In-Depth Analysis of General Motors' $7.1 Billion EV Business Impairment: Strategic Contraction and Investment Value Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest collected data and market information, I will provide you with a systematic and comprehensive analysis report.

General Motors announced on January 8, 2026 that it will recognize a

| Expense Item | Amount | Purpose Description |

|---|---|---|

| EV Business Contraction | $6 billion |

Mainly for asset impairment of battery plants and EV production capacity |

| Business Restructuring Costs | $1.1 billion | $500 million of which is cash expenditure (employee placement, plant transformation, etc.) |

Total |

$7.1 billion |

Fourth-quarter one-time charge |

Notably, including this charge,

Mary Barra, Chairman and CEO of General Motors, stated publicly:

- Capacity Reallocation: Production capacity originally designated for electric vehicles will be redirected to increase output of high-margin full-size pickup trucks and SUVs

- Product Line Freeze: No further expansion of the electric vehicle lineup, focusing on sales of existing electric models

- Hybrid Transformation: Plans to launch plug-in hybrid models as a transitional solution

- Abandonment of Long-Term Targets: Officially abandons the commitment to “full electrification of all models by 2035”

Despite the large impairment charge, General Motors’ stock price rose against the trend, hitting a 52-week high [0]:

| Indicator | Value |

|---|---|

Latest Closing Price |

$85.13 (after-hours) |

Single-Day Gain |

+3.93% |

52-Week High |

$85.18 |

52-Week Low |

$41.60 |

Market Capitalization |

$79.42 billion |

P/E Ratio |

16.25x |

This counterintuitive market reaction indicates that investors have a positive attitude towards General Motors’ “stop-loss” strategy and its return to core profitable businesses.

The

| Policy Change | Specific Content | Effective Time |

|---|---|---|

| Termination of $7,500 Tax Credit | Federal EV purchase subsidy officially canceled | September 30, 2025 |

| Relaxation of CAFE Standards | Corporate Average Fuel Economy standards significantly lowered | July 2025 |

| Invalidity of California Emission Standards | Revocation of California’s authority to set independent emission standards | 2025 |

| Termination of Environmental Penalty Mechanism | Termination of the penalty mechanism for non-compliant fuel economy in place since 1975 | July 2025 |

Eric Anderson, an auto analyst at S&P Global, pointed out:

The U.S. EV market is experiencing a significant decline [1][4]:

| Time Node | Sales Change | Market Characteristics |

|---|---|---|

| November 2025 | Approximately 40% year-on-year decline | Demand plummeted after subsidy withdrawal |

| Q4 2025 (Forecast) | 24% year-on-year decrease | Forecast by BloombergNEF |

| GM Q4 Sales | 7% year-on-year decline | Overall decline, with a larger drop in EV sales |

- High interest rate environment suppresses large-ticket consumption

- Insufficient charging infrastructure

- Persistent range anxiety

- Hybrid models diverting demand as a “more pragmatic option”

For traditional U.S. automakers, the EV business has been in a loss-making state for a long time [4][5]:

- 2021-2024: Cumulative operating loss of nearly $13 billionin the EV business [4]

- 2025: Expected additional loss of approximately $5 billion in the EV business

- Impairment Charge: $19.5 billion(Q4 2025)

- High costs of full-size electric pickup trucks and SUVs

- Lack of sufficient production scale to reduce battery procurement costs

- Disadvantaged position in negotiations with battery suppliers

Colin McKerracher, analyst at BloombergNEF, stated:

| Automaker | Specific Measures | Impairment Amount |

|---|---|---|

Ford Motor |

Cancels all-electric F-150 Lightning, next-generation T3 electric pickup projects, shifts to extended-range hybrid; terminates battery joint venture with SK On | $19.5 billion |

