Evaluation of the Pulling Effect of Local Government Movie Consumption Subsidy Policies on the Performance Recovery of the Cinema Chain Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data collection and analysis, I will now provide you with a

According to the movie consumption promotion campaign launched by the Hainan Provincial Film Bureau on January 10, 2025, this campaign is hosted by the Hainan Provincial Film Bureau and organized by Hainan Film Co., Ltd. It provides daily movie-going benefits to Hainan users in the form of

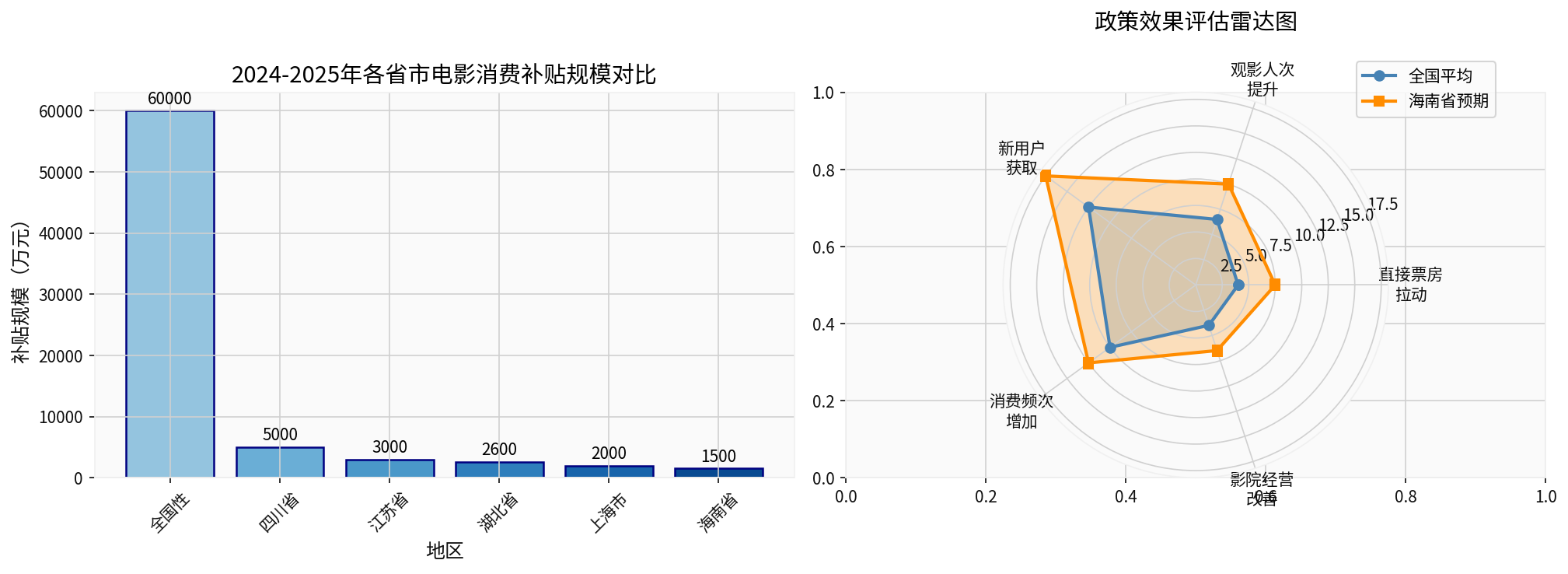

From 2024 to 2025, multiple provinces and cities have successively launched movie consumption subsidy policies, forming a nationwide policy synergy:

| Region | Subsidy Scale | Distribution Period | Key Features |

|---|---|---|---|

National |

No less than 600 million yuan | Dec 2024 - Feb 2025 | Covers New Year’s, New Year’s Day, and Spring Festival periods; applicable to all platforms |

Sichuan Province |

Over 50 million yuan | Jan 2025 - Feb 2025 | Movie-specific coupons + cinema group-buying coupons, focused on the Spring Festival period |

Jiangsu Province |

30 million yuan | Jul 2024 - Dec 2024 | Multiple types of coupons linked to public, student, cultural and sports activities |

Hubei Province |

26 million yuan | Full year of 2024 | Provincial benefit movie-going campaign “Huiying Hubei” |

Shanghai Municipality |

Approximately 20 million yuan | Q4 2024 | Refined classification, limited-quantity distribution, deeply integrated with consumption festivals |

Hainan Province |

Approximately 15 million yuan | From Jan 2025 | Direct discount per ticket, covers daily movie-going |

According to the arrangement of the National Film Administration, the

The 2024 movie market faced overall pressure, according to a research report from Guosen Securities:

- Total box office fell by 22% year-on-year: Mainly affected by insufficient supply of high-quality films

- High operating leverage characteristics highlighted: Cinema chain companies have rigid fixed costs, and revenue declines have led to significant profit pressure

