Analysis Report on GameStop (GME) CEO Ryan Cohen's Performance-Based Stock Option Incentive Plan

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive data collected, I now provide a detailed analysis report for you.

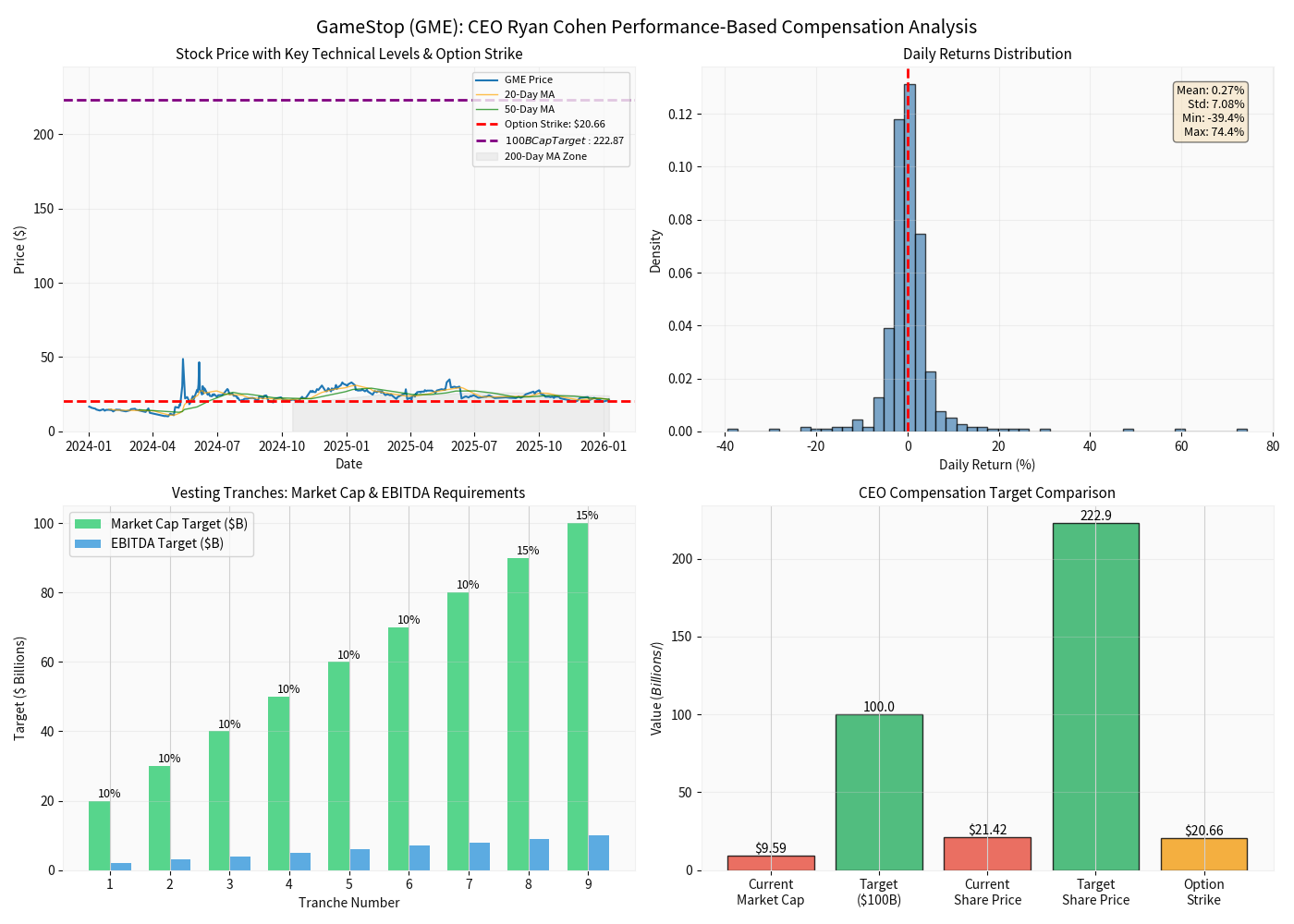

GameStop Corp. announced a landmark performance-based stock option grant to its Chairman and CEO Ryan Cohen on January 7, 2026. Designed to incentivize Cohen to achieve “extraordinary growth”, the plan has a potential value of up to

| Metric | Value |

|---|---|

| Current Market Capitalization | $9.59B |

| Target Market Capitalization | $100B |

| Required Growth Rate | 943% |

| Option Exercise Price | $20.66/share |

| Number of Option Shares | 171,537,327 shares |

| Target Stock Price (to achieve $100B market cap) | $222.87 |

| Target Cumulative EBITDA | $10B |

| Maximum Potential Payout | ~$34.7B |

The core feature of this incentive plan is its

| Traditional CEO Compensation | Cohen’s Incentive Plan |

|---|---|

| Fixed Annual Salary | No Fixed Compensation |

| Cash Bonus | No Cash Incentives |

| Time-Vested Stock | No Pure Time-Vested Shares |

| Guaranteed Income | 100% At-Risk Compensation |

As stated in the company’s filing with the SEC: “His compensation is fully ‘at-risk’, meaning he will only receive payment if the company achieves significant market and operational goals. This structure ensures that Mr. Cohen’s incentives are directly aligned with creating long-term value for GameStop shareholders” [4][5].

