Comparison of R&D Personnel Salaries Between Peicheng Technology and Keli Technology and Analysis of Impacts on Technological Competitiveness

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the collected information, I will conduct a systematic and comprehensive analysis for you.

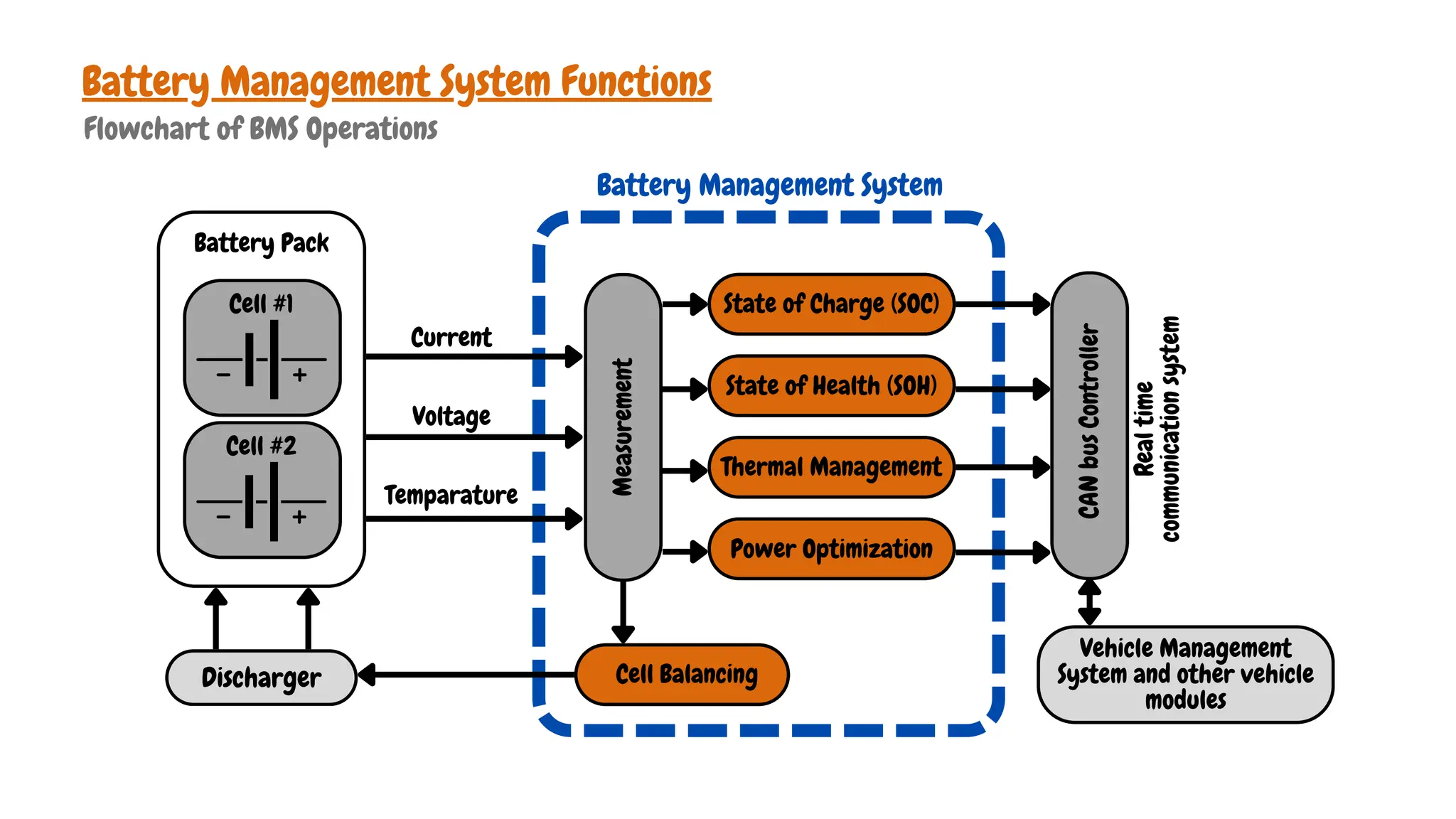

According to public information, Peicheng Technology and Keli Technology are both located in Nanshan District, Shenzhen, with their main business focusing on battery management system (BMS) related fields. However, there are significant differences between the two in terms of R&D investment and output efficiency:

| Indicator | Peicheng Technology | Keli Technology | Comparison Difference |

|---|---|---|---|

Number of R&D Personnel (End of 2024) |

198 people | 148 people | Peicheng has 33.8% more personnel |

Average Annual Salary of R&D Personnel (2024) |

RMB 211,800 | RMB 428,600 | Peicheng’s is only 49.4% of Keli’s |

Cumulative Authorized Patents (As of End of 2024) |

24 items | 89 items | Keli’s is 3.7 times that of Peicheng’s |

Invention Patents |

17 items | 38 items | Keli’s is 2.2 times that of Peicheng’s |

Company Establishment Time |

2004 | 2010 | Peicheng was established 6 years earlier |

Data source: [1][2]

According to the prospectus disclosure, in the R&D center construction project planned by Peicheng Technology, the average salary of R&D personnel is RMB 211,800, while the average annual salary of R&D personnel at Keli Technology during the same period is as high as RMB 428,600, exactly half of the former’s [1]. This difference is extremely abnormal within the same region and industry.

