In-depth Analysis of Zheshang Bank's Top Management Reshuffle: The Path to Breaking the 1.67% Net Interest Margin Dilemma

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on authoritative information obtained, I have prepared this in-depth analysis report on

On December 31, 2025, Zheshang Bank (Stock Codes: 601916.SH, 02016.HK), with assets reaching RMB 3.39 trillion, released multiple personnel change announcements in a concentrated manner, marking the official finalization of the core position adjustments that quietly started in the second half of 2025 [1]. This personnel reshuffle covers the entire management hierarchy from the Chairman to Assistant Presidents, representing the most thorough reshaping of the bank’s governance structure in recent years.

| Position | Name | Year of Birth | Tenure Status | Background Characteristics |

|---|---|---|---|---|

| Chairman | Chen Haiqiang | 1974 | Pending Regulatory Approval | Promoted internally, the first internally promoted Chairman in nearly a decade |

| President | Lü Linhua | 1978 | Newly Appointed | Transferred from Vice President of Zhejiang Rural Commercial United Bank, with extensive experience in regulation |

| Vice President | Zhou Weixin | 1971 | Promoted Internally | From the Bank of China system, with abundant local financial resources |

| Vice President | Pan Huafeng | 1972 | Promoted Internally | Veteran in risk control, formerly Chief Risk Officer |

Following this adjustment, Zheshang Bank has abolished the Assistant President level, forming a three-level flat management structure of “Chairman - President - Vice President”. Former Vice President Lin Jingran, and former Assistant Presidents Wang Chaoming and Hou Bo resigned collectively. This streamlining move has been interpreted by the market as an important measure to improve management efficiency and strengthen accountability [1].

According to Zheshang Bank’s 2025 third quarterly report, as of the end of September, the bank’s total assets reached RMB 3.39 trillion, representing a 1.91% increase from the end of the previous year. Core profitability indicators show a downward trend:

| Indicator | First Three Quarters of 2025 | Year-on-Year Change |

|---|---|---|

| Operating Income | RMB 48.931 Billion | -6.78% |

| Net Interest Income | RMB 34.438 Billion | -3.23% |

| Non-Interest Net Income | RMB 14.493 Billion | -14.26% |

| Net Profit | RMB 11.668 Billion | -9.59% |

| Net Interest Margin | 1.67% | Down 4 BPs from the full-year figure of the previous year |

| Non-Performing Loan Ratio | 1.36% | Down 0.02 percentage points from the end of the previous year |

| Cost-to-Income Ratio | 26.44% | Down 1.46 percentage points year-on-year |

A comparison of Zheshang Bank with its major peers can more clearly reveal its competitive position:

| Bank | 2025 Q3 Net Interest Margin (%) | 2024 Net Interest Margin (%) | Year-on-Year Change (BPs) | Non-Performing Loan Ratio (%) | ROE (%) |

|---|---|---|---|---|---|

| China Merchants Bank | 2.03 | 2.10 | -7 | 0.95 | 16.82 |

| Industrial Bank | 1.76 | 1.83 | -7 | 1.08 | 11.56 |

| Bank of Ningbo | 1.82 | 1.88 | -6 | 0.76 | 14.50 |

Zheshang Bank |

1.67 |

1.71 |

-4 |

1.36 |

7.66 |

| Industry Average | 1.42 | 1.52 | -10 | 1.49 | 10.50 |

-

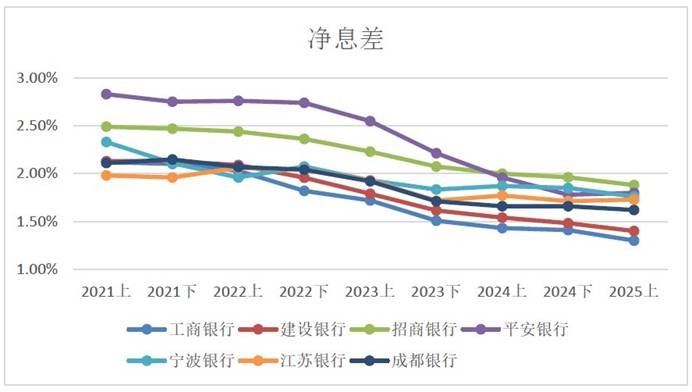

Limited Relative Advantage in Net Interest Margin: Although Zheshang Bank’s 1.67% net interest margin is higher than the industry average (1.42%), it only ranks in the middle tier among joint-stock banks, with a gap of 36 basis points compared to China Merchants Bank (2.03%) [2][3].

-

Significant Gap in Profitability: The ROE is only 7.66%, far lower than China Merchants Bank’s 16.82% and Bank of Ningbo’s 14.50%, accounting for only 72.8% of the industry average.

-

Pressure on Asset Quality: Although the non-performing loan ratio dropped by 0.02 percentage points from the beginning of the year to 1.36%, the balance of non-performing loans increased from RMB 25.494 billion to RMB 25.661 billion, indicating that the improvement in asset quality relies more on scale expansion rather than substantive risk resolution [1].

-

Slowing Trend of Interest Margin Narrowing: The net interest margin decreased by 4 basis points year-on-year, and the decline rate has significantly narrowed compared to last year, showing signs of marginal improvement [2].

Behind Zheshang Bank’s net interest margin pressure lie deep-seated business structure issues:

The new management team presents a professional complementary pattern of “Regulation + Risk Control + Local Resources”:

Based on the professional background and strategic direction of the new management, potential breakthrough strategies include:

In the third quarter of 2025, the net interest margin of commercial banks remained flat at 1.42%. Although the narrowing rate showed signs of marginal easing, the decline in asset-side yields still far exceeded the improvement in liability costs. In the third quarter, the net interest margin of joint-stock banks increased by 1 BP to 1.56%, reversing the narrowing trend since the second quarter of 2024 [3].

- The trend of deposit term continuation persists, with the proportion of fixed deposits hitting a new high of 66.4%. The rigidity of liability costs continues to restrict profit margins [3].

- Asset-side pricing continues to face pressure. The combination of declining loan interest rates and business structure adjustments leads to insufficient momentum for net interest margin recovery.

- Risks in the real estate sector remain highly concentrated, with the non-performing loan ratio remaining at around 4%, accounting for nearly 40% of corporate non-performing loans [3].

Against the backdrop of widespread pressure on net interest margins, regional banks have achieved performance growth exceeding the industry average by relying on regional economic advantages and characteristic businesses. For example, some banks with in-depth layout in the Yangtze River Delta region have achieved double-digit net profit growth, forming a stark contrast with the average growth rate of only 0.65% for large state-owned banks and joint-stock banks [3].

This trend is both an opportunity and a challenge for Zheshang Bank: as the only national joint-stock bank headquartered in Zhejiang, it has regional advantages in deeply cultivating the Yangtze River Delta, but at the same time, it faces fierce competition from local city commercial banks such as Bank of Ningbo and Bank of Hangzhou.

As of January 12, 2026, Zheshang Bank’s stock closed at US$3.03 (approximately RMB 22), corresponding to the following valuation levels:

| Indicator | Value | Industry Comparison |

|---|---|---|

| Market Capitalization | US$83.22 Billion | - |

| P/E (TTM) | 5.97x | Below Industry Average |

| P/B (TTM) | 0.47x | At a Historical Low |

| ROE (TTM) | 7.66% | Below Industry Average |

- Improved Management Stability: After the formation of the new team, the governance structure tends to be stable, and the continuity of strategic implementation is expected to be enhanced.

- Marginal Improvement in Asset Quality: The non-performing loan ratio has continued to decline, and risk reduction work has achieved results.

- Strong Deposit Growth: The deposit scale has exceeded RMB 2 trillion, and the liability structure has been optimized.

- Clear Regional Strategy: The three-year “Deep Roots in Zhejiang” action plan provides a clear development path.

- Continuous Pressure on Net Interest Margin: The 1.67% net interest margin ranks in the lower-middle tier among peers, and profit growth faces challenges in an interest rate downcycle.

- Compliance Risk: Frequent fines have been issued recently, and compliance construction still needs to be strengthened.

- Intensified Peer Competition: Facing competitive pressure from local institutions such as Bank of Ningbo and Bank of Hangzhou.

- Macroeconomic Uncertainty: Risks in the real estate sector and the progress of real economy recovery affect asset quality.

Zheshang Bank’s current top management reshuffle is a strategic adjustment against the backdrop of double declines in operating income and net profit, and a widening gap in peer competition. The professional complementarity of the new management team with backgrounds in “regulation + risk control + local resources” provides capacity support to address challenges such as narrowing net interest margins, compliance risks, and asset quality issues.

- Although the 1.67% net interest margin ranks in the middle tier among peers, there is a significant gap with leading joint-stock banks. It needs to respond through business structure optimization and cost control.

- The new management has the professional ability to address compliance pain points and strengthen risk control, and is expected to repair governance shortcomings.

- The combination of the “Deep Roots in Zhejiang” strategy and regional advantages is a key starting point for differentiated competition.

- The lagging development of intermediary business is the biggest shortcoming, and there is broad space for expanding wealth management and investment banking businesses.

Looking ahead, the key to Zheshang Bank’s successful breakthrough lies in whether the new management can transform professional capabilities into strategic execution, and achieve substantive progress on three fronts: the battle to defend net interest margins, the battle to improve asset quality, and the battle to break through in intermediary business.

[1] East Money - “Zheshang Bank with RMB 3.39 Trillion in Assets Undergoes Top Management Reshuffle: Can the New Team Fill Old Holes and Break the ‘Lagging Crisis’?” (https://caifuhao.eastmoney.com/news/20260112172355084616500)

[2] Zheshang Bank Official Website - “Zheshang Bank’s Third Quarterly Report Released: Adhere to ‘Quality First, Moderate Scale’ to Precisely Serve the Real Economy” (http://www.czbank.com/cn/pub_info/Press_releases/202511/t20251106_125701.shtml)

[3] Caixin - “Commercial Banks’ Third Quarter Net Interest Margin Remains Flat at 1.42%, Profitability Shows Marginal Improvement” (https://finance.caixin.com/2025-11-15/102383515.html)

[4] Securities Times - “State Administration of Financial Regulation Releases Latest Data! Joint-Stock Banks’ Net Interest Margin Rises 1 BP Month-on-Month” (https://www.stcn.com/article/detail/3496747.html)

[5] Jinling API Data - Company Fundamental and Financial Analysis

格林美15万吨镍产能释放与城市矿山战略深度解析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.