Analysis Report on the Impact of Phillips 66 Refinery Closure

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I will provide you with a comprehensive analysis report on the impact of Phillips 66’s refinery closure on its long-term profitability and market competitiveness.

Phillips 66 has announced the closure of its Wilmington Refinery located in the Los Angeles area of California. With a crude oil processing capacity of

Phillips 66’s Wilmington Refinery closure is part of a large-scale consolidation in California’s refining industry. Valero Energy Corporation also plans to shut down its Benicia Refinery (170,000 barrels per day) in the San Francisco Bay Area by April 2026. The closure of these two facilities together accounts for approximately 8-10% of California’s refining capacity [1].

| Impact Dimension | Specific Performance |

|---|---|

| Capacity Loss | 139,000 barrels per day (accounting for approximately 5-6% of California’s refining capacity) |

| Impact on West Coast Gasoline Production | Expected to decrease by approximately 9% |

| California Gasoline Supply | Will rely more on external imports |

The significant reduction in California’s refining capacity is expected to cause tight gasoline supply in the region in the short term, driving up fuel prices in California [1]. However, this impact is not entirely negative for Phillips 66.

Based on the latest financial data [0]:

- Revenue Composition: U.S. operations contribute 78.1% of the company’s revenue ($2.696 billion), while UK operations account for 9.8% ($339 million)

- Earnings Trend: The company’s earnings per share in Q3 2025 was $2.52, beating market expectations by 17.76%

- Cash Flow: Latest annual free cash flow is $2.332 billion

Phillips 66’s refinery closure is not a simple capacity reduction, but

-

UK Market Expansion: In January 2026, Phillips 66 announced the acquisition of the Lindsey Refinery assets in the UK, which will be integrated with the company’s existing Humber Refinery [3]. This acquisition will:

- Enhance the company’s marketing capabilities in the UK market

- Improve profit margins in the UK market

- Not affect the company’s debt repayment capacity

-

Product Portfolio Optimization: After closing the California refinery, the company can focus resources on more profitable business areas, including:

- Chemical products

- Natural Gas Liquids (NGL) business (accounting for 17.7% of revenue)

- Renewable fuels

- Improved Profitability: The latest quarterly operating margin and net profit margin are 0.94% and 1.14% respectively, indicating stable business operations

- Adequate Cash Flow: The annual free cash flow of $2.332 billion provides a buffer for the company during the trough of the industry cycle

- Analyst Confidence: UBS maintains a Buy rating with a target price of $160, representing approximately 16% upside from the current stock price [3]

- Financial reports show the company adopts aggressive accounting policieswith a low depreciation-to-capital expenditure ratio, which may limit upside potential for earnings

- Debt risk rating is medium risk, requiring attention to debt management

- California is known for strict environmental regulations and declining local fuel demand, and is regarded by major oil companies as an increasingly difficult operating environment

- Phillips 66’s choice to exit strategically rather than continue investing to meet regulatory pressure reflects the management’s emphasis on capital allocation efficiency

- Through the acquisition of the Lindsey Refinery, Phillips 66’s position in the UK market will be significantly enhanced

- Integration with the Humber Refinery will generate synergies and improve operational efficiency

| Metric | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | 38.43x | Higher than the industry average |

| Price-to-Book (P/B) Ratio | 2.15x | Moderate |

| Price-to-Sales (P/S) Ratio | 0.43x | Relatively low, indicating potential undervaluation |

| Beta Coefficient | 0.9 | Lower than market volatility |

- Buy Rating Share: 52.9% (18 analysts)

- Hold Rating Share: 44.1% (15 analysts)

- Average Target Price: $150, representing 4.9% upside from the current price

Analyst Manav Gupta maintains a Buy rating on Phillips 66 based on the following reasons [2][3]:

- Strategic Value of the UK Acquisition: The acquisition of the Lindsey Refinery will enhance the company’s market position without affecting its financial health

- Valuation Attractiveness: InvestingPro analysis shows the stock price is undervalued relative to its intrinsic value

- Business Diversification: The company’s business structure can effectively hedge regional risks