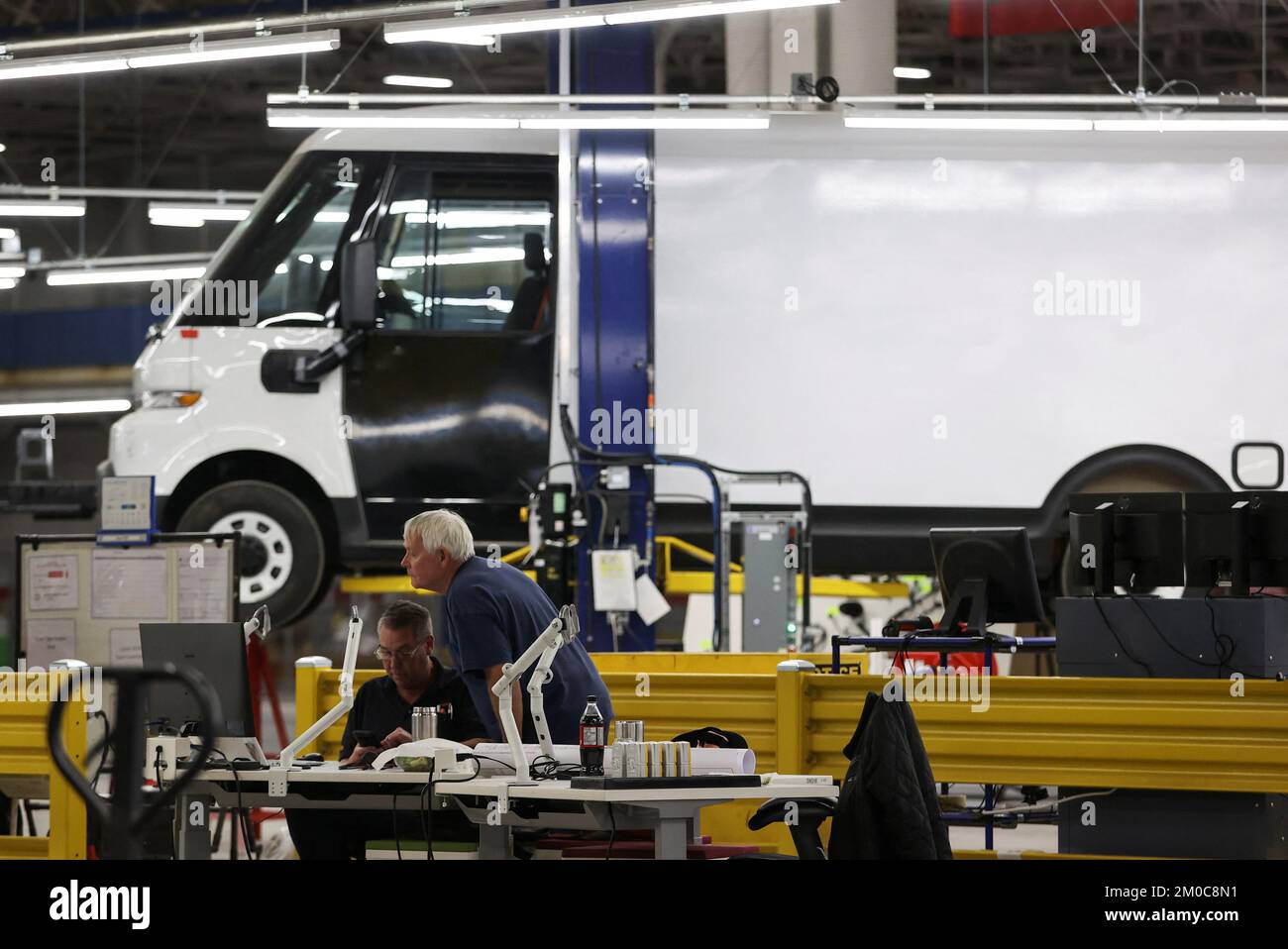

General Motors |

Scales back EV production capacity, freezes new models, shifts to hybrid | $7.1 billion |

Stellantis |

Cancels Ram 1500 electric pickup R&D plan, increases investment in hybrid | Partial impairment charge |

It’s not just the U.S.; major global automotive markets are re-evaluating electrification targets [4][5]:

- The EU relaxed the 2035 “ban on internal combustion engines” from “zero emissions” to “90% emission reduction”

