Commercial Metals Company (CMC): Jefferies Bullish Outlook Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I have comprehensive data. Let me compile a thorough analysis of Jefferies’ bullish outlook on Commercial Metals.

Jefferies has adopted a

Jefferies analyst

| Factor | Description |

|---|---|

Relative Underperformance |

CMC had underperformed peers by roughly 5% in recent weeks, creating an attractive entry point[1] |

Rebar Pricing Resilience |

Continued strength in rebar pricing, a key product category for CMC[1] |

Earnings Upgrade Potential |

Expected rebar demand to drive earnings upgrades[1] |

Compelling Valuation |

Stock valuation has become more attractive following recent weakness[1] |

Strategic Priorities |

Focus on integration of precast concrete acquisitions and West Virginia rebar mill ramp-up[1] |

Jefferies’ broader steel sector analysis identifies several tailwinds:

- Falling Imports: Reduced steel imports are tightening domestic supply-demand dynamics

- Inventory Rationalization: Inventories have declined, supporting pricing

- Tariff Protection: Expected maintenance of steel tariffs provides downside protection for U.S. producers

- Capital Spending Easing: Expected moderation in capex spending should boost free cash flow

- Muted Scrap Prices: Lower scrap costs should support margins and enable upside to consensus forecasts

The firm expects U.S. steel producers to experience

Commercial Metals delivered strong FY2025 results, demonstrating operational resilience:

| Metric | Value | Analysis |

|---|---|---|

Market Cap |

$8.01 billion | Large-cap steel producer |

Current Price |

$72.22 | Near 52-week high ($75.03) |

P/E Ratio (TTM) |

18.32x | Reasonable valuation vs. peers |

P/B Ratio (TTM) |

1.86x | Below historical averages |

ROE |

10.54% | Solid return on equity |

Net Profit Margin |

5.46% | Healthy profitability |

Operating Margin |

4.87% | Efficient operations |

Current Ratio |

4.47x | Exceptional liquidity |

Quick Ratio |

3.70x | Strong short-term position |

| Quarter | EPS | Revenue | EPS Surprise |

|---|---|---|---|

| Q4 FY2025 | $1.37 | $2.12B | +1.48% |

| Q3 FY2025 | $0.74 | $2.02B | — |

| Q2 FY2025 | $0.26 | $1.75B | — |

- EPS of $1.37 beat estimates of $1.35

- Revenue of $2.12B exceeded $2.08B expectations

- Consolidated core EBITDA increased 33% year-over-yearto $291.4M

- North American Steel Group generated $239.4M in adjusted EBITDA

- Emerging Businesses segment delivered 13.4% sales growth[2]

| Balance Sheet Item | August 31, 2025 | August 31, 2024 |

|---|---|---|

Cash & Equivalents |

$1.04B | $858M |

Total Current Assets |

$3.49B | $3.29B |

Total Current Liabilities |

$1.26B | $835M |

Long-term Debt |

$1.31B | $1.15B |

Total Stockholders’ Equity |

$4.19B | $4.30B |

The company’s

The U.S. steel sector enters 2026 on “firmer ground” with several structural positives:

- Flat-Rolled Steel Prices: Up approximately 10% in the past two months due to falling imports and tightening inventories[1]

- Data Center Construction: Emerging as the strongest demand sector, with spending at seasonally-adjusted annual rate of $41.4B in August 2025, 26% higher than August 2024[4]

- Infrastructure Spending: 60% of IIJA funds remaining to be spent, driving incremental demand[5]

The rebar market presents favorable fundamentals:

| Metric | Value |

|---|---|

U.S. Rebar Market (2025) |

$7.31 billion |

U.S. Rebar Market (2026 Forecast) |

$7.70 billion |

U.S. Market CAGR (2025-2034) |

5.25% |

Global Rebar Market (2025) |

$257.87 billion |

Global Market CAGR (2025-2034) |

5.75% |

- Public infrastructure projects

- Commercial construction

- Industrial facility expansion

- Data center construction (structural steel requirements)

The

- $1.2 trillionin funding over five years (signed November 2021)

- 1.5 million tonsof incremental annual rebar demand at full run rate

- 60% of fundsstill remaining to be spent as of early 2026[5]

CMC is well-positioned to benefit given its:

- Seven electric arc furnace (EAF) mini mills

- Two EAF micro mills

- Extensive fabrication and processing network

- Geographic footprint aligned with infrastructure project locations

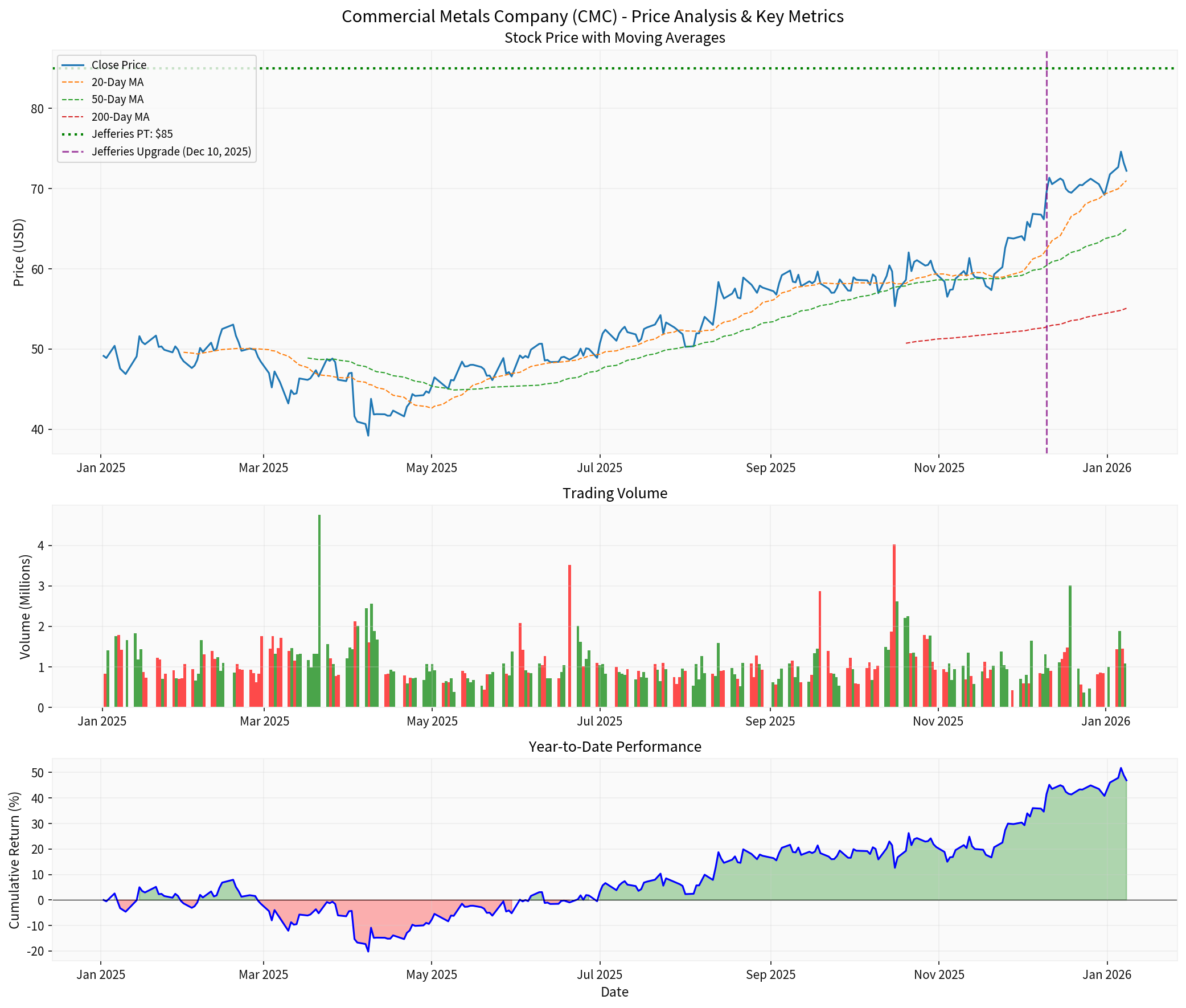

| Period | Performance |

|---|---|

1 Month |

+8.13% |

3 Months |

+21.71% |

6 Months |

+38.92% |

1 Year |

+51.74% |

YTD |

+0.55% |

| Indicator | Value | Interpretation |

|---|---|---|

20-Day MA |

$71.00 | Short-term support |

50-Day MA |

$64.96 | Intermediate support |

200-Day MA |

$55.08 | Long-term trend positive |

Beta |

1.49 | Higher volatility than market |

Trend |

Sideways/Neutral | Trading range: $71.00-$73.19 |

| Rating | Count | Percentage |

|---|---|---|

Buy |

12 | 46.2% |

Hold |

12 | 46.2% |

Sell |

2 | 7.7% |

| Firm | Rating | Price Target | Recent Action |

|---|---|---|---|

Jefferies |

Buy | $78 | Upgrade to Buy (Dec 10, 2025) |

Goldman Sachs |

Buy | $84 | Maintain (Dec 30, 2025) |

Wells Fargo |

Overweight | $79 | Maintain (Dec 15, 2025) |

JPMorgan |

Overweight | $78 | Upgrade (Dec 5, 2025) |

Morgan Stanley |

Overweight | — | Upgrade (Oct 24, 2025) |

CMC’s management has outlined key priorities for 2026:

- Integration of Precast Concrete Acquisitions— Expanding downstream presence

- West Virginia Rebar Mill Ramp-Up— Increasing production capacity

- Arizona 2 Mill Optimization— Delivered first full quarter of positive EBITDA in Q4 2025

- Margin Enhancement— Strategic initiatives targeting improved returns on capital

- Capital Allocation— FY2026 capex projected at $600M with effective tax rate of 4-8%

Jefferies’ bullish outlook on Commercial Metals is supported by:

- Strong balance sheet with 4.47x current ratio

- Consistent earnings beats (Q4 FY2025 EPS surprise: +1.48%)

- Core EBITDA growth of 33% YoY

- Strategic capacity expansion (Arizona 2, West Virginia mill)

- Precast concrete acquisition strategy

- Rebar pricing resilience

- Falling steel imports supporting domestic pricing

- Data center construction boom

- Infrastructure spending tailwinds (IIJA)

- Expected free cash flow improvement

- Trading at 18.32x P/E — reasonable for fundamentals

- Below historical average P/B (1.86x)

- Price targets of $78-$85 imply 8-18% upside

- Recent underperformance created entry opportunity

| Risk Factor | Description |

|---|---|

Beta 1.49 |

Higher volatility than market |

MACD Death Cross |

Technical bearish signal |

Litigation Exposure |

$362M contingent litigation-related loss recorded in FY2025 |

Steel Price Volatility |

Subject to cyclical demand fluctuations |

Interest Rate Sensitivity |

Higher rates may slow construction activity |

Jefferies’ upgrade of Commercial Metals reflects a confluence of company-specific strengths and favorable industry dynamics. The stock’s recent underperformance created an attractive entry point, while the combination of resilient rebar pricing, strong infrastructure demand, and improving free cash flow prospects supports the bullish outlook. The $78-$85 price target range implies meaningful upside from current levels, with the company’s solid balance sheet and strategic initiatives providing downside protection.

[1] Yahoo Finance - “Metals & Mining outlook: Nucor remains top pick at Jefferies, CMC upgraded to Buy” (https://finance.yahoo.com/news/metals-mining-outlook-nucor-remains-105114980.html)

[2] Investing.com - CMC Stock Analysis (https://www.investing.com/equities/commercial-metals-comp)

[3] SEC EDGAR - Commercial Metals Company 10-K Filing (https://www.sec.gov/Archives/edgar/data/22444/000002244425000138/cmc-20250831.htm)

[4] Argus Media - “Viewpoint: US flat steel demand hinges on data centers” (https://www.argusmedia.com/en/news-and-insights/latest-market-news/2771030-viewpoint-us-flat-steel-demand-hinges-on-data-centers)

[5] Zacks Investment Research - CMC Equity Research Report (https://advisortools.zacks.com/proxy/ResearchReport/CMC/report?d=20260105)

[6] Nasdaq - “Jefferies Upgrades Commercial Metals (CMC)” (https://www.nasdaq.com/articles/jefferies-upgrades-commercial-metals-cmc)

[0] 金灵API市场数据 (Commercial Metals Company Overview & Technical Analysis)

爱美客肉毒毒素独家经销权获批影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.