Analysis of Investment Opportunities in Localization of Semiconductor Materials and Equipment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above in-depth research data and market analysis, I now provide you with a systematic and comprehensive analysis report on investment opportunities and competitive landscape against the backdrop of localization of semiconductor materials and equipment.

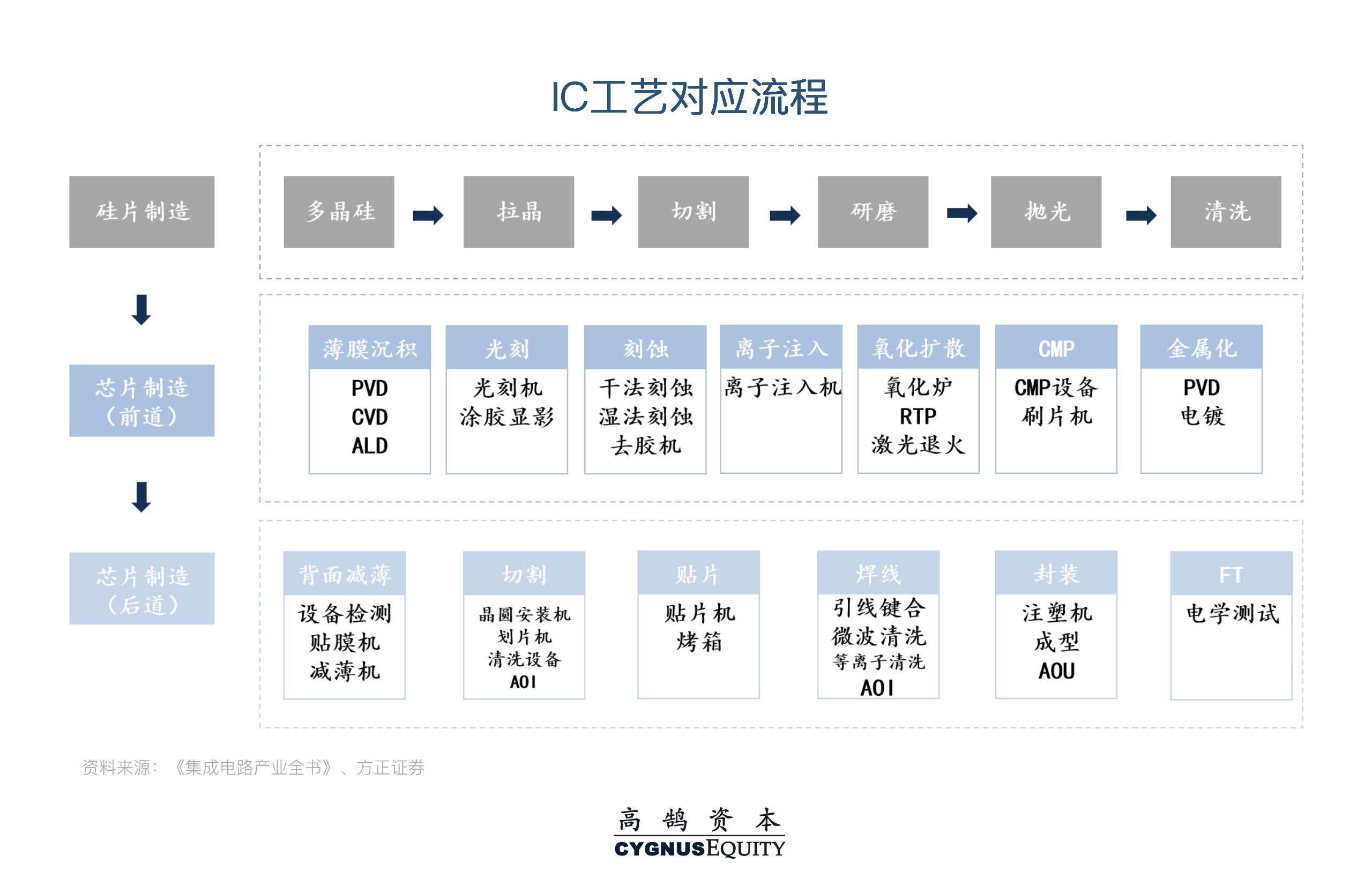

The “Several Policies of Guangzhou on Promoting High-Quality Development of the Integrated Circuit Industry Across the Entire Chain During the 15th Five-Year Plan Period (Draft for Comments)” issued by the Guangzhou Municipal Bureau of Industry and Information Technology marks a new stage in local governments’ systematic support for the semiconductor industry [1]. This policy clearly proposes two core goals:

- Production lines for manufacturing materials such as photomasks, photoresists, electronic specialty gases, high-purity sputtering targets, and large-size silicon wafers

- Focus on breaking through bottleneck links in domestic substitution of semiconductor materials

- Leading enterprises in manufacturing equipment such as lithography, etching, ion implantation, deposition, cleaning, and testing

- Build independent supply capacity for equipment covering front-end processes

This policy framework echoes the national-level “50% domestic equipment procurement red line” policy. According to an internal notice from the Ministry of Industry and Information Technology, chip manufacturers must use at least 50% domestic equipment when adding new production capacity. This mandatory requirement has been implemented since early 2025, and is strictly enforced for mature process production lines (≥28nm), while appropriately relaxed for advanced process production lines (<14nm) [2].

The localization rate of China’s semiconductor equipment has increased significantly from 25% in 2024 to 35% by the end of 2025, exceeding the 30% target set at the beginning of the year [3]. The adoption rate of domestic equipment in key sectors such as etching and thin film deposition has exceeded 40% [4]. This progress is attributed to:

- Technological Breakthroughs: AMEC’s 5nm-level etching equipment has entered validation at TSMC’s advanced process lines; the utilization rate of NAURA’s oxidation furnaces and diffusion furnaces in SMIC’s 28nm production lines exceeds 60%

- Policy Support: The third phase of the National Integrated Circuit Industry Investment Fund (with a scale of over RMB 300 billion) focuses on supporting R&D of domestic equipment, and the Ministry of Industry and Information Technology provides a 15% procurement subsidy

- Market Demand: China’s semiconductor market reached RMB 1.8 trillion in 2025, accounting for 31% of the global share

According to industry data, the localization rates of various equipment segments show significant structural differentiation:

| Equipment Type | Localization Rate | Global Market Size | Domestic Substitution Space | Key Domestic Manufacturers |

|---|---|---|---|---|

| Photoresist Strippers | 80% | US$1.5B | Low | Etang Semiconductor |

| Thermal Processing Equipment | 35% | US$2.5B | Medium-Low | NAURA, Huazhuo Precision Technology |

| Cleaning Equipment | 28% | US$4.0B | Medium | ACM Research (Shanghai), ToPure Technology |

| CMP Equipment | 25% | US$2.8B | Medium | Haina Qingke |

| Etching Equipment | 18% | US$12.0B | High | AMEC, NAURA |

| Thin Film Deposition Equipment | 18% | US$11.7B | High | Tuojing Technology, AMEC |

| Ion Implantation Equipment | 8% | US$3.6B | Very High | Suke Zhongkexin, KAST |

| Coating & Developing Equipment | 5% | US$3.7B | Very High | Xinyuan Micro, ACM Research (Shanghai) |

| Metrology & Testing Equipment | 5% | US$12.0B | Very High | C-Fly Tech, Wuhan Jingce Electronics |

| Lithography Equipment | <1% | US$18.0B | Extremely High | SMEE |

- AMEC’s CCP etching equipment fully covers most applications for processes above 28nm, has entered the 5nm cycle verification stage, with critical dimension uniformity of less than 1nm [6]

- NAURA dominates silicon etching and dielectric etching in 8-inch production lines, and has successfully applied its products in key steps such as hard mask etching and aluminum pad etching in 12-inch production lines

- Tuojing Technology’s PECVD, ALD, and SACVD products cover logic chip and memory chip manufacturing, with customers including SMIC and Huahong Group

- NAURA has deployed in LPCVD, APCVD, and ALD fields, and is the domestic leader in the PVD sector

- MicroGuide Nano is the first domestic equipment company to successfully apply mass-produced High-k ALD to front-end production lines at the 28nm node

- Accelerated localization of DUV lithography machines for mature processes (28nm and above)

- Advanced processes rely on multiple patterning technology to compensate

- Coating & developing equipment is supporting lithography machines, with a localization rate of <5%; Xinyuan Micro has covered i-line, KrF, and ArF segments

| Material Type | Localization Rate | Global Market Size | Key Enterprises |

|---|---|---|---|

| Silicon Wafers | 20% | US$14.0B | Simgui Technology, Lion Micro |

| Electronic Specialty Gases | 30% | US$6.5B | Nanda Optoelectronics, Huate Gas, Jinhong Gas |

| Photoresist | 15% | US$5.5B | Tongcheng New Materials, Nanda Optoelectronics, Jingrui Electronic Materials |

| CMP Slurries & Pads | 15% | US$3.5B | Anji Technology, Haina Qingke |

| Wet Chemicals | 25% | US$5.5B | Jingrui Electronic Materials, Shanghai Xinyang |

| Sputtering Targets | 20% | US$2.2B | Jiangfeng Electronics, Grikin Advanced Materials |

| Photomasks | 15% | US$6.0B | Lovi Optical Technology, Qingyi Photomask |

| Coating & Developing Materials | 25% | US$2.8B | Xinyuan Micro, ACM Research (Shanghai) |

| Enterprise | Core Technology | Market Position | Capacity Plan |

|---|---|---|---|

Tongcheng New Materials |

KrF/ArF Photoresist | KrF market share over 40%, ArF qualified | 10,000-ton annual photoresist production project |