- The UK and Canada have simultaneously slowed down the promotion of mandatory EV adoption targets

| Automaker | Adjustment Content |

|---|---|

| Volkswagen | Cuts production of ID.4 at Tennessee plant, furloughs 160 employees |

| Honda | Lowers 2030 EV sales target from 30% to 20% |

| Porsche | Delays launch of some all-electric models, incurs €1.8 billion in charges |

| Hyundai/Kia | Allocates capacity at the $7.6 billion Georgia plant to hybrid and fuel-powered models |

This round of strategic contraction sends a clear signal:

- Fuel vehicle sales have peaked globally, but a large portion of demand is shifting to hybrid vehicles[4]

- S&P Global Auto forecasts: Global demand for fuel vehicles and hybrid vehicles will continue to grow until at least 2032 [4]

- For traditional automakers, focusing on fuel vehicles and hybrids is a more acceptable optionwithout the need for large-scale adjustments to existing businesses [4]

Based on the latest financial data [0]:

| Dimension | Indicator | Assessment |

|---|---|---|

Profitability |

ROE 4.68%, Net Profit Margin 1.66%, Operating Profit Margin 4.39% | Moderately profitable, with room for improvement |

Liquidity |

Current Ratio 1.23, Quick Ratio 1.06 | Robust short-term solvency |

Valuation |

P/E 16.25x, P/B 1.24x | Relatively reasonable |

Cash Flow |

Negative free cash flow (-$5.98 billion) | Need to pay attention to capital allocation efficiency |

- Financial attitude is categorized as “conservative”, indicating the company adopts prudent accounting policies

- Debt risk rating is “medium risk”, overall financial situation is controllable

- Q3 earnings report exceeded expectations (EPS $2.80 vs. estimated $2.29), showing resilience of core businesses

| Rating Agency | Rating | Target Price | Rating Date |

|---|---|---|---|

Consensus Rating |

Buy |

$88.00 (+3.4% upside potential) | January 2026 |

| Morgan Stanley | Upgraded to Overweight | - | December 8, 2025 |

| Piper Sandler | Upgraded to Overweight | - | January 8, 2026 |

- Strong Buy: 2 (4%)

- Buy: 30 (60%)

- Hold: 14 (28%)

- Sell: 4 (8%)

- Profit Improvement: TD Cowen analysts predict that thanks to relaxed emission regulations, General Motors’adjusted operating profit will increase by approximately $3 billionin the next few fiscal years [4]

- Cash Flow Restoration: Scaling back high-investment EV business will free up capital

- Market Sentiment: Investors have given positive feedback on the “stop-loss” move

- Hybrid Product Cycle: Both General Motors and Ford are accelerating the layout of hybrid models, which is expected to capture demand shifting from fuel vehicles to hybrids

- Pickup/SUV Advantages: The preference for high-margin pickup trucks in the U.S. market will not change, and traditional automakers have a moat in these areas

- Energy Storage Business Expansion: Ford and General Motors are exploring battery energy storage businesses, which may become new profit growth points

| Risk Type | Specific Content |

|---|---|

Further Impairment of EV Assets |

The company expects more asset impairment charges in the future [3] |

Market Share Loss |

The Detroit Big Three hold less than 5% of the global EV market share [4] |

Policy Uncertainty |

If policies re-tighten electrification requirements in the future, the strategic adjustment may put the company in a passive position |

Technical Route Risk |

If breakthroughs in technologies such as solid-state batteries occur, the strategy focusing on hybrids may lag behind |

| Stage Feature | Previous Strategy | Current Adjusted Strategy |

|---|---|---|

| Target | Full electrification by 2035 | Timeline delayed or abandoned |

| Technical Route | Pure electric priority | Multi-pronged approach of hybrid, extended-range, and pure electric |

| Investment Focus | Expansion of EV production capacity | Optimization of existing assets, profit priority |

| Decision Basis | Policy-driven | Market/profit-driven |

Traditional automakers are rebalancing capital allocation:

- First Tier: High-margin fuel models (pickup trucks, SUVs) — cash flow foundation

- Second Tier: Hybrid/extended-range models — main force in the transition period

