In-Depth Analysis of TSMC's Fourth-Quarter Earnings Beat

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data to provide you with a

TSMC released its fourth-quarter 2024 (FY2025 Q3) results on January 9, 2026, with

| Key Metrics | Performance Data |

|---|---|

| Fourth-Quarter Revenue | T$1,046.08 billion (+20% YoY) |

| December Monthly Revenue | T$678.19 billion (+20.4% YoY) |

| Full-Year 2025 Revenue | ~T$2.7 trillion (+30%+ YoY) |

| Gross Margin | 59%+ (All-Time High) |

| Net Profit Margin | 43.7% |

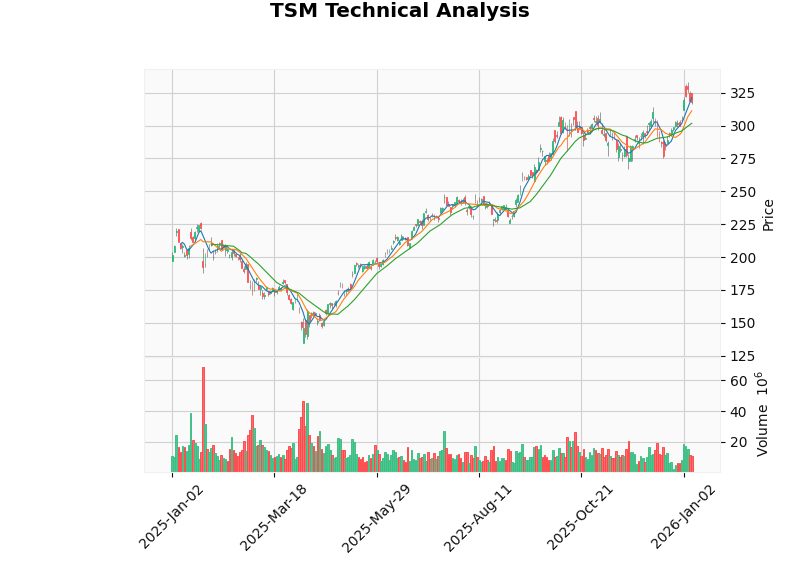

TSMC ADR (NYSE: TSM) has seen strong stock performance[0]:

| Metrics | Values |

|---|---|

| Current Price | $318.01 |

| 52-Week High | $333.08 |

| 52-Week Low | $134.25 |

| 1-Year Gain | +52.62% |

| Market Capitalization | $1.65 trillion |

| P/E Ratio (TTM) | 27.46x |

TSMC’s earnings beat

According to industry reports, TSMC has

| Client | Projected 2026 Order Volume |

|---|---|

| NVIDIA | ~510,000 CoWoS Wafers |

| Broadcom | 150,000 Wafers |

| AMD | 105,000 Wafers |

Total |

~765,000 Wafers |

“Existing 3nm capacity has been fully taken up by orders for AI GPUs, cloud data centre application-specific integrated circuits (ASICs) and flagship mobile processors”[3]

- TSMC’s monthly CoWoS capacity is expected to reach 120,000-130,000 wafers by the end of 2026

- Over 85% of 2026 CoWoS capacity has been booked

- NVIDIA alone accounts for approximately 595,000 wafers of total industry capacity[2]

TSMC’s advanced packaging revenue grew from US$600 million in 2018 to US$8.4 billion in 2025, representing a

TSMC’s revenue structure is undergoing a

| Period | HPC (High-Performance Computing) | Smartphones |

|---|---|---|

| Q1 2020 | 30% | 49% |

| Q3 2025 | 57% |

29% |

This shift means that

As TSMC’s largest CoWoS client, NVIDIA continues to benefit from:

- Guaranteed access to sufficient advanced packaging capacity

- Smooth mass production of the Blackwell and Rubin platforms

- Sustained growth in demand for data center AI chips

Although Apple remains TSMC’s largest single client, its share has continued to decline:

- At the 2nm node, Apple’s share will drop to 48%, losing its dominant position for the first time in a decade[4]

- Demand for M-series chips is relatively stable, but growth momentum lags behind that of AI GPUs

TSMC’s strong performance is

| Metrics | TSM | Nasdaq 100 Index | Assessment |

|---|---|---|---|

| Forward P/E Ratio | 16-26x | 33x | Significant Discount |

| 2025 EPS Growth | 48% | - | High Growth |

| 2026 Expected Growth | 25-30% | - | Outperforms Market |

According to Morgan Stanley’s analysis, TSMC’s valuation remains attractive even after the target price upgrade:

“The stock remains attractive at 16x or 13x our 2026/2027 average EPS”[5]

| Rating Distribution | Percentage |

|---|---|

| Buy | 72.7% (16 firms) |

| Hold | 27.3% (6 firms) |

| Median Target Price | $357.50 (+12.4%) |

| Target Price Range | $330 - $400 |

- Goldman Sachs raised TSMC’s target price by 35%, emphasizing that AI will continue to drive demand[6]

- Morgan Stanley expects 30% revenue growth in 2026, exceeding the market consensus of 22%[5]

- 2026 EPS is expected to reach $15.43 (based on 48% growth assumption)