Nanda Optoelectronics |

ArF Photoresist | The only domestic enterprise with mass-produced ArF, qualified for 28nm | 50-ton annual ArF production line |

Jingrui Electronic Materials |

KrF/ArF Photoresist | Monthly KrF production capacity exceeds 1 ton, ArF in small-batch production | 30,000-ton annual semiconductor photoresist production project |

Shanghai Xinyang |

KrF/ArF Photoresist | Mass supply of I-line/KrF, received ArF orders | Large-scale production line under construction |

- Nanda Optoelectronics ranks first in global market share of Mo sources; capacity utilization rates of electronic specialty gases and precursor materials are 102% and 93% respectively, with tight supply

- Huate Gas and Jinhong Gas have comprehensive layouts in high-purity gas sectors

- Market Capitalization: RMB 217.6 billion

- Current Stock Price: RMB 348.76

- 2025 Increase: 94.88%

- P/E (TTM): 113.72x

- ROE: 9.31%

- Etching Equipment Leader: CCP etching equipment covers most applications above 28nm, 5nm-level equipment enters cycle verification

- Thin Film Deposition Breakthrough: Thin film equipment such as LPCVD and ALD have successfully entered the market; Q3 2025 financial report shows strong new equipment orders

- Platform Layout: Formed a four-front-end process equipment matrix of “etching + thin film + metrology + wet process” through the acquisition of Hangzhou Zhonggui, covering 80% of key processes in chip manufacturing

- H1-Q3 2025 revenue increased by 37.3% YoY, net profit attributable to shareholders increased by 23.9% YoY

- Gross profit margin remains stable, R&D investment continues to increase

- Healthy free cash flow, low debt risk [10]

- Stock price continues to rise along the 50-day moving average, MACD in long position

- KDJ indicator is at a high level of 79.8, RSI is in the overbought zone

- Short-term support level: RMB 296.65, resistance level: RMB 356.29

- Market Capitalization: RMB 44.7 billion

- Current Stock Price: RMB 265.42

- 2025 Increase: 153.17%

- P/E (TTM): 59.72x

- ROE: 25.06% (industry-leading)

- CMP Slurry Leader: Leading localization rate of CMP slurries, products cover logic chips and memory chips

- Wet Chemicals Leader: Advanced technology for electronic-grade wet chemicals, high capacity utilization

- Outstanding Profitability: Net profit margin of 32.10%, far exceeding the industry average

- Q3 2025 EPS: RMB 1.38, exceeding expectations by 14.05%

- Earnings have exceeded expectations for multiple consecutive quarters, with strong growth momentum

- Abundant operating cash flow, healthy financial structure

- Stock price rises strongly along the 20-day moving average, cumulative increase in 2025 exceeds 150%

- MACD golden cross upward, KDJ indicator runs in the overbought zone

- Short-term support level: RMB 228.28, resistance level: RMB 272.60

- Market Capitalization: RMB 32.0 billion

- 2025 Increase: 85.2%

- Localization Rate of CMP Equipment: 20-30%

- Leading localization rate of CMP equipment; single-wafer cleaning equipment received repeat orders from Huahong Shanghai’s 12-inch 28nm production line

- Equipment uptime exceeds 90%, product reliability verified

- Net profit growth for 4 consecutive years, high growth certainty

- Market Capitalization: RMB 38.0 billion

- 2025 Increase: 95.8%

- Photoresist Business Revenue: RMB 442 million (H1 2025)

- Controlling stake in Beijing Kehua gives it over 40% market share of KrF photoresist

- ArF/ArFi photoresist products have passed verification by domestic chip manufacturers and are in mass production

- The only A-share enterprise cooperating with ASML in EUV photoresist development

- Independently develops electronic-grade phenolic resin, with a full industrial chain layout

- Market Capitalization: RMB 15.0 billion

- 2025 Increase: 186.5% (industry’s top gainer)

- Photoresist Revenue: Exceeded RMB 106 million (H1 2025)

- Full product matrix covering G-line, I-line, KrF, and ArF

- Monthly KrF photoresist production capacity exceeds 1 ton

- ArF products have entered verification in Yangtze Memory Technologies’ advanced process production lines

- H1-Q3 2025 net profit growth rate exceeds 19200% YoY

| Sub-sector | Investment Targets | Rationale |

|---|---|---|

| Etching Equipment | AMEC, NAURA | Technological breakthrough + market share gain + full order book |

| Thin Film Deposition | Tuojing Technology, MicroGuide Nano | Driven by memory/HBM demand + domestic substitution |

| CMP Equipment | Haina Qingke | Penetration into mature processes + demand for advanced packaging |

| Metrology & Testing | C-Fly Tech, Wuhan Jingce Electronics | Lowest localization rate + policy support |

| Sub-sector | Investment Targets | Rationale |

|---|---|---|

| Photoresist | Tongcheng New Materials, Nanda Optoelectronics, Jingrui Electronic Materials | Risk of supply cuts from Japan + technological breakthrough + capacity release |

| Electronic Specialty Gases | Nanda Optoelectronics, Huate Gas | Mature category + high capacity utilization |

| CMP Slurries & Pads | Anji Technology, Haina Qingke | Platform layout + outstanding profitability |

High Domestic Substitution Space

│

┌────────────────────┼────────────────────┐

│ │ │

│ Photoresist (Strong Buy) │ Etching Equipment (Strong Buy) │

│ Metrology & Testing (Watch) │ Thin Film Deposition (Strong Buy) │

Low◄─┼────────────────────┼────────────────────┼►High

Mar │ │ │ Mar

ket │ Silicon Wafers (Watch) │ Cleaning Equipment (Buy) │ ket

Spa │ Sputtering Targets (Watch) │ CMP Equipment (Buy) │ Si

ce │ Wet Chemicals (Buy) │ Testing Equipment (Buy) │ ze

│ Electronic Specialty Gases (Buy) │ Ion Implantation (Watch) │

│ │ │

└────────────────────┼────────────────────┘

│

Low Domestic Substitution Space

- R&D progress of advanced process equipment may fall short of expectations

- International giants continue to increase R&D investment to maintain technological leadership

- The implementation intensity of the 50% domestic equipment policy may be adjusted

- Advanced process production lines may be granted more exceptions

- Risk of a global semiconductor cycle downturn

- Memory capacity expansion progress may be affected by price fluctuations

- Price competition among domestic manufacturers may intensify

- International manufacturers may cut prices to maintain market share

- Supply chain security incidents may cause short-term disruptions

- Technology export controls may continue to escalate

-

Accelerated Localization Process: The localization rate of semiconductor equipment has exceeded 35%, entering the core climbing phase of the acceleration period on the S-shaped growth curve, and the growth rate will accelerate significantly in the future [11].

-

Structural Opportunities Highlighted: Segments with localization rates below 10% such as lithography, metrology & testing, and coating & developing have the largest growth space; segments that have broken through the 10-20% range such as etching and thin film deposition are in a rapid penetration period.

-

Clear Policy Support: The “50% domestic equipment procurement red line” policy is enforced, with the third phase of the National Integrated Circuit Industry Investment Fund providing over RMB 300 billion in support, combined with supporting policies from local governments, forming a policy synergy.

-

Technological Breakthroughs Expected: AMEC’s 5nm etching machine has entered verification, the yield of the 7nm pilot line exceeds expectations, and 14nm domestic equipment is expected to be put into mass production as early as Q2 2026.

[1] Securities Times - “Guangzhou’s Plan to Accelerate the Construction of a Strong Advanced Manufacturing City (2024–2035)” (https://www.stcn.com/article/detail/3579703.html)

[2] New Third Board Information - “Overview of China’s Semiconductor Supply Chain Independence Progress” (https://www.xinsanbanbao.com/20251231/news/n98415.html)

[3] ICwise - “China’s Semiconductor Equipment Enters Core Acceleration Period” (https://www.esmchina.com/marketnews/56588.html)

[4] Yahoo News - “China’s Semiconductor Equipment Localization Rate Exceeds 35%, Far Exceeding Expectations” (https://tw.news.yahoo.com/)

[5] Guojin Securities - In-Depth Report on Semiconductor Equipment Industry: “Resonance of Memory Capacity Expansion and Independent Controllability, Broad Domestic Substitution Space”

[6] Futu News - “Semiconductor Equipment Industry: 2026 Outlook Amid Domestic Substitution” (https://news.futunn.com/post/

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.