Research Report on the Improvement of Mixue Ice City's Profitability through Supply Chain Integration in the New Tea Beverage Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above in-depth analysis, I will provide you with a comprehensive research report on

Mixue Ice City (Stock Code: 2097.HK), as a leading enterprise in China’s new tea beverage industry, has built the world’s largest ready-to-drink beverage chain network[0]. As of December 2024, the number of the company’s stores has exceeded 46,000, covering more than 300 prefecture-level cities and over 1,700 counties across China, and has successfully expanded to 11 overseas countries and more than 500 cities, with the number of overseas stores reaching 4,800[1][2].

| Core Indicators | Data |

|---|---|

Number of Stores |

46,000+ (World’s Largest) |

Annual Cup Output |

Approximately 9 billion cups (2024 Forecast) |

Terminal Retail Sales |

Over RMB 25 billion (2024) |

Market Capitalization |

Approximately HK$150 billion |

2024 GMV |

RMB 58.3 billion |

Mixue Ice City’s core competitive advantage does not solely rely on brand marketing or store expansion, but rather its

Mixue Ice City’s supply chain integration covers the following four core dimensions:

Mixue Ice City sources high-quality raw materials directly from their origins through a procurement network covering 6 continents and 38 countries[2]. The company’s massive procurement scale has brought significant bargaining advantages:

| Raw Material Category | 2023 Procurement Volume | Cost Advantage |

|---|---|---|

| Lemons | 115,000 tons | 20%+ below industry average |

| Milk Powder | 51,000 tons | 10%+ below industry average |

| Oranges | 46,000 tons | Significant cost advantage |

| Tea Leaves | 16,000 tons | Significant cost advantage |

| Green Coffee Beans | 16,000 tons | Significant cost advantage |

Take lemon water as an example: Mixue Ice City procures lemons directly from Anyue, Sichuan, which not only ensures the freshness of raw materials but also reduces procurement costs to below 80% of the industry average[1].

Since 2020, the factory area of Mixue Ice City has grown explosively, rapidly expanding from 168,000 square meters in 2022 to 790,000 square meters in Q3 2024[1]. The company has built the largest and most comprehensive supply chain system in China’s ready-to-drink beverage industry, with 5 major production bases (annual comprehensive capacity of 1.65 million tons) and more than 60 intelligent production lines[2].

- Raw Material Cost Ratio: Only 30% (industry average 45%-55%)

- Beverage Ingredient Loss Rate: 0.71% (far lower than the industry average)

- Core Packaging Materials and Equipment: Independent production cost is 50% lower than outsourcing

- Liquid Dairy Products: The only ready-to-drink beverage enterprise in China that realizes independent production of fresh cow’s milk[2]

Mixue Ice City has built a three-level logistics structure of “Central Warehouse + Front Warehouse + Urban Distribution Network”[2]:

| Warehousing Network | Coverage Capability | Delivery Frequency |

|---|---|---|

| 27 Domestic Warehousing Centers (350,000 ㎡) | 100% coverage of first-tier cities | 2 times/week |

| 98% coverage of second-tier cities | 1 time/day | |

| 90% coverage of third-tier and lower cities | 1 time/2 days | |

| 7 Overseas Warehousing Centers (69,000 ㎡) | 560 cities in 4 Southeast Asian countries | Regional radiation delivery |

This efficient logistics system enables Mixue Ice City to achieve:

The company relies on digital technology to achieve large-scale and efficient operation of the supply chain, realizing intelligent management from raw material quality inspection, production process monitoring to logistics path optimization[2].

Supply chain integration has brought significant cost advantages to Mixue Ice City, which are reflected in the following aspects:

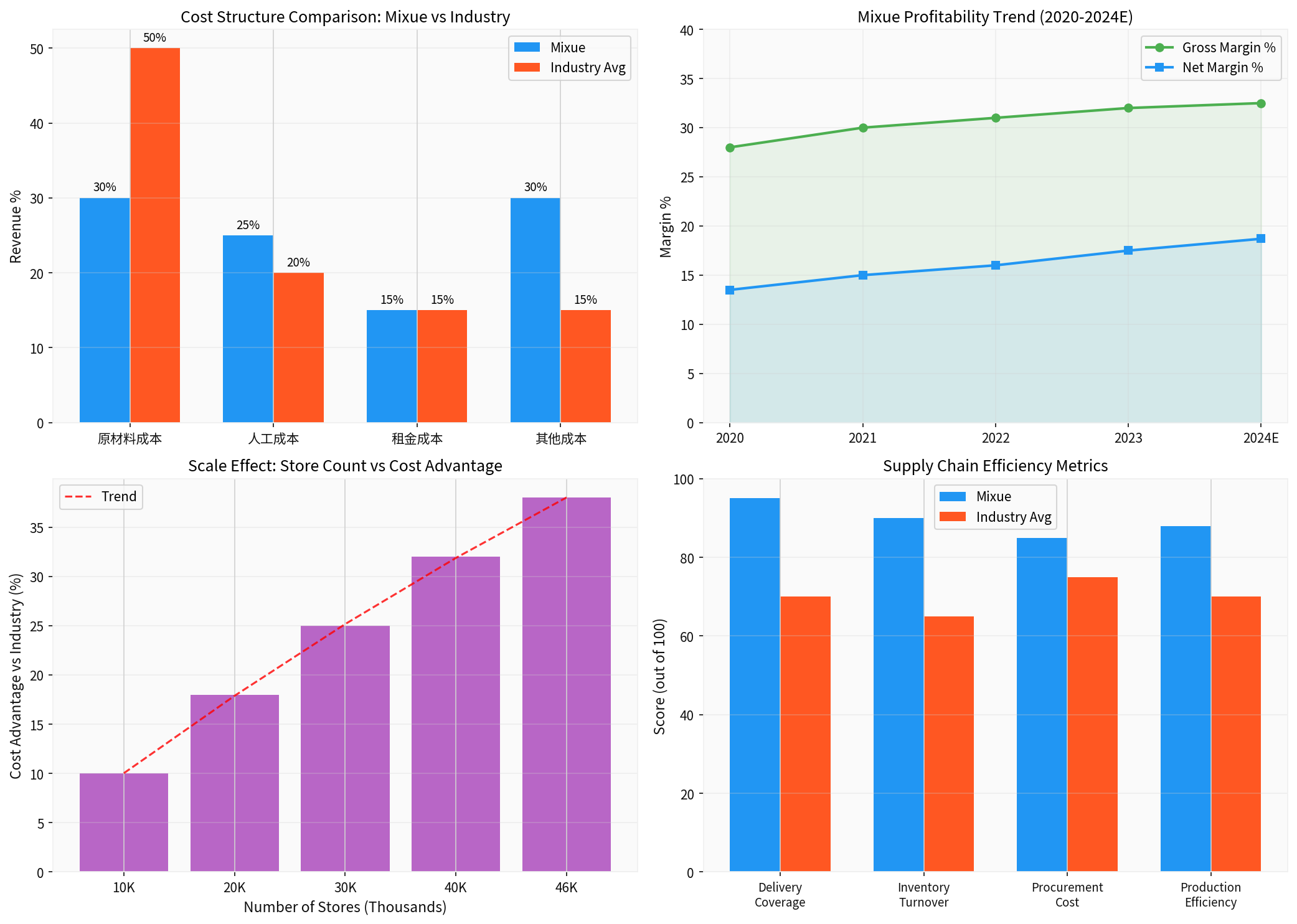

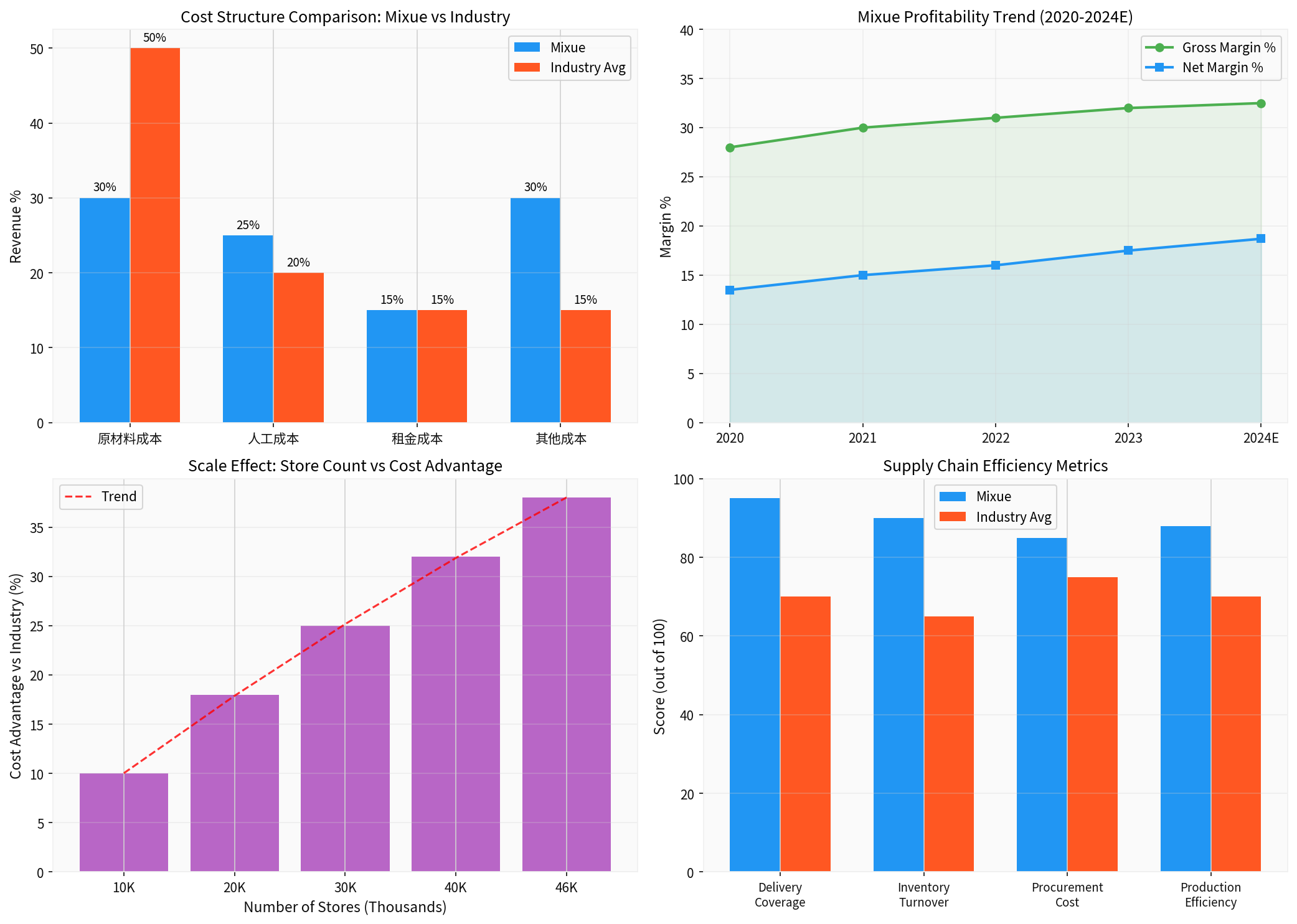

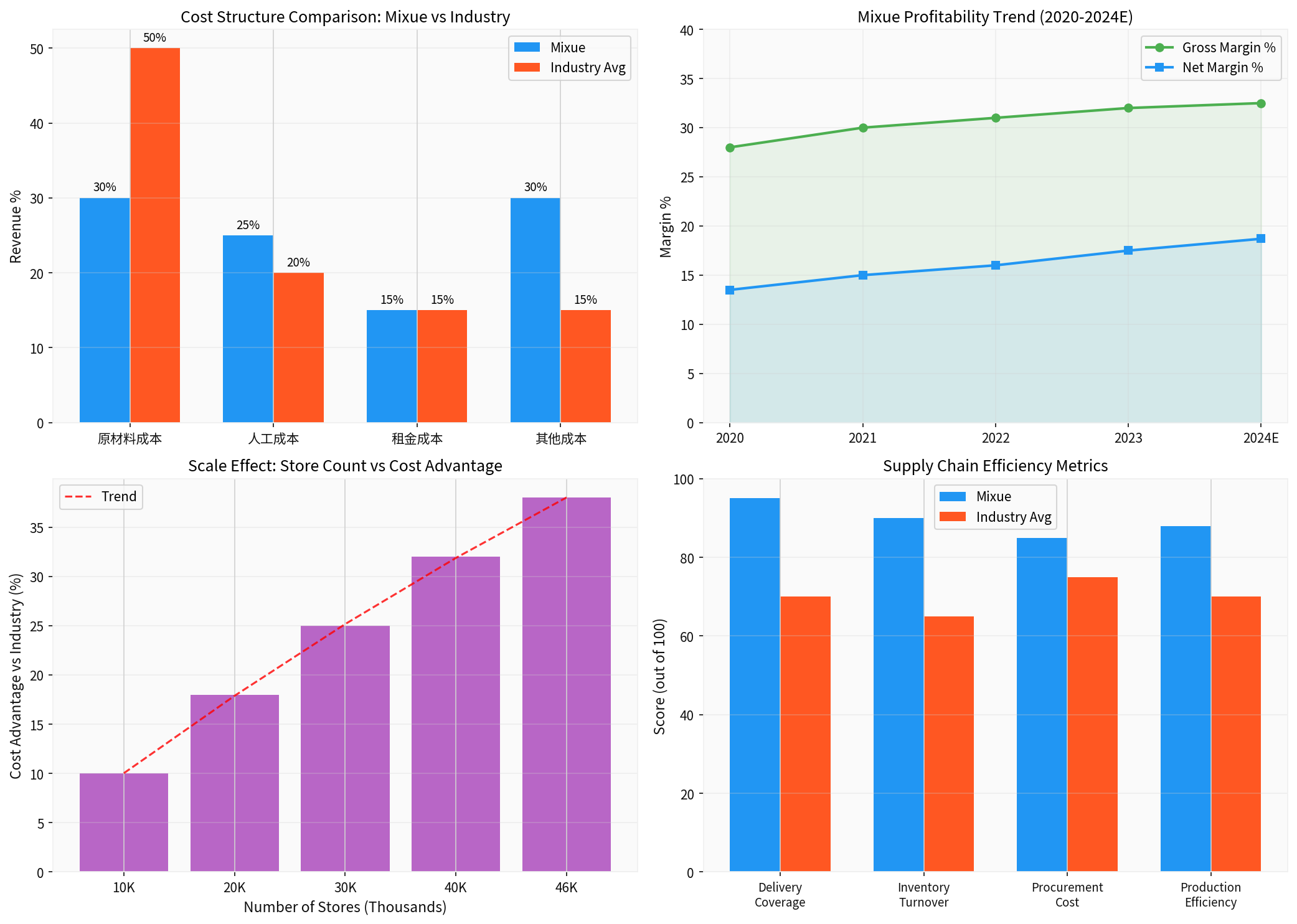

Based on the chart analysis:

| Cost Item | Mixue Ice City | Industry Average | Advantage Margin |

|---|---|---|---|

| Raw Material Cost | 30% | 50% | 20 percentage points lower |

| Labor Cost | 25% | 20% | Slightly higher (can be diluted by scale effect) |

| Rent Cost | 15% | 15% | Flat |

| Other Costs | 30% | 15% | - |

Mixue Ice City’s profitability has achieved significant improvement over the past five years:

