In-Depth Analysis of the Reasons for Institutional Brokerages' Increase in Holdings of BGRIMM Technology: Investment Opportunities Amid the High Prosperity of the Rare Earth Permanent Magnet Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and market information, I will systematically analyze the reasons why BGRIMM Technology has attracted simultaneous increases in holdings from three major brokerages including Goldman Sachs.

BGRIMM Technology Co., Ltd. is a high-tech enterprise focusing on magnetic materials and components, whose main business covers the R&D, production, and sales of products such as rare earth permanent magnet materials and magnetic material components[0]. As an important target in the magnetic materials sector of the A-share market, the company has benefited from the rapid development of the new energy industry chain.

| Indicator | Value |

|---|---|

| Current Price | ¥23.89 |

| 2025 Year-to-Date Increase | ~59% |

| 52-Week High | ¥29.44 |

| 52-Week Low | ¥14.50 |

| 20-Day Moving Average | ¥22.73 |

| Current Price Above MA20 | Yes |

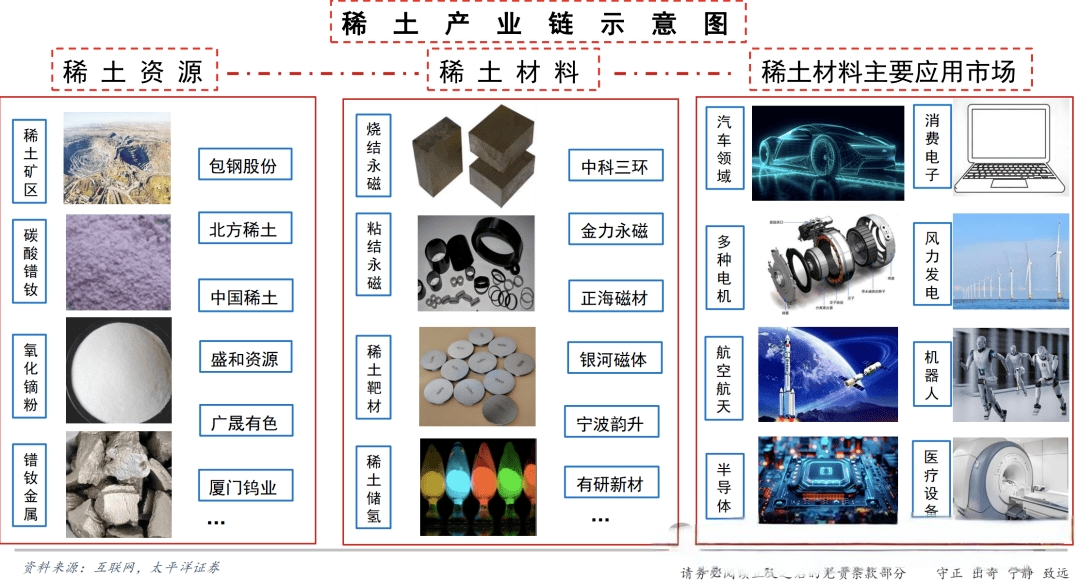

As a national strategic mineral resource, rare earths are indispensable core materials for key fields such as new energy vehicles, wind power, high-end chips, and national defense and military industries[1]. According to industry research data:

- Rare Earth Metals Market Size: The market size in the base year of 2025 is approximately USD 7.2 billion, and it is expected to reach USD 12.6 billion by 2035, with a compound annual growth rate of approximately 6.5%[2]

- Praseodymium-Neodymium Metal Price: The average price in July 2025 increased by approximately 16% compared to January[1]

- Policy Support: The Ministry of Commerce has issued consecutive announcements to strengthen rare earth export controls, providing policy support for domestic rare earth prices[3]

The main application fields of rare earth permanent magnet materials are showing rapid growth:

| Application Field | Demand Driver |

|---|---|

| New Energy Vehicles | Surge in demand for electric vehicle drive motors |

| Wind Power Industry | Continuous growth in offshore wind power installed capacity |

| Energy-Efficient Home Appliances | Increasing penetration rate of high-efficiency energy-saving motors |

| Humanoid Robots | Emerging high-end application scenarios[3] |

| Low-Altitude Aircraft | Emerging market driven by policies |

Based on the latest financial analysis data[0]:

