U.S. Earnings Broadening Strength Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis examines the January 13, 2026 Seeking Alpha report highlighting the broadening strength in U.S. corporate earnings beyond the “Magnificent 7” technology stocks. The article presents a constructive outlook for U.S. equities, anchored by artificial intelligence as a structural growth driver and evidence of improving earnings breadth across the S&P 500 index [1]. Current market data shows the S&P 500 reaching near-record levels at 6,977, with the Russell 2000’s 0.83% weekly gain supporting the thesis of earnings expansion beyond mega-cap tech [0]. Analyst consensus indicates Q4 2025 earnings growth of 8.3% year-over-year, with a notable 0.5% increase in earnings estimates during the quarter—contrary to the typical downward revision pattern [2]. While the outlook remains constructive, decision-makers should note that the “broadening” thesