Tesla Q3 2025 Earnings Analysis: Mixed Results with AI/Robotics Focus

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on Tesla’s Q3 2025 financial results announcement [1] published on October 22, 2025, which revealed mixed performance with strong revenue growth but significant profitability decline, while management emphasized transformative AI and robotics initiatives.

Tesla’s third quarter 2025 results present a complex narrative of traditional automotive metrics versus future technology bets. The company delivered $28.1 billion in revenue, exceeding analyst estimates of $26.37 billion and representing 12% year-over-year growth [2][3]. However, this top-line performance masked significant profitability deterioration, with net income falling 37% to $1.37 billion ($0.39 GAAP EPS) and operating income declining 40% to $1.6 billion, resulting in a 5.8% operating margin [2][3].

The market’s reaction was notably positive, with Tesla’s stock surging 6.9% on October 23 to $448.98 [0], suggesting investors prioritized management’s forward-looking technology narrative over current financial performance. This outperformance occurred despite broader technology sector weakness of -1.74% [0], indicating company-specific drivers.

Key operational highlights included over 497,000 vehicle deliveries, record energy storage deployments of 12.5 GWh, and approximately $4 billion in free cash flow [3]. The energy business showed particularly strong momentum, with revenue jumping 44% to $3.42 billion, now representing approximately 25% of total revenue [2].

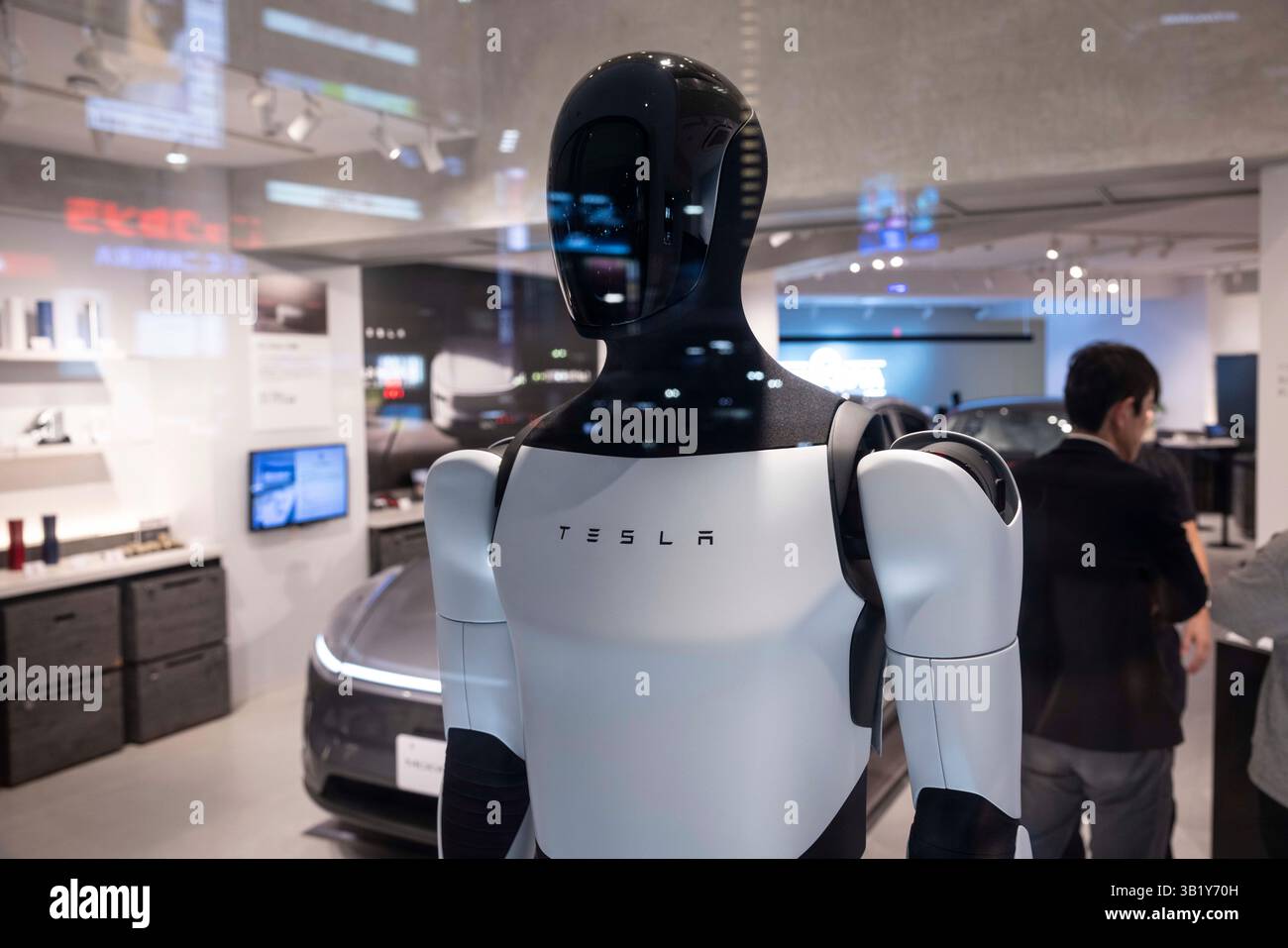

Tesla’s Q3 2025 results demonstrate a company in transition, with traditional automotive metrics showing pressure while future technology initiatives drive investor enthusiasm. Revenue growth of 12% to $28.1 billion [2][3] was achieved at the cost of 37% lower net income [2][3], reflecting strategic investments in AI and robotics.

The company maintains strong financial positioning with over $41 billion in cash and investments [3], providing flexibility for continued technology development. However, the current valuation implies significant success in executing on ambitious AI and robotics timelines that face substantial technical, regulatory, and competitive challenges.

Investors should monitor key milestones including Austin robotaxi safety driver removal, FSD v14 adoption rates, Optimus prototype progress, and energy storage growth sustainability. The disconnect between current financial performance and market valuation suggests heightened sensitivity to execution outcomes on technology initiatives.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.