Pulai Tech (002324) Limit-up Analysis: Driven by LCP Material Breakthrough, but Short-term Gains Are Overextended

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Pulai Tech (Shanghai Pulai Composites Co., Ltd., 002324.SZ) surged to a limit-up on January 10, 2026, entering the limit-up pool. The company is mainly engaged in polymer new materials, LCP materials, sodium-ion batteries and modified materials businesses, and is a representative new materials enterprise in the chemical sector[1][2].

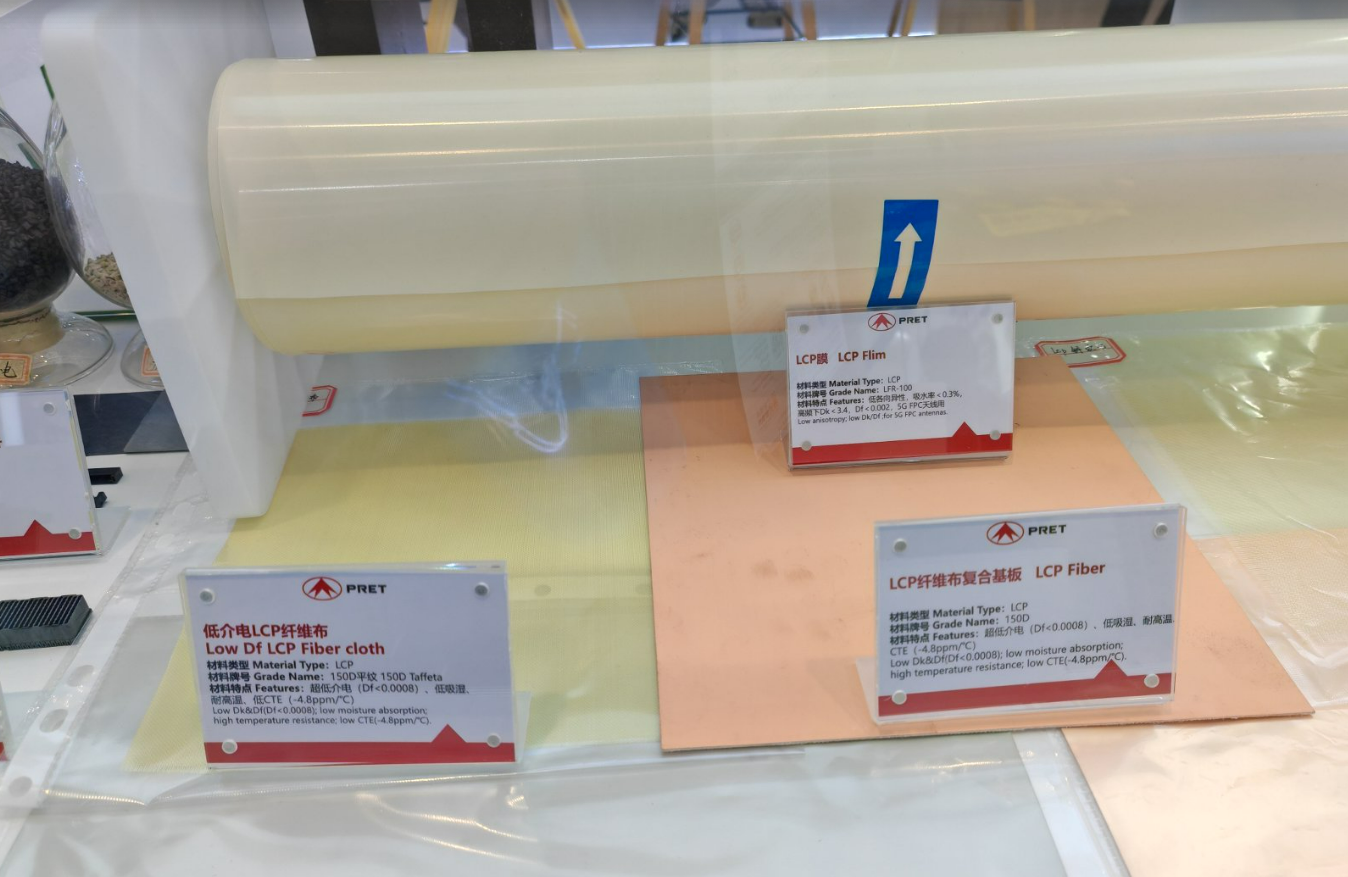

The core driver of this limit-up stems from the company’s major breakthrough in the LCP (Liquid Crystal Polymer) film sector. According to official investor relations activity records, Pulai Tech’s LCP film products have begun mass supply for flexible board antennas of next-generation consumer electronics mobile phone terminals of leading customers in the consumer electronics industry. This marks the breakthrough from 0 to 1 in the application of LCP films in domestic mobile phone terminals, breaking the long-term monopoly of foreign manufacturers in the high-end LCP film application field[2][3]. It is worth noting that only three enterprises worldwide currently have large-scale mass production capacity, and Pulai Tech is the only domestic enterprise to achieve this technological breakthrough. This technological barrier advantage provides it with a significant competitive moat. In addition, this mass production has important strategic layout implications for various terminal fields under the future 6G/millimeter wave high-frequency communication network.

