Impact Analysis of BMO Capital Maintaining an "Outperform" Rating on Constellation Brands

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data and analysis I have collected, below is a comprehensive impact analysis of BMO Capital maintaining an “Outperform” rating on Constellation Brands.

| Metric | Value | Industry Comparison |

|---|---|---|

| Market Cap | $25.82B | Large consumer goods company |

| Price-to-Earnings (P/E) | 23.26x | Near industry median |

| ROE | 15.12% | Strong performance |

| Net Profit Margin | 11.83% | Healthy level |

| Current Ratio | 1.34 | Financially healthy |

The company released its latest quarterly earnings report (Q3 FY2025) on January 8, 2026, showing revenue of $2.22B, exceeding market expectations by 3.15%; earnings per share (EPS) was $3.06, beating expectations by 16.35% [0]. This better-than-expected performance is an important basis supporting analysts’ maintenance of an optimistic rating.

Based on the latest market data, the rating distribution for Constellation Brands among 20 analysts is as follows [1][2]:

| Rating | Number of Analysts | Percentage |

|---|---|---|

| Strong Buy | 5 | 25% |

| Buy | 5 | 25% |

| Hold | 9 | 45% |

| Sell | 1 | 5% |

The consensus target price is $177.35, implying an upside of approximately 19.9% from the current stock price ($147.91) [1][2]. BMO Capital maintains its “Outperform” rating, aligning with the optimistic stance of major institutions such as Needham ($180) and Wells Fargo (Overweight).

BMO Capital maintains its “Outperform/Buy” rating, which means the institution expects Constellation Brands to outperform its sector and broad market indices over the next 6-12 months. The core messages conveyed by this rating include:

- Solid growth potential in the company’s core beer business

- Significant results from cost control and efficiency improvement initiatives

- Rational capital allocation strategy (share repurchases + dividends)

- Unshakable brand image and market position

- Brand Moat: Corona and Modelo are leading brands in the U.S. imported beer market with a loyal consumer base

- Improved Cash Flow: The company continues to generate strong free cash flow to support shareholder return programs

- Operational Efficiency: Cost-saving and efficiency improvement projects continue to contribute incremental earnings

- Capital Return: The medium-term share repurchase authorization ($4B) reflects management’s confidence in the company’s value

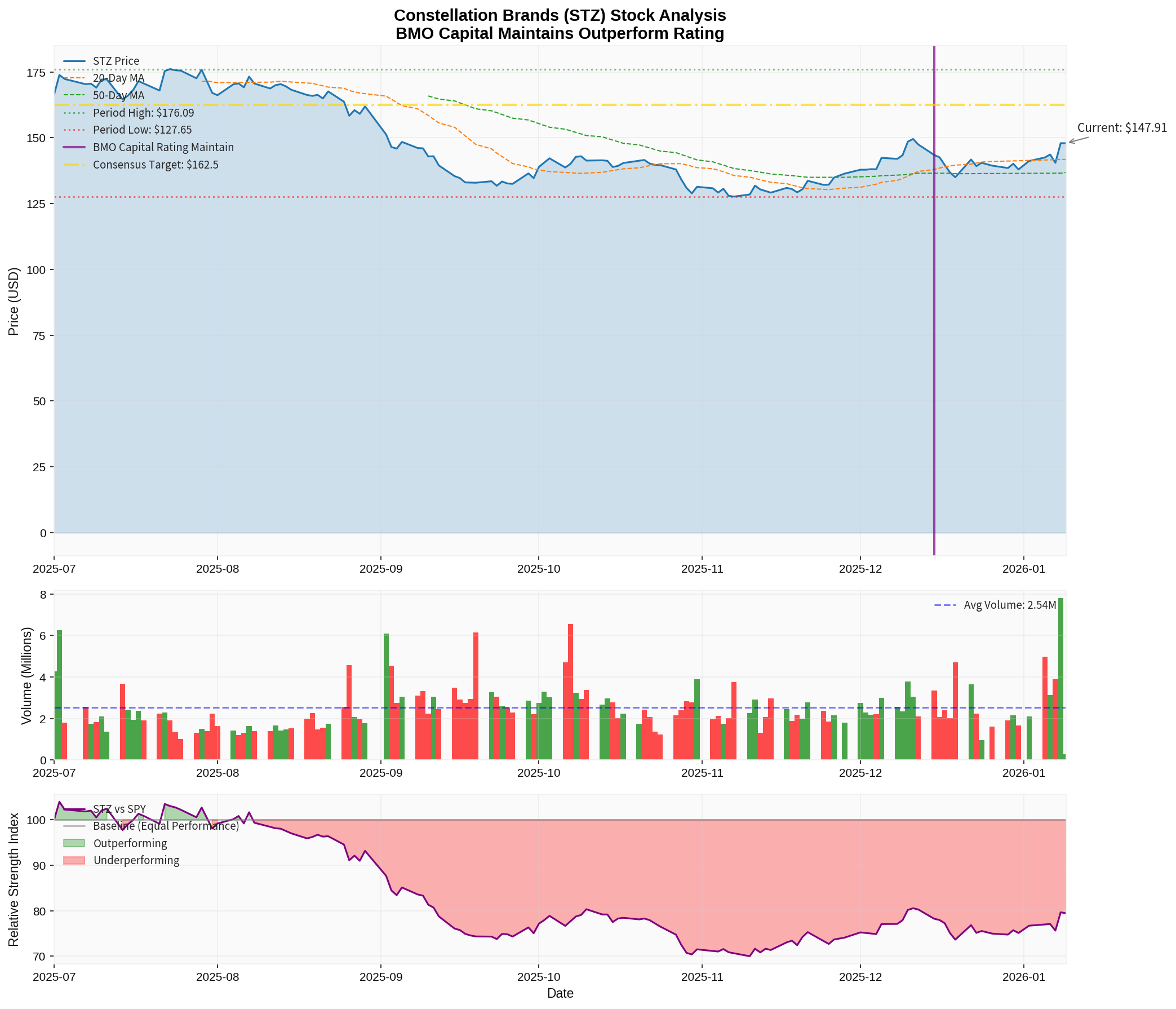

Based on trading data analysis from July 2025 to January 2026 [0]:

| Time Period | Performance |

|---|---|

| Past 1 Month | +3.17% |

| Past 3 Months | +3.46% |

| Past 6 Months | -12.50% |

| Past 1 Year | -18.65% |

| YTD | +4.77% |

- 20-day moving average: $141.79

- 50-day moving average: $136.82

- The current stock price ($147.91) is above both short-term moving averages, indicating bullish momentum in the near term

- MACD Indicator: No crossover signal, overall bullish

- KDJ Indicator: K=68.0, D=62.8, showing a golden cross in a bullish formation

- RSI(14): In the normal range, no overbought or oversold conditions

- Support Level: $141.79 (20-day moving average)

- Resistance Level: $150.02

Relative strength index analysis shows that STZ underperformed the S&P 500 slightly over the past 6 months [0]. However, the stock has shown signs of stabilizing and rebounding recently, particularly rebounding from around $135 to $148 since December 2025.

BMO Capital’s maintenance of an “Outperform” rating has the following implications for different types of investors:

- Signal Strength: A major brokerage maintaining its rating unchanged typically sends a signal that “no significant changes have occurred in the company’s fundamentals”

- Sector Allocation: In the consumer goods sector, STZ, as a leader in the beer segment, has defensive properties

- Risk Management: With a beta coefficient of 0.44, volatility is lower than the broader market, making it suitable as a portfolio stabilizer

- Confidence Support: Ratings from reputable institutions can serve as one of the reference points for investment decisions

- Risk Warning: Investors need to make comprehensive judgments based on personal risk tolerance and investment objectives

- Better-than-Expected Earnings: The latest quarterly EPS and revenue both exceeded expectations, demonstrating business resilience [0]

- Shareholder Returns: $604 million in share repurchases were completed in FY2025, providing substantial capital returns [2]

- Reasonable Valuation: The current P/E (23.26x) is within the historical reasonable range

- Dividend Yield: The current dividend yield is approximately 2.3-2.9%, providing stable cash flow

- Weak Long-Term Trend: Cumulative decline of 31.37% over 3 years, 34.81% over 5 years [0]

- Intensified Competition: The craft beer and hard seltzer markets are highly competitive

- Macroeconomy: Slowdown in consumer spending may impact demand for premium beer

- Debt Level: Long-term debt is approximately $10.285 billion, requiring attention to solvency [3]

- Long-term investors preferring stable cash flow

- Allocation funds bullish on the defensive properties of consumer goods

- Investors with investment experience in the alcoholic beverage industry

- Wait for the stock price to pull back to the $140-$145 range to establish positions

- Focus on the opportunity of expectation gaps ahead of the next earnings report release on April 8, 2026

- Conservative Target: $160 (+8.2%)

- Neutral Target: $177.35 (+19.9%)

- Optimistic Target: $180 (+21.7%)

BMO Capital’s maintenance of an “Outperform” rating on Constellation Brands is an affirmation of the company’s fundamentals and long-term development potential. From a market reaction perspective, this rating provides short-term confidence support for the stock price, but investors should note the following key points:

- Rating Nature: Maintaining the rating indicates that the institution holds a “cautiously optimistic” attitude towards the company, rather than a strong recommendation to buy

- Valuation Upside: The consensus target price of $177.35 implies an upside of approximately 20% [1][2]

- Risk-Return Profile: Considering the stock’s underperforming long-term performance, investors need to balance short-term momentum and long-term value

[0] Gilin API Data - Constellation Brands (STZ) Company Overview, Financial Analysis, Stock Price Data and Technical Indicators

[1] Public Investing - Constellation Brands (STZ) Stock Forecast (https://public.com/stocks/stz/forecast-price-target)

[2] MarketBeat - Constellation Brands (STZ) Stock Forecast and Price Target 2026 (https://www.marketbeat.com/stocks/NYSE/STZ/forecast/)

[3] SEC EDGAR - Constellation Brands Q3 FY2026 10-Q Filing (https://www.sec.gov/Archives/edgar/data/16918/000001691826000005/stz-20251130.htm)

[4] GuruFocus - STZ Analyst Reiterates Buy Rating (https://www.gurufocus.com/news/4097150/stz-analyst-reiterates-buy-rating-and-maintains-price-target-at-180-stz-stock-news)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.