NVIDIA Vera Rubin Architecture Cooling Statement Triggers Significant Selloff in U.S. Liquid Cooling Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

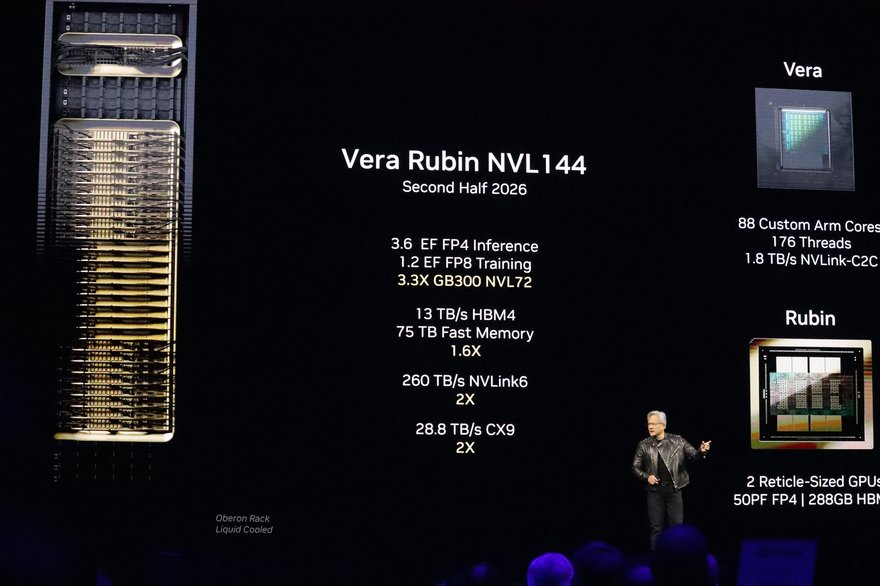

This analysis examines the market impact of NVIDIA CEO Jensen Huang’s announcement at CES 2026 regarding the Vera Rubin architecture’s cooling requirements. Huang’s statement that the new platform can operate without traditional water chillers triggered significant volatility in U.S. data center cooling-related stocks, with several companies experiencing their largest single-day declines in months. The event highlights the profound influence NVIDIA’s technology roadmap continues to exert on ancillary industries and investment sentiment surrounding AI infrastructure.

On January 5-6, 2026, NVIDIA CEO Jensen Huang took the stage at CES 2026 in Las Vegas to unveil the company’s next-generation Vera Rubin platform, representing NVIDIA’s third-generation rack-scale architecture. The platform comprises six co-designed chips that have entered full production and are expected to be available from partners in the second half of 2026 [4][5]. While the announcement covered performance capabilities and deployment timelines, it was Huang’s commentary on cooling requirements that captured immediate market attention.

Huang stated that the new Rubin chips can be cooled using water at temperatures where “no water chillers are necessary for data centres” [1][2]. This statement, quickly dubbed the “Rubin Revelation” by industry analysts, suggested a fundamental shift in data center thermal management requirements. The implications for companies specializing in data center cooling infrastructure were substantial and immediately reflected in stock performance.

A critical nuance that emerged from the announcement deserves careful attention: despite Huang’s statement about eliminating the need for traditional chillers, the Vera Rubin system is actually

The distinction lies in the type of liquid cooling required. Traditional water chiller systems use mechanical refrigeration to cool water before circulating it through data center cooling infrastructure. Huang’s comments suggested that Rubin’s cooling requirements can be met with significantly simpler cooling tower setups or even ambient water temperatures in appropriate climates, potentially eliminating the need for energy-intensive chiller units. However, direct-to-chip liquid cooling solutions remain essential to the architecture’s thermal management strategy.

The cooling-related stock selloff on January 6, 2026, represented one of the most pronounced single-day sector movements in recent months. The following table summarizes the performance of key affected companies:

| Company | Ticker | Stock Movement | Impact Assessment |

|---|---|---|---|

| Johnson Controls International | JCI | -7.5% to $112.40 | Severe; multi-month low |

| Modine Manufacturing | MOD | -7.5% (after 21% initial drop) | Severe; extreme volatility |

| Trane Technologies | TT | -5.3% to $370.40 | Significant; multi-month low |

| Carrier Global | CARR | -1.1% | Moderate |

| Vertiv Holdings | VRT | -2.1%, then +0.6% recovery | Mixed |

Johnson Controls and Trane Technologies were among the

An interesting counterpoint emerged in data storage stocks, which rallied on the same news that pressured cooling companies. Sandisk Corp. rose

Industry analysts offered varied interpretations of the announcement’s implications. Baird analyst Timothy Wojs expressed concerns about the structural impact on traditional cooling equipment manufacturers, stating that the comments create “questions/concerns about the longer-term positioning of chillers within data centres over time, particularly as liquid cooling becomes more prominent” [2]. This view reflects legitimate strategic concerns about the potential obsolescence of established product categories that have historically represented significant revenue streams for cooling equipment suppliers.

Citi analyst Andrew Kaplowitz offered a more nuanced perspective, acknowledging the rapid evolution of thermal management in data centers while noting that the major cooling companies “won’t be caught by surprise” by these technological developments [2]. This viewpoint suggests that established equipment manufacturers have been anticipating the industry transition toward liquid cooling and have been developing corresponding product portfolios to maintain relevance in an evolving market.

