Strategic Analysis of XPeng Motors (XPEV)'s Robotics Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data, I will systematically analyze the strategic logic of XPeng Motors’ layout in the robotics business.

He Xiaopeng, founder of XPeng Motors, stated: “In the future, intelligent vehicle manufacturers will also serve as intelligent robotics manufacturers, creating a 1+1>2 synergistic effect.” This strategic judgment is based on the following core logics [1][2]:

Humanoid robots and intelligent vehicles share high similarities in core technical architecture:

| Technology Module | Autonomous Driving Vehicle | Humanoid Robot | Feasibility of Technology Reuse |

|---|---|---|---|

| Environmental Perception | Vision + LiDAR | 720° Visual Perception | High |

| Decision-Making & Planning | End-to-End Large Model | VLA Architecture Model | High |

| Execution & Control | Drive-by-Wire Chassis | Joint Motor Control | Medium |

| Chip Computing Power | Turing AI Chip | Turing AI Chip | Fully Homologous |

XPeng Motors’ AI Eagle Eye Vision System, end-to-end large model, and Turing AI Chip can be directly applied to robotics products [3].

The automotive industry and humanoid robotics share numerous common suppliers, and automakers possess:

- Strong industrial manufacturing capabilities

- A complete and mature component supply chain system

- Rich mass production experience and quality control systems

This provides a significant first-mover advantage for robotics R&D and manufacturing [2].

XPeng Motors has formed a strategic layout of three business segments:

- First Growth Curve: AI-powered Vehicles (2025 deliveries rose 126% year-over-year to 429,445 units) [4]

- Second Growth Curve: Flying Cars (the “Land Aircraft Carrier” has received nearly 4,000 pre-orders, with mass production scheduled for 2026)

- Third Growth Curve: AI Humanoid Robots (targeting commercial mass production in 2026) [3]

To date, XPeng Motors has disclosed over 4,000 patents, including the following robotics-related patent applications [5]:

- “Control Method and Electronic Device for Bipedal Robots”

- “Leg Structure and Humanoid Robot”

- “Posture Generation Method, Device, Robot, Medium, and Product for Humanoid Robots”

Automotive Intelligent Driving Technology ──────────────────────────────────────→ Robotics Applications

│

├── AI Eagle Eye Vision System ───────────────────────────→ 720° Environmental Perception Capability

├── End-to-End Large Model ─────────────────────────────→ Robotics "Brain" (VLA Architecture)

├── Turing AI Chip (3000TOPS Computing Power) ────────────────────→ On-Board Computing Power for Robots

├── Cloud-Based World Foundation Model ─────────────────────────→ Universal Physical AI Model

└── Reinforcement Learning Algorithm ─────────────────────────────→ Walking & Obstacle Avoidance Capabilities

| Product | Launch Time | Core Features | Technology Source |

|---|---|---|---|

PX5 |

October 2023 | Straight-leg Walking, 11-DOF Dexterous Hand | Technologies Homologous to Intelligent Driving |

Iron (4th Generation) |

November 2024 | 62 Degrees of Freedom, 178cm Height, Factory Applications | Turing Chip + Eagle Eye Vision |

5th Generation (Planned) |

2026 | Mass Production with L3-level Capabilities | VLA Architecture + World Foundation Model |

Currently, the Iron robot has been put into practical use at XPeng’s Guangzhou factory, with some production positions operated by robots [1][3].

| Dimension | Assessment | Description |

|---|---|---|

Perception System |

★★★★★ | Direct reuse of AI Eagle Eye Vision System, 720° blind-spot-free environmental perception |

Decision-Making System |

★★★★★ | End-to-end large model architecture is universal, empowered by cloud-based foundation model |

Execution System |

★★★☆☆ | Specialized development for joint motors is required, but there is a technical foundation |

Chip Computing Power |

★★★★★ | Turing Chip is compatible with both vehicles and robots, fully homologous |

| Indicator | Value | Industry Comparison |

|---|---|---|

| Market Capitalization | US$1.952 Billion | - |

| P/S | 1.90x | Mid-to-low among new energy vehicle manufacturers |

| P/B | 2.23x | - |

| 52-Week Gain | +69.28% | Outstanding Performance |

| Analyst Target Price | $29.50 | 43.6% Upside Potential |

If the robotics business is successfully commercialized, it will significantly change the company’s valuation logic:

- From “pure automaker” → “AI technology company”