- Cash Flow Capacity: Strong free cash flow supports ongoing operations and shareholder returns

UBS’s rating also focuses on the following risks:

- Overall cyclical fluctuations in the energy industry

- Impact of regulatory policy changes on refining operations

- Structural transformation of global energy demand

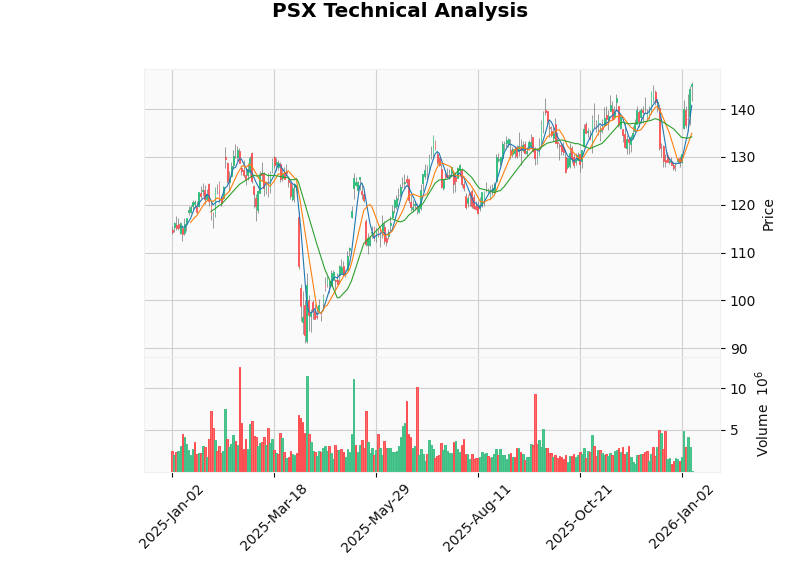

- Trend Judgment: In an uptrend (to be confirmed), a buy signal was issued on December 30

- Key Price Levels:

- Support Level: $134.94

- Resistance Level: $145.66

- Next Target Level: $149.81

- Risk Indicators: KDJ and RSI show the stock is in an overbought zone in the short term, with potential pullback risk

| Assessment Dimension | Rating | Explanation |

|---|---|---|

| Strategic Transformation | Positive |

Exits the low-margin California market to focus on high-value businesses |

| Cash Flow | Stable |

$2.3 billion in free cash flow provides resilience |

| Earnings Growth | Neutral |

Aggressive accounting policies may limit earnings from exceeding expectations |

| Capital Return | Good |

Stock price has risen 8.48% year-to-date, with a 1-year return of 25.52% |

- Globalized layout reduces regional risks

- Strategic expansion in the UK market

- Lower beta coefficient provides defensiveness

- Loss of market share in California

- Faces industry consolidation pressure

The closure of Phillips 66’s refinery

UBS’s decision to maintain a Buy rating is reasonable, and the $160 target price is based on recognition of the company’s strategic value and market position. Investors should pay attention to the company’s Q4 2025 earnings report to be released on February 4, 2026, to further verify the effectiveness of its business transformation.

[1] MMCG Invest - U.S. Fuel Prices Change Forecast 2026 (https://www.mmcginvest.com/post/u-s-fuel-prices-change-forecast-2026-impact-on-gas-stations-margins-and-profitability)

[2] Fintel - UBS Maintains Phillips 66 (PSX) Buy Recommendation (https://www.nasdaq.com/articles/ubs-maintains-phillips-66-psx-buy-recommendation)

[3] Investing.com - Phillips 66 stock: UBS reiterates Buy rating as company acquires UK refinery assets (https://www.investing.com/news/analyst-ratings/phillips-66-stock-ubs-reiterates-buy-rating-as-company-acquires-uk-refinery-assets-93CH-4432907)

[4] Lodi 411 - The Impact of Phillips 66 and Valero Refinery Closures in California (https://lodi411.com/lodi-eye/the-impact-of-phillips-66-and-valero-refinery-closures-in-california)

[0] Jinling AI Financial Database (Company Profile, Financial Analysis, Technical Analysis)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.