Analysis of Limin Co., Ltd. (002734.SZ): 661% Net Profit Growth and Operational Efficiency

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

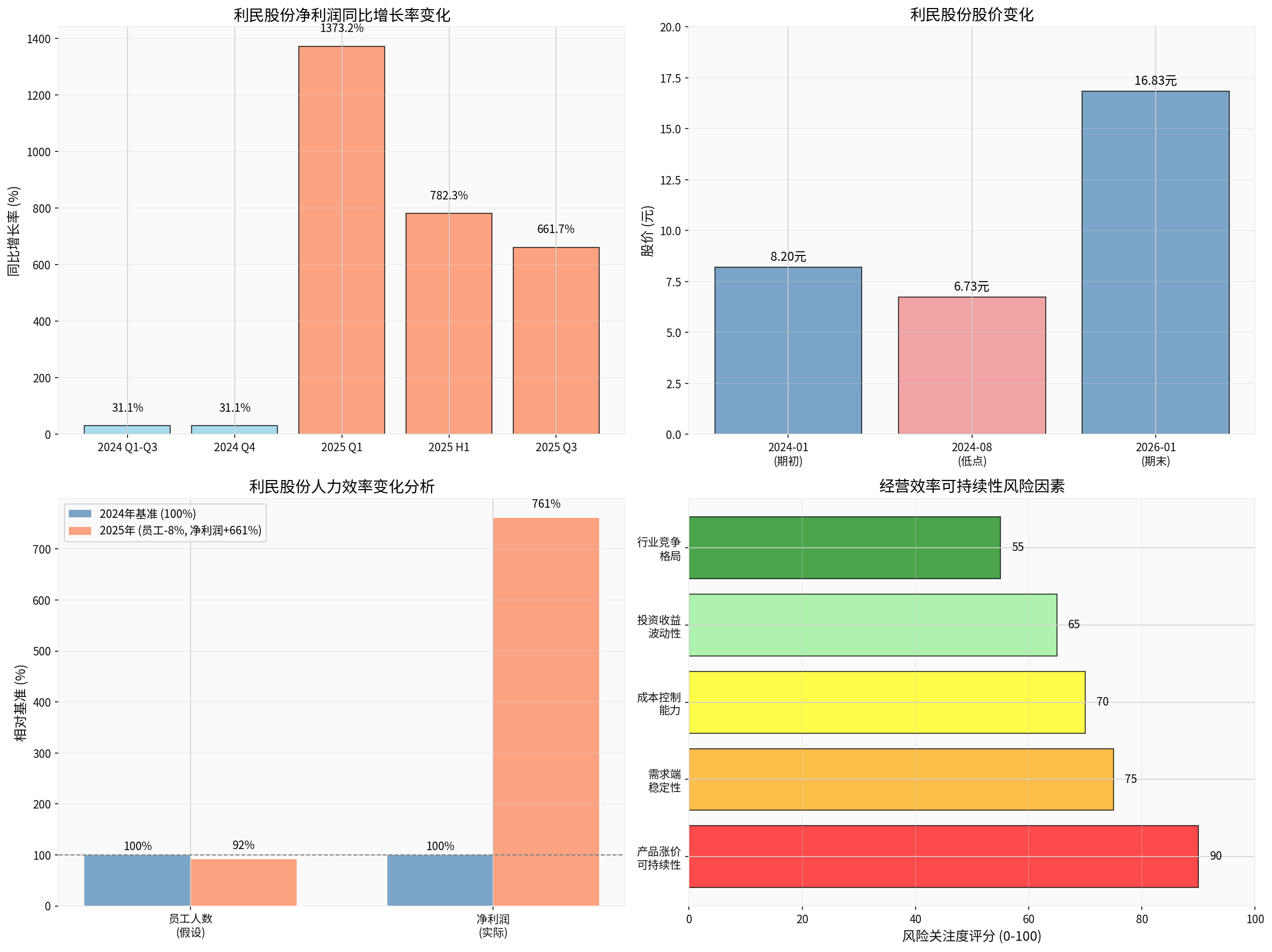

Based on the collected data and analysis, we now present an in-depth analysis report on Limin Co., Ltd. (002734.SZ) regarding its 661% net profit growth alongside an 8% headcount reduction.

- Q1 2025: Net profit surged 1373% year-on-year (due to base effect)

- H1 2025: Net profit increased 782% year-on-year

- First three quarters of 2025: Net profit rose 661% year-on-year[1]

According to industry data, the prices of the company’s main products have been on a continuous upward trend since March 2024[2]:

| Product | Price Change | Growth Rate |

|---|---|---|

| Emamectin Benzoate | RMB 500,000/ton → RMB 715,000/ton | +43% |

| Abamectin | RMB 350,000/ton → RMB 515,000/ton | +47% |

| Mancozeb | RMB 23,500/ton → RMB 25,000/ton | +6.4% |

| Chlorothalonil | Starting from RMB 18,000/ton | Upward |

The improved performance of the company’s affiliated entities has contributed significant investment income, emerging as another key source of net profit growth[1].

The 8% reduction in headcount has led to a direct decrease in labor costs, but this factor has relatively limited contribution to net profit growth.

-

Sustainability of Product Price Hikes (Risk Score: 90/100)

- Pesticide prices are significantly affected by supply and demand in the global agrochemical market

- This round of price hikes mainly stems from the end of the global agrochemical destocking cycle, rather than sustained improvement on the demand side[2]

- If downstream inventory replenishment is completed, there is significant risk of price correction

-

Volatility of Investment Income (Risk Score: 65/100)

- The performance of affiliated entities is uncertain

- Fluctuations in investment income may affect future profit stability

-

Demand-Side Stability (Risk Score: 75/100)

- Agricultural demand is relatively rigid, but cyclical fluctuations exist

- Uncontrollable factors such as extreme weather and the severity of plant diseases and insect pests

-

Sustainability of Cost Control (Risk Score: 70/100)

- The room for workforce optimization is already limited

- There is still pressure from raw material and energy costs

-

Industry Competition Landscape (Risk Score: 55/100)

- The pesticide industry is highly competitive, with increasing concentration among leading players[2]

- Trend Judgment:The stock price is currently in a sideways consolidation phase, with no clear trend signals[3]

- Beta Coefficient:0.65 (relative to the Shenzhen Component Index), with relatively low volatility

- Support Level:RMB 16.20 (20-day moving average)

- Resistance Level:RMB 17.06 (short-term resistance level)

- Annualized Volatility:Currently around 29.55%, which has declined from previous highs

[1] Sohu Securities - Limin Co., Ltd. Performance Forecast and Company Profile (https://q.stock.sohu.com/cn/002734/yjyg.shtml)

[2] Guosen Securities - Research Report on Limin Co., Ltd. (002734.SZ) (http://pdf.dfcfw.com/pdf/H3_AP202505261679298130_1.pdf)

[0] Jinling AI - Market Data and Technical Analysis

[3] Jinling AI - Technical Indicator Analysis of Stock Price K-line Chart

海南封关政策背景下酒店业价格分层现象与消费趋势分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.