Analysis of the Impact of Changes in U.S. Overseas Fund Transfer Regulatory Policies on International Capital Flows and Investment Decisions

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the information I have collected, I will prepare a systematic analysis report on the changes in U.S. overseas fund transfer regulatory policies and their impacts.

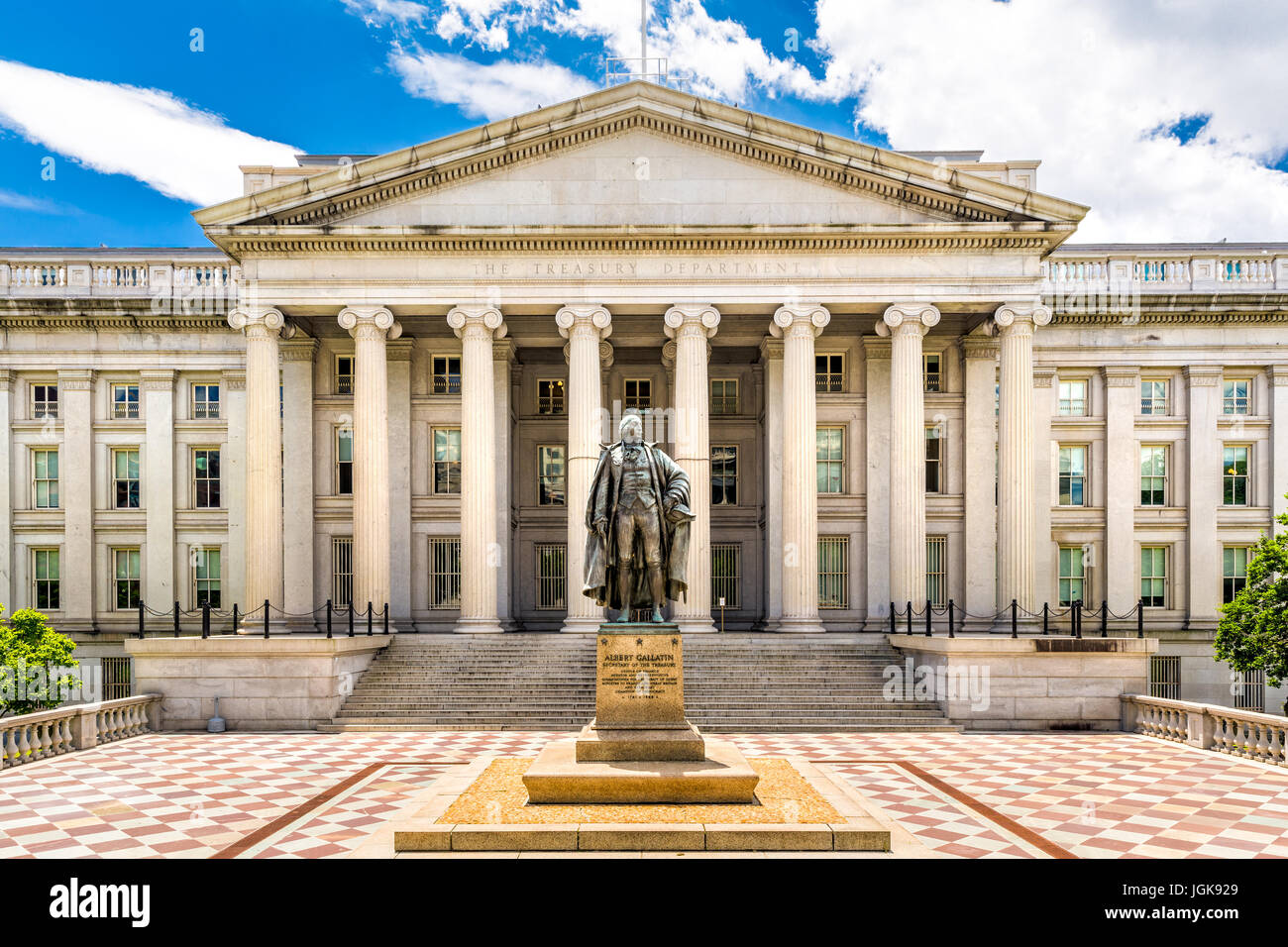

U.S. Treasury Secretary Scott Bessent, on behalf of the Trump administration, outlined the U.S. basic stance on cross-border capital flows:

This policy stance is based on the following principles:

- Anti-money laundering (AML) and counter-terrorist financing (CTF) remain regulatory priorities: The U.S. Financial Crimes Enforcement Network (FinCEN), a subsidiary of the U.S. Department of the Treasury, continues to strengthen monitoring of cross-border fund transfers, particularly supervision of Money Services Businesses (MSBs) in the southwest border region[2]

- Differentiate between legitimate and illicit funds: The core focus of regulators is whether the use of funds is legal, rather than the direction of capital flow itself

- Technological means enable supervision: The technological modernization promoted by Bessent allows FinCEN to implement data-driven border operations to accurately identify suspicious transaction patterns[3]

