Analysis of the Major Asset Restructuring: Northern Dragon's Acquisition of 51% Equity of Shunyi Technology

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will present the complete analysis report to you.

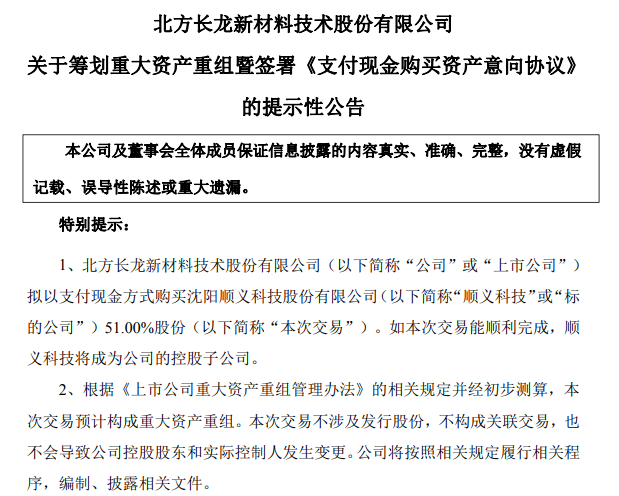

According to the announcement released on January 8, 2026 by Northern Dragon New Material Technology Co., Ltd. (Stock Code: 301357.SZ, GEM of Shenzhen Stock Exchange), the company plans to acquire 51% equity of Shenyang Shunyi Technology Co., Ltd. via cash payment. If the transaction is successfully completed, Shunyi Technology will become a holding subsidiary of Northern Dragon. According to preliminary calculations, this transaction is expected to constitute a major asset restructuring[1][2].

| Item | Content |

|---|---|

Acquisition Method |

Cash Acquisition |

Acquisition Ratio |

51% Equity |

After Transaction Completion |

Shunyi Technology becomes a holding subsidiary of Northern Dragon |

Transaction Nature |

Expected to constitute a major asset restructuring |

Share Issuance |

No share issuance involved |

Connected Transaction |

Does not constitute a connected transaction |

Change of Control |

Will not lead to changes in the company’s controlling shareholder and actual controller |

Trading Suspension Arrangement |

The stock will not be suspended from trading |

Currently, the company has signed the “Intentional Agreement for Cash Purchase of Assets” with the shareholders of Shunyi Technology, but the transaction is still in the planning stage, and the specific transaction methods and terms need further negotiation and demonstration[2].

Founded in 2012, Shunyi Technology focuses on the field of intelligent control technology. Its main business covers the development, production and sales of five major product lines: health management systems, intelligent testing equipment, simulation equipment, maintenance support equipment, and intelligent control systems. Its products are mainly applied in the national defense technology field[2].

The equity structure of Shunyi Technology is relatively concentrated, with Li Yingshun as the actual controller:

- Direct shareholding: 54.34%

- Indirect control via employee shareholding platform Hangzhou Yaqige Investment Management Partnership (Limited Partnership): 6.42%

- Actual voting rights of shares controlled: 60.76%

It is worth noting that Shunyi Technology launched IPO counseling in May 2024, with Changjiang Securities Underwriting & Sponsoring Co., Ltd. as the counseling institution. In May 2025, it received an acquisition intention from another A-share company Cixing Co., Ltd. (300307.SZ), but the transaction was terminated in August due to the failure of the two parties to reach an agreement on some commercial terms[2].

Based on the transaction plan data previously disclosed by Cixing Co., Ltd., the financial performance of Shunyi Technology in recent years is as follows:

| Financial Indicator | 2023 | 2024 | Year-on-Year Change |

|---|---|---|---|

| Operating Revenue | RMB 284 million | RMB 225 million | -20.8% |

| Net Profit | RMB 27.716 million | RMB 54.8797 million | +98.0% |

| Net Profit Margin | 9.76% | 24.39% | +14.63 pct |

Shunyi Technology showed typical characteristics of “cost reduction and efficiency improvement” in 2024: although its operating revenue decreased by about 21% year-on-year, its net profit increased significantly by 98%, and its net profit margin jumped from less than 10% to more than 24%, reflecting a strong improvement in profitability[2].

