Analysis of the Deterioration Trend in Single-Store Profit Models of Listed New Tea Beverage Companies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will conduct a systematic and comprehensive analysis for you based on the collected data.

Based on a comprehensive analysis of the financial data, operational indicators, and market performance of major listed new tea beverage companies,

| Indicator | 2022 | 2023 | 2024 | Change Range |

|---|---|---|---|---|

| Average Monthly Profit per Store | RMB 15,000-20,000 | RMB 12,000-18,000 | RMB 8,000-12,000 | 30-40% Decline |

| Payback Period | 10-14 months | 12-18 months | 15-24 months | 5-10 Months Extension |

| Average Daily GMV per Store | RMB 8,000-13,000 | RMB 7,000-11,000 | RMB 6,000-9,000 | 15-25% Decline |

| Industry Store Closure Rate | 1.0-1.5% | 1.2-1.8% | 1.5-2.0% | Significant Increase |

According to industry research data [1][2]:

- Mixue Bingcheng: Monthly profit per store dropped from RMB 18,000 in 2022 to RMB 12,000 in 2024 (-33%), but it still maintains relatively strong profitability

- Nayuki’s Tea (02150.HK): Monthly profit per store plummeted from RMB 12,000 to RMB 5,000 (-58%), showing the most severe deterioration

- CHAGEE (CHA): Same-store sales dropped by 27.9% in Q3 2025, with a 23.4% decline in overseas markets [3]

- Entire Industry: 5,788 store closures in 2025, involving at least 35 brands [1]

| Indicator | Data | Industry Comparison |

|---|---|---|

| Market Capitalization | HKD 1.84 billion (early 2026) | Only 1% of Mixue Bingcheng’s |

| ROE | -15.50% | Significantly lower than the industry average |

| Net Profit Margin | -13.15% | Sustained losses |

| Stock Performance | 93.69% decline over 5 years | Worst performer |

| Revenue Growth | 14.4% year-on-year decline in H1 2025 | Negative growth |

As a representative of the direct-operated model, Nayuki’s Tea bears all costs such as store rent, labor, and raw materials. It adjusts slowly amid fluctuations in the consumption environment, and easily falls into the dilemma of “diseconomies of scale”. Its single-store investment amounts to as much as RMB 500,000-1,000,000, with a payback period of 18-24 months, far longer than that of franchise brands.

- Revenue: RMB 3.208 billion, 9.4% year-on-year decline

- Net Profit Attributable to Parent Company: RMB 394 million, 38.5% year-on-year decline

- Net Profit Margin: Dropped from 18.3% to 12.4%

- Same-store sales declined by 27.9% (domestic) and 23.4% (overseas)

Although CHAGEE successfully listed on Nasdaq in April 2025, raising USD 411 million, its stock price has continued to decline after listing. As of January 2026, the stock price has fallen by over 50% from the offering price, and over 65% from its peak.

| Brand | Model | Single-Store Investment | Payback Period | 2024 Performance |

|---|---|---|---|---|

| Mixue Bingcheng | Franchise | RMB 200,000-500,000 | 8-12 months | 35% revenue growth, 5% decline in single-store GMV |

| Guming | Franchise | RMB 200,000-500,000 | 8-12 months | 39% revenue growth, 8% decline in single-store GMV |

| Chabaidao | Franchise | RMB 200,000-500,000 | 8-12 months | 22% revenue growth, 12% decline in single-store GMV |

| Aunt Shanghai | Franchise | RMB 250,000-550,000 | 10-15 months | Stable performance |

As of 2025, the total number of ready-to-drink tea stores nationwide has exceeded 415,000, with the number of stores for leading brands as follows:

- Mixue Bingcheng: 43,800 stores (ranking first)

- Guming: 12,000 stores

- CHAGEE (CHA): 10,100 stores

- Chabaidao: Approximately 8,000 stores

- Aunt Shanghai: Approximately 8,000 stores

Intensive store openings have led to diluted store performance in regions, creating internal competition among stores of the same brand.

Food delivery and group buying platforms have intensified low-price competition, with the actual price of popular milk tea often falling below RMB 5 [4]. This has led to:

- Decline in terminal prices

- Pressure on brand gross profit margins

- Some brands are in a state of “losing money on every sale”

Consumers are experiencing “taste fatigue” with tea beverage products, and the lifecycle of new products is becoming shorter and shorter, possibly only 2-3 months from launch to delisting. In this context, brands need to continuously invest in marketing and R&D, further eroding profits.

Costs such as rent, labor, and raw materials continue to rise, while terminal prices are falling, creating a “scissors gap” effect and exerting dual pressure on single-store profitability.

| Dimension | Franchise Model | Direct-Operated Model |

|---|---|---|

| Asset Efficiency | High (asset-light operation) | Low (heavy asset burden) |

| Expansion Speed | Fast | Slow |

| Risk Resistance Capability | Strong | Weak |

| Profit Stability | Relatively Good | Relatively Poor |

| Typical Brands | Mixue Bingcheng, Guming | Nayuki’s Tea, HEYTEA |

- Cost-Effective Brands(Mixue Bingcheng, Guming, Chabaidao): Low single-store investment (RMB 200,000-500,000), quickly recoup funds through high sales volume, and have greater advantages amid the consumption downgrade trend

- Premium Brands(Nayuki’s Tea, HEYTEA): High single-store investment (RMB 500,000-1,000,000), great pressure on sales per square meter, and at a disadvantage in price wars