The award is divided into

| Tranche | Vesting Percentage | Market Cap Threshold | Cumulative EBITDA Threshold |

|---|---|---|---|

| 1 | 10% | $20B | $2.0B |

| 2 | 10% | $30B | $3.0B |

| 3 | 10% | $40B | $4.0B |

| 4 | 10% | $50B | $5.0B |

| 5 | 10% | $60B | $6.0B |

| 6 | 10% | $70B | $7.0B |

| 7 | 10% | $80B | $8.0B |

| 8 | 15% | $90B | $9.0B |

| 9 | 15% | $100B | $10.0B |

Since Ryan Cohen joined the board in January 2021, the company has experienced significant financial improvement [4]:

| Metric | 2021 | Current (TTM) | Change |

|---|---|---|---|

| Market Capitalization | $1.3B | $9.3B | +615% |

| SG&A Expenses | $1.7B | $950.8M | -44.4% |

| Net Profit | -$381.3M | +$421.8M | Turned from loss to profit |

Under Cohen’s leadership, GameStop is implementing a multi-layered strategic transformation:

- Cost Structure Optimization: Closed a large number of physical stores (590 U.S. stores closed in FY2024, with 200 more expected to close in January 2025) [7]

- International Contraction: Exited the Austrian, Irish, Swiss, German, Italian, and Canadian markets, and is in the process of selling its French business [7]

- Diversified Asset Allocation: Allocated a large portion of cash to cryptocurrencies (Bitcoin) [8][9]

- Business Focus Adjustment: Shifted from traditional physical retail to e-commerce and digital assets

| Metric | Q3 FY2025 | YoY Change |

|---|---|---|

| Revenue | $821M | -4.6% |

| EPS | $0.24 | 20% above expectations |

| Net Profit Margin | 11.08% | Significantly improved |

| Current Ratio | 10.39 | Financially healthy |

The company’s FY2025 revenue has dropped by over 35% compared to 2022, and its stock price has fallen by 80% from its 2021 all-time high [7].

The incentive plan, through its dual-threshold design, effectively binds Cohen’s personal interests closely to shareholder returns and the company’s fundamental performance:

- Market Capitalization Threshold: Ensures Cohen’s rewards are directly tied to shareholder wealth growth

- EBITDA Threshold: Prevents achieving stock price increases through pure market speculation (such as meme stock hype) without improving fundamentals

- Dual Verification Mechanism: Prevents Cohen from inflating stock prices through high-risk behaviors (such as excessive leverage)

- The targets are extremely aggressive, which may induce short-termistbehaviors

- High-risk investments like the Bitcoin strategy may stem from performance pressure [10]

- The $100B target may require a complete business model transformationfar beyond the scope of traditional retail

| Dimension | Assessment |

|---|---|

Risk-Adjusted Return Alignment |

Extremely High — 100% at-risk compensation structure |

Long-Term Value Orientation |

High — Cumulative EBITDA rather than annual metrics |

Mitigation of Moral Hazard |

Medium — No rewards if minimum threshold is not met |

Achievability |

Low — Requires 943% growth, extremely challenging |

| Comparison Dimension | GameStop (Cohen) | Tesla (Musk) |

|---|---|---|

| Target Market Cap Growth | $9.3B → $100B (+943%) | Similar level of growth |

| Incentive Type | 171.5 million share options | Similar option structure |

| Minimum Threshold | $20B market cap + $2B EBITDA | Has similar minimum threshold |

| Execution Risk | Extremely High — Traditional retail industry transformation | Extremely High — New entrant in the automotive industry |

Achieving the $100B market cap target requires one or a combination of the following pathways:

| Pathway | Requirements | Difficulty |

|---|---|---|

| Stock Price Increase | $21.42 → $222.87 (+940%) | Extremely High |

| Business Expansion | Substantial revenue growth | High |

| Profit Margin Improvement | Significant enhancement of profitability | High |

| Strategic Mergers & Acquisitions | Major acquisitions | Medium |

| Cryptocurrency Returns | Success of Bitcoin investment | High Volatility |

- Special General Meeting of Shareholders: March or April 2026

- Cohen will recuse himself from voting[4][6]

- The compensation package was independently evaluated by a third-party compensation consulting firm

- Cohen did not participate in the board’s vote on the package

- Fully transparent information disclosure

If all options vest, 171.5 million shares will be exercised. At the exercise price of $20.66 per share, the company will receive approximately

- If the market cap reaches $100B, the stock price will be approximately $222.87, so exercising the options will yield profits