- Opens up a US$25 trillionglobal robotics market space (predicted by Elon Musk)

- Referencing Tesla (TSLA)'s valuation model: Dual engines of vehicles + robotics

- R&D cost sharing (the same AI system serves vehicles, robots, and flying cars)

- Data closed-loop effect (factory robot data feeds back to intelligent driving algorithms)

- Scale effect (one-time R&D for chips and models, reusable across multiple products)

| Indicator | 2024E | 2025E | 2026E |

|---|---|---|---|

| Revenue (CNH 100 Million) | 410.3 | 955.6 | 1220.6 |

| Gross Margin | 14.0% | 14.3% | 14.5% |

| Non-GAAP Net Profit | -CNH 5.38 Billion | -CNH 2.23 Billion | Turns Profitable |

Analysts expect the company to

| Risk Type | Details |

|---|---|

| Technological Risk | Robotics commercialization progress falls short of expectations |

| Market Risk | Humanoid robotics market is still in the early stage, with high demand uncertainty |

| Capital Risk | Continuous increase in R&D investment, cash flow pressure |

| Competitive Risk | Strong competitors such as Tesla Optimus and Huawei |

-

Clear Strategic Logic: XPeng’s layout in the robotics business is a rational strategic choice based on technological homology, supply chain reusability, and growth curve expansion.

-

Feasible Technology Migration: Core autonomous driving capabilities (perception, decision-making, chips) can be effectively migrated to the robotics field, and the company has verified the technical route through PX5 and Iron products.

-

Positive Impact on Valuation:

- Short-term: The robotics business has not yet contributed revenue, so valuation uplift is limited

- Mid-term (2026): If robot mass production is achieved, it will open up valuation imagination space

- Long-term: The positioning of an AI technology company is expected to bring valuation restructuring

-

Catalysts:

- Progress of 2026 robot mass production plan

- Mass production of Turing AI Chip for vehicles (Q2 2025)

- Launch and deployment of World Foundation Model

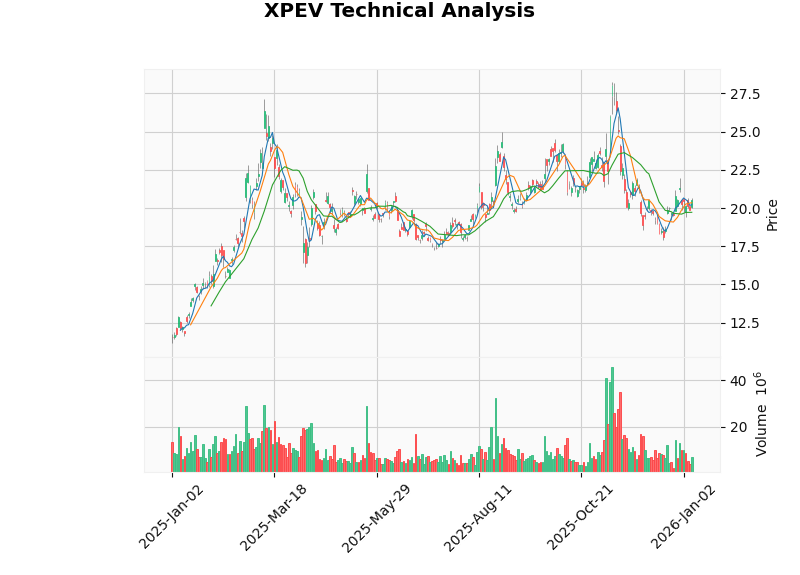

From a technical analysis perspective, XPEV is currently in a

- Support level: $19.72

- Resistance level: $20.97

- Beta: 1.13 (slightly higher than market volatility)

- Trend judgment: Sideways consolidation, waiting for directional choice [7]

The current stock price corresponds to 0.9x/0.7x P/S for 2025-2026, providing a valuation safety margin, but attention should be paid to:

- Earnings guidance in the Q4 FY2025 report (January 16, 2026)

- Commercialization progress of the robotics business

- Implementation of intelligent driving functions and globalization progress

[1] Gasgoo - CES 2025: Nearly Half of NVIDIA’s Robotics Legion Comes from China

[4] CleanTechnica - XPENG Sales Rise 126%, from 190,068 to 429,445

[5] Relevant reports from 36Kr (provided in user context)

[6] Eastmoney - XPeng Motors: Leader in Intelligentization, Reborn

[7] Data from Jinling AI Technical Analysis API

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.