Analysis of the Impact of Post-Holiday Airfare Declines on Airlines' Revenue

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest industry data and policy information, I will systematically analyze the impact of post-holiday airfare declines on the revenue of Chinese airlines and the response strategies adopted by airlines.

After the conclusion of the 2026 New Year’s Day holiday, airfares on many domestic routes dropped sharply. According to market data, one-way tickets to multiple popular tourist cities will be available at a minimum of 10% to 20% of the full price in the coming month, with some fares even costing less than 200 yuan [1]. For example, the fare for the Fuzhou-Nanjing route is as low as 199 yuan (approximately 17% of the full price), and the fare for the Fuzhou-Wuhan route is around 180 yuan (approximately 18% of the full price). This “window period” is expected to last until the start of the Spring Festival travel rush in early February [1].

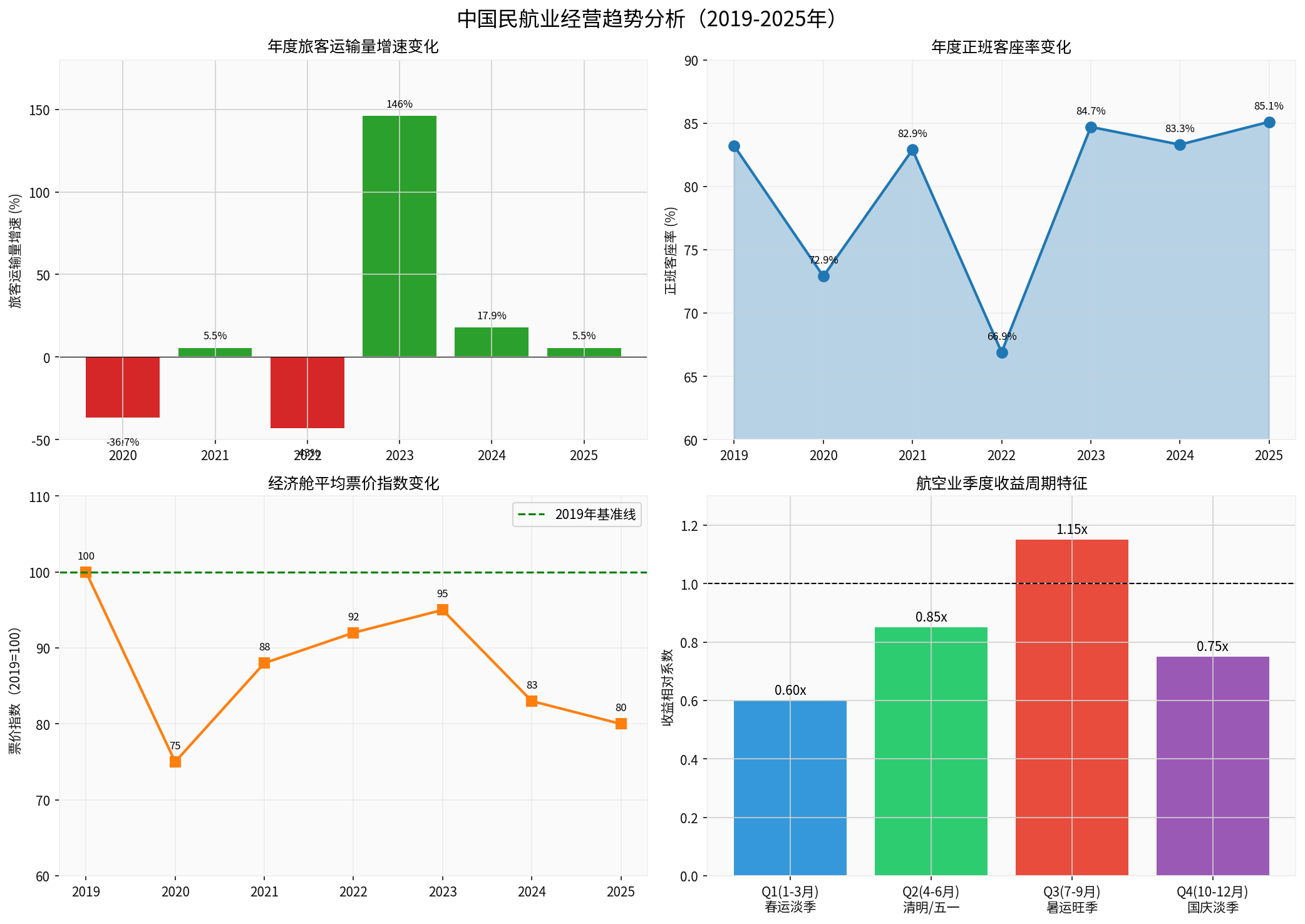

Data from the Civil Aviation Administration of China (CAAC) shows that the average economy class fare in 2025 reached 738 yuan, a year-on-year decrease of 3.1%, presenting a typical scenario of “strong passenger traffic but weak revenue performance” [1]. This phenomenon stems from the widespread “trading lower fares for higher passenger volumes” strategy adopted by airlines: although the passenger load factor continued to rise and hit a new record high (the scheduled flight load factor in 2025 was 85.1%, a year-on-year increase of 1.8 percentage points), the continuous decline in airfares restricted revenue growth [2].

The civil aviation sector exhibits obvious seasonal revenue fluctuation patterns. According to industry research data:

| Quarter | Characteristics | Relative Revenue Coefficient |

|---|---|---|

| Q1 (Jan-Mar) | Off-peak period prior to the Spring Festival travel rush | 0.60x |

| Q2 (Apr-Jun) | Qingming/Wuyi holidays | 0.85x |

| Q3 (Jul-Sep) | Summer travel peak | 1.15x |

| Q4 (Oct-Dec) | Off-peak period post National Day holiday | 0.75x |

The post-holiday period (the off-peak season in Jan-Mar) has a revenue coefficient of only 0.6, making it the lowest revenue period of the year. Based on the estimated single-quarter profit of approximately 3 billion yuan for the three major airlines in Q3 2025, off-peak season losses could reach a similar scale, severely eroding peak-season profits [3].

