Assessment of Customer Concentration and Accounts Receivable Bad Debt Risks for Husong Technology

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the collected information, I now provide you with a comprehensive assessment and analysis of Husong Technology’s customer concentration and accounts receivable bad debt risks.

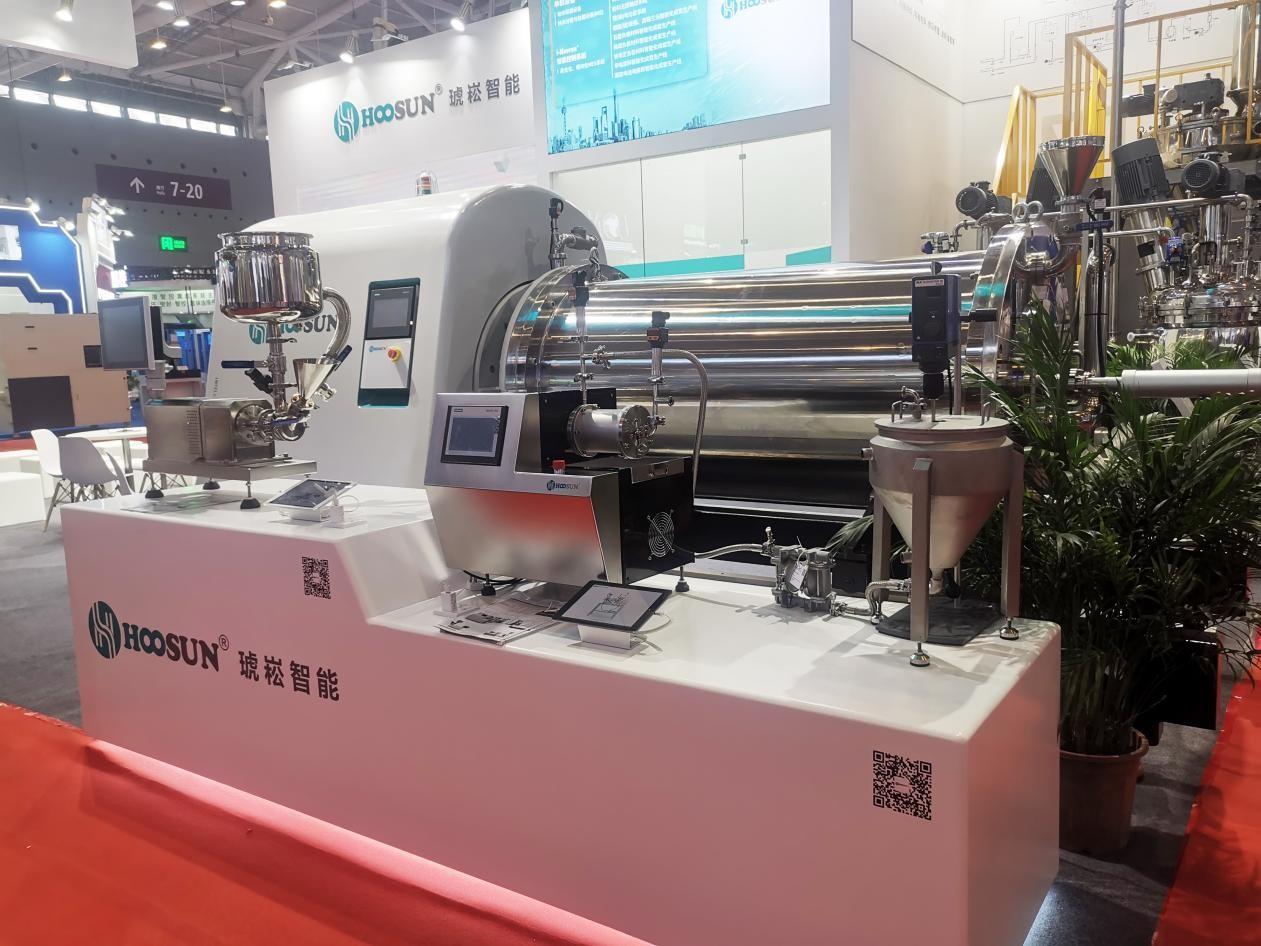

Husong Technology Group Co., Ltd. is a provider of intelligent production line platforms for process industries, focusing on intelligent production line solutions for micro-nano materials. According to data disclosed in the prospectus, the company has extremely high customer concentration [1]:

| Report Period | Revenue Share of Top 5 Customers | Revenue Share of Largest Single Customer |

|---|---|---|

| 2022 | 96.0% | 71.9% |

| 2023 | 92.1% | 43.7% |

| 2024 | 85.1% | 41.7% |

| 2025H1 | 97.0% |

47.4% |

Husong Technology’s average turnover days of trade receivables and notes show a significant deterioration trend [1]:

- 2024: 88 days

- H1 2025:511 days(up 480.7%)

The sharp deterioration of this indicator shows that the company’s collection capacity has dropped significantly, and accounts receivable are seriously stagnant.

| Period | Net Cash Flow from Operating Activities |

|---|---|

| 2024 | -RMB 88.308 million |

| H1 2025 | -RMB 66.787 million |

Although the company recorded a book net profit of RMB 15.298 million in 2024, operating cash flow has remained negative, indicating poor profit quality and serious insufficiency in actual collection capacity [1].

Based on financial data, Husong Technology has the following bad debt risk signals:

| Risk Dimension | Assessment Result | Risk Level |

|---|---|---|

| Customer Concentration | Top 5 customers account for 97% | Extremely High |

| Account Age Structure | Turnover days increased from 88 days to 511 days | Extremely High |

| Cash Flow Status | Sustained net outflow | High |

| Single Customer Dependence | Largest customer accounts for 47.4% | High |

| Performance Volatility | H1 2025 revenue decreased by 73.5% YoY | High |

According to historical data from the 2017 annual report (the company was listed on the NEEQ before), its accounts receivable bad debt provision accrual policy is as follows [2]:

| Account Age | Accrual Ratio |

|---|---|

| Within 1 year | 1% |

| 1-2 years | 10% |

| 2-3 years | 20% |

| 3-4 years | 50% |

| Over 4 years | 100% |

If the current accounts receivable aging structure deteriorates and a large amount of receivables fall into the age range of over 1 year, the bad debt provisions to be accrued in accordance with the above policy will have a significant impact on profits.

High customer concentration (97%)

↓

Deterioration of single customer's operations / Termination of cooperation

↓

Failure to collect accounts receivable

↓

Bad debt losses erode profits

↓

Risk of cash flow breakdown

↓

Short-term debt repayment pressure (As of June 2025, cash reserves dropped to RMB 170 million, a significant decrease from RMB 432 million at the end of 2024) [1]

Assuming a default by a major customer among the top five customers, the impact under different bad debt ratio scenarios is as follows:

| Bad Debt Ratio | Estimated Impact Amount (as % of 2024 Revenue) | Impact on Net Profit |

|---|---|---|

| 5% | Approximately RMB 35.5 million | Fully offsets 2024 net profit |

| 10% | Approximately RMB 71 million | Equivalent to 10% of 2024 revenue |

| 20% | Approximately RMB 142 million | Far exceeds the company’s bearing capacity |

- Cash Burn Rate: From H2 2024 to H1 2025, the semi-annual net cash outflow was approximately RMB 132 million (RMB 432 million - RMB 170 million × 2 + adjustments)

- Number of Months of Cash Reserve Support: At the current burn rate, cash reserves can support operations for approximately7-8 months

| Assessment Dimension | Comprehensive Score | Risk Level |

|---|---|---|

| Customer Concentration Risk | 9/10 | Extremely High |

| Accounts Receivable Collection Risk | 8.5/10 | High |

| Adequacy of Bad Debt Provisions | 7/10 | Medium-High |

| Liquidity Risk | 7.5/10 | High |

Comprehensive Risk Rating |

— | High Risk |

- High Alert: A customer concentration rate of 97% means the company’s performance fully depends on the cooperation stability of a small number of customers

- Focus on Account Age: A turnover period of 511 days indicates a significant deterioration in accounts receivable quality; close attention should be paid to changes in account age distribution

- Cash Flow Monitoring: Continuously track the cash burn rate and assess short-term solvency

- Customer Diversification: The company needs to accelerate customer expansion to reduce dependence on single customers

- Industry Cycle: Changes in the prosperity of the downstream new energy industry will directly affect customers’ payment capacity and willingness

[1] OFweek Intelligent Manufacturing Network - “Husong Technology Spurts Towards HKEX Listing: Obvious Performance Volatility, Extreme Dependence on a Small Number of Customers” (https://m.ofweek.com/im/2026-01/ART-201900-12003-30678656.html)

[2] Eastmoney.com - “Husong Intelligence 2017 Annual Report” (http://pdf.dfcfw.com/pdf/H2_AN201804201127469495_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.