If TSMC’s P/E ratio converges from the current 26x to the Nasdaq 100’s 33x,

SMH (VanEck Semiconductor ETF), a representative ETF for the semiconductor sector, has a performance that confirms the sector’s prosperity:

![]()

| Metrics | TSM | NVDA | SMH |

|---|---|---|---|

| Gain Since October 2025 | +16.5% |

+10.2% | +8.3% |

| 1-Year Gain | +52.6% | +118.5% | +57.5% |

| Beta (vs SPY) | 1.27 | 1.68 | 1.34 |

TSMC’s capacity expansion directly drives demand for:

| Sub-Sector | Benefit Logic |

|---|---|

| Semiconductor Equipment | Full order books for ASML, Applied Materials, and KLA Corporation |

| High-Purity Chemicals | Advanced processes require higher material purity |

| Photomasks | Sustained growth in demand for advanced process photomasks |

| Target Materials | Increased demand for advanced packaging materials |

| Priority | Field | Benefit Logic |

|---|---|---|

| ★★★★★ | AI Data Centers | Priority access to CoWoS capacity, robust demand for GPUs/ASICs |

| ★★★★☆ | Premium Smartphones | Stable demand for flagship 3nm process chips |

| ★★★☆☆ | PCs/Servers | Weak demand for traditional CPUs, but AI PCs bring incremental growth |

| ★★☆☆☆ | IoT/Consumer Electronics | Mild recovery in demand for mature processes |

TSMC’s leading position has differentiated impacts on competitors:

| Company | Impact Analysis |

|---|---|

Samsung Electronics |

Benefiting from the memory chip (HBM) super cycle, Q4 profit is expected to triple[1] |

Intel |

Foundry business is under pressure, but its 18A process has secured PC orders |

UMC |

Intensified competition in mature processes, focusing on differentiation |

- The “Toll Road” of AI Computing Infrastructure

“Investors are increasingly recognizing TSMC not just as a technology stock, but as the toll road of the digital economy”[4]

- Dual-Driven Growth from Earnings Expansion and Valuation Uplift

- 2026 EPS is expected to grow by 25-30%

- Forward P/E ratio is expected to expand from 26x to 33x

- Strong Certainty of Sector Structural Growth

- The global semiconductor market is expected to grow by 26% to US$975 billion in 2026[6]

- The AI chip market is expected to exceed US$1 trillion by 2030 (per AMD’s forecast)

| Risk Category | Specific Risk | Impact Assessment |

|---|---|---|

Geopolitical |

Risk of escalating cross-Strait tensions | Long-term risk premium |

Macroeconomic |

Slowdown in AI capital expenditure | Demand-side correction |

Competitive |

Catch-up by Samsung/Intel | Market share loss |

Valuation |

Risk of chasing highs at current prices | Short-term pullback pressure |

Execution |

Delays in capacity expansion | Order loss |

| Time Horizon | Recommendation |

|---|---|

Short-Term (1-3 Months) |

Buy on dips, support level around $301-310 |

Medium-Term (6-12 Months) |

Target price $357-400, with 12-26% upside potential |

Long-Term |

Core holding to benefit from AI computing growth dividends |

TSMC’s 20% year-over-year revenue growth in the fourth quarter, which beat expectations,

-

Industry Chain Level: Shortages in advanced process and packaging capacity will persist until the end of 2026; new entrants face supply chain barriers

-

Valuation Level: As the industry’s “toll road”, TSMC has potential for dual-driven growth from earnings expansion and valuation uplift; its current valuation still trades at a discount to the Nasdaq 100

-

Allocation Recommendation: As a core target in AI computing infrastructure, TSMC is worthy of gradual accumulation during pullbacks; however, close attention should be paid to geopolitical risks and valuation pullback risks

[1] Investing.com - “TSMC posts Q4 revenue of T$1,046.08 billion, above forecasts” (https://www.investing.com/news/stock-market-news/tsmc-posts-q4-revenue-of-104608-billion-above-forecasts-4438484)

[2] Tech in Asia - “TSMC market cap tops $1.7t on AI chip demand” (https://www.techinasia.com/news/tsmc-market-cap-tops-17t-ai-chip-demand)

[3] TechNode - “TSMC slows launch of new 3nm projects, encourages clients to consider 2nm” (https://technode.com/2026/01/09/tsmc-slows-launch-of-new-3nm-projects-encourages-clients-to-consider-2nm/)

[4] SemiAnalysis - “How Apple made TSMC, and vice versa” (https://www.ped30.com/2026/01/08/apple-tsmc-semianaysis/)

[5] Finviz - “TSMC (TSM): AI Boom, Revenue Upside, and Attractive Valuation Through 2027” (https://finviz.com/news/270819/tsmc-tsm-ai-boom-revenue-upside-and-attractive-valuation-through-2027)

[6] NASDAQ - “History Says the Stock Market Could Soar in 2026” (https://www.nasdaq.com/articles/history-says-stock-market-could-soar-2026-here-1-cheap-artificial-intelligence)

[7] Benzinga - “Billionaire Investor Trims Taiwan Semiconductor As Geopolitical Risks Surge” (https://www.benzinga.com/markets/large-cap/26/01/49799821/billionaire-investor-trims-taiwan-semiconductor-as-geopolitical-risks-surge)

[0] Jinling AI - TSMC real-time quotes, financial analysis, and technical analysis data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.