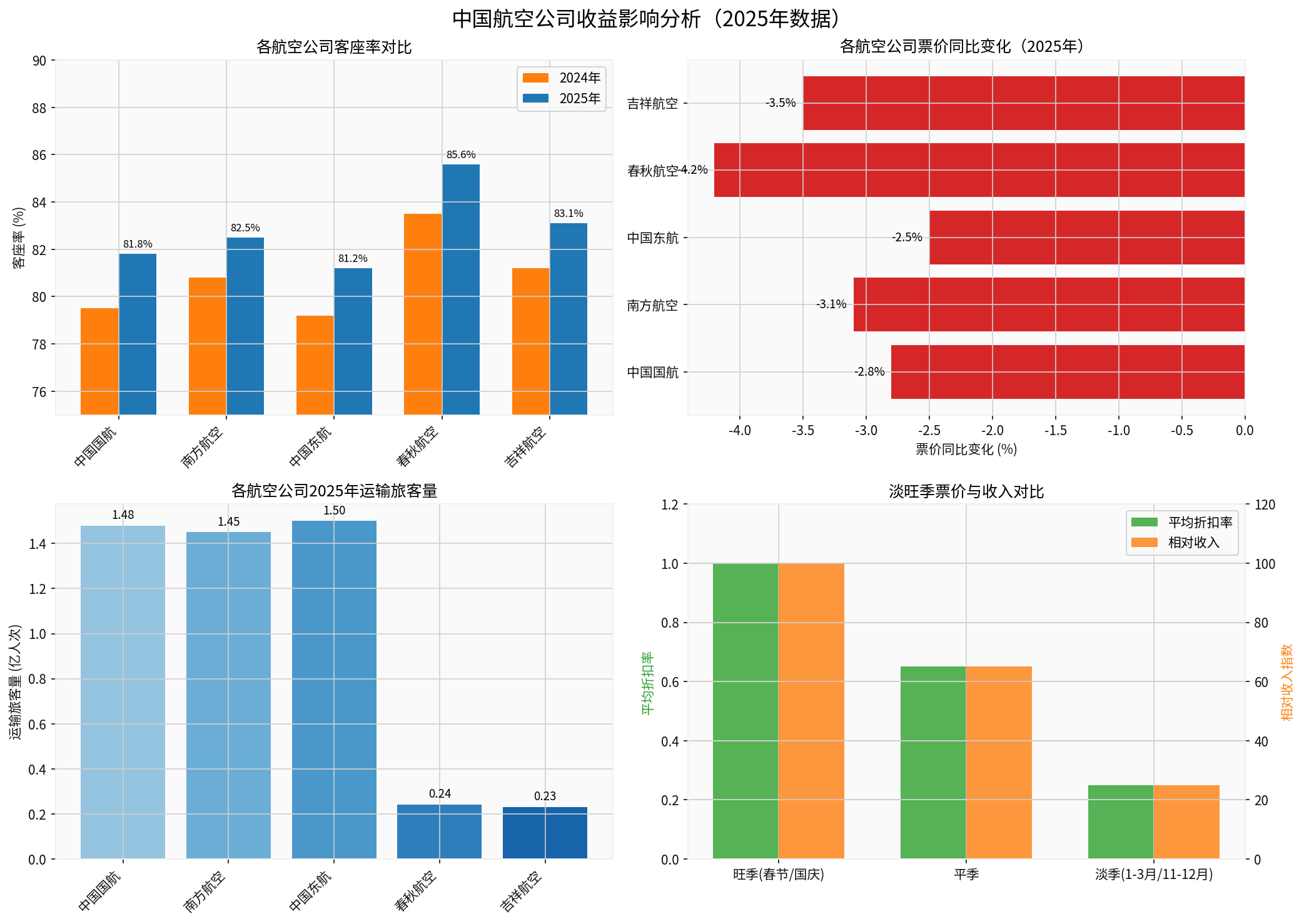

According to 2025 financial data, the impact of airfare declines varies significantly among different airlines:

| Airline | 2025 Passenger Load Factor | Year-on-Year Change in Airfare | Net Profit Characteristics |

|---|---|---|---|

| Air China | 81.8% | -2.8% | Profitable, but net profit margin is only 1-2% |

| China Southern Airlines | 82.5% | -3.1% | Profitable, relying on international route recovery |

| China Eastern Airlines | 81.2% | -2.5% | International route revenue grew over 70% year-on-year |

| Spring Airlines | 85.6% | -4.2% | Faces the greatest pressure from falling airfares |

| Juneyao Airlines | 83.1% | -3.5% | Dragged down by fleet maintenance costs |

Although Spring Airlines maintained the industry’s highest passenger load factor (85.6%), it also recorded the largest year-on-year airfare decline (-4.2%), reflecting that low-cost carriers face more prominent price competition pressure during the off-peak season [4].

Airlines use refined revenue management to balance passenger load factor and airfares:

- Advanced Booking Strategy: Launch early-bird discounts during the off-peak season to lock in customers in advance

- Last-Minute Discounts: Dynamically adjust fares based on remaining seat availability as the flight departure time approaches

- Differentiated Service Pricing: Launch multi-tier products such as basic economy, economy, and business class to cater to customer groups with different price sensitivities