Barclays analyst Julian Mitchell provided context on the weight that investors should assign to NVIDIA’s technology announcements, noting that “given the primacy of Nvidia to the whole AI ecosystem, one should not take their comments lightly, although they seem rather dramatic at first glance” [1]. This balanced assessment acknowledges both the significance of NVIDIA’s roadmap and the tendency for initial market reactions to overshoot fundamental implications.

Understanding the relative exposure of each affected company to data center cooling markets provides essential context for assessing the appropriateness of the stock price movements:

| Company | Data Center Revenue Exposure | Risk Level | Strategic Positioning |

|---|---|---|---|

| Johnson Controls International | Low-double-digit (~10-15%) | High | Traditional HVAC focus |

| Trane Technologies | ~10% | High | Climate control specialist |

| Carrier Global | ~5% | Moderate | Diversified building systems |

| nVent Electric | Strong liquid cooling portfolio | Lower | Potential beneficiary |

| Vertiv Holdings | Strong liquid cooling position | Mixed | Dual exposure |

Companies with higher exposure to traditional chiller systems and lower current participation in direct-to-chip liquid cooling solutions faced more severe stock price declines. Conversely, companies like nVent Electric and Vertiv Holdings, which have established positions in liquid cooling technology, experienced less severe impacts or demonstrated recovery patterns.

Several critical details that would enable more precise assessment of the announcement’s implications remain unspecified:

Huang did not specify the exact water temperatures required for effective Rubin cooling, creating uncertainty about which geographic regions and existing facility configurations can operate without chiller supplementation. Data centers in colder climates may be able to leverage ambient temperatures, while facilities in warmer regions may still require mechanical cooling assistance.

The transition from current-generation architectures to Vera Rubin will occur over multiple years, and the pace of adoption will significantly influence demand patterns for cooling equipment. Enterprise data center operators may delay capital expenditure decisions pending clearer evidence of Rubin’s actual cooling requirements in production environments.

It remains unclear whether existing data centers deploying Rubin hardware will require chiller retrofits or can operate with simplified cooling infrastructure. This uncertainty contributes to the hesitancy among data center operators to commit to traditional cooling equipment purchases.

The analysis reveals several risk factors warranting attention from investors and industry participants:

-

Structural Market Transition Risk: The data center cooling market is undergoing a fundamental transition from traditional HVAC and chiller systems toward direct-to-chip liquid cooling. Companies heavily invested in legacy product categories face existential positioning challenges.

-

Demand Uncertainty: The potential elimination of chiller requirements for certain data center applications introduces uncertainty into demand forecasting for traditional cooling equipment manufacturers.

-

Narrative Risk: The market response demonstrates the significant influence of major technology company statements on investor sentiment toward related industries, creating potential for repeated volatility as AI infrastructure continues evolving.

-

Liquid Cooling Specialists: Companies with established positions in direct-to-chip liquid cooling technology may benefit from the architectural transition, as the shift toward liquid cooling accelerates regardless of chiller requirements.

-

Contrarian Investment Opportunities: Several analysts have characterized the selloff as potentially “overdone,” suggesting that investors with longer time horizons may find entry points in quality companies experiencing temporary share price weakness.

-

Hybrid Solution Development: Traditional cooling companies may find opportunities in developing integrated solutions that combine traditional and liquid cooling elements for comprehensive thermal management.

The immediate outlook suggests continued volatility as investors process the implications of NVIDIA’s announcement. Expect analyst re-ratings, revised price targets, and potential guidance adjustments from affected companies. The affected cooling equipment manufacturers will likely issue clarifying statements regarding their strategic positioning in the evolving thermal management landscape.

As Vera Rubin systems begin shipping to data center operators in the second half of 2026, actual performance data will clarify the true cooling requirements and help resolve current uncertainties. Data center operators may continue delaying chiller purchases pending this operational evidence. The trend toward direct-to-chip liquid cooling will likely accelerate regardless of the ultimate resolution of chiller requirement questions.

The fundamental trajectory toward liquid cooling in high-density computing environments appears established regardless of specific architectural announcements. Traditional cooling companies will likely increase investment in liquid cooling technologies to maintain relevance, potentially through internal development, strategic acquisitions, or partnerships with specialized technology providers.

Geographic and climate factors will continue to influence cooling requirements, with chiller systems potentially remaining relevant in warmer climates or for specific high-performance computing applications requiring tightly controlled thermal environments.

The NVIDIA Vera Rubin cooling announcement represents a significant event in the evolution of data center thermal management, triggering immediate and substantial market reaction across the liquid cooling concept stock universe. While the initial selloff may have overshot fundamental implications, the underlying technology trends toward liquid cooling appear结构性 and likely to continue reshaping the competitive landscape for cooling equipment manufacturers.

Companies with diversified portfolios, established liquid cooling capabilities, and demonstrated adaptation agility appear better positioned to navigate this transition successfully. Investors should monitor the actual deployment and operational performance of Vera Rubin systems throughout 2026 to refine their understanding of the long-term implications for the data center cooling industry.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.