Valuation Assessment of Hong Kong-listed AI Concept Stocks After Zhipu AI's Surge and Trend Analysis of the Hang Seng Tech Index

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest collected market data and technical analysis, I provide you with the following in-depth analysis report:

Since the start of 2026, Hong Kong-listed AI concept stocks have seen an unprecedented surge. Zhipu AI (HK02513) landed on the Hong Kong Stock Exchange on January 8 under the halo of “the world’s first AI large model stock”, with an issue price of HK$116.2, corresponding to a market capitalization of over HK$51.1 billion [1]. Just 4 trading days after listing, the stock price hit a high of HK$214, representing an increase of over 82% from the issue price [2]. Meanwhile, MINIMAX (HK0100) listed on January 10 with an issue price of HK$165. In just two trading days, its stock price reached a high of HK$479, with a cumulative increase of over 190%, and its market capitalization exceeded HK$100 billion, making it the world’s largest AI company IPO by issuance size in the past four years [2].

Hong Kong-listed AI concept stocks have seen a comprehensive rally:

- Insilico Medicine rose over 14%, doubling from its issue price

- Weimob Group rose over 20%

- MOONS rose over 17%

- 4Paradigm rose over 13%

- Meitu rose over 12%

- Biren Technology rose over 11% [2]

As of the end of 2025, the price-to-earnings (PE) ratio of the Hang Seng Tech Index was

- The PE ratio of the Nasdaq Index was 41.33x

- The PE ratio of the S&P 500 Index was 29.18x[3]

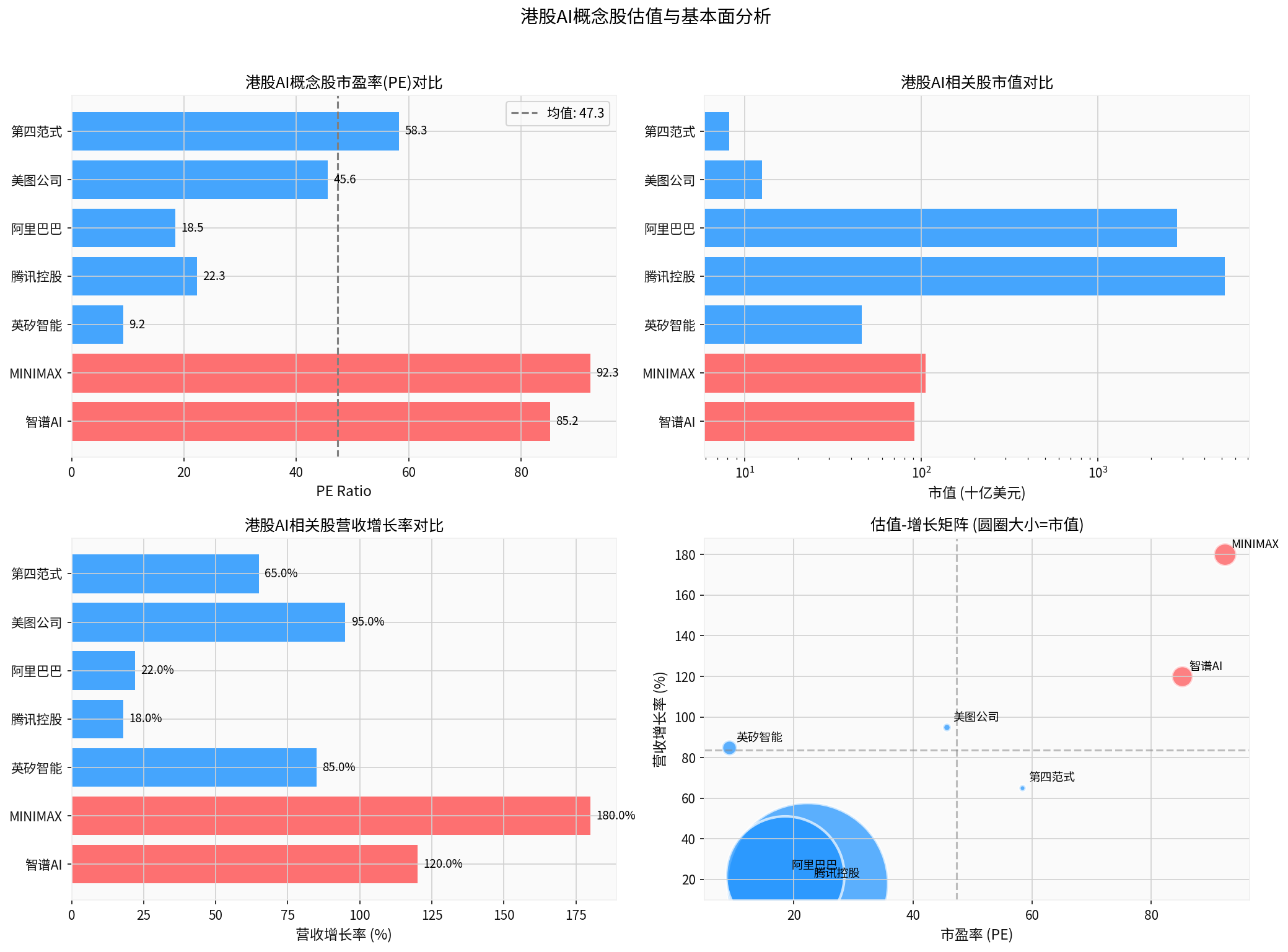

This data shows that although the valuations of AI concept IPOs are relatively high (Zhipu AI at approximately 85x PE, MINIMAX at approximately 92x PE), the overall valuation level of the Hang Seng Tech Index is still significantly lower than that of U.S. tech sectors. From a valuation perspective, the Hong Kong AI sector

