LUCY Stock Analysis: Reddit Promotion Triggers 20% Surge in Innovative Eyewear

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis examines the correlation between a Reddit promotion post and subsequent stock movement in LUCY (Innovative Eyewear Inc.). The original event, a Reddit post published on November 11, 2025, promoted LUCY as an undervalued penny stock with significant upside potential, highlighting the company’s ChatGPT-enabled smart glasses and strong Q2 2025 financial performance [1].

The stock experienced a dramatic 20.15% surge on November 12, 2025, the day following the Reddit post [2]. This movement occurred during pre-market trading sessions where LUCY showed gains of over 20% [3]. The timing suggests the Reddit promotion may have contributed to retail investor momentum, though other fundamental catalysts were also present.

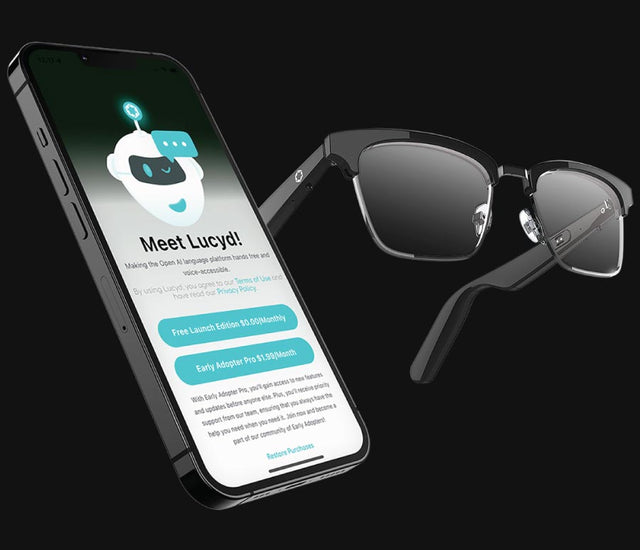

LUCY represents Innovative Eyewear Inc., a company specializing in ChatGPT-enabled smart glasses under the Lucyd brand. Despite the recent surge, the stock has experienced significant volatility throughout 2025, declining 68.7% year-to-date from $4.92 at the beginning of the year to approximately $1.54 by November [4].

- Extreme volatility demonstrated by 68.7% YTD decline despite recent gains

- Penny stock characteristics with low float and typical volume increase manipulation risk

- Reddit promotion suggests potential for pump-and-dump patterns

- Profitability challenges remain despite recent improvements [5]

- Legitimate business expansion into growing North American and European safety eyewear markets

- Strong technological positioning with ChatGPT integration and advanced smart eyewear features

- Recent product launches and international partnerships provide fundamental growth drivers

- Improved financial metrics suggest operational turnaround may be underway [2]

LUCY stock experienced a 20.15% surge on November 12, 2025, following a Reddit promotion the previous day that highlighted the company’s AI-enabled smart glasses technology and strong Q2 2025 financial performance. While Innovative Eyewear Inc. shows legitimate business improvements with new product launches, international expansion, and better financial results, the stock remains highly volatile after declining 68.7% year-to-date. The company’s focus on ChatGPT-enabled smart glasses under the Lucyd brand positions it in the growing wearable technology market, but investors should be aware of the elevated risks associated with low-float, retail-driven momentum stocks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.