In addition to the substantive breakthrough in LCP materials, the company is also involved in a number of cutting-edge concepts. In the brain-computer interface field, the company’s LCP film products are suitable for use as flexible electrode materials, and joint development and verification work with overseas customers has been carried out, which is currently in clinical trials[2]. However, investors should pay special attention that in the abnormal fluctuation announcement disclosed by the company on January 8, it clearly stated that it does not expect large-scale orders for LCP film products in the brain-computer interface field to be generated in the short term, and no operating revenue has been formed in this field, which will not have a significant impact on the company’s performance for a certain period of time[4]. The same applies to the commercial aerospace sector: although LCP fiber materials have been supplied to leading domestic customers for low-orbit satellites (used in the core middle layer of satellite flexible solar wings), the current business order volume is very small, accounting for less than 0.01% of total operating revenue[4].

The sodium-ion battery business has shown relatively substantive progress. The company has achieved mass shipments and leads the industry in sales volume, received RMB 126 million in strategic investment, delivered the largest domestic energy storage project (30MWh), achieved a 10,000-cycle technological breakthrough in polyanion sodium batteries, and the new production capacity is expected to be gradually put into operation in the third quarter of 2026[3].

From the secondary market performance, Pulai Tech has shown a typical strong upward trend recently. As of January 8, 2026, the company’s 20-day gain reached as high as 86.76%, with 4 consecutive limit-ups, and hit a record high of RMB 23.42[5]. From the price evolution, the stock price has quickly risen from about RMB 11 to over RMB 21, and the short-term skyrocketing speed is worthy of attention.

Data from the Dragon and Tiger List (January 6, 2026) shows that the turnover on that day reached RMB 525 million, with total purchases of RMB 300 million and total sales of RMB 473 million. In terms of capital types, hot money and institutions showed a net buying trend, while foreign capital showed a net selling pattern[1][3]. This capital structure indicates that domestic institutional investors and active hot money are more positive about short-term theme speculation, while foreign capital is relatively cautious.

It is worth noting that from January 6 to 7, 2026, the company received intensive research from multiple institutions, including well-known institutional investors such as Bank of Communications Schroder, ABC-CA Fund, Taiping Pension, Caitong Fund, Ping An Asset Management, Dongfang Hong Asset Management, Taiping Assets, Greenwoods Asset Management, HFT Fund, CCB Fund, and Xingyin Fund, as well as brokerage research institutions such as Huachuang Securities, Western Securities, and Guojin Securities[2]. The increased institutional attention has supported the short-term stock price performance to a certain extent.

From a fundamental perspective, Pulai Tech delivered outstanding performance in the first three quarters of 2025. Net profit increased by 53.48% to 67.82% year-on-year, net profit excluding non-recurring items increased by 64.17% to 79.81% year-on-year, and the net cash flow from operating activities reached RMB 689 million, a year-on-year increase of 203.46%[3]. Strong cash flow and profit growth provide certain fundamental support for the company’s valuation.

In terms of capacity expansion, the company currently has 550,000 tons of modified material production capacity, and the new 150,000-ton capacity at the Tianjin base is expected to be put into operation in the first quarter of 2026. After commissioning, the total production capacity will reach 700,000 tons, focusing on supporting emerging markets such as new energy vehicles, robots, and low-altitude aircraft[3].

A 20-day gain of 86.76% is an extreme upward level; the stock price nearly doubled in just 20 trading days, creating significant pressure for short-term profit-taking. Historical experience shows that such rapid gains are often accompanied by sharp pullback risks.

Although the brain-computer interface and commercial aerospace concepts have great imagination space, the company has clearly announced that related businesses will not contribute substantive revenue in the short term. No operating revenue has been formed in the brain-computer interface field, and the commercial aerospace business orders account for less than 0.01% of total revenue[4]. Investors need to be alert to the expectation gap between concept speculation and actual performance.

According to the Dragon and Tiger List data, foreign capital showed a net selling trend. In the current market environment, continuous foreign capital outflows may create periodic pressure on the stock price.

Although only three global enterprises can mass-produce LCP films, full market competition may emerge in the medium to long term; the sodium-ion battery sector is also highly competitive, and it remains to be seen whether the company can maintain its leading position in fierce competition.

From a technical perspective, the current limit-up price is about RMB 21.29, and the record high of RMB 23.42 (hit on January 8, 2026) is a short-term resistance level. The 5-day moving average of about RMB 17-18 and the 10-day moving average of about RMB 15-16 can be used as reference support levels for pullbacks.

| Scenario | Probability | Forecast |

|---|---|---|

| Continue to hit limit-up | Medium | If market sentiment is exuberant, it may challenge 5 consecutive limit-ups, but risks will surge sharply |

| High-level consolidation | High | Faces short-term profit-taking pressure and will enter a platform consolidation phase |

| Pullback correction | High | Short-term gains are too large, and there is a need to retest the 10-day moving average |

Overall, Pulai Tech’s limit-up

[1] Sina Finance - Pulai Tech Limit-up Analysis on January 8, 2026

[2] Eastmoney.com - Pulai Tech Investor Relations Activity Record

[3] China Finance Information Network - Pulai Tech Investor Relations Management Information

[4] Securities Times - Pulai Tech Abnormal Fluctuation Announcement

[5] Dbanker - Analysis of Pulai Tech Limit-up/Limit-down Reasons

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.