| Stock Type | Representative Stock | Price-to-Earnings (PE) | Price-to-Book (PB) | Revenue Growth Rate |

|---|---|---|---|---|

AI IPOs |

Zhipu AI | 85.2 | 12.5 | 120% |

AI IPOs |

MINIMAX | 92.3 | 15.8 | 180% |

Mature Tech Giants |

Tencent Holdings | 22.3 | 4.5 | 18% |

Mature Tech Giants |

Alibaba | 18.5 | 2.8 | 22% |

From the valuation matrix, AI IPOs enjoy a high growth premium, but their valuations have deviated significantly from traditional valuation frameworks, reflecting more of the market’s optimistic expectations for the future [4].

Based on data analysis from November 1, 2025, to January 12, 2026 (a total of 48 trading days) [0]:

| Indicator | Value | Signal Interpretation |

|---|---|---|

| Latest Closing Price | 26,569.85 | - |

| 20-Day Price Change | +4.07% | Short-term trend upward |

| RSI(14) | 67.48 | Neutral to strong, not overbought |

| MACD | +147.79 | Golden cross, bullish signal |

| Bollinger Band Position | 89.7% | Close to upper band, short-term overbought |

- Positive Signals: Short-term moving averages in bullish arrangement, RSI in strong range, MACD golden cross

- Risk Signals: Stock price close to Bollinger Band upper band, short-term overbought risk

-

Continuous Capital Inflows: The E Fund Hang Seng Tech ETF (513010) recorded a full-year net capital inflow ofCNY 19.047 billionin 2025, and continued to receive buying even during index corrections [3]

-

Strong Southbound Capital: In 2025, southbound capital net bought approximatelyHK$1.4 trillionworth of Hong Kong stocks, continuously increasing holdings of tech leaders such as Tencent, Meituan, Xiaomi, and Tencent [3]

-

Improved Fundamentals: Tencent’s Q3 2025 advertising revenue grew 21% year-on-year, Alibaba Cloud Intelligence’s business grew 24%, and Kuaishou’s AI large model brought a 4%-5% revenue increment [3]

-

Positive Analyst Ratings: Goldman Sachs strategists maintain an overweight rating on Hong Kong-listed tech stocks, believing that surging AI-related demand and reasonable valuations will drive further stock price increases [2]

-

Obvious Valuation Advantage: The Hang Seng Tech Index’s PE (22.87x) is only55%of the Nasdaq’s (41.33x), leaving room for revaluation [3]

-

Short-Term Overbought Risk: New listed stocks such as Zhipu AI and MINIMAX have seen excessive short-term gains, facing pullback pressure

-

Profit Verification Pressure: AI large model companies are generally in a phase of high investment and high losses, with the timing of profitability still uncertain [4]

-

Spillover of Global Tech Stock Volatility: Concerns about the pace of AI investment in the global market in Q4 2025 led to a 20%-40% pullback in U.S. tech sectors, and Hong Kong-listed tech stocks were not immune [3]

-

Widening Valuation Divergence: The excessive valuation gap between new IPOs and mature enterprises may trigger capital rotation adjustments

The

- Hang Seng Tech Index as a whole(22.87x PE): Valuation is reasonable, with allocation value

- AI Newly Listed Stocks(80-90x PE): Short-term bubble risk exists, caution is advised when chasing highs

- Mature Tech Leaders(18-22x PE): Valuation is relatively low, can accumulate on dips

- Continuous capital inflows provide support

- Obvious valuation advantage, with room for revaluation

- Gradual commercialization of AI technology, improving fundamentals

- Global capital re-evaluating Chinese tech assets

Short-term Note: Pullback risks of AI newly listed stocks may disturb market sentiment.

[1] Securities Times - “Zhipu Lists: Uncovering the Capital Layout of the World’s First AI Large Model Stock” (https://www.stcn.com/article/detail/3577855.html)

[2] National Business Daily - “Hong Kong AI Concept Stocks Surge; MINIMAX’s Stock Price Soars 190% in Two Trading Days After Listing” (https://www.mrjjxw.com/articles/2026-01-12/4216023.html)

[3] Gelonghui - “The Year of Global Divergence: The Next Step for Tech Stocks” (https://www.sohu.com/a/974312914_313170)

[4] Alpha Factory - “The Race for Hong Kong’s First AI Large Model Stock: Track Competition Between Zhipu and MiniMax” (https://finance.sina.com.cn/cj/2026-01-05/doc-inhfhavn6766708.shtml)

[0] Jinling API Market Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.