Implications of Australian Household Consumption Resilience for Asia-Pacific Investment Allocation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest collected data and market analysis, I will provide you with a comprehensive investment analysis report.

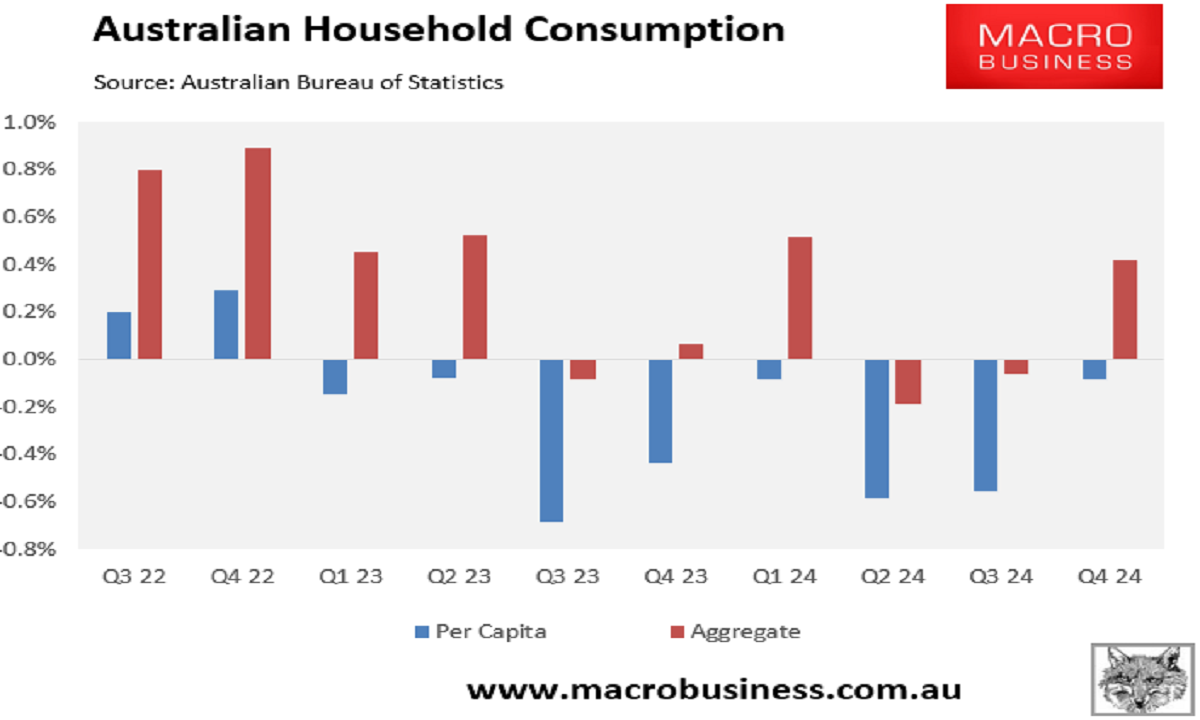

According to the November 2025 household spending data released by the Australian Bureau of Statistics (ABS), the Australian consumer market has demonstrated significant resilience characteristics [1]:

| Indicator Category | November Month-over-Month Change | Annual Year-over-Year Change | Drivers |

|---|---|---|---|

Total Household Spending |

+1.0% | +6.3% | Broad-based Growth |

Services Spending |

+1.2% | +7.8% | Major Events, Sports Competitions |

Goods Spending |

+0.9% | +4.9% | Black Friday Promotions |

Furniture and Household Equipment |

+2.2% | — | Discount-driven |

Clothing and Footwear |

+2.0% | — | Seasonal Promotions |

Recreation and Culture |

+1.7% | +8.6% | Concerts, Sports Competitions |

- Broad-based Growth: All eight categories recorded growth in November, covering all states and territories [1]

- Geographic Distribution: Tasmania (+2.1%) and Western Australia (+1.7%) led national growth [1]

- Structural Transformation: Services growth (7.8%) continues to outpace goods consumption (4.9%), reflecting post-pandemic consumption pattern shifts