Founded in 2010, Northern Dragon focuses on the military equipment field, mainly engaging in the R&D, design, production and sales of supporting equipment for military vehicles, with the performance research, process structure design and application technology of non-metallic composite materials as its core. The company’s products are widely used in main battle equipment such as wheeled and tracked vehicles for electronic information, armored combat, and armored support[3][4].

The main products of Northern Dragon are divided according to application scenarios:

- Interior of Man-Machine-Environment System for Military Vehicles: Core product, accounting for more than 90% of the revenue in the reporting period

- Ammunition Equipment

- Auxiliary Equipment for Military Vehicles

- Communication Equipment for Military Vehicles

Northern Dragon has a prominent industry position in the field of composite material supporting equipment for military vehicles:

-

“Little Giant” Enterprise with Specialized, Sophisticated, Unique, and New Features: Recognized as a third batch of “Little Giant” enterprises with specialized, sophisticated, unique, and new features by the Ministry of Industry and Information Technology in July 2021[4]

-

Demonstration Enterprise of Military-Civilian Integration in Shaanxi Province: Recognized by the Office of the Military-Civilian Integration Development Committee of the Shaanxi Provincial Party Committee in January 2022[4]

-

Drafting Unit of National Military Standards: Invited to be a drafter of the national military standard “Specification for Multi-Functional Linings of Military Vehicles”, and is the only enterprise participating in the drafting of national military standards in the field of military vehicle linings[4]

-

Wide Application of Equipment: Its products have been applied in 67 Army vehicle models, 1 Rocket Force vehicle model, 3 Navy vehicle models, and mainstream models such as 8×8/6×6/4×4; it participates in the supporting supply of more than 1,000 sets of military equipment annually[3][4]

-

Outstanding R&D Strength: It has long undertaken research tasks of military scientific research projects, with more than 30 vehicle models involved in projects in the R&D stage, and more than 10 of these projects have delivered prototype vehicles waiting for batch production according to military needs[4]

| Financial Indicator | 2024 | First Three Quarters of 2025 |

|---|---|---|

| Operating Revenue | RMB 108 million | RMB 122 million |

| Net Profit | -RMB 10.89 million | RMB 11.2885 million |

| Net Profit Margin | -10.08% | 9.25% |

Northern Dragon incurred a loss in 2024, mainly affected by factors such as delayed order signing and delivery. However, it turned losses into profits in the first three quarters of 2025, with operating revenue increasing by 159.21% year-on-year and net profit of RMB 11.2885 million, showing a significant recovery in profitability[2][5].

Estimation of the impact of consolidation after the acquisition based on 2024 financial data:

| Item | Before Acquisition (Northern Dragon) | Consolidation Contribution of Shunyi Technology (51%) | After Acquisition and Consolidation (Estimated) |

|---|---|---|---|

| Operating Revenue | RMB 108 million | RMB 115 million | RMB 223 million |

| Net Profit | -RMB 11 million | RMB 28 million | RMB 17 million |

- Operating Revenue Growth: +106.2%

- Net Profit: Turned from loss to profit, with an expected profit of approximately RMB 17.1 million

After the completion of the acquisition, Northern Dragon’s revenue scale will double, and more importantly, it will significantly improve the company’s profitability and turn losses into profits.

Northern Dragon and Shunyi Technology both belong to the military industry sector, and have strong synergy in business and market resources:

- Northern Dragon: Focuses on the application of non-metallic composite materials in the field of military vehicle equipment

- Shunyi Technology: Focuses on intelligent control technology, providing health management systems, intelligent testing equipment, etc.