According to data from listed companies in the same industry, the average annual salary of R&D personnel in the BMS industry is as follows [3]:

- Keli Technology: RMB 327,500 (2023)

- HiRain Technologies: RMB 358,500

- Huasu Technology: RMB 254,200

- Industry Average: RMB 313,400

Peicheng Technology’s salary level of RMB 211,800 is significantly lower than the industry average, reflecting obvious disadvantages in attracting and retaining R&D talents.

The BMS industry is a technology-intensive industry, and the scale and quality of the R&D team largely determine an enterprise’s technological level and industry competitiveness [3]. The low salary level may lead to:

- Loss of high-end talents: Experienced and highly skilled core R&D personnel may be poached by competitors

- Reduced recruitment attractiveness: Difficulty in attracting outstanding graduates from top universities and senior industry talents

- Damaged team stability: Salaries below the market level will affect the work enthusiasm and loyalty of the R&D team

In terms of patent output efficiency:

| Company | Per Capita Patents of R&D Personnel | Per Capita Invention Patents of R&D Personnel |

|---|---|---|

| Peicheng Technology | 0.12 patents/person | 0.09 invention patents/person |

| Keli Technology | 0.60 patents/person | 0.26 invention patents/person |

Although Peicheng Technology has more R&D personnel, its per capita patent output is only one-fifth of that of Keli Technology [1][2]. This reflects:

- Failure of the “human wave” strategy: R&D efficiency is not proportional to the number of personnel, and low salaries are difficult to stimulate innovation vitality

- Weak technological accumulation: The gap in patent numbers indicates insufficient reserves of core technologies and intellectual property

- Lagging product iteration: Few R&D achievements mean that the speed of product technology upgrading may lag behind that of competitors

The R&D projects that Peicheng Technology plans to invest in cover cutting-edge fields such as single-cell AFE wireless BMS, gallium nitride BMS, and sodium-ion battery BMS [4]. However:

- Insufficient R&D investment: Insufficient salary investment will affect the quality and progress of R&D projects

- Quality of technical talents: Low salaries may only allow the recruitment of R&D personnel with less experience or average capabilities

- Technological innovation capability: The shortage of core technical talents will restrict the enterprise’s breakthroughs in cutting-edge technology fields

In the competitive landscape of the BMS industry, technological strength is the core competitiveness:

- Customer trust: Weak technological accumulation may affect the trust of vehicle manufacturers and battery manufacturers

- Order acquisition capability: Insufficient R&D strength may put the company at a disadvantage in bidding

- Industry status: The number of patents and technological level directly affect the industry ranking and brand influence

Analysis points out that Peicheng Technology’s R&D personnel have the following characteristics: “large number, low salary, few achievements” [1], which has raised questions about the identification criteria for R&D personnel:

- Is there a situation where production line technical personnel are confused with R&D personnel?

- Is the collection of R&D expenses accurate?

- Are there problems in the accounting of human resource costs?

The prospectus shows that although the number of production personnel and product sales volume have both increased significantly, the direct labor costs have not increased synchronously [1]. This abnormal phenomenon has further deepened doubts about the rationality of the company’s human resource cost accounting.

The salary of Peicheng Technology’s R&D personnel is only half of that of Keli Technology, which will have the following impacts on its future technological competitiveness:

- Difficulty in attracting and retaining high-end R&D talents

- The progress efficiency of R&D projects may decrease

- Technological innovation capabilities are restricted

- The gap in patented technology accumulation will further widen

- The speed of product technology iteration lags behind that of competitors

- Layout in cutting-edge technology fields (wireless BMS, gallium nitride, sodium-ion batteries, etc.) may be hindered

- Industry technological competitiveness continues to weaken

- Market position may be marginalized

- Risk of customer churn increases

The BMS industry has a fast technological iteration speed and is a typical knowledge-intensive industry. Enterprises must use competitive salaries to attract outstanding talents and continue to invest in R&D in order to maintain technological leading advantages. If Peicheng Technology fails to face up to and solve the problem of low salaries for R&D personnel, its future technological competitiveness in the BMS industry will face severe challenges.

[1] Sina Finance - “Peicheng Technology IPO: Large Number of R&D Personnel, Low Salaries, Few Achievements” (https://finance.sina.com.cn/stock/marketresearch/2026-01-09/doc-inhfsfzt4664407.shtml)

[2] Sina Finance - “Peicheng Electronics Distributes Urgent Dividend of RMB 77.5 Million and Raises RMB 62 Million for Working Capital” (https://finance.sina.com.cn/roll/2025-12-29/doc-inhemqaw5023253.shtml)

[3] Shenzhen Stock Exchange - Prospectus of Ligao (Shandong) New Energy Technology Co., Ltd. (http://reportdocs.static.szse.cn/UpFiles/rasinfodisc1/202407/RAS_202407_26212512DCC3B6167A4C4C819B8F8550B67A23.pdf)

[4] Eastmoney.com - Prospectus of Peicheng Technology (https://pdf.dfcfw.com/pdf/H2_AN202512231806671627_1.pdf)

[5] Keli Technology Official Website (https://www.klclear.com/index.php?m=home&c=Lists&a=index&tid=10)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.