Low-cost carriers like Spring Airlines have an advantage in this regard, as their cost per available seat kilometer (CASK) is approximately 30% lower than that of traditional airlines, enabling them to support more competitive low-price strategies [4].

Major airlines optimize their route networks to address off-peak season challenges:

- Hub Transfer Products: The three major airlines, including Air China and China Eastern Airlines, leverage the transfer capabilities of their core hubs in Beijing and Shanghai to capture premium revenue as international passenger traffic rebounds

- Trunk-Feeder Synergy: Utilize domestic regional aircraft such as the C919 and C909 to operate high-density trunk-feeder combined markets, improving route efficiency

- Frequency Increases on High-Demand Routes: Shift capacity to high-yield long-haul international routes, such as China Eastern Airlines’ new ultra-long-haul route from Shanghai to Buenos Aires [5]

Against the backdrop of pressure on airfares, airlines are actively expanding non-ticket revenue sources:

- Baggage Fees: Implement differentiated pricing based on baggage allowances

- Seat Selection Fees: Charge additional fees for popular seats

- In-Flight Service Upgrades: Paid meals, Wi-Fi services, etc.

- Member Benefits System: Enhance customer loyalty and repeat purchase rates through points and member benefits

China Eastern Airlines’ “Air Express” free rebooking and basic Wi-Fi service is a typical example of enhancing service added value and reducing reliance on price competition [5].