Despite robust consumption data, consumer confidence indexes have shown fluctuations [2]:

| Indicator | December Reading | Month-over-Month Change |

|---|---|---|

| Westpac-Melbourne Institute Consumer Confidence Index | 94.5 | -9.0% |

| 1-Year Economic Outlook | 94.6 | -9.7% |

| 5-Year Economic Outlook | 95.7 | -11.7% |

| Index of Timing for Durable Goods Purchases | 98.9 | -11.4% |

A joint report by Bain & Company and NielsenIQ (NielsenIQ) reveals major structural changes in the Asia-Pacific consumer market [3]:

Core Forecast: The Asia-Pacific region will surpass North America to become the world’s largest consumer market by 2035

- Private consumption is projected to grow at a

7% compound annual growth rate- Total consumption will reach

US$36 trillionby 2035- Global consumption will nearly double from US$65 trillion in 2025 to US$110-120 trillion

| Country/Region | 2024 FMCG Growth | H1 2025 Growth | Core Drivers |

|---|---|---|---|

India |

7.2% | 13.7% | Digitalization, Urbanization |

China |

2.8% | 4.7% | E-commerce Recovery, Policy Support |

South Korea |

Stable | Robust | E-commerce Expansion |

Southeast Asia |

3.5% | 1.8% | Growth Slowdown |

Australia |

Robust | Stable | Services Consumption |

Asia-Pacific consumption growth exhibits a healthier volume-price balance characteristic:

- Volume Growth Contribution: 2.8%

- Price Growth Contribution: 1.2%

- Compared to North America and Western Europe: Growth is primarily driven by price increases

This indicates that Asia-Pacific consumption growth is more sustainable and resilient.

Based on current market data, the following five-dimensional evaluation framework is recommended:

| Evaluation Dimension | Key Indicators | Investment Implications |

|---|---|---|

Consumption Growth Quality |

Volume-Price Structure, Category Distribution | Prioritize ‘volume-price dual growth’ markets |

Consumer Confidence |

Confidence Indexes, Purchase Intentions | Monitor confidence inflection points |

Inflation Environment |

CPI Trends, Real Purchasing Power | Capitalize on real income growth |

Employment and Income |

Unemployment Rate, Wage Growth Rate | Income-driven growth is more sustainable |

Policy Support |

Fiscal/Monetary Policy Orientation | Monitor pro-consumption policies |

According to research from Franklin Templeton, VanEck and other institutions, the main investment themes for consumption-driven markets in 2026 include [5][6]:

- Increasing penetration of premium consumer goods

- Growing demand for health and wellness products

- Continuous expansion of e-commerce channels

- Mobile payments and digital financial services

- Smart devices, AI services

- Technology-driven consumption experiences

- Domestic substitution trend

- Local leaders in emerging markets

| Market Type | Representative Countries | Investment Rationale | Risk Warnings |

|---|---|---|---|

High-Growth Type |

India, Indonesia | Demographic Dividend, Digitalization | Valuation Volatility, Policy Risks |

Recovery Type |

China, Thailand | Policy Support, Valuation Recovery | Real Estate Risks, External Demand |

Mature and Stable Type |

Australia, South Korea | Consumption Resilience, Dividend Returns | Low Growth Rate, Exchange Rate Risks |

Theme-driven Type |

Vietnam, Philippines | Industrial Chain Transfer, Export Orientation | Foreign Capital Dependence, Geopolitical Risks |

Investment implications derived from the Australian case:

- Robust labor market: Unemployment rate is expected to remain at 4.5% [7]

- Sustained wage growth: Expected to remain at 3.25% [7]

- Asset wealth effect: Property market is gradually stabilizing

- Consumer Staples: Supermarket and retail leaders have strong defensiveness

- Consumer Discretionary: Home furnishing and automotive durable goods benefit from consumption recovery

- Services Consumption: Tourism, recreation, and catering benefit from event recovery

