Analysis of Hengrui Medicine's PD-L1/TGF-β Bispecific Antibody Approval and Clinical Design Controversies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected information, I will provide you with an in-depth analysis report on Hengrui Medicine’s PD-L1/TGF-β bispecific antibody approval and clinical design controversies.

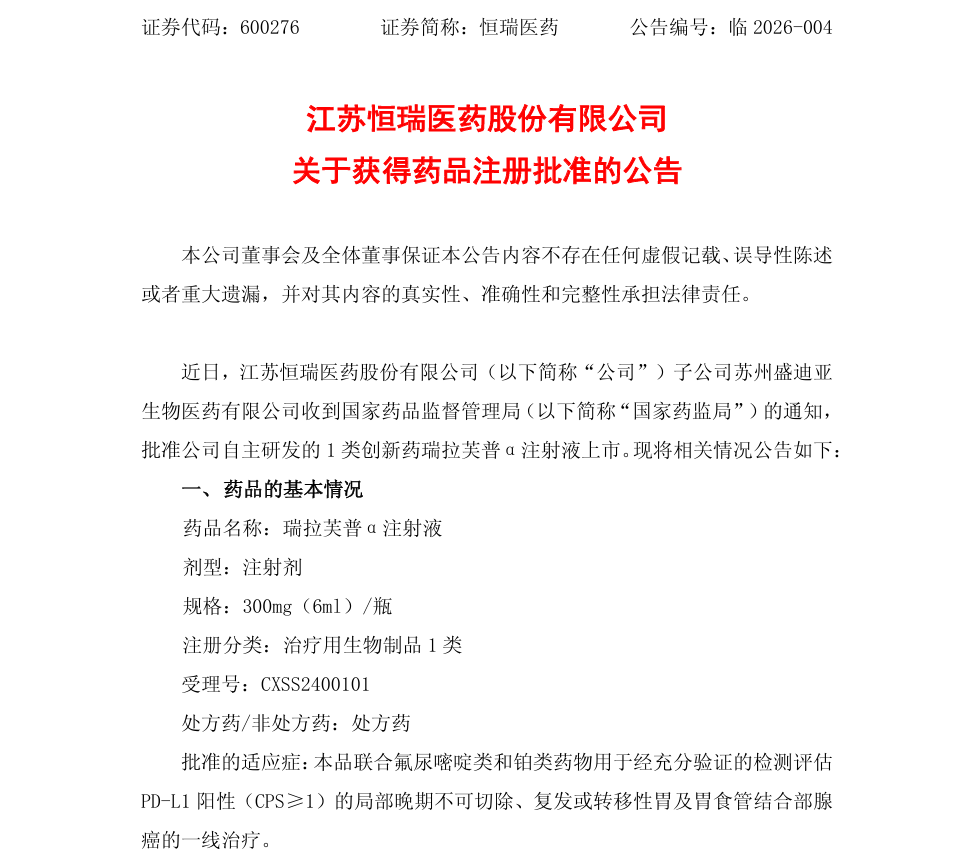

On January 7, 2026,

- The world’s first approved anti-PD-L1/TGF-βRII bispecific antibody fusion protein[1][2]

- Indication: Combined with fluoropyrimidine and platinum-based drugs, for first-line treatment of locally advanced unresectable, recurrent or metastatic gastric and gastroesophageal junction adenocarcinoma with PD-L1-positive (CPS≥1) status confirmed by fully validated testing [1]

- R&D Entity: Suzhou Sundia Biopharmaceutical Co., Ltd., a subsidiary of Hengrui Medicine

Ruilafupu Alpha Injection adopts an innovative dual-target design:

| Component | Mechanism of Action |

|---|---|

Anti-PD-L1 IgG4 monoclonal antibody |

Blocks PD-L1 signaling and releases the immune checkpoint |

Extracellular domain of TGF-β receptor II (TGF-βRII) |

Maintains high affinity for TGF-β and improves the immunosuppressive microenvironment |

This unique structure achieves a dual mechanism of action:

The RELIGHT study (also known as SHR-1701-Ⅲ-307 study) is a

- Control Group: Placebo combined with chemotherapy (CAPOX regimen)

- Experimental Group: Ruilafupu Alpha Injection combined with chemotherapy

- Primary Endpoint: Overall Survival (OS)

- Study Scale: Participated by 43 hospitals in China

Based on the primary efficacy data reported at the 2024 ESMO Annual Congress (LBA60) [1][4][5]:

| Population | Median OS (Experimental Group) | Median OS (Control Group) | Survival Improvement | Reduction in Mortality Risk (HR) |

|---|---|---|---|---|

ITT Population |

15.8 months | 11.2 months | 4.6 months | HR=0.66 (34%) |

PD-L1 CPS≥1 Subgroup |

16.7 months | 10.3 months | 6.4 months | HR=0.57 (43%) |

Gastric Cancer with Liver Metastasis Subgroup |

16.8 months | 10.3 months | 6.5 months | HR=0.46 (54%) |

- Grade ≥3 treatment-related adverse events (TRAEs) showed no significant difference compared with the control group [4]

- Unique Advantage: The first immunotherapy drug observed in a Phase III study to improve chemotherapy-induced hematological toxicity (reduction in platelets, neutrophils, and white blood cells), with an approximately 10% reduction in hematological toxicity compared to the control group, demonstrating potential myeloprotective effects [4]

According to reports from professional medical media, the RELIGHT study has the following

“The limitation of the study is that it did not conduct a head-to-head comparison with PD-1 inhibitor combined chemotherapy regimens.”

This indicates that the control group setting of the study has the following potential issues:

| Comparison Dimension | Current Design | Ideal Design |

|---|---|---|

| Control Group Selection | Placebo + Chemotherapy | PD-1 Inhibitor + Chemotherapy (e.g., Pembrolizumab + Chemotherapy) |

| Direct Comparison | No | Yes |

| Clinical Guidance Value | Proves superiority over chemotherapy | Proves superiority over standard of care |

-

Regulatory Approval: The study design has been recognized and approved for marketing by the NMPA, indicating that its scientific and ethical rationality has passed regulatory review [1]

-

Historical Control Significance: Before PD-1/PD-L1 inhibitors were approved for first-line gastric cancer treatment, chemotherapy was indeed the standard of care

-

Validation of Innovative Mechanism: This is the first time that the clinical value of a PD-L1/TGF-β bifunctional fusion protein has been demonstrated in a Phase III clinical trial [6]

-

Changes in Treatment Landscape: As PD-1 inhibitor combined chemotherapy regimens such as Pembrolizumab and Nivolumab have become the first-line standard of care for gastric cancer [7], the clinical guidance value of a chemotherapy-only control group has declined

-

Limitations of Indirect Comparison: Cannot directly prove whether SHR-1701 combined with chemotherapy is superior to existing PD-1 inhibitor combined chemotherapy regimens

-

Challenges in Medical Insurance Access: May face questions about the lack of head-to-head data during medical insurance negotiations

Professor Peng Zhi from Peking University Cancer Hospital pointed out: “There is still much to explore in terms of biomarkers. PD-L1 is an important biomarker, but how to better select patients who can benefit from Ruilafupu Alpha Injection (SHR-1701) treatment is a very important research topic.” [3]

| Product | Company | Target | Approval Status |

|---|---|---|---|

| Pembrolizumab | Merck & Co. | PD-1 | Approved |

| Nivolumab | BMS | PD-1 | Approved |

| Cadonilimab | Akeso Biopharma | PD-1/CTLA-4 | Approved in September 2024 |

Aizeli® |

Hengrui Medicine |

PD-L1/TGF-β |

Approved in January 2026 |

- The world’s first approved PD-L1/TGF-β bispecific antibody fusion protein [1]

- Dual-target synergistic effect, showing significant benefits in refractory populations such as gastric cancer with liver metastasis (HR=0.46) [4]

- Meta-analysis showed a superior OS benefit trend in advanced gastric cancer patients with PD-L1 CPS≥1 [4]

- Unique safety profile (myeloprotective effects) [4]

- As a first-in-class product, it may receive policy support in medical insurance negotiations and hospital access

| Challenge Type | Specific Content | Impact Level |

|---|---|---|

Clinical Evidence |

Lack of head-to-head comparison with PD-1 inhibitor combined chemotherapy | Medium-High |

Medical Insurance Access |

Need to demonstrate incremental value compared to existing standard of care | Medium |