- Third Tier: Contraction and stop-loss of EV business — loss control

- Exploration Tier: New opportunities such as energy storage business

- Ford plans to invest approximately $2 billion in the next two years to expand its energy storage business [5]

- General Motors redirects EV plant capacity to pickup truck production

- Overall capital expenditure related to EVs is significantly reduced

- The slowdown in EV development is a foregone conclusion

- Pure EV companies such as Tesla and Rivian will gain a relative competitive advantage, but face the challenge of shrinking overall market size[3]

- Hybrid models will enter a growth window

- After the EU relaxed the 2035 “ban on internal combustion engines”, traditional automakers have gained breathing room

- However, difficulties in the European battery industry (such as Northvolt’s bankruptcy) have hindered the construction of localized supply chains [4][5]

- Chinese new energy automakers such as BYD will gain a relative competitive advantage

- Global EV discourse power may tilt towards China

- Strategies of General Motors, Ford, etc. in the Chinese market may also be affected

-

General Motors’ $7.1 billion charge is “stop-loss” rather than “defeat”: It marks the company’s shift from aggressive electrification to a pragmatic strategy, which the market has interpreted positively

-

The electrification transformation of traditional automakers has entered an “Era of Rationality”: Policy-driven growth is no longer sustainable, and market-oriented competition has become the dominant factor

-

Short-term profit improvement but long-term strategic pressure: Relaxed emission regulations bring immediate profit growth, but abandoning the first-mover advantage in EVs may face challenges in the medium to long term

-

Industry structure is facing reshaping: The parallel development of pure electric and hybrid vehicles will become the new normal, and the global discourse power of Chinese new energy automakers is expected to increase

| Dimension | Assessment |

|---|---|

| Short-Term (6 months) | Positive - Profit improvement expectations, reasonable valuation |

| Medium-Term (12 months) | Neutral - Hybrid product cycle, performance recovery |

| Long-Term (3 years) | Cautious - Risk of lagging EV strategy |

- Release of Q4 earnings report on January 27, 2026 (estimated EPS $2.21) [0]

- Launch progress of hybrid models

- Continuation of EV asset impairment

- Performance in the Chinese market

For investors focusing on the automotive sector, strategic considerations in the current environment:

- Traditional Automakers: Focus on targets that prioritize profit improvement and hybrid transformation (such as General Motors, Ford)

- EV Makers: Focus on companies with scale advantages and technological leadership (such as Tesla)

- Industrial Chain: Focus on investment opportunities in energy storage and hybrid-related suppliers

[1] Bloomberg - “GM’s EV Charges Balloon to $7.6 Billion as US Demand Craters” (https://www.bloomberg.com/news/articles/2026-01-08/gm-s-ev-charges-balloon-to-7-6-billion-as-market-in-us-craters)

[2] MarketWatch - “GM becomes the latest carmaker to write down billions in pivot away from EVs” (https://www.marketwatch.com/story/gm-becomes-the-latest-carmaker-to-write-down-billions-in-pivot-away-from-evs-39910611)

[3] Sina Finance - “2026 Responses of EV Makers Will Shape the Industry’s Future” (https://finance.sina.com.cn/stock/usstock/c/2025-12-23/doc-inhcuyuc6669955.shtml)

[4] Securities Times - “Europe and the US Adjust Automotive Industry Policies, Electrification Transformation May Slow Down” (https://www.stcn.com/article/detail/3577655.html)

[5] Guancha.cn - “Ford Leads the ‘U-Turn’, the Pure Electric Bubble of the U.S. Auto Industry Has Burst” (https://www.guancha.cn/qiche/2025_12_16_800617.shtml)

[6] The Guardian - “General Motors reports $7bn earnings loss after pulling back from EVs” (https://www.theguardian.com/business/2026/jan/08/general-motors-earnings-loss)

Report Generation Date: January 9, 2026

Data Sources: Real-time market data from Jinling API, news reports from mainstream financial media

Disclaimer: This report is for investment reference only and does not constitute specific investment advice. Investors should make independent investment decisions based on their own risk tolerance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.