Recent U.S. measures in cross-border fund transfers include the following important actions:

| Time | Policy/Action | Core Content |

|---|---|---|

| November 2025 | FinCEN issues cross-border fund transfer alert | Strengthens monitoring of cross-border fund transfers involving undocumented foreigners[4] |

| December 2025 | FinCEN border operation | Conducts money laundering risk investigations on over 100 Money Services Businesses[5] |

| December 2025 | U.S. Department of the Treasury imposes sanctions on Iran-Venezuela arms trade | Cuts off illicit fund flow channels[6] |

| December 2025 | Lifts some sanctions on Syria | Eases fund transfer restrictions in specific regions[7] |

These measures indicate that U.S. regulatory policies feature

According to data from the Institute of International Finance (IIF), the net inflow of portfolio investment into major emerging markets reached $285.1 billion in the first 10 months of 2025, representing a year-on-year increase of 14.9%[8]. This trend is driven by multiple factors:

The repeated record highs of international gold prices reflect a shift in the logic of global asset allocation — in an era of uncertainty, investors are moving from “return-driven” to “return and risk balance”[9]. The average geopolitical risk index has soared to 139.7, and market confidence in U.S. dollar assets has wavered.

After the Federal Reserve resumed interest rate cuts, cross-border capital is accelerating its outflow from the U.S. A research report from Western Securities points out that cross-border capital outflows from the U.S. are driving the Federal Reserve to gradually launch quantitative easing[10]. U.S. stock valuations are at historically high levels, and may face significant adjustment pressure once the liquidity environment tightens.

Emerging markets have demonstrated combined advantages in investment returns and macro stability, becoming a new direction for international capital inflows. In 2025, the subscription amount for China’s U.S. dollar sovereign bonds reached 30 times the issuance amount, fully demonstrating strong demand from international investors for emerging market assets[11].

The rapidly advancing “land purchase bans” in various U.S. states pose substantive barriers to Chinese enterprises’ direct investment in the U.S. These laws often have simple provisions and vague definitions, increasing investment uncertainty[12]. Enterprises need to meet both U.S. foreign investment review requirements and China’s overseas investment fund approval requirements, and problems in any link may lead to transaction suspension.

Capital flows feature “fast in, fast out” and are highly sensitive to changes in the external environment. The net inflows of international investors’ bond and equity investments in emerging markets reached $261.3 billion and $23.8 billion respectively, with bond investment accounting for as high as 91.6%[13]. This structure reflects investors’ dual considerations of safety and profitability.

The traditional “compliance post-positioning” strategy is no longer applicable, and enterprises need to prioritize compliance at the beginning of investment decision-making. The blurring of technological boundaries (such as dynamic updates of technology controls in fields like AI and chip design) has made risk assessment of M&A transactions more complex[14].

U.S. overseas fund transfer regulatory policy changes have multi-dimensional impacts on investment decisions:

| Impact Dimension | Specific Performance |

|---|---|

Rising Compliance Costs |

Investors need to prepare more detailed identity documents and fund source proofs (such as income certificates, tax payment certificates, asset sale contracts, etc.)[15] |

Extended Transaction Cycles |

Large-sum fund transfers face longer review cycles, hindering temporary investment decisions |

Narrowed Channels |

The space for fund transfers relying on informal channels (such as underground banks, virtual currencies) has been significantly compressed |

Strategies Need to Be Prioritized |

Investors need to plan overseas fund needs in advance several years with a longer-term perspective[16] |

Investors should proactively complete comprehensive due diligence at mainstream financial institutions and establish long-term, stable, and transparent financial transaction records. These records will become “credit assets” for cross-border financial capabilities, enabling smoother access when handling businesses in the future.

Policies encourage investment under a “pipeline-style” opening framework. Investors should prioritize the following official channels:

- Stock Connect schemes such as Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect

- Cross-Border Wealth Management Connect

- Qualified Domestic Institutional Investors (QDII)

- Overseas Direct Investment (ODI) filing channels

The new regulatory environment involves multiple factors such as technological logic, data governance, financial structure, and international politics. An effective team should include professionals in law, finance, foreign exchange, data security, IT, public affairs, risk management, etc.[17].

Add “regulatory veto clauses” to transaction contracts, establish data isolation and overseas localized processing solutions, purchase political risk insurance for projects, and design “multi-path M&A structures” that can respond to different regulatory scenarios[18].

Global cross-border capital flow supervision shows a clear trend of coordination:

The Financial Action Task Force (FATF) is promoting the establishment of strong AML/CTF systems in various countries[21]. This framework includes a multi-level reporting network such as the Model Competent Authority Agreement (MCAA), Common Reporting Standard (CRS), and Country-by-Country Reporting (CbCR).

Under the frameworks of CRS (Common Reporting Standard) and the U.S. FATCA (Foreign Account Tax Compliance Act), cross-border financial account information is being automatically exchanged globally. The overseas asset information of high-net-worth individuals will become more transparent[22].