Competitive Pressure |

Akeso’s Cadonilimab has been approved and included in guidelines | Medium |

Commercialization Capability |

Need to build a new commercial team to promote the bispecific antibody product | Medium-Low |

| Indicator | Value |

|---|---|

| Current Price | $63.78 |

| Market Capitalization | $406.85B |

| Price-to-Earnings Ratio (P/E) | 56.40x |

| 1-Year Growth | +48.05% |

| 5-Day Growth After Approval | +6.19% |

- Net Profit Margin: 24.10%

- Return on Equity (ROE): 14.19%

- Current Ratio: 6.55 (sound financial condition)

- Restricted Academic Promotion: May face questions such as “Why not compare with standard of care” during academic promotion

- Disadvantage in Medical Insurance Negotiations: Lack of head-to-head data may affect pricing power in medical insurance negotiations

- Guideline Recommendation Priority: Guidelines such as CSCO and NCCN may prioritize regimens with head-to-head evidence

- Regulatory Endorsement: NMPA approval has confirmed its clinical value

- Differentiated Positioning: Dual-target mechanism provides differentiated competitive advantages

- Liver Metastasis Subgroup Data: Shows outstanding efficacy in refractory populations (HR=0.46), which can be used as a core promotion point

- Initiate a head-to-head Phase III study with PD-1 inhibitor combined chemotherapy

- Expected Timeline: 2-3 years

- Conduct post-marketing real-world studies

- Collect clinical practice data in refractory populations such as those with liver metastasis

- Emphasize the unique value of the dual-target mechanism

- Highlight significant benefits in populations with liver metastasis

- Emphasize the safety advantage of myeloprotection

- Combined therapy with ADC drugs

- Explore earlier application scenarios such as neoadjuvant therapy

| Evaluation Dimension | Conclusion |

|---|---|

Product Value |

Has first-in-class innovative value with solid clinical data |

Clinical Design Controversy |

Has certain limitations but has obtained regulatory approval |

Commercial Prospects |

Opportunities and challenges coexist; differentiated positioning is the key |

Short-term Impact |

Stock price has already reflected some positive news; need to pay attention to medical insurance negotiation progress |

Long-term Value |

Depends on head-to-head study results and medical insurance access status |

- Risk of innovative drug R&D falling short of expectations

- Risk of policy changes in the pharmaceutical industry (medical insurance negotiations, volume-based procurement)

- Impact of macroeconomic fluctuations on the pharmaceutical industry

- Competitive pressure from accelerated launch of competing products

Taking into account:

- Hengrui Medicine’s platform advantages as a leading domestic innovative drug enterprise

- The first-in-class value of the PD-L1/TGF-β bispecific antibody

- A rich R&D pipeline (over 100 independently developed innovative products in clinical development) [1]

It is recommended to

[1] Hengrui Medicine - Hengrui’s Innovative Drug Aizeli® Approved for Advanced Gastric Cancer, the World’s First Marketed Anti-PD-L1/TGF-βRII Bispecific Antibody Fusion Protein (https://www.hengrui.com/media/detail-901.html)

[2] Pharmcube - World’s First! NMPA Approves PD-L1/TGF-βRⅡ Bispecific Antibody Fusion Protein (https://bydrug.pharmcube.com/news/detail/7fe0d54799d4e3819be3c714cf1d9b68)

[3] Liangyihui Oncology News - Professor Peng Zhi: China’s Original PD-L1/TGF-β Bifunctional Fusion Protein SHR-1701 Shines Again on the International Stage (https://bydrug.pharmcube.com/news/detail/6d4ba04782edcf5bfd2e61183984e89b)

[4] Shen L, et al. 2024 ESMO LBA60 - Primary Efficacy Data of the RELIGHT Study

[5] Peng Z, et al. 2025 ESMO Asia Poster 298P - Analysis Results of the PD-L1 CPS≥1 Subgroup

[6] Yisheng - Current Status and Problems of Advanced Gastric Cancer Treatment in 2024 (https://apps.medtrib.cn/media/phone/post/app/2523973/)

[7] 2025 CSCO Guidelines for the Diagnosis and Treatment of Gastric Cancer and NCCN Guidelines Version 3.2025 Gastric Cancer

[8] Jinling AI - Hengrui Medicine Company Fundamental Data (600276.SS)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.