Investment Risk Case Analysis of *ST Shengxun (003004.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and market information, I will conduct a systematic analysis of this typical case of *ST Shengxun, revealing its warning significance for investment decisions regarding risk-warning companies.

- Stock Code: 003004.SZ

- Full Company Name: Beijing Shengxun Electronics Co., Ltd.

- Core Business: Security system integration services, AIoT technology platform, smart city solutions

- Listing Date: November 17, 2020

- Current Status: *ST Label (Delisting Risk Warning)

According to the company’s announcement, *ST Shengxun triggered Article 9.3.1 of the “Shenzhen Stock Exchange Stock Listing Rules” due to its 2024 financial indicators – “the lowest of the audited total profit, net profit, and net profit after deducting non-recurring gains and losses for the most recent fiscal year is negative, and operating revenue after deduction is less than 300 million yuan”. The company’s stock has been subject to delisting risk warning since May 6, 2025, and the stock abbreviation has been changed from “Shengxun Co., Ltd.” to “*ST Shengxun”[1].

2025 is the first fiscal year after the company was subject to delisting risk warning. According to the new delisting rules, if the company’s 2025 financial data still fails to meet the standards, the company will face the risk of delisting[1].

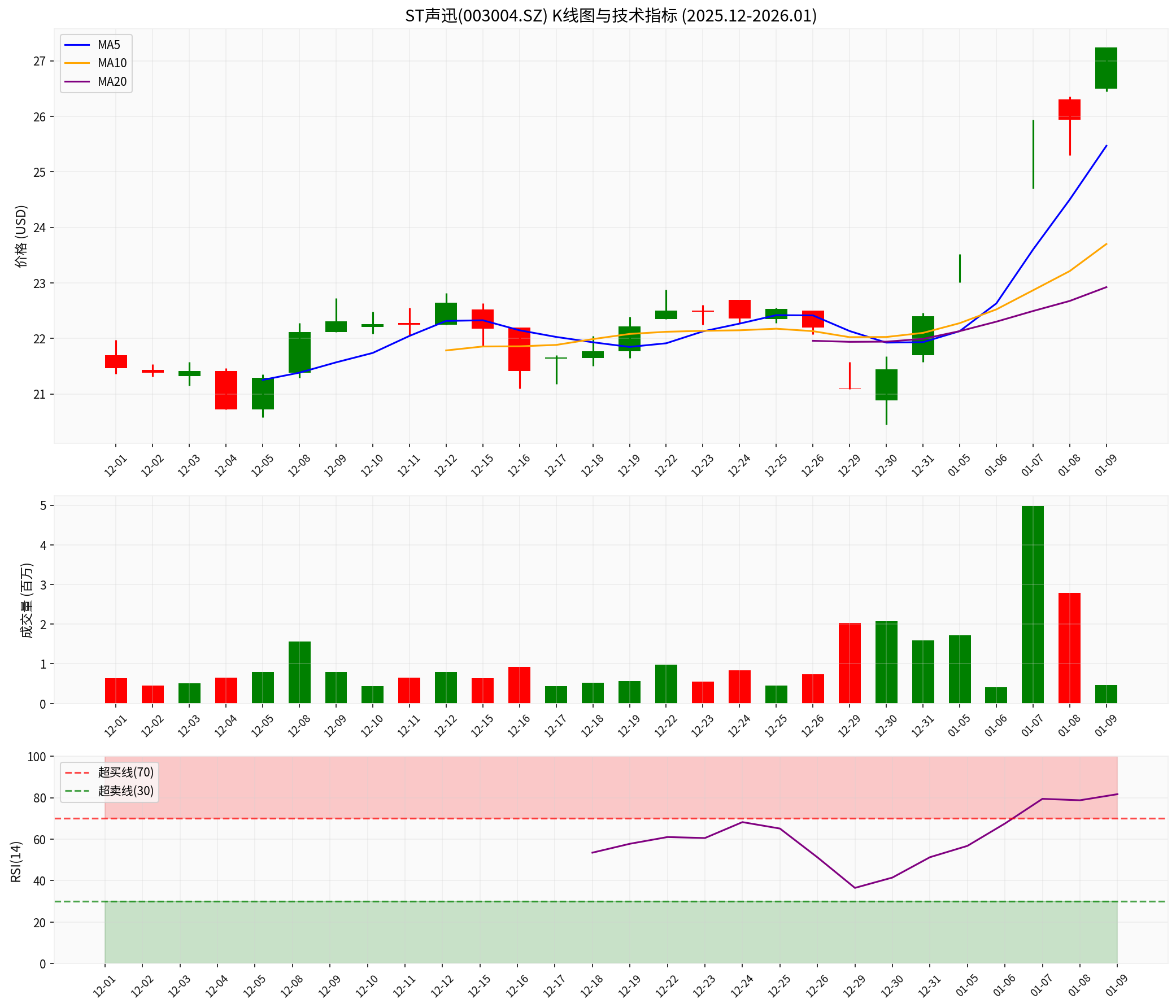

| Indicator | Value | Signal Interpretation |

|---|---|---|

| Latest Closing Price | $27.24 | In the historical high range |

| 20-day Moving Average | $22.92 | Stock price deviates significantly from the moving average |

| KDJ Indicator | K:92.7, D:83.5, J:111.0 | Severe overbought zone[0] |

| 5-day Price Increase | +15.82% | Excessive short-term price increase |

| 30-day Price Increase | +22.10% | Substantial cumulative medium-term price increase[0] |

From a technical analysis perspective, this stock exhibits typical characteristics of short-term capital speculation[0]:

- Clear Overbought Signal: The J value of the KDJ indicator exceeds 100, and RSI is in the overbought zone

- Excessive Deviation Rate: The deviation of the stock price from the 20-day moving average exceeds 20%

- Volume Divergence: The stock price rises but trading volume fails to expand sustainably in coordination

The chart above shows the K-line trend of *ST Shengxun from December 2025 to January 2026, from which we can clearly see:

- The rapid pull-up process of the stock price in the short term

- The RSI indicator continues to operate in the overbought zone

- Trading volume shows a pulse-like expansion characteristic

| Share Reduction Subject | Reduction Ratio | Reduction Method | Reduction Period | Reason for Reduction |

|---|---|---|---|---|

| Liu Mengran | ≤2.04% (≤1.65 million shares) | Concentrated Auction / Block Trade | Within 15 trading days + 3 months after announcement | Personal capital needs |

| Liu Jianwen and his concerted actors | ≤2.64% (≤2.1322 million shares) | Concentrated Auction / Block Trade | Within 15 trading days + 3 months after announcement | Personal capital needs |

Total |

4.68% |

- | February to May 2026 |

- |

- Sensitive Time Node: Choosing to announce the share reduction plan after a short-term surge in stock price, suspected of “cash out at high prices”

- Large Reduction Scale: The total share reduction is nearly 5%, and the cash-out scale is considerable based on the current market value

- Consistency of Collective Action: The two shareholders announced their share reduction plans almost simultaneously, with the same reason of “personal capital needs”

- System Compliance: According to the “Shenzhen Stock Exchange Self-Regulatory Guidelines for Listed Companies No. 18 - Share Reduction by Shareholders, Directors, Supervisors, and Senior Executives”, illegal share reduction under circumstances where it is prohibited will face penalties of “ordered repurchase and surrender of price difference to the listed company”[2]

| Indicator | Value | Industry Reference | Risk Assessment |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | -82.42 | varies | Loss-making Status |

| Price-to-Book Ratio (P/B) | 3.42 | varies | Overvalued |

| Return on Equity (ROE) | -3.82% | >8% is preferred | Negative Return |

| Net Profit Margin | -7.98% | >10% is preferred | Sustained Losses |

| Current Ratio | 2.16 | >1.5 is preferred | Short-term solvency is acceptable[0] |

- Sustained Deterioration of Profitability: The company is in a loss-making state, and there is no sign of turning profitable in the short term

- Overhanging Delisting Risk: 2025 is a critical year that will determine the company’s fate. If operating revenue fails to reach 300 million yuan and net profit remains negative, the company will face delisting

