Implications of the Record-High Margin Trading Turnover for the A-Share Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

On January 12, 2026, the A-share market’s margin trading turnover reached approximately RMB 427.2 billion, hitting a record high. This is the second time in A-share history that the turnover has exceeded the RMB 400 billion mark, with the previous occurrence being RMB 407.3 billion on October 8, 2024 [1]. Meanwhile, as of January 9, 2026, the margin balance had reached RMB 2.63 trillion, breaking the RMB 2.6 trillion mark for the first time, accounting for 2.47% of the A-share free float market capitalization, and margin trading accounted for 10.96% of A-share transaction volume [2].

From a longer-term perspective, the number of new margin trading accounts opened in 2025 reached 1.542 million, a substantial 52.9% increase compared to 1.0085 million in 2024, achieving three consecutive years of growth [2]. As of the end of 2025, the total number of margin trading accounts had exceeded 15.64 million, indicating sustained enthusiasm among investors for using leveraged tools.

The Shanghai Composite Index recorded a rare “16 consecutive upward gains” trend, setting the longest consecutive gain record in the index’s history, with a single-day increase of 1.38% on January 5, marking the largest single-day gain [3]. On January 9, 2026, the total transaction volume of the entire A-share market exceeded the RMB 3 trillion mark, the first time since September 18, 2024, and the Shanghai Composite Index stood firmly at 4100 points for the first time in a decade [3].

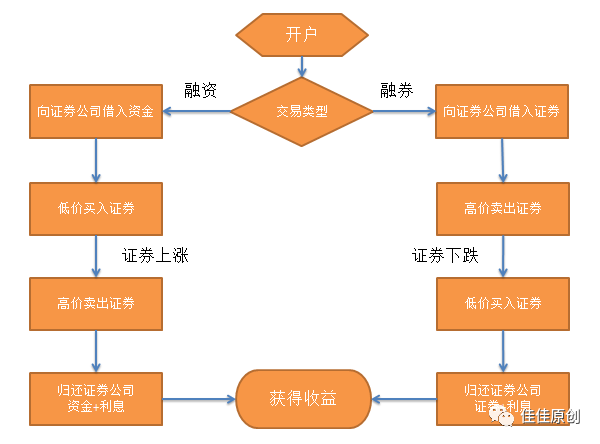

As an important credit trading tool in the A-share market, the expansion of margin trading funds helps enhance market liquidity and activity, injecting incremental capital into the market, hence it is called a “bull market accelerator” [2]. In the first week of 2026, the net inflow of margin trading funds reached RMB 85.779 billion, ranking fifth in A-share history for single-week inflows, indicating a trend of “accelerated entry” of leveraged funds [1].

In terms of capital flows, sectors such as semiconductors, industrial metals, and general equipment have become key destinations for margin trading inflows at the start of the year. From January 5 to 6, the top three industries in terms of net margin purchases were semiconductors (RMB 2.903 billion), industrial metals (RMB 2.285 billion), and general equipment (RMB 2.069 billion), reflecting high recognition by leveraged funds of the main themes of technological innovation and cyclical recovery [2].

Personnel from securities firm branches stated that margin trading clients showed high enthusiasm for “increasing positions” and entering the market in the first week, but they favored short-term operations and chased hot themes [1]. This phenomenon indicates that current leveraged funds are mainly “transactional” in nature, rather than long-term allocation funds. Meanwhile, the number of new A-share accounts opened in December 2025 reached 2.5967 million, a year-on-year increase of 30.55%, showing obvious signs of incremental capital entering the market [3].

Wang Zejun, an analyst at China Post Securities, pointed out that changes in the margin balance are closely related to the evolution of the A-share market since the “September 24” event in 2024. Starting from RMB 1.54 trillion in October 2024, the margin balance broke through the RMB 1.6 trillion, 1.7 trillion, and 1.8 trillion marks in approximately three months; the upward trend resumed in mid-August 2025, rising from around RMB 2 trillion to the RMB 2.5 trillion level [2].

| Institution | Core View |

|---|---|

Soochow Securities |

There are no obvious short-term risks, overall risks are controllable, and attention should be paid to seasonal volume contraction before the Spring Festival |

Kaiyuan Securities |

Resonance of multiple liquidity factors, coupled with RMB appreciation and expectations of a market rally, boosts the market |

Guosen Securities |

There is still room for the spring market to unfold further; even if there are periodic fluctuations, it may still be a good opportunity for positioning |

Shenwan Hongyuan Securities |

There are no major downward risks in the spring, only a consolidation after the short-term market has fully unfolded |

China Post Securities |

The margin trading market will shift from a “high-speed expansion phase” to a “high-quality growth phase” in 2026, with the balance expected to range between RMB 2.6 trillion and 3.2 trillion [2] |

The record-high margin trading turnover sends the following positive signals:

- Increased Market Confidence: Investor risk appetite has rebounded significantly, and optimistic expectations for the market outlook have driven the accelerated entry of leveraged funds

- Adequate Liquidity: Multiple capital sources have formed a resonance, including household deposit shifts, ETF capital inflows, and foreign capital inflows

- Emerging Structural Opportunities: The themes of technological growth and cyclical recovery have gained recognition from capital

- Positive Factors: Margin balance hitting record highs repeatedly, continuous growth in new account openings, transaction volume exceeding RMB 3 trillion, 16 consecutive gains in the Shanghai Composite Index

- Constraining Factors: Leveraged funds favoring short-term operations, obvious divergence in sector rotation, disturbances from seasonal factors

- Institutional Consensus: There is still room for the spring market to unfold, but short-term volatility risks need to be watched

- Moderately Optimistic but Rational: Recognize the current market recovery trend, but remain vigilant against short-term volatility risks

- Focus on Structural Opportunities: Technological growth remains the main theme; pay phased attention to low-valuation sectors such as real estate and non-bank finance

- Control Leverage Risks: When using margin trading tools, operate prudently based on your own risk tolerance and avoid over-leveraging

- Emphasize Fundamentals: Allocate to high-quality companies with solid fundamentals, favorable valuations, and growth potential

[1] Securities Times Network - “Scavenging Over RMB 80 Billion! Margin Trading Funds Accelerate Inflows in the First Week of the Year!” (2026-01-12)

https://www.stcn.com/article/detail/3586427.html

[2] Securities Times Network - “2025 Margin Trading Data Released! New Accounts Exceed 1.54 Million, Leveraged Funds Accelerate Entry!” (2026-01-12)

https://www.stcn.com/article/detail/3585629.html

[3] The Paper - “4100 Points, 16 Consecutive Gains, Is the Spring Market Here?” (2026-01-13)

https://m.thepaper.cn/newsDetail_forward_32367205

[4] China Economic Net - “Margin Balance Grows Significantly at the Start of 2026” (2026-01-08)

http://m.ce.cn/gp/gd/202601/t20260108_2688419.shtml

Report Generation Date: January 13, 2026

Data Sources: Jinling AI Financial Database, Public Market Information

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.