Analysis of Insider Trading Signals from Rollins Inc (ROL)'s Executive Chairman

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to SEC Form 4 filings, Rollins Inc’s Executive Chairman John F. Wilson sold 1,520 shares of the company’s stock on

While the $90,000 transaction amount is relatively small and routine, viewing this sale within the full-year context presents a different picture:

| Date | Transaction Type | Number of Shares | Price | Amount | Nature |

|---|---|---|---|---|---|

| May 29-30, 2025 | Sale | 80,000 shares | ~$56.39 | $4,510,800 | Large-scale share disposal |

| July 25, 2025 | Sale | 30,000 shares | $58.04 | $1,741,200 | Active sale |

December 15, 2025 |

Sale |

1,520 shares |

$59.40 |

$90,228 |

Tax-related |

Even more alarming is the approximately

- R. Randall Rollins Voting Trust: Sold 20,000,000 shares

- Gary W. Rollins Voting Trust: Sold 20,000,000 shares

- LOR INC: Sold approximately 19,300,000 shares

This collective $3.4 billion share disposal is one of the largest insider selling events in the 2025 market, and is by no means a simple portfolio adjustment.

- CEO Jerry Gahlhoff: Sold 30,000 shares in June 2025 (approximately $1.706 million)

- CIO Thomas Tesh:Purchased7,187 shares in November 2025 (valued at approximately $417,000) — this is one of the few positive buying signals[2][3]

The DCF valuation model indicates that the current stock price is significantly overvalued:

| Scenario | Intrinsic Value | Relative to Current Price |

|---|---|---|

| Conservative Scenario | $17.98 | -70.1% |

| Base Scenario | $24.07 | -60.0% |

| Optimistic Scenario | $39.04 | -35.2% |

Probability-Weighted Average |

$27.03 |

-55.1% |

| Current Market Price | $60.21 | — |

The current P/E ratio reaches

- This is a “sell-to-cover” transaction

- The Executive Chairman still holds 607,587 shares, indicating alignment with shareholder interests

- Such transactions typically do not represent management’s judgment on valuation

Wilson’s total share sales of $6.34 million for the full year, combined with the family trust’s massive $3.4 billion share disposal, constitute a

- Management and major shareholders believe the stock price has fully reflected its value

- There may be unrecognized operational or industry risks in the market

- The founding family is conducting a strategic divestment

The DCF model indicates a 55% potential downside, and there is still a 35% correction risk even in the optimistic scenario[4].

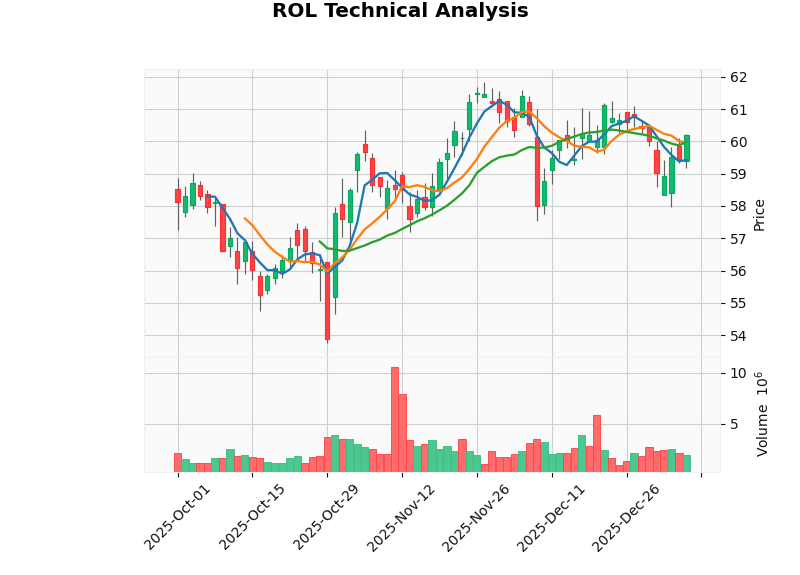

Technical indicators show:

- MACD: No crossover signal, slightly bearish

- KDJ: K value 51.5, D value 46.6, slightly bullish

- RSI: In the normal range

- Trend Judgment: Sideways consolidation (range of $59.68-$60.74)

- Beta: 0.79 (low correlation with the broader market)[0]

While the $90,000 tax-related sale is a neutral event in itself, it

- The family trust’s $3.4 billion sell-offis the most important negative signal — this is a large-scale strategic divestment that cannot be explained by personal tax planning

- Wilson’s cumulative $6.34 million share disposal for the yearindicates that the Executive Chairman continues to believe the current valuation fully reflects the company’s value

- DCF valuation showing 55% overvaluationprovides a fundamental explanation for the insider selling

- The CIO’s share purchaseis one of the few positive signals, but its scale is insufficient to offset the negative impact of the collective sell-off

| Risk Factor | Rating |

|---|---|

| Insider Trading Signal | High Risk |

| Valuation Risk | High Risk |

| Technical Risk | Medium |

| Fundamentals (ROE 36.5%) | Positive |

| Analyst Consensus | Slightly Positive |

The risk-reward ratio of Rollins stock is currently unattractive. Recommendations:

- Holding Investors: Consider reducing positions or setting a tight stop-loss level (range of $55-$57)

- Potential Investors: Wait for a better entry opportunity (at least a 20-30% discount from the current price, i.e., the range of $42-$48)

- Risk-Tolerant Investors: May retain a small position, but need to closely monitor the Q4 earnings report (to be released on February 11, 2026) and subsequent insider trading activities

[0] Jinling API Market Data - Rollins Inc Company Overview, Stock Price Data, Technical Analysis (January 8, 2026)

[1] Stock Titan - “Rollins (ROL) Executive Chairman Wilson Reports Tax…” (https://www.stocktitan.net/sec-filings/ROL/form-4-rollins-inc-insider-trading-activity-be875429241f.html)

[2] Seeking Alpha - Rollins Inc SEC Filing Analysis (https://seekingalpha.com/symbol/ROL)

[3] Finviz - ROL Insider Trading Data (https://finviz.com/quote.ashx?t=ROL)

[4] Jinling API DCF Valuation Analysis - Rollins Inc Intrinsic Value Assessment (January 8, 2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.