- Financial Sector: Benefits from consumer credit demand

| Strategy Type | Recommended Allocation Ratio | Core Target Types |

|---|---|---|

High-Growth Strategy |

30-40% | Indian and Indonesian consumption leaders |

Recovery Strategy |

20-30% | Chinese consumption upgrade targets |

Robust Strategy |

20-30% | High-dividend stocks from Australia and South Korea |

Theme Strategy |

10-20% | Digital beneficiaries in Southeast Asia |

- Consumer Electronics: Benefits from AI terminal replacement cycle

- Automotive: Increasing penetration of new energy vehicles

- Retail: E-commerce and new retail models

- Food and Beverage: Consumer staples + health upgrade

- Travel and Leisure: Services consumption recovery

| Risk Type | Potential Impact | Hedging Strategy |

|---|---|---|

Inflation Resurgence |

Erodes real consumption capacity | Allocate to real return assets |

Prolonged High Interest Rates |

Suppresses durable goods consumption | Focus on high-dividend targets |

Geopolitics |

Supply chain and trade disruptions | Diversified allocation |

Exchange Rate Volatility |

Foreign exchange gains and losses | Currency hedging tools |

-

Verification of Australian Consumption Resilience: Despite fluctuations in consumer confidence, actual consumption data maintains robust growth, demonstrating the shock resistance of consumption-driven economies.

-

Establishment of Asia-Pacific Consumption Dominance: By 2035, the Asia-Pacific region will become the world’s largest consumer market, with a 7% compound annual growth rate providing structural opportunities for investors.

-

Significant Differences in Growth Quality: Asia-Pacific consumption exhibits ‘volume-price dual growth’ characteristics, which is more sustainable than the ‘price-only growth’ model in North America/Western Europe.

-

Continuation of Diversified Pattern: The diversified pattern of high growth in India, recovery in China, and slowdown in Southeast Asia requires investors to adopt refined allocation strategies.

- Monitor the interest rate policy path of the Reserve Bank of Australia (RBA) — the market expects a pause in rate hikes until the end of 2026 [8]

- Seize pullback opportunities in high-growth markets such as India and Indonesia

- Prudently assess the strength of China’s consumption recovery

- Capitalize on the main trend of Asia-Pacific consumption upgrade

- Monitor digital and AI-driven consumption innovation

- Position for health consumption amid aging population

- Embrace the historic opportunity of the Asia-Pacific region becoming the world’s largest consumer market

- Capitalize on the long-term trend of consumption structure shifting from goods to services

- Emphasize investment themes of sustainable consumption and green consumption

[1] Australian Bureau of Statistics. “Household spending remains strong in November.” ABS Media Release, December 2025. https://www.abs.gov.au/media-centre/media-releases/household-spending-remains-strong-november

[2] Trading Economics. “Australia Consumer Sentiment Falls Sharply.” December 2025. https://tradingeconomics.com/australia/consumer-confidence-mom/news/510095

[3] Bain & Company & NielsenIQ. “Six trends to watch in 2026 as Asia-Pacific prepares to overtake North America.” PR Newswire, December 16, 2025. https://finance.yahoo.com/news/six-trends-watch-2026-asia-010500805.html

[4] Fortune. “Asia will get steady growth next year, defying global headwinds, says Mastercard’s chief APAC economist.” December 12, 2025. https://fortune.com/2025/12/asia-steady-growth-next-year-tariffs-mastercard-tourism/

[5] Franklin Templeton. “Global Emerging Markets Outlook 2026.” December 2025. https://www.franklintempleton.com/articles/2025/equity/global-emerging-markets-outlook-2026

[6] VanEck. “Navigating an Emerging Markets Inflection: Innovation, Discipline and Quality Growth.” December 2025. https://www.vaneck.com/us/en/blogs/emerging-markets-equity/navigating-an-emerging-markets-inflection-innovation-discipline-and-quality-growth/

[7] Commonwealth Bank. “Budget update shows Australia’s deficit narrowing as economy strengthens.” December 17, 2025. https://www.commbank.com.au/articles/newsroom/2025/12/myefo-deficit-narrowing-as-economy-strengthens.html

[8] Westpac IQ. “RBA on hold in 2026, risks on both sides.” December 2025. https://www.westpaciq.com.au/economics/2025/12/luci-rba-call-17-december-2025

[9] Deloitte. “Global Economic Outlook 2026.” December 2025. https://www.deloitte.com/us/en/insights/topics/economy/global-economic-outlook-2026.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.