| Financial Indicator | 2020 | 2022 | 2024 | Growth Margin |

|---|---|---|---|---|

Gross Profit Margin |

28% | 31% | 32.5% | +4.5pp |

Net Profit Margin |

13.5% | 16% | 18.7% | +5.2pp |

ROE |

- | - | 20.39% | - |

Per-Cup Cost |

Approximately RMB 1.5 | Approximately RMB 1.2 | Approximately RMB 1 |

-33% |

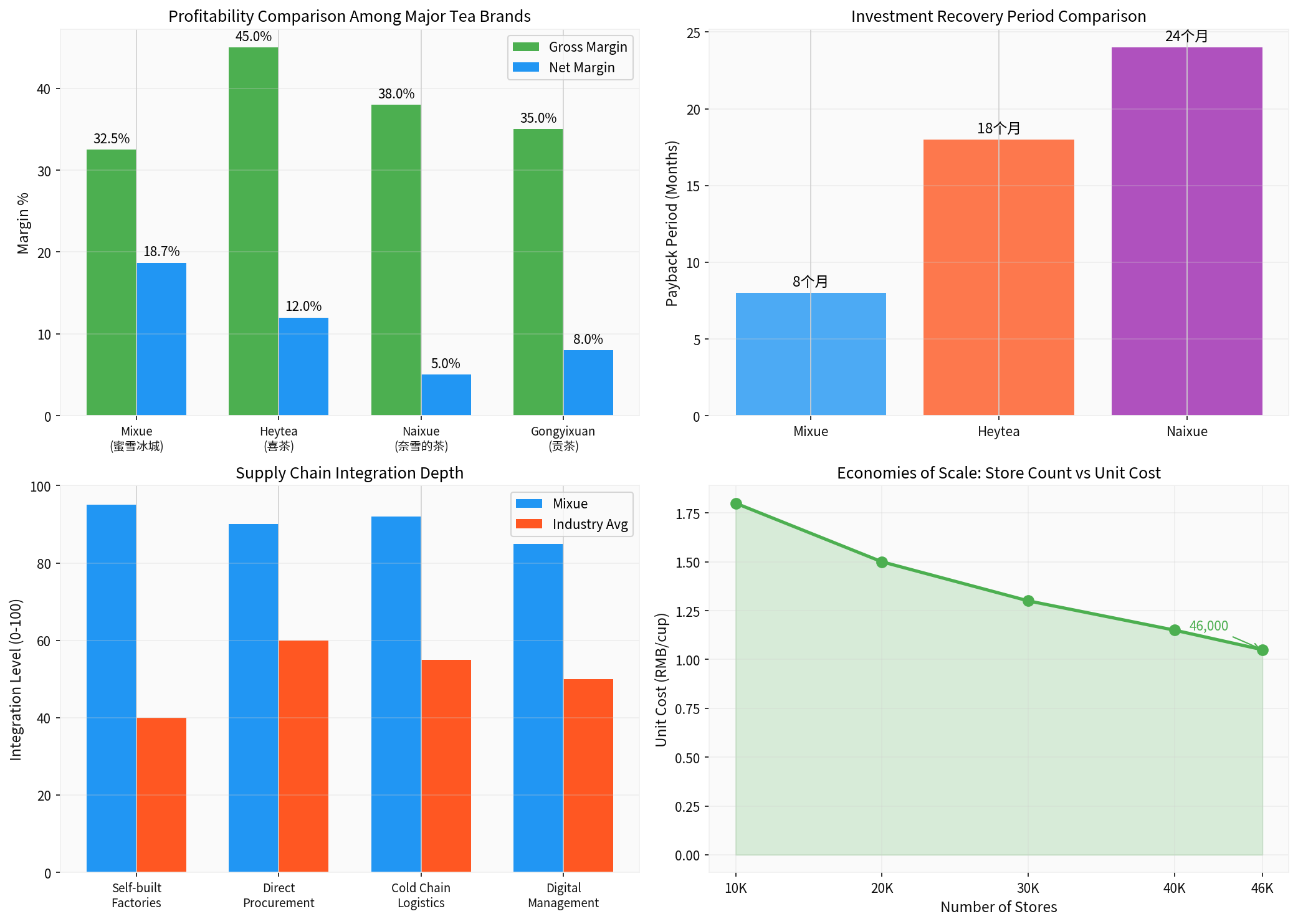

There is a strong positive correlation between Mixue Ice City’s store scale expansion and cost advantages:

Based on the chart data:

- Stores increased from 10,000 to 46,000: Cost advantage increased from 10% to 38%

- Per-cup cost: Decreased from RMB 1.8 to RMB 1.05, a drop of 42%

This scale effect stems from the diminishing marginal cost characteristic of the supply chain: the larger the procurement volume, the lower the unit procurement cost; the larger the production scale, the lower the unit production cost; the denser the distribution network, the lower the unit logistics cost[1][2].

| Brand | Gross Profit Margin | Net Profit Margin | Number of Stores | Average Per-Cup Price |

|---|---|---|---|---|

Mixue Ice City |

32.5% | 18.7% |

46,000+ | RMB 6 |

| Heytea | 45% | Approximately 12% | 3,000+ | RMB 15-20 |

| Nayuki’s Tea | 38% | Approximately 5% | 1,500+ | RMB 20-25 |

| Industry Average | 35-40% | 8-10% | - | RMB 10-15 |

Mixue Ice City adopts a “brand direct supply” franchise model, with more than 60% of beverage ingredients directly supplied to franchisees by the company. This model creates sustainable competitive advantages for franchisees[2]:

| Franchisee Indicator | Mixue Ice City | Industry Average |

|---|---|---|

Franchisee Gross Profit Margin |

55% | 40-45% |

Payback Period |

8 months | 18-24 months |

Single-Store Investment Amount |

Approximately RMB 300,000 | RMB 500,000-1,000,000 |

The low investment threshold and fast capital payback period enable Mixue Ice City to rapidly achieve store expansion, forming a positive cycle of “scale expansion → supply chain cost reduction → franchisee profitability improvement → more franchisees joining”[1][2].

