Analysis of the Impact of Data Property Right Registration System on the Investment Value of A-share Data Element Industry Chain

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest information I have collected, now I provide you with an in-depth analysis report on the impact of the data property right registration system on the investment value of the A-share data element industry chain.

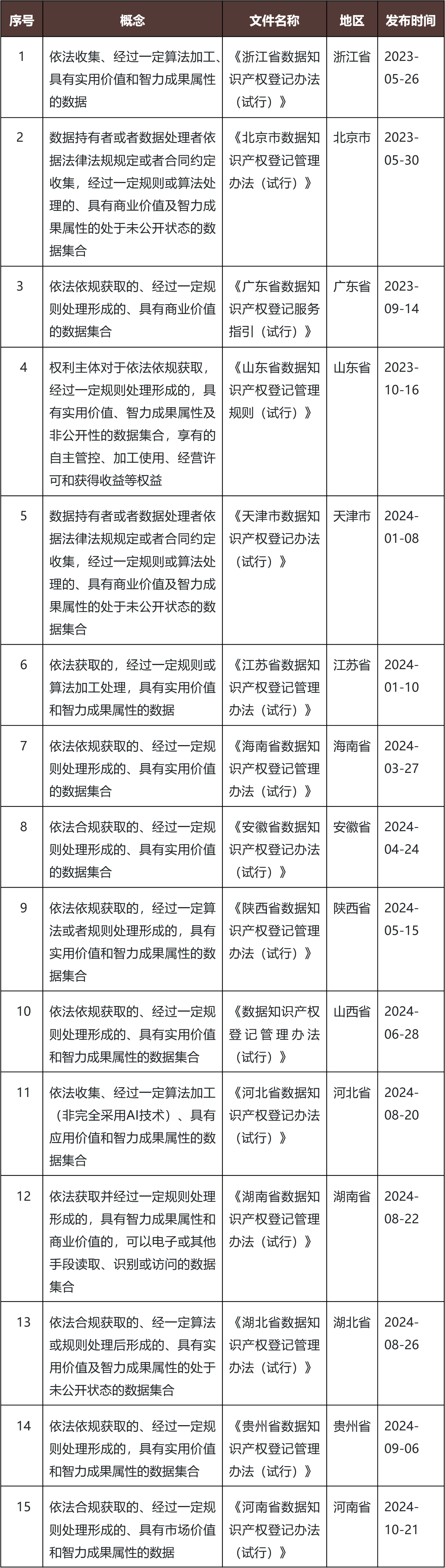

On January 11, 2024, the National Data Administration announced that it will further study and establish a registration system adapted to the characteristics of data, promote the circulation and use of data, and release the value of data elements [1]. This policy marks a new stage in the construction of infrastructure for China’s data element market.

| Time | Policy Document | Core Content |

|---|---|---|

| January 2025 | ‘Implementation Plan for Improving Data Circulation Security Governance to Better Promote the Marketization and Valorization of Data Elements’ | Promote compliant and efficient circulation and utilization of data elements |

| April 2025 | ‘Notice on Organizing and Launching the 2025 Pilot Work for the Innovative Development of Trusted Data Spaces’ | Launch three types of trusted data space pilots for enterprises, industries, and cities |

| May 2025 | ‘2025 Action Plan for the Construction of Digital China’ | Focus on the reform of market-oriented allocation of data elements |

| July 2025 | ‘Model Text of Data Circulation and Transaction Contract’ | Standardize data transaction behaviors |

| October 2025 | ‘Implementation Plan for Strengthening Scenario Applications in the Pilot Construction of National Data Infrastructure’ | Drive data infrastructure construction with scenario applications |

- Promote the conclusion of the ‘Data Elements ×’ Three-Year Action Plan (2024-2026) and build more than 300 typical application scenarios

- The Supreme People’s Court will revise the ‘Provisions on the Cause of Action in Civil Cases’ and add an independent cause of action for ‘disputes over data and online virtual property’

- Study and formulate regulations for the construction of a unified national market, and improve the standards for data resource registration and transactions

- More than 30 national standards in the data field will be launched in 2026 [2]

According to data disclosed by Liu Liehong, Member of the Party Leadership Group of the National Development and Reform Commission, Secretary of the Party Leadership Group and Director of the National Data Administration [3]:

| Indicator | 2024 Data |

|---|---|

| National Data Production Volume | 41.06 Zettabytes |

| Number of National Data Enterprises | Over 400,000 |

| Scale of Data Industry | 5.86 Trillion Yuan |

According to data from iResearch [3]:

- The scale of China’s data element industry will maintain rapid growth with a compound annual growth rate of about 20.26%

- It is expected to exceed 300 billion yuan in 2028

- Sub-industry Forecasts:

- Data element market in the financial industry: Exceed 100 billion yuan

- Industrial manufacturing: Reach 30.2 billion yuan

- Healthcare industry: Reach 25 billion yuan

| Data Exchange | Cumulative Data Transaction Scale |

|---|---|

| Guiyang Big Data Exchange | 2,697 listed products, transaction volume exceeding 5 billion yuan |

| Shenzhen Data Exchange | Cumulative transaction volume exceeding 15 billion yuan |

| Beijing International Big Data Exchange | Cumulative data transaction volume reaching 2250TB |

┌─────────────────────────────────────────────────────────────┐

│ Data Element Industry Chain │

├─────────────────────────────────────────────────────────────┤

│ Upper Stream: Data Collection, Data Storage, Data Processing│

│ ↓ │

│ Mid Stream: Data Analysis, Data Trading Platforms, Data Right Confirmation and Registration │

│ ↓ │

│ Lower Stream: Application Scenarios in Finance, Healthcare, Transportation, Meteorology, Industrial Manufacturing, etc. │

└─────────────────────────────────────────────────────────────┘

According to the ‘Opinions on Cultivating Data Circulation Service Institutions to Accelerate the Marketization and Valorization of Data Elements’ issued by the National Data Administration [3], three types of institutions form a ‘Value Creation Triangle’:

| Institution Type | Functional Positioning | Core Value |

|---|---|---|

Data Exchanges |

Build a trusted ‘field’ | Transaction matching and compliance supervision |

Data Circulation Service Platform Enterprises |

Deeply cultivate the ‘depth’ of the industry | Platform operation and technical support |

Data Merchants |

Responsible for the ‘exquisite craftsmanship’ of products | Data product development and services |

According to industry research [5], A-share data element concept stocks mainly cover the following fields:

| Sub-field | Representative Companies | Business Characteristics |

|---|---|---|

Data Infrastructure |

Yihualu (300212), Taiji Co., Ltd. (002368), Data Harbor (603881) | Data storage, IDC operation |

Data Services and Platforms |

People’s Daily Online (603000), Zhejiang Digital Culture Group (600633) | Operation of data trading platforms |

Government Affairs Data |

Taiji Co., Ltd., Digital Zheng Tong (300075) | Smart city, government affairs data |

Data Security |

DBAPPSecurity (688023), VenusTech (002439) | Data security and compliance |

Operator Data |

China Mobile (600941), China Telecom (601728), China Unicom (600050) | Massive user data resources |

- Establish a data property right registration system, clarify the ‘separation of three rights’ of data ownership, use right, and income right [6]

- Solve the biggest obstacles to data assetization – ‘ambiguous ownership’ and ‘restricted circulation’

- Provide a legal basis for the inclusion of data assets into financial statements

- Reduce Investment Uncertainty:After data right confirmation, the value of enterprises’ data assets can be quantified and audited

- Activate Data Asset Financing:After data property right registration, it can be used as collateral for financing from financial institutions

- Promote the Inclusion of Data Assets into Financial Statements:Enterprises can record data assets in the intangible assets item of financial statements

| Impact Dimension | Specific Performance |

|---|---|

Demand-side Growth |

Strong demand for high-value data in fields such as finance, healthcare, and industry |

Supply-side Activation |

Continuous expansion of product portfolios of local data exchanges |

Application Scenario Expansion |

Shift from compliance verification to substantial release of economic utility |

According to industry analysis [3], the business model of the data industry is undergoing profound changes:

Traditional Model: Project-based Development → Repurchasable Data Services

- Property Rightization of On-Exchange Transactions:Data products are recorded as intangible assets after registration on exchanges

- Lightweight Service Scenario Innovation:Such as ‘shared drone’ services that realize data value in real time

- Public Data Operation with Government-Enterprise Collaboration:Governments purchase data services on demand, and enterprises obtain stable income

With the improvement of the data property right registration system, data assets will receive more reasonable valuations:

| Valuation Dimension | Traditional Valuation | New Valuation |

|---|---|---|

Asset Recognition |

Not recorded or vaguely recorded | Clearly recorded as intangible assets |

Value Assessment |

Lack of unified standards | Multi-dimensional pricing model |

Transaction Pricing |

Lack of basis | Blockchain traceability + value assessment |

- The data property right registration system is still in the exploratory stage, and specific implementation rules may be adjusted

- Regulatory policies such as data security and personal information protection may affect data circulation

- There is uncertainty in the connection between local and national policies

- The data element market is still in the early stage, and the commercialization model is not yet mature

- The data pricing mechanism has not been unified, and the price discovery function needs to be improved

- Intensified market competition may lead to a decline in profit margins

- Breakthrough progress has not yet been made in core technologies for secure data circulation

- Technologies such as blockchain traceability and multi-dimensional pricing models are still being improved

- The complexity of non-standard data governance restricts promotion

- The valuation of data asset value is subjective, which may lead to impairment risks

- The proportion of data business revenue in some enterprises is low, and the contribution to performance is limited

- The return cycle of R&D investment and output is uncertain

Based on policy directions and market prospects, it is recommended to focus on the following tracks:

| Priority | Track | Rationale | Representative Fields |

|---|---|---|---|

| ★★★★★ | Data Infrastructure |

Clear policy support, underlying support for the data element market | IDC, data storage, trusted data spaces |

| ★★★★★ | Data Right Confirmation and Registration Services |

Direct beneficiaries of system construction | Data registration, right confirmation services, compliance assessment |

| ★★★★☆ | Financial Data Services |

Largest market scale (expected to exceed 100 billion yuan), mature applications | Financial risk control, intelligent investment research, data APIs |

| ★★★★☆ | Government Affairs Data Operation |

Accelerated implementation of policies on authorized operation of public data | Smart city, government affairs cloud, inclusion of data assets into financial statements |

| ★★★☆☆ | Healthcare Data |

Driven by both policies and demand, clear scenarios | Medical insurance data, health big data, pharmaceutical R&D |

Screening Logic:

├── Have advantages in data resources (government resources, operator resources, industry data)

├── Have practices or clear plans for the inclusion of data assets into financial statements

├── Have layouts in data right confirmation, registration, and transaction links

├── High performance elasticity, with the proportion of data business expected to increase

└── Relatively reasonable valuation, with a margin of safety

| Type | Allocation Recommendations |

|---|---|

Core Allocation |

Leaders in data infrastructure (Yihualu, Taiji Co., Ltd., Data Harbor) |

Elastic Allocation |

Data service and platform companies (People’s Daily Online, Zhejiang Digital Culture Group) |

Value Allocation |

Operator data assets (China Mobile, China Telecom, China Unicom) |

Theme Allocation |

Data security and compliance (DBAPPSecurity, VenusTech) |

| Time | Catalyst | Expected Impact |

|---|---|---|

| Q1 2026 | Implementation of the deployment of the National Data Work Conference | Policy clarification, valuation recovery of the sector |

| First Half of 2026 | Intensive issuance of national standards in the data field | Accelerated industry standardization |

| Second Half of 2026 | Conclusion of the ‘Data Elements × Three-Year Action Plan’ | Large-scale implementation of application scenarios |

| End of 2026 | Verification of data industry scale | Performance realization, emergence of leading enterprises |

According to the deployment of the National Data Work Conference [7]:

- 2026:The year of data element value release, with the outbreak of large-scale applications

- 2027-2028:A unified national data market is initially formed

- 2029-2030:The data industry becomes an important pillar industry of the national economy

The establishment of the data property right registration system has a

- Institutional Level:The data right confirmation mechanism removes legal obstacles for data assetization, and the inclusion of data assets into financial statements will change from ‘optional’ to ‘mandatory’

- Market Level:The market scale maintains rapid growth (CAGR of over 20%), and it is expected to exceed 300 billion yuan in 2028

- Investment Level:Companies in the industry chain will gain new value growth points, and the valuation system will be reconstructed

- Risk Level:Attention should be paid to the uncertainty of policy implementation progress, commercialization process, and technological breakthroughs

[1] National Data Administration. Policy release on ‘Further Studying and Establishing a Registration System Adapted to the Characteristics of Data’. January 11, 2024

[2] Official website of the National Data Administration. ‘Progress in the Construction of National Standards in the Data Field’. January 2026. https://www.nda.gov.cn/

[3] Securities Times Network. ‘Exclusive Interview with Dong Xuegeng, Former Director of Hainan Big Data Administration: The Value of Data Elements is Expected to Burst on a Large Scale in 2026’. January 2026. https://www.stcn.com/article/detail/3585206.html

[4] Sina Finance. ‘Data Market ‘Strong Function’ Circulation Service Institutions Move Towards Differentiated Division of Labor’. January 10, 2026. https://finance.sina.com.cn/jjxw/2026-01-10/doc-inhftymc5469725.shtml

[5] Eastmoney.com. ‘Analysis of Data Center Concept Stocks: Which are the Leading Listed Companies in Data Centers’. 2024. https://baike.jfinfo.com/4052224.html

[6] Win Law Firm. ‘Must-Read Book in the Era of Data Assetization: From Resource to Capital’. 2024. https://www.winlawfirm.com/cn/Details/1000/3b394c8a84e0274d

[7] Global Law Office. ‘Heavy Release of the ‘Annual Report on Data Element Market Observation (2025)’’. January 4, 2026. https://www.glo.com.cn/Content/2026/01-04/0935093311.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.