With revenue-side growth restricted, airlines maintain profitability through cost control:

- Fleet Optimization: Juneyao Airlines plans to resolve the A320neo engine maintenance issue by the end of 2026 and focus capacity deployment on high-yield routes [4]

- Jet Fuel Cost Hedging: Use the fuel surcharge mechanism to pass on part of the risk of oil price fluctuations

- Digital Operations: Reduce operational costs through intelligent crew scheduling and refined maintenance

The 2026 National Civil Aviation Work Conference clearly stated that it will crack down on cutthroat competition and prevent malicious competition through below-cost pricing [2]. Specific measures include:

- Airfare Monitoring and Early Warning Mechanism: Develop and formulate a passenger transport cost survey method, and establish a coordinated airfare monitoring and early warning mechanism

- Capacity Regulation: Scientifically control the review rhythm of domestic route flights and strictly restrict capacity supply on low-efficiency routes

- Sales Channel Supervision: Coordinate and strengthen supervision of online sales platforms to prevent malicious price competition at the channel level

- Industry Self-Regulation: Implement the Aviation Passenger Transport Self-Discipline Convention of the China Air Transport Association [3]

The CAAC is collecting route cost data from various airlines to provide a basis for price supervision. This means that the phenomenon of excessively low post-holiday airfares is expected to be regulated, creating a policy environment for a reasonable recovery of industry airfares [2].

Institutions such as Guotai Haitong Securities predict that China’s civil aviation sector will enter a “super cycle” in 2026:

- Demand Side: Passenger traffic is expected to reach 810 million, representing a year-on-year growth of 5.2%

- Supply Side: The net growth rate of fleet deliveries will remain below 3%, resulting in relatively tight capacity supply

- Airfare Side: With the implementation of anti-cutthroat competition measures, airfares are expected to achieve “moderate growth” [3]

Different types of airlines will present differentiated development paths:

| Type | Competitive Advantage | Development Strategy |

|---|---|---|

| Three Major Airlines | Hub network, slot and route rights resources | Increase the proportion of international routes, focus on high-end business customers |

| Spring Airlines | Low cost, refined management | Maintain price competitiveness, deepen penetration in tier-2 and tier-3 markets |

| Juneyao Airlines | Flexible fleet, differentiated services | Resolve capacity bottlenecks, expand high-yield routes to Europe, America, and Oceania |

For investors focusing on the aviation sector, the following investment themes are recommended:

- Earnings Elasticity: High elasticity of Air China (601111.SH) and China Southern Airlines (600029.SH) amid international route recovery

- Cost Advantage: Spring Airlines’ (601021.SH) low-cost moat

- Turnaround Opportunity: Juneyao Airlines’ (603885.SH) capacity recovery opportunity [3]

The impact of post-holiday airfare “plunges” on airlines’ revenue is both structural and cyclical. In the short term, off-peak low airfares will indeed pressure airlines’ Q1 revenue; however, in the medium to long term, as the sector enters an era of low supply growth, demand continues to grow steadily, and policies guide against cutthroat competition, the airfare center is expected to rise gradually.

The core of airlines’ strategies to balance off-peak passenger traffic and airfares is:

[1] New Yellow River - “Some Routes Offer Tickets as Low as 10-20% of Full Price; Window Period Lasts Until Early February” (http://travel.china.com.cn/txt/2026-01/08/content_118268024.shtml)

[2] Guancha.cn/China Business News - “CAAC to Regulate Excessively Low Airfares This Year” (https://www.guancha.cn/politics/2026_01_06_802959.shtml)

[3] Zhitong Finance/Guotai Haitong - “Airlines Expected to Continue Sharply Reducing Losses YoY in 25Q4; Fares to Rise During Spring Festival Travel Peak” (https://cn.investing.com/news/stock-market-news/article-3155922)

[4] Securities Times - “Solving the Puzzle of Aviation Stocks: How to Convert Passenger Traffic Dividends into Actual Profits? | A-Shares 2026 Investment Strategy ⑦” (https://www.stcn.com/article/detail/3566176.html)

[5] Tencent News - “2025 Civil Aviation Sector Wraps Up Successfully: Double Growth in Passenger Traffic and Profits, Highlighted by Strong Airline Data” (https://news.qq.com/rain/a/20260102A03T4900)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.