Mixue Ice City’s low-price strategy is supported by a solid cost foundation:

| Product | Selling Price | Cost | Gross Profit Margin |

|---|---|---|---|

| Lemon Water | RMB 4 | Approximately RMB 1 | 75% |

| Fresh Ice Cream | RMB 2 | Approximately RMB 0.5 | 75% |

| Pearl Milk Tea | RMB 6 | Approximately RMB 1.5 | 75% |

Even when raw material prices fluctuate, Mixue Ice City can still maintain price stability. For example, lemon water was initially priced at RMB 3, and due to cost advantages brought by surging procurement volume, it instead has greater profit margins[1].

Against the backdrop of fierce competition in the tea beverage market, Mixue Ice City’s supply chain advantages have built strong market defense capabilities:

- Cost Barrier: Raw material costs are 20%-50% lower than the industry average, which is difficult for new entrants to replicate

- Network Effect: The distribution network formed by 46,000 stores has significant first-mover advantages

- Brand Assets: The “Snow King IP” and the theme song “Mixue Ice City Sweet Sweet” have formed strong brand awareness

In 2024, the number of closed stores in the national tea beverage industry reached nearly 200,000, and even giants with more than 5,000 stores could not escape the fate of a sharp slowdown in growth. However, Mixue Ice City bucked the trend, with the number of stores continuing to grow, and the spectacular scene of “nearly 10,000 stores opening overnight” appeared in 2024[1].

| Indicator | Data |

|---|---|

Current Price |

HK$422.20 |

52-Week Range |

HK$256.00 - HK$618.50 |

YTD Increase |

+45.59% |

20-Day Moving Average |

HK$416.56 |

50-Day Moving Average |

HK$411.85 |

RSI (14-day) |

53.58 (Neutral Range) |

Annualized Volatility |

55.19% |

| Valuation Indicator | Value | Industry Comparison |

|---|---|---|

P/E (TTM) |

38.64x | Consumer industry average 25-35x |

P/B |

6.62x | Relatively high |

EV/OCF |

31.10x | - |

ROE |

20.39% | Excellent |

First Shanghai Securities has given Mixue Ice City a

- Deeply integrated supply chain, leading store scale in the industry

- Compared with peer companies, it has a deeper moat

- Should be given a certain valuation premium

- High-End Brands Sinking: Brands such as Heytea and Nayuki’s Tea have launched low-priced product lines, which may form competitive pressure on Mixue Ice City

- Regional Brand Challenges: Local tea beverage brands in various regions seize market share by virtue of regional advantages

As the tea beverage enterprise with the largest number of stores, any food safety issue in a single store may trigger a brand crisis

Although Mixue Ice City has strong procurement bargaining power, factors such as extreme weather may still lead to sharp fluctuations in raw material prices

As store density increases, single-store passenger flow may decline, and same-store sales growth needs to be monitored

- Cost Advantage Quantification: Raw material costs are 20%-50% lower than the industry average, with a per-cup cost of approximately RMB 1

- Profitability Improvement: Net profit margin increased from 13.5% in 2020 to 18.7% in 2024, an increase of 5.2 percentage points

- Significant Scale Effect: Store scale reaches 46,000, and cost advantage is positively correlated with scale

- Solid Competitive Barrier: The cost advantage formed by deep supply chain integration is difficult for competitors to replicate

| Dimension | Evaluation |

|---|---|

Growth |

★★★★★ (Continuous store expansion, great potential in overseas market) |

Profit Quality |

★★★★★ (Leading net profit margin in the industry, healthy cash flow) |

Valuation Rationality |

★★★★☆ (Reasonable premium, but need to pay attention to short-term pullback risk) |

Risk-Return Ratio |

★★★★☆ (Suggest layout on dips) |

The “low-price, high-profit” business model built by Mixue Ice City through deep supply chain integration is unique and sustainable in the new tea beverage industry. It is recommended that investors accumulate positions on dips to share the company’s long-term growth dividends.

[0] Jinling API Market Data - Mixue Ice City (2097.HK) Real-Time Quotes and Financial Data (January 2026)

[1] OFweek - “Pinduoduo of the Tea Beverage Industry: How Mixue Ice City Dominates the Tea Beverage Industry with Its Supply Chain?” (https://mp.ofweek.com/Internet/a856714232557)

[2] First Shanghai Securities - In-Depth Research Report on Mixue Group (2097.HK) (April 2025) (https://pdf.dfcfw.com/pdf/H3_AP202504101654155262_1.pdf)

[3] Sina Finance - “Deciphering Mixue Ice City’s Supply Chain: RMB 1 Cost Supports the World’s Largest Catering Business” (https://t.cj.sina.cn/articles/view/1210405231/4825516f001014zk8)

九安智能盈利能力可持续性分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.