- Northern Dragon has profound accumulation in the field of composite material applications

- Shunyi Technology has advantages in intelligent control technology

- The integration of the two parties’ technologies is expected to improve the intelligent level of military equipment

- Both belong to the national defense technology field, with overlapping downstream customers

- Can realize shared customer resources and reduce customer acquisition costs

- Upstream raw material procurement can form scale effects

- Reduce procurement costs and enhance bargaining power

- Business Scale Expansion: The revenue scale will increase from about RMB 100 million to more than RMB 200 million, achieving leapfrog development

- Improvement of Profitability: Injecting high-profitability assets is expected to significantly improve the company’s overall profit level

- Enriched Product Lines: Expanding from a single interior of man-machine-environment system to multiple fields such as intelligent control and testing equipment

- Enhanced Market Position: After integration, it is expected to form stronger comprehensive competitiveness in the military composite material field

- Laying a Foundation for Future Development: The expansion of business scale will help enhance the company’s status and influence in the military industry

- The acquisition of high-quality assets sends a positive signal to the market

- The expectation of turning losses into profits is expected to boost market confidence

- The military industry theme combined with the concept of merger and reorganization may attract capital attention

- The transaction is still in the planning stage, and the final plan has not yet been determined

- The acquisition consideration is unknown, and there may be risks of premium acquisition

- The previous failure of Cixing Co., Ltd.'s acquisition of Shunyi Technology requires attention to potential obstacles

- Doubled Revenue Scale: Significant growth in revenue scale after consolidation

- Improved Profitability: Injecting assets with high net profit margin (Shunyi Technology’s net profit margin is about 24%)

- Release of Synergy Effects: Cost savings and revenue growth brought by integration of technology, customers, and supply chain

- Enhanced Market Competitiveness: Enhanced comprehensive solution capability, which is conducive to obtaining more orders

- Integration Risk: Uncertainties exist in the integration of corporate culture and management teams

- Performance Commitment Risk: Uncertainty exists whether the target company can fulfill its performance commitments

- Industry Policy Risk: Compliance and order risks brought by the particularity of the military industry

- Valuation Risk: The acquisition consideration may affect future goodwill and shareholder returns

- Transaction Uncertainty Risk: The transaction is still in the planning stage, and uncertainties exist regarding the specific transaction methods, terms, and whether it can be finally completed[1][2]

- Valuation Risk: The acquisition consideration has not been determined yet; if there is a high premium, it may affect shareholder returns

- Integration Risk: Uncertainties exist in the integration of corporate culture, management teams, and business synergy after the merger and acquisition

- Industry Policy Risk: The military industry is affected by factors such as military expenditure budgets, equipment procurement plans, and international situations

- Historical Transaction Risk: The previous acquisition of Shunyi Technology by Cixing Co., Ltd. was terminated due to disagreements on commercial terms, so potential issues need to be paid attention to[2]

- Performance Fluctuation Risk of the Target Company: Shunyi Technology’s operating revenue decreased year-on-year in 2024, so attention should be paid to its business stability

Northern Dragon’s acquisition of 51% equity of Shunyi Technology is a strategic industrial merger and acquisition:

- Both belong to the military industry sector, with strong business synergy

- The target asset has outstanding profitability (net profit margin exceeds 24%)

- Can help Northern Dragon turn losses into profits

- Conforms to the company’s strategic expansion of military product business

- The transaction is still in the early stage, and the final plan and valuation are the key

- The history of the previous failed acquisition deserves attention

- The integration effect needs time to be verified

- Pay close attention to the details of the transaction plan disclosed in subsequent announcements

- Pay attention to the acquisition consideration and performance commitments

- Pay attention to the progress of regulatory approval

- Evaluate the integration effect after the transaction is completed

[1] Eastmoney.com - Northern Dragon: Planning Major Asset Restructuring (https://finance.eastmoney.com/a/202601083612966943.html)

[2] Sina Finance - 301357: Planning Major Asset Restructuring! (https://finance.sina.com.cn/stock/s/2026-01-08/doc-inhfreqm6536150.shtml)

[3] Huajin Securities - Northern Dragon New Stock Coverage Research Report (https://pdf.dfcfw.com/pdf/H3_AP202303291584639039_1.pdf)

[4] Time Weekly Online - Northern Dragon: “Little Giant” with Specialized, Sophisticated, Unique, and New Features, Invited to Draft National Military Standards (https://www.time-weekly.com/wap-article/293250)

[5] Sohu Securities - Northern Dragon Financial Data (https://q.stock.sohu.com/cn/301357/index.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.