Industry research shows that

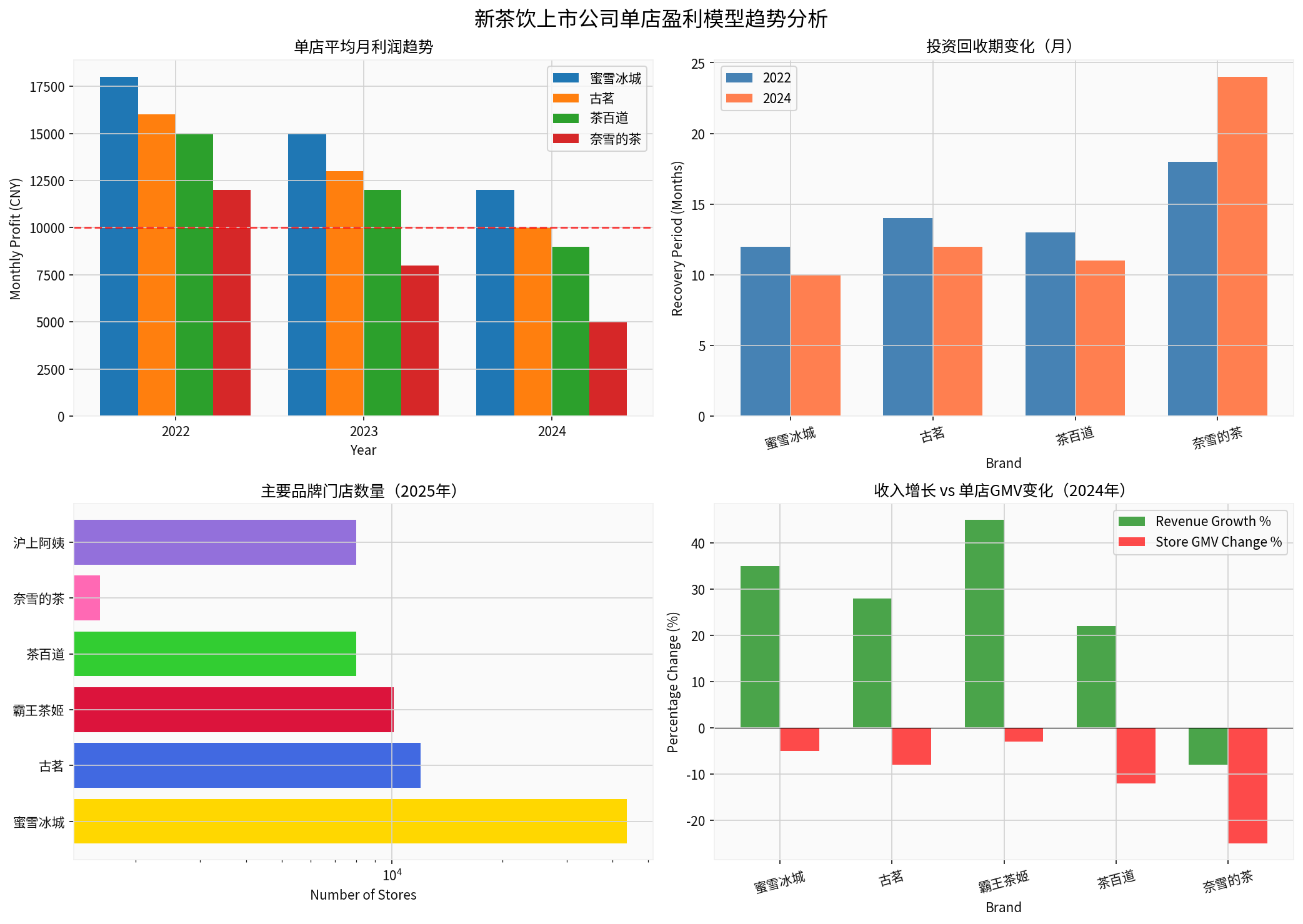

The above chart shows:

- Trend of Average Monthly Profit per Store: Profits of all brands have declined, with Nayuki’s Tea seeing the largest drop (-58%)

- Change in Payback Period: Nayuki’s Tea’s payback period extended from 18 months to 24 months

- Store Quantity Distribution: Mixue Bingcheng leads by a wide margin with 43,800 stores

- Divergence Between Revenue Growth and Single-Store GMV: Most brands have achieved revenue growth but seen declines in single-store GMV

- Short-Term (2026): Price wars will continue, single-store profitability will be under pressure, and the store closure rate may rise further

- Mid-Term (2027-2028): Industry integration will accelerate, small and medium-sized brands will be eliminated, and the concentration of leading brands will increase

- Long-Term (After 2029): The last remaining players will win, and supply chain efficiency will become the core competitiveness

- Changes in same-store sales (SSS)

- Franchisee retention rate

- Changes in payback period

- Comparison between store closure rate and net new store count

- Trends of gross profit margin and net profit margin

| Brand | Rating | Rationale |

|---|---|---|

| Mixue Bingcheng | Recommended |

Obvious supply chain advantages, mature model, strong risk resistance |

| Guming | Cautiously Recommended |

Stable performance, but facing fierce competition |

| CHAGEE (CHA) | Hold |

Overseas market is a highlight, but domestic same-store sales have declined severely |

| Nayuki’s Tea (02150.HK) | Avoid |

Obvious dilemma of direct-operated model, poor financial status |

It is an industry consensus that the single-store profit models of listed new tea beverage companies

- Decline in Profitability: 30-40% drop in average monthly profit per store

- Extended Payback Period: Extended from an average of 12 months to 18-24 months

- Falling Same-Store Sales: 10-28% decline in same-store sales for leading brands

- Rising Store Closure Rate: Over 5,700 store closures across the entire industry in 2025

- The franchise model is far superior to the direct-operated model

- Cost-effective brands are more resilient than premium brands

- Supply chain capabilities have become the core competitiveness

The industry is shifting from “scale expansion” to “value deep cultivation”. The key to success in the future does not lie in “how many stores are opened”, but in “whether each store operates efficiently”.

[1] 36Kr - “2025 Catering Industry Review: The Year of New Tea Beverage IPOs, Supply Chain Competition After the Capital Feast” (https://www.36kr.com/p/3632093163275268)

[2] Ebrun - “2025 Catering Industry Review: The Year of New Tea Beverage IPOs, Supply Chain Competition After the Capital Feast” (https://www.ebrun.com/20260110/636182.shtml)

[3] Tiger Brokers - “CHAGEE (CHA) Stock Price, Market, News, Financial Reports, Data” (https://www.laohu8.com/S/CHA)

[4] Sina Finance - “Ready-to-Drink Tea Industry Yearbook: IPO Wave, Food Delivery Wars, and Breaking Through Involution” (https://finance.sina.com.cn/jjxw/2025-12-30/doc-inhepszs7294664.shtml)

[5] PE Daily - “New Tea Beverages in 2026: Half Deep Sea, Half Open Ocean” (https://news.pedaily.cn/202601/559520.shtml)

[0] Jinling AI - Nayuki’s Tea (02150.HK) Company Financial Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.