In-Depth Analysis of CSSC DEFENCE's 2025 Earnings Growth Forecast

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the obtained data and industry research materials, I will conduct a systematic analysis of the driving factors and sustainability of the sharp growth in CSSC DEFENCE’s 2025 net profit forecast.

CSSC DEFENCE released its 2025 annual earnings forecast on January 9, 2026, expecting to achieve net profit attributable to shareholders of the parent company

| Indicator | 2024 (Actual) | 2025 (Forecast) | Growth |

|---|---|---|---|

| Net Profit | RMB 377 million | RMB 940 million-RMB 1.12 billion | +149.61%~+196.88% YoY |

| Q4 Net Profit | - | RMB 285 million-RMB 465 million | +121%~261% QoQ |

The global shipbuilding market maintained a high boom in 2024: annual new orders reached 170 million deadweight tons (DWT)/65.81 million compensated gross tons (CGT), up

As of the end of June 2025, CSSC DEFENCE’s outstanding orders total approximately RMB 68 billion[3]. The company has consistently ranked

According to a research report from Shenwan Hongyuan, CSSC DEFENCE’s

The company continues to enhance production efficiency and cost control; the quantity and price of delivered ship products have increased significantly year-on-year, with operating revenue reaching

According to the 2024 semi-annual report, CSSC DEFENCE’s investment income from associated and joint ventures reached

Dividends from the company’s participating companies have increased year-on-year, further boosting investment income levels. The carrying value of the company’s equity investments in associated enterprises amounts to

CSSC DEFENCE holds approximately 2.89% of the shares of China CSSC Holdings Ltd. (600150.SH)[6]. China CSSC Holdings achieved a net profit attributable to parent shareholders of RMB 10.541 billion in the first three quarters of 2025[6]. As an important participating shareholder, CSSC DEFENCE has shared considerable dividend income from this investment.

- Global shipyard capacity recovery is slow; global ship delivery volumes are expected to reach 44.33 million CGT and 44.72 million CGT in 2025 and 2026, respectively, representing growth of only 8%/1%[2]

- The current global shipyard outstanding order coverage ratio reaches 3.8 years, a historical high

- Against the backdrop of rigid shipbuilding capacity, shipyards’ pricing power remains strong

- As of Q3 2024, vessels aged 15 years or above account for approximately 33%of the total

- Conservative estimates show that the global average annual ship delivery demand will reach approximately 110 million DWTfrom 2025 to 2030, with aging ship replacement demand accounting for over 50%[2]

- The proportion of alternative energy vessels in deliveries/new orders has increased year by year, reaching 36%/49%in 2024 respectively[2]

- Stricter new environmental regulations from the International Maritime Organization (IMO) will accelerate the pace of ship replacement

- China CSSC Holdings has announced a new commitment from CSSC Group to resolve intra-group horizontal competition

- Huangpu Wenchong is a shipyard controlled by CSSC DEFENCE; attention should be paid to the progress of subsequent intra-group asset integration[4]

- Global new ship orders fell 44.5%year-on-year in January-October 2025[7]

- The 2025 shipbuilding market has declined due to the impact of US Section 301 tariffs

- Investment income depends on the operating conditions and dividend policies of participating companies

- Investment income accounted for under the equity method has certain volatility

- Fluctuations in raw material prices such as steel affect shipbuilding costs

- Exchange rate fluctuations have an impact on export-oriented shipbuilding businesses