- Debt Risk: Low-risk category

- Financial Stance: Neutral, maintaining balanced accounting practices

- Free Cash Flow: Positive value, sound cash flow situation

- Price-to-Earnings Ratio (TTM): 40.74x, valuation is within a reasonable range for the industry

From the end of 2025 to the beginning of 2026, multiple international brokerages have released positive outlooks on China’s stock market[4]:

| Institution | Key Forecast Points |

|---|---|

Goldman Sachs |

The MSCI China Index still has 30% upside potential in the next two years |

JPMorgan Chase |

The MSCI China Index is expected to rise by approximately 18% by the end of 2026, and the CSI 300 Index is expected to rise by approximately 12% |

UBS |

The profit growth rate of all A-shares is expected to rise from 6% this year to 8% in 2026 |

Morgan Stanley |

Global investors are gradually returning to the Chinese market |

From a technical analysis perspective[0]:

- MACD Indicator: In a bullish configuration, no death cross signal

- KDJ Indicator: K value: 84.0, J value: 81.2, indicating short-term overbought but still having momentum

- RSI Indicator: In the overbought risk zone

- Beta Coefficient: 0.57, relatively low volatility compared to the market

- Trend Judgment: Sideways consolidation, reference trading range: ¥22.73 - ¥24.12

The “anti-involution” policy aims to reduce vicious competition within the industry and improve corporate profitability and quality[4]. This policy orientation is conducive to improving the profit margin of the materials industry where BGRIMM Technology operates.

Enterprise globalization and enhancement of global competitiveness are themes widely favored by foreign institutional investors[4]. As a leader in magnetic materials, with the improvement of Chinese enterprises’ technical level and brand influence, the overseas market has become a new growth space for BGRIMM Technology.

Compared with previous rare earth export control measures, the scope and depth of controls in 2025 have been comprehensively expanded[3]. The strategic value of rare earths has been highlighted again, and the prosperity of the sector is expected to continue to rise.

| Risk Type | Specific Content |

|---|---|

| Price Fluctuation | Rare earth metal market prices fluctuate sharply with high uncertainty[2] |

| Alternative Technologies | Alternative technologies such as ferrite or composite materials may affect rare earth demand[2] |

| Valuation Risk | Current P/E ratio is 40.74x, stock price is approximately 5% higher than the 20-day moving average |

| Policy Changes | Uncertainties exist in the implementation details of rare earth export control policies |

The three major brokerages including Goldman Sachs have simultaneously increased their holdings of BGRIMM Technology mainly based on the following logic:

- Industry Level: The rare earth permanent magnet industry is in a high prosperity cycle, with obvious policy support and continuous growth in downstream demand

- Company Level: As a leader in magnetic materials, BGRIMM Technology has a sound financial situation and its performance growth is promising

- Market Level: Foreign institutional investors are collectively bullish on Chinese assets, with the technology and materials sectors being key allocation directions

- Technical Level: The stock price has performed strongly, technical indicators are bullish, and it has high capital attention

Overall, BGRIMM Technology aligns with the allocation logic of foreign institutional investors’ core investment theme of “Technology Growth + Strategic Resources” in China’s A-share market. Driven by the dual forces of the upward industry prosperity and continuous return of foreign capital, the company is expected to continue to maintain good performance.

[1] Caifuhao - Guangtai Vacuum Industry Analysis Report (https://caifuhao.eastmoney.com/news/20251226131625372270520)

[2] Research Nester - Rare Earth Metals Market Size and Share Report (https://www.researchnester.com/cn/reports/rare-earth-metals-market/5142)

[3] Shanghai Nonferrous Metals Network - Rare Earth Industry News (https://news.smm.cn/keywords/稀土)

[4] Securities Times - Foreign Investors’ Analysis of A-Shares in 2026 (https://www.stcn.com/article/detail/3542403.html)

[0] Gilin AI Financial Database - Company Overview and Financial Analysis of BGRIMM Technology (600980.SS)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.