- If targets are not met, there will be no dilution effect

- Shareholders only bear dilution after actual value is created

| Metric | Value |

|---|---|

| Consensus Rating | Hold (55.6% of analysts) |

| Target Price | $18.25 (14.8% below current price) |

| Target Price Range | $11.50 - $25.00 |

| Buy Ratings | 16.7% |

| Sell Ratings | 27.8% |

| Metric | Value | Signal |

|---|---|---|

| Current Price | $21.42 | - |

| 50-Day Moving Average | $21.68 | Slightly below the moving average |

| 200-Day Moving Average | $24.20 | Significantly below the moving average |

| 52-Week Volatility | 37.47% | High Volatility |

| 1-Year Return | -35.01% | Weak |

- Business Transformation Risk: The transformation from traditional retail to cryptocurrencies and digital assets carries high uncertainty

- Market Competition Risk: Digital game distribution platforms continue to erode the physical game retail market

- Execution Risk: The 943% market cap growth target is extremely aggressive

- Regulatory Risk: Cryptocurrency investments face changes in regulatory policies across different countries

- Stock Price Volatility Risk: As a “Meme stock”, the stock price may fluctuate drastically

- Bitcoin Strategy: If the cryptocurrency market continues to perform well, it may provide excess returns

- Cost Structure Optimization: Ongoing store integration and efficiency improvements

- Cash Reserve Advantage: Sufficient cash provides strategic flexibility

- Brand Value: The GameStop brand still has influence among gamers

The performance-based stock option incentive plan granted by GameStop to CEO Ryan Cohen is a

- Extremely High Incentive Alignment: 100% at-risk compensation ensures Cohen only receives rewards after creating substantial value for shareholders

- Extremely Challenging Targets: The 943% market cap growth and $10B cumulative EBITDA targets require a revolutionary business transformation

- Sound Governance Structure: Independent evaluation, recusal from voting, and fully transparent disclosure reflect good corporate governance practices

- Shareholder Value Depends on Strategy Execution: The ultimate value of the plan depends on Cohen’s ability to successfully transform GameStop from a traditional retailer into a new enterprise with digital asset allocation

- Risks and Opportunities Coexist: For investors willing to bear high volatility and optimistic about the cryptocurrency strategy, this incentive plan provides exposure to highly aligned interests between management and shareholders

[1] CNN Business - “GameStop CEO Ryan Cohen could be set for a $35 billion payday” (https://www.cnn.com/2026/01/07/business/gamestop-ceo-ryan-cohen-compensation-package)

[2] Retail TouchPoints - “GameStop Closing up to 200 Stores this Month as Board Approves 35B Performance-Based Pay Package for CEO” (https://www.retailtouchpoints.com/features/financial-news/gamestop-closing-up-to-200-stores-this-month-as-board-approves-35b-performance-based-pay-package-for-ceo)

[3] U.S. News - “GameStop Details CEO’s Compensation Package Which Doesn’t Include Any Guaranteed Pay” (https://www.usnews.com/news/best-states/texas/articles/2026-01-07/gamestop-details-ceos-compensation-package-which-doesnt-include-any-guaranteed-pay)

[4] GameStop SEC 8-K Filing (2026-01-07) - “GameStop Announces Long-Term Performance Award for Ryan Cohen” (https://www.sec.gov/Archives/edgar/data/1326380/000132638026000004/gme-20260106.htm)

[5] Yahoo Finance - “GameStop details CEO’s compensation package which doesn’t include any guaranteed pay” (https://finance.yahoo.com/news/gamestop-details-ceos-compensation-package-140537446.html)

[6] GameStop Investor Relations - “GameStop Announces Long-Term Performance Award for Ryan Cohen” (https://investor.gamestop.com/news-releases/news-details/2026/GameStop-Announces-Long-Term-Performance-Award-for-Ryan-Cohen/default.aspx)

[7] Benzinga - “GameStop Stock Near 52-Week Lows: Can Cohen’s New Deal Spark A Turnaround?” (https://www.benzinga.com/trading-ideas/movers/26/01/49796883/gamestop-stock-near-52-week-lows-can-cohens-new-deal-spark-a-turnaround)

[8] IG - “GameStop Q1 2025 Earnings Preview: Bitcoin Strategy Takes Center Stage” (https://www.ig.com/en/news-and-trade-ideas/gamestop-q1-2025-earnings-preview--bitcoin-investment-adds-new-d-250602)

[9] Financial Content - “GameStop’s Crypto Coup: Unexpected Profitability and Bold Bitcoin Bet” (https://markets.financialcontent.com/redlandsdailyfacts/article/marketminute-2025-9-9-gamestops-crypto-coup-unexpected-profitability-and-bold-bitcoin-bet-ignite-market-buzz)

[10] SSRN - “GameStop’s Bitcoin Strategy: An Analysis of Irrationality” (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5198211)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.