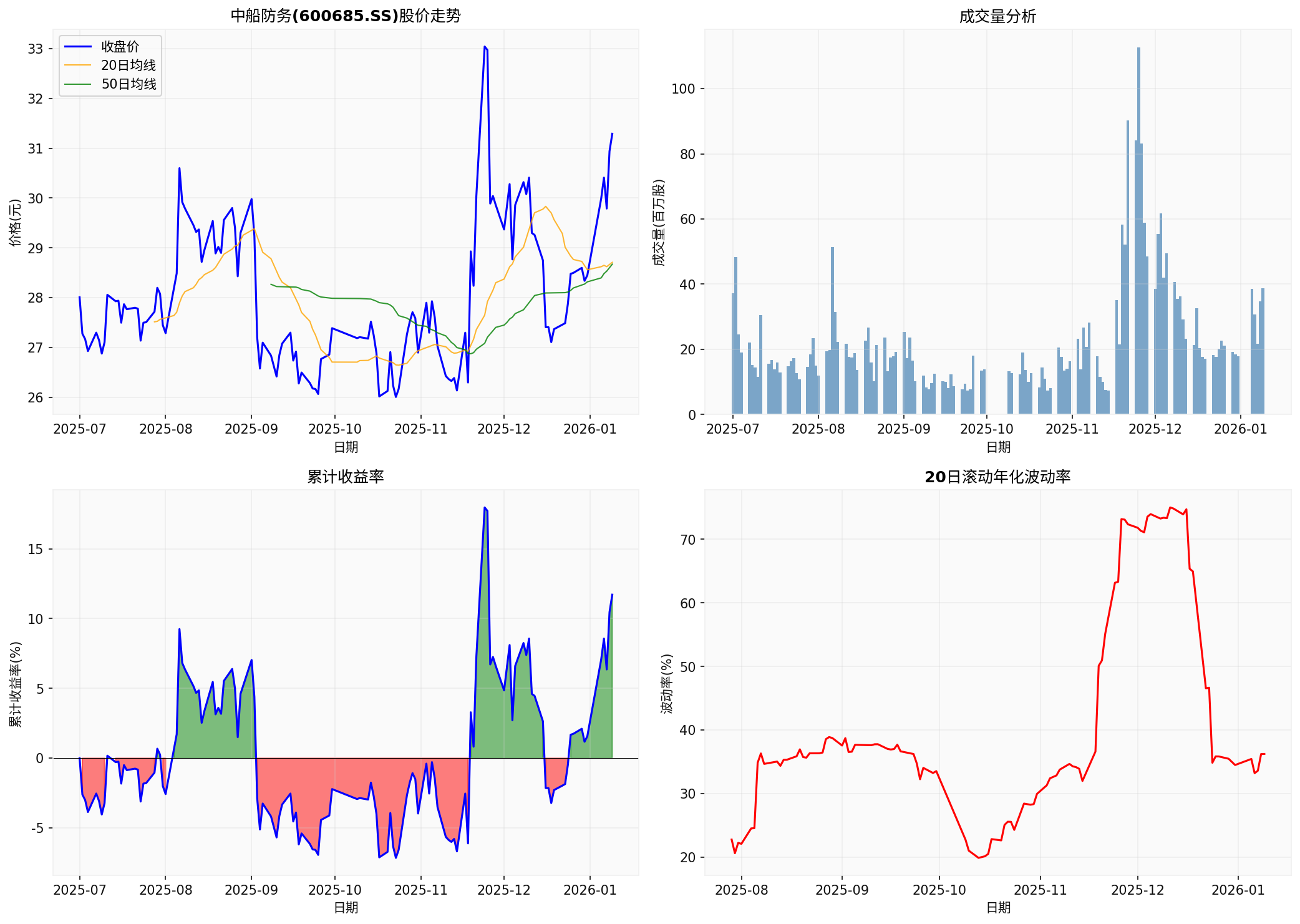

As of January 9, 2026, the stock price of CSSC DEFENCE is

| Indicator | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | 52.33x | Mid-to-upper level in the industry |

| Price-to-Book (P/B) Ratio | 2.46x | - |

| Return on Equity (ROE) | 4.79% | Room for further improvement |

- GF Securities: Shipbuilding demand is expected to see a “second acceleration” in 2026. Analogous to the construction machinery market in 2019, the second acceleration in demand is expected to drive up the valuation center[4]

- China Merchants Securities: The shipbuilding sector is expected to benefit in 2026 from the aging existing supply of mainstream vessel types, gradually recovering crude oil and dry bulk cargo volumes, continuously lengthening shipping distances, and IMO environmental regulations[4]

- Founder Securities: CSSC DEFENCE has sufficient outstanding orders, and its profitability is expected to be steadily realized with the delivery of high-value vessels[4]

The sharp

-

Higher revenue from ship productsis mainly driven by the industry’s high boom, sufficient outstanding orders, delivery of high-value orders, and improved production efficiency. These factors are expected to continue in 2026

-

Growth in investment incomedepends on the performance improvement of associated enterprises and dividends from participating companies. Against the backdrop of group synergies and stable operations of participating companies, this growth has certain sustainability

-

In the medium to long term, the supply-demand gap in the shipbuilding industry cannot be resolved in the short term. Demand for aging ship replacement and environmental low-carbon transformation will sustain the industry’s boom beyond2030

-

Risk Warning: Attention should be paid to factors such as short-term fluctuations in new ship orders, volatility in investment income, raw material and exchange rate risks

Overall, as a core shipbuilding platform under CSSC Group, CSSC DEFENCE has good investment value in this round of the shipbuilding upcycle. It is recommended to continue paying attention to the company’s order acquisition and the delivery progress of outstanding orders.

[1] Sina Finance - CSSC DEFENCE’s 2025 Net Profit Expected to Surge 149.61%-196.88% YoY (https://money.finance.sina.com.cn/corp/go.php/vCB_AllNewsStock/symbol/sh600685.phtml)

[2] Soochow Securities - 2025 Shipbuilding Industry Strategy: Shipyards Enter Profit Inflection Point (https://pdf.dfcfw.com/pdf/H3_AP202502241643445055_1.pdf)

[3] Sina Finance - CSSC DEFENCE: The Company Achieved Operating Revenue of RMB 14.315 Billion in the First Three Quarters of 2025 (https://finance.sina.cn/stock/quote/sh600685.html)

[4] Zhitong Finance - CSSC DEFENCE Rises Over 6%; Second Acceleration of Shipbuilding Demand Expected to Lift Valuation Center (https://cj.sina.cn/articles/view/5835524730/15bd30a7a020022tpk)

[5] HKEX - CSSC DEFENCE 2024 Semi-Annual Report (https://www.hkexnews.hk/listedco/listconews/sehk/2024/0926/2024092600030_c.pdf)

[6] China CSSC Holdings 2025 Third Quarter Report (https://stockmc.xueqiu.com/202510/600150_20251029_842E.pdf)

[7] Securities Times - Global New Ship Order Volume Drops Over 40% YoY (https://www.stcn.com/article/detail/3524819.html)

[0] Gilin API Market Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.