise from single digits to 30%-50% from 2024 to 2029, which is a huge deterministic trend [5].

The global SiC substrate market is undergoing profound changes. Wolfspeed’s market share plummeted from 62% in 2022 to 33.7% in 2024, with Chinese players rising rapidly relying on cost advantages [6]. Currently, the main global competitors include:

| Enterprise | Market Share | Features |

|---|---|---|

| Wolfspeed | 33.7% | Global SiC leader, sold GaN business to focus on SiC [6] |

| II-VI/Coherent | 14% | Second-largest U.S. supplier |

| SiCrystal | 12% | German enterprise |

| STMicroelectronics | 10% | European IDM giant |

| Infineon | 8% | Invested EUR 5 billion to expand Kulim plant |

| Rohm | 7% | Japanese power semiconductor expert |

| ON Semiconductor | 6% | Secured long-term supply agreements with automakers to guarantee growth |

Infineon is promoting mass production of 300mm (12-inch) GaN wafers, and plans to deliver samples to customers in the fourth quarter of 2025; ON Semiconductor has signed long-term supply agreements (LTSA) with leading automakers, with a target of increasing SiC device revenue share to 12%-15% in 2025 [7]. The joint venture plant of STMicroelectronics and Infineon in Chongqing is expected to start mass production of 8-inch SiC and GaN devices in the third quarter of 2025 [7].

The domestic SiC power module market has high concentration, and ‘ranking among the top six’ is a barrier in itself. The main players include:

- Silan Microelectronics (600460.SS): Phase I of its 8-inch SiC production line is operational, with an annual capacity of 420,000 wafers, and a total investment of RMB 12 billion [8]

- Basic Semiconductor: China’s only full-industry-chain SiC IDM enterprise, ranked sixth in the 2024 SiC power module market with a 2.9% market share [5]

- Sky Universe Semiconductor: Leader in silicon carbide epitaxial wafers

- Xinlian Integration: China’s first 8-inch SiC MOSFET production line, secured mass production orders from over 10 enterprises in 2025 [2]

- Tanke Tianrun: Focused on SiC power devices

Basic Semiconductor has a 2.8% market share in the SiC device market, ranking eighth; its gate driver market share is 1.7%, ranking ninth [5]. Although its advantages are not strong, it means great room for growth, and technological changes have brought this opportunity.

- Mass production of 8-inch wafers: Switching from 6-inch to 8-inch products has significant economic advantages. It is expected that the volume production of 8-inch wafers will still take some time, and new energy vehicles will be the first scenario for 8-inch mass production implementation [4]

- 12-inch breakthrough: China has successfully developed the world’s first high-quality 12-inch silicon carbide epitaxial wafer [4]

- Advanced packaging: New technical routes such as plastic-encapsulated silicon carbide modules and embedded modules are under development

Silan Microelectronics’ 8-inch silicon carbide power device chip manufacturing production line is independently developed and mass-produced by the company. It has successfully overcome multiple core process difficulties in the manufacturing of 8-inch silicon carbide wafers, marking the company’s key leap from technological breakthrough to large-scale delivery in the third-generation semiconductor field [8].

| Project | Details |

|---|---|

| Total Investment | RMB 12 billion |

| Construction Method | Built in two phases |

| Phase I Capacity | Annual output of 420,000 8-inch SiC chips |

| Full Capacity | Annual output of 720,000 8-inch SiC chips |

| Capacity Ramp-up Timeline | Phase I is planned to gradually ramp up capacity from 2026 to 2028 |

This production line will mainly serve application scenarios such as new energy electric vehicles, photovoltaics, energy storage, charging piles, large household appliances, AI server power supplies, and industrial power supplies [8].

The strategic logic of Silan Microelectronics’ investment in industrial chain enterprises such as Zhizhan Technology includes:

- Industrial Chain Synergy: By investing in key upstream enterprises, ensure the supply capacity of SiC modules, and form synergies with its own chip manufacturing business

- Technology Integration: Zhizhan Technology has accumulated profound expertise in silicon carbide wide bandgap semiconductors and advanced power conversion technologies, which can complement Silan Microelectronics’ manufacturing capabilities

- Market Positioning: Zhizhan Technology’s products have been applied in scenarios such as new energy vehicle thermal management, main drive electronic control, super charging and energy storage, and expanded to liquid-cooled super charging, AI computing power centers, and embodied intelligent control fields [1], which are highly aligned with Silan Microelectronics’ target markets

| Indicator | Value |

|---|---|

| Market Capitalization | RMB 49.19 billion |

| Current Stock Price | USD 29.59 |

| P/E (TTM) | 91.08x |

| P/B | 4.12x |

| ROE | 4.42% |

| Net Profit Margin | 4.23% |

| Current Ratio | 1.93 |

Latest quarterly results (Q3 2025): Revenue reached RMB 3.38 billion (below the expected RMB 3.53 billion, with a deviation of -4.25%), EPS was USD 0.05 (below the expected USD 0.09, with a deviation of -45.91%) [9].

Based on the DCF model, the valuation results of Silan Microelectronics are as follows:

| Scenario | Intrinsic Value | vs Current Price |

|---|---|---|

| Conservative Scenario | USD 47.39 | +60.3% |

| Base Scenario | USD 60.36 | +104.2% |

| Optimistic Scenario | USD 94.52 | +219.8% |

| Weighted Average | USD 67.42 | +128.1% |

Base scenario assumptions:

- Revenue growth rate: 27.2% (based on 5-year historical average)

- EBITDA margin: 17.0%

- WACC: 8.7%

- Terminal growth rate: 2.5%

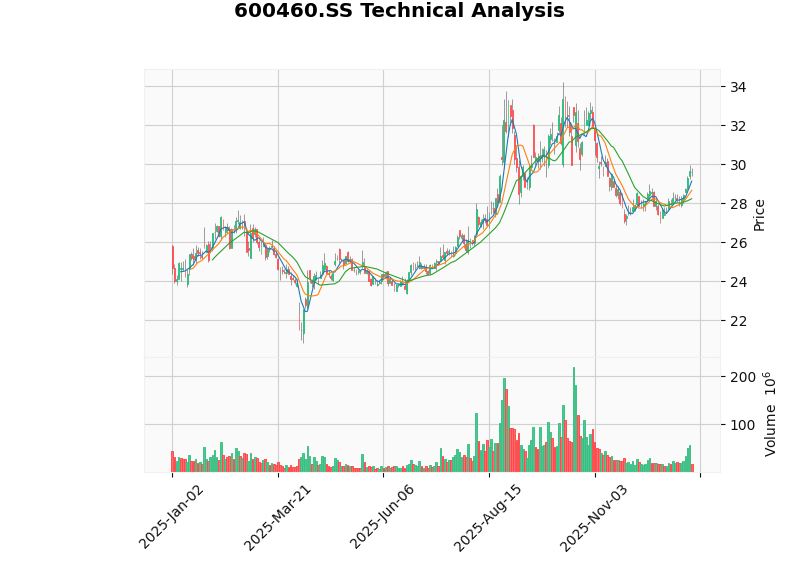

- Trend Judgment: Sideways consolidation / No clear trend

- Price Range: Support level at USD 28.23, resistance level at USD 29.88

- Risk Indicators: KDJ indicator shows overbought warning (K:83.9, D:79.9), RSI indicates overbought risk

- Beta Coefficient: 0.64 (Low volatility relative to the Shanghai Composite Index)

- Industry in High Growth Period: China’s SiC power module market has a CAGR of 36.6%, and the penetration rate of automotive-grade SiC will rise from 12% to 30%-50%

- Leading Capacity: 8-inch SiC production line is operational, with an annual capacity of 420,000 wafers, ranking among the top in China

- Full Industry Chain Layout: IDM model covers from chip design to module packaging

- Industrial Capital Synergy: Invested in enterprises such as Zhizhan Technology to build an ecosystem

- Valuation Attractiveness: Current price is discounted by over 50% compared to the DCF weighted average valuation

- Profitability Pressure: Current P/E reaches 91x, with a net profit margin of only 4.23%, and valuation requires high growth support

- Intense Market Competition: International giants are expanding capacity, and competition among domestic enterprises is intensifying

- Technology Iteration Risk: The evolution from 8-inch to 12-inch may change the competitive landscape

- Macroeconomic Fluctuations: New energy vehicle sales affect SiC demand

- Yield Ramp-up: It takes time to improve the yield of the new production line, which may affect gross margin

The silicon carbide semiconductor industry is at a critical inflection point from technology verification to large-scale volume production, with the popularization of the 800V high-voltage platform for new energy vehicles as the core driver. The industry has the characteristics of ‘slow to heat up but long slope with thick snow’, with China’s market CAGR reaching 36.6% from 2025 to 2029, and the penetration rate of automotive-grade SiC will continue to rise.

- Industry Positioning: Leading domestic enterprise in the SiC field, with leading 8-inch production line

- Valuation Level: Current price is significantly discounted compared to DCF valuation, but high growth is needed to digest the valuation

- Investment Strategy: It is recommended to pay attention to the progress of capacity ramp-up, yield improvement, and downstream customer designation. Medium- to long-term allocation value is prominent, but attention should be paid to the overbought risk indicated by short-term technical indicators

[1] EET-china - “Silicon Carbide Investment Boom Surges! Another Company Completes Nearly RMB 300 Million Series C Financing” (https://www.eet-china.com/mp/a465221.html)

[2] EET-china - “Over RMB 400 Million, 3 More SiC Enterprises Secure Financing” (https://www.eet-china.com/mp/a465306.html)

[3] ESM China - “Top 10 Market and Application Trends in the Electronics Industry in 2026” (https://www.esmchina.com/news/13691.html)

[4] Silicon Carbide Observer - “Silicon Carbide at the Bottom, Riding the AI Tailwind” (http://www.sic2jg.com/news_x.php?id=1826&pid=2)

[5] 36Kr - “China’s Only Full-Industry-Chain SiC IDM Files for Hong Kong IPO Again, The Hard Technology of Basic Semiconductor” (https://m.36kr.com/p/3588148055605254)

[6] Sina Finance - “GaN, Changes Occur” (https://finance.sina.com.cn/roll/2025-12-19/doc-inhchwwp5953762.shtml)

[7] Caifuhao - “Hope Jingsheng Can Make a Breakthrough in Volume Production in 2026” (https://caifuhao.eastmoney.com/news/20251222214602118546500)

[8] East Money - “New Updates on 15+ Semiconductor Projects! Silan Microelectronics/Jinglong Technology/Yuejie Semiconductor/Zijin Jiabo” (https://caifuhao.eastmoney.com/news/20260107200225075826280)

[9] Jinling AI - Company fundamental data and technical analysis

[10] TrendForce Compound Semiconductors - Industry research report

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.