- Cash Flow Pressure: The latest data shows that the company’s free cash flow is negative (approximately -107 million yuan), resulting in significant operating pressure[0]

- Conservative Accounting Policies: Financial analysis shows that the company adopts conservative accounting policies, and the high depreciation/capital expenditure ratio indicates significant asset impairment pressure[0]

The *ST Shengxun case provides the following important warnings for investment decisions regarding risk-warning companies:

| Risk Signal | Specific Performance | Response Strategy |

|---|---|---|

| Abnormal Stock Price Limit-Up | Consecutive limit-ups without fundamental support | Avoid stocks with excessive price increases |

| Overbought Technical Indicators | Severe overbought KDJ and RSI | Wait for indicator repair |

| Abnormal Trading Volume | Pulse-like expansion followed by contraction | Pay attention to volume-price coordination |

| Theme Speculation | No substantive positive support | Distinguish between value and speculation |

Signals transmitted to the market by collective shareholder share reduction:

- Insiders are Bearish: Major shareholders lack confidence in the company’s future development

- Recognition of Overvaluation: The current position is considered overvalued by insiders

- Urgent Capital Needs: Insist on share reduction and cash-out even during the restricted period

- Short-term Stock Price Peak: There have been many cases in history where “stock prices peaked after share reductions”

Investment in *ST companies requires special attention to:

| Risk Type | Specific Content | Investment Suggestion |

|---|---|---|

| Financial Delisting Risk | Operating revenue < 300 million yuan and net profit is negative | Focus on the 2025 annual report |

| Major Illegal Delisting | Financial fraud, insider trading, etc. | Verify historical violation records |

| Trading-Based Delisting | Market value < 500 million yuan | Pay attention to market value changes |

| Standard-Based Delisting | Internal control defects, major shareholder occupation of funds | Pay attention to regulatory penalties |

According to the 2024 New “Nine Articles of the State” and the new delisting rules[3]:

- Revenue standard for loss-making main board companiesincreased from 100 million yuan to300 million yuan

- Market value delisting indicatorincreased from below 300 million yuan tobelow 500 million yuan

- Failure to meet dividend requirementswill trigger ST risk warning

- Threshold for major illegal delisting triggered by financial fraudhas been lowered

- *Avoid ST Stocks After a Sharp Surge: Abnormal price increases such as “4 limit-ups in 5 days” are often accompanied by huge pullback risks

- Pay Attention to Insider Behavior: Share reductions by major shareholders and management are usually leading indicators of deteriorating company fundamentals

- In-depth Research on Financial Data: Focus on operating revenue scale, net profit change trends, and cash flow status

- Set Stop-Loss Discipline: If you decide to invest in *ST stocks, you must set strict stop-loss levels

- Control Position Ratio: The position of *ST stocks should not exceed 10% of the total position

- Pay Attention to Key Time Nodes: Before and after annual report disclosure, effective date of delisting risk warning, etc.

*Core Lessons from the ST Shengxun Case:

When a *ST stock experiences a short-term surge without any improvement in fundamentals, while major shareholders announce large-scale share reductions at the same time, investors should be highly vigilant. This combination of “surge + share reduction” is almost a typical “pump and dump” pattern, with a 99% probability of becoming a top-taker.

[0] Jinling AI Financial Database (Stock Market Quotes, Technical Analysis, Financial Data)

[1] Shanghai Securities News - Announcement on Abnormal Fluctuation in Stock Trading of Beijing Shengxun Electronics Co., Ltd. (2026-01-07)

(https://paper.cnstock.com/html/2026-01/07/content_2167368.htm)

[2] Zhong Lun Law Firm - Share Reduction by Shareholders, Directors, Supervisors, and Senior Executives of Listed Companies

(https://www.zhonglun.com/research/articles/53515.html)

[3] Securities Times - Multiple Companies Issue Delisting Risk Warnings (2025-02-17)

(https://www.stcn.com/article/detail/1530267.html)

[4] Shenzhen Stock Exchange - Guideline Document on Share Reduction by Shareholders, Directors, and Senior Executives

(https://docs.static.szse.cn/www/lawrules/rule/stock/supervision/currency/W020250327580660638732.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.