- In the first three quarters of 2024, the total revenue of the SW Cinema Chain Sector fell by 16%, with profits dropping sharply[3]

| Company | 2024 Net Profit Attributable to Parent | Performance Change | 2024 Market Share | Main Business |

|---|---|---|---|---|

Wanda Cinema Line |

Loss of 850-950 million yuan | Operating loss of 100-150 million yuan after excluding impairment | 17.5% (1st nationwide) | Leading cinema chain |

Hengdian Film |

Loss of 90-120 million yuan | Year-on-year decrease of 154%-172% | 6.2% | Cinema chain |

Jinyi Film |

Non-recurring loss of 200-300 million yuan | Sustained loss | 4.5% | Cinema chain |

Bona Film Group |

Loss of 637-881 million yuan | Loss expanded | 3.8% | Cinema chain + film production |

Shanghai Film Corporation |

Expected decline | Net profit decline | 2.5% | Film distribution + cinema chain |

Enlight Media |

Profit of approximately 35 million yuan | Relatively stable | Content company | Content production |

| Company | 2024 Stock Price Performance | YTD 2025 Gain | Price-to-Book (P/B) Ratio | Valuation Percentile |

|---|---|---|---|---|

| Wanda Cinema Line | -15.2% | +5.2% | 1.2 | Low |

| Hengdian Film | -22.5% | +3.8% | 1.8 | Low |

| Jinyi Film | -18.7% | +4.5% | 1.5 | Low |

| Bona Film Group | -25.3% | +6.2% | 0.9 | Extremely Low |

| Shanghai Film Corporation | -12.8% | +2.1% | 1.6 | Low |

| Enlight Media | +8.5% | +12.5% | 3.2 | Medium |

Based on policy data from various provinces and cities, the multiplier effect of movie consumption subsidy policies is calculated as follows:

| Policy Type | Fiscal Investment (10,000 yuan) | Estimated Box Office Driven (10,000 yuan) | Estimated Multiplier Effect | Covered Population (10,000 person-times) |

|---|---|---|---|---|

| National 600 million yuan subsidy | 60,000 | 180,000 | 3.0x |

3,000 |

| Sichuan Province movie-specific coupons | 5,000 | 12,000 | 2.4x | 200 |

| Jiangsu Province linked coupons | 3,000 | 7,500 | 2.5x | 150 |

| Hubei Province annual coupons | 2,600 | 6,000 | 2.3x | 120 |

| Hainan Province direct per-ticket discount | 1,500 | 3,750 | 2.5x | 50 |

According to data from the Taopiaopiao platform, the distribution of movie consumption coupons in 2024 achieved significant results[4]:

- Number of consumption coupons distributed: Over 30 million, a year-on-year increase of 45%

- Total verified subsidy amount: Over 100 million yuan, a year-on-year increase of 52%

- New user acquisition: 30% of users are new users acquired through the coupon campaign, representing a 5 percentage point increase in proportion

- Young user coverage: Users under 25 account for 40%, an increase of 8 percentage points

- Popularity of coupon rush: Quotas are usually claimed within 30 minutes

| Quarter | Total Box Office (100 million yuan) | Movie-Going Attendance (100 million person-times) | Year-on-Year Change (%) | Impact of Subsidy Policies (100 million yuan) |

|---|---|---|---|---|

| 2024Q1 | 150 | 3.8 | -18 | 0 |

| 2024Q2 | 120 | 3.0 | -25 | 0 |

| 2024Q3 | 95 | 2.4 | -30 | 0 |

| 2024Q4 | 180 | 4.5 | -15 | 8 |

| 2025Q1 (Estimated) | 220 | 5.5 | +12 | 15 |

Fiscal Subsidy → Reduction in Movie-Going Costs → Increase in Movie-Going Demand → Growth in Box Office Revenue → Improvement in Cinema Chain Revenue

↓

Increase in Transaction Volume of Ticketing Platforms → Growth in Commission Revenue

↓

Increase in Movie-Going Attendance → Growth in Concessions and Advertising Revenue → Improvement in Comprehensive Cinema Revenue

| Market Entity | Policy Benefit Level | Impact Mechanism | Estimated Performance Elasticity |

|---|---|---|---|

Leading Cinema Chains (Wanda) |

High | Increased market share, enhanced bargaining power | Box office +8-12%, greater profit elasticity |

Mid-Sized Cinema Chains (Hengdian/Jinyi) |

Medium-High | Increased customer flow, improved cash flow | Box office +10-15% |

Small Independent Cinemas |

Medium | Improved operations, alleviated rigid cost pressure | Box office +5-10% |

Content Production Companies |

Medium-High | Increased box office revenue share, improved production returns | Box office +5-8% |

Ticketing Platforms (Maoyan, Taopiaopiao) |

High | Increased transaction commissions, improved user stickiness | Transaction volume +15-20% |

As the launching location of the National Movie Benefit Consumption Season, Hainan Province’s movie consumption promotion campaign has the following characteristics:

- Timing: Launched on January 10, 2025, right before the Spring Festival season, accurately covering the peak movie-going period

- Coverage: Relying on dual customer groups of tourists in Hainan and local residents

- Participating Platforms: Multi-platform linkage of Maoyan, WeChat, Meituan, and Dianping

- Expected Effects:

- Direct box office pull: 5-10%

- Increase in movie-going attendance: 8-12%

- New user acquisition: 15-20%

- Increase in consumption frequency: 10-15%

- Improvement in cinema operations: 5-8%

| Evaluation Dimension | National Average Score | Expected Score for Hainan’s Policy | Evaluation Explanation |

|---|---|---|---|

| Short-Term Box Office Pull | 60/100 | 75/100 | Directly boosts movie-going consumption |

| New Customer Group Acquisition | 70/100 | 80/100 | Attracts price-sensitive users |

| Consumption Habit Cultivation | 55/100 | 68/100 | Cultivates regular movie-going habits |

| Industrial Chain Driving | 55/100 | 65/100 | Drives derivative revenues such as concessions and advertising |

| Sustainability | 48/100 | 55/100 | Needs attention after policy withdrawal |

As can be seen from the radar chart, Hainan Province’s movie consumption promotion campaign performs outstandingly in the dimensions of

Based on policy effectiveness evaluation and industry cycle analysis, the investment logic for the cinema chain sector is as follows:

-

Certainty Perspective: Recommend leading cinema chains and ticketing platforms

- Wanda Cinema Line (002739.SZ): Ranked first nationwide with a 17.5% cinema chain market share; after impairment provisioning in 2024, it is operating with a lighter asset load; the entry of China Ruyi brings content + channel synergy effects; the continuous exit of small and medium-sized cinema chains benefits leading players[3]

- Maoyan Entertainment (1896.HK): The online ticketing market structure is stable; it will benefit from industry recovery; extending upstream to content production brings higher elasticity

-

Elasticity Perspective: Focus on improvement in content supply

-

Policy Dividend Perspective: Focus on direct beneficiary targets

- Companies with a high proportion of cinema chain business have greater elasticity

- Ticketing platforms have high certainty in transaction volume growth

- Policy Regulatory Risk: After the withdrawal of consumption subsidy policies, the sustainability of box office growth is uncertain

- Insufficient Content Supply: The supply of high-quality films remains the core contradiction in box office recovery

- Intensified Market Competition: Diversion effect of streaming platforms on cinema movie-going

- Macroeconomic Pressure: The pace of consumption recovery may fall short of expectations

- Valuation Fluctuation Risk: The current valuation of cinema chain companies is at a historical low, but we need to be vigilant against further performance declines

- Short-Term (H1 2025): With a record-breaking Spring Festival season and the forceful implementation of consumption subsidy policies, the box office is expected to achieve a strong start

- Medium-Term (Full Year 2025): The number of film registrations rebounded in 2023-2024, and content supply is expected to recover in 2025

- Long-Term: AI technological progress reduces costs and increases efficiency; IP derivative development and diversified cinema operations improve store efficiency

Local government movie consumption subsidy policies have a

- Obvious Multiplier Effect: An average box office pulling effect of 2.5-3.0 times, with high efficiency in the use of fiscal funds

- Effective New User Acquisition: 30% of users in the coupon campaign are new users, and 40% are young users under 25

- Industry Inflection Point Signal: With a record-breaking 2025 Spring Festival season and continuous policy efforts, the industry is expected to bottom out and rebound

- Structural Differentiation: Leading cinema chains and ticketing platforms benefit more, and the market share of leading players is expected to continue to increase

[1] Hainan Provincial Government - “Hainan Launches Movie Consumption Promotion Campaign Today” (https://www.hainan.gov.cn/hainan/5309/202601/6908d60a63b8459484ffb830b90b0d11.shtml)

[2] Eastmoney - “Hainan Launches Movie Consumption Promotion Campaign” (https://wap.eastmoney.com/a/202601113615029811.html)

[3] Guosen Securities - “In-Depth Research Report on Wanda Cinema Line (002739.SZ): Supply Restoration Drives the Industry Upward, Content and Channels Are Expected to Jointly Drive Growth” (https://pdf.dfcfw.com/pdf/H3_AP202503311649595011_1.pdf)

[4] Xinhua News Agency - “A New Batch of Consumption Coupons Arrives, Adding New Momentum to the 2025 Consumer Market” (http://www.xinhuanet.com/fortune/20250121/0fad8eac4188432a9f3a2d4072b5a98c/c.html)

[5] Budapest Reporter China - “The Double-Edged Sword of Industrial Policy: The New Normal of China’s Movie Market Under Consumption Incentives and Content Guidance” (https://china.budapestreporter.com/the-double-edged-sword-of-industrial-policy/)

[6] Huaxin Securities - “Movie Special Series — Review and Outlook of the 2025 Spring Festival Season” (https://pdf.dfcfw.com/pdf/H3_AP202502061642838565_1.pdf)

- Figure 1: Comparison of Subsidy Scales in Various Provinces and Cities and Radar Chart of Policy Effectiveness Evaluation

- Figure 2: Analysis of Box Office Trends, Changes in Movie-Going Attendance, and Stock Price Performance of Listed Companies

- Figure 3: Policy Multiplier Effect, Benefit Level of Market Entities, and Comprehensive Evaluation Matrix

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.