Supervision of cross-border flows of cryptocurrencies has become a new focus. Countries are including electronic currency products in the scope of reporting, and traditional regulatory blind spots are being gradually closed[23].

China has simultaneously strengthened supervision of cross-border capital flows in recent years:

| Regulatory Field | Policy Key Points |

|---|---|

Foreign Exchange Management |

Strengthens purpose review and source verification of fund outflows |

Cross-Border Data Flows |

Strengthens supervision of data security and cross-border flows of personal information |

Overseas Investment |

Adopts pre-approval or filing mechanisms for certain industries |

Anti-Money Laundering |

Implements information sharing and collaboration with tax, customs, and other departments[24] |

The core content of the

- Trigger Threshold: Enhanced identity verification is required for single cross-border remittances of RMB 5,000 or the equivalent of USD 1,000 or more

- Core Obligation: Financial institutions must take reasonable measures to verify the identity information of remitters

- Information Retention: Retention period extended from 5 years to at least 10 years[25]

Against the background of Sino-U.S. dual supervision, the choice facing enterprises is no longer “whether to go overseas”, but “how to go overseas more standardly and smartly”[26].

- Establish a complete compliance file and accumulate traceable fund source records

- Prioritize the use of formal financial institutions and compliant investment channels

- Proactively communicate with regulators before major transactions

- Plan overseas fund needs several years in advance

- Build a diversified investment portfolio to spread regulatory risks

- Consider establishing compliance frameworks in different jurisdictions

- Transform compliance from a “cost center” to a “strategic center”

- Establish a dynamic compliance system for forecasting, planning, communication, and adjustment

- Actively participate in the formulation of international rules to safeguard legitimate rights and interests

The core characteristics of changes in U.S. overseas fund transfer regulatory policies can be summarized as follows:

-

Policy Logic: “Compliance Equals Openness” — cross-border transfers that can prove the legitimacy of fund sources are permitted

-

Regulatory Focus: Shift from “regulating funds” to “regulating flow directions and sanctioned targets” for more accurate risk identification

-

Global Impact: Promotes the rebalancing of global capital flows, with emerging markets seeing relatively increased attractiveness

-

Investment Impact: Rising compliance costs and extended transaction cycles, but channels for compliant investment remain unobstructed

-

Strategic Shift: Enterprises need to shift from “following rules” to “compliance strategy”, prioritizing compliance in decision-making processes

Looking ahead, U.S. cross-border fund transfer regulatory policies may show the following trends:

FinCEN’s data-driven border operations indicate that technological means are enabling more accurate risk identification. Technologies such as blockchain analysis and artificial intelligence screening will be more widely applied to cross-border fund monitoring.

Continue to tighten controls on sanctioned targets (such as Iran and Venezuela), but maintain openness towards normal business activities. This differentiated policy will continue to deepen.

Under the FATF framework, the convergence of regulatory standards among countries will further accelerate, and the “one compliance, global applicability” of cross-border compliance is expected to be gradually realized.

Compliance awareness will profoundly change investors’ asset allocation behavior. Investment targets with high transparency and good compliance records will enjoy valuation premiums, while funds relying on gray channels will face systemic crowding out.

[1] Treasury Secretary Scott Bessent Twitter

[2] FinCEN Announces Data-Driven Border Operation

[3] Boring Compliance - Treasury News

[4] FinCEN Alert on Cross-Border Funds Transfers

[5] FinCEN Border Operation to Address Potential Money Laundering

[6] Boring Compliance - Iran-Venezuela Sanctions

[7] Boring Compliance - Syria Sanctions Relief

[8] Tencent News - Top 10 International Financial News of 2025

[9] Institute of International Finance (IIF) Cross-Border Capital Flow Data

[10] Western Securities - Ride the Wind: Top 10 Forecasts for 2026

[11] Fudan University - Commentary on China’s U.S. Dollar Sovereign Bonds

[12] Attorney Liu’s Article - New Compliance Challenges for Chinese Enterprises Investing in the U.S.

[13] Institute of International Finance (IIF) - Emerging Market Capital Flow Data

[14] Attorney Liu’s Article - Redefining Compliance

[15] IngStart - Interpretation of 2026 Cross-Border Remittance New Rules

[16] IngStart - Impact of Cross-Border Remittances on Chinese Investors

[17] Attorney Liu’s Article - Building a Cross-Departmental Compliance Team

[18] Attorney Liu’s Article - Institutionalized Compliance Tools

[19] Attorney Liu’s Article - Blurring of Technological Boundaries

[20] Attorney Liu’s Article - Fragmentation of Local Restrictions

[21] IngStart - Alignment with FATF International Standards

[22] IngStart - CRS and FATCA Frameworks

[23] Albright Law - Cryptocurrency Tax Supervision

[24] IngStart - China’s Cross-Border Capital Regulatory Policies

[25] IngStart - Core Clauses of 2026 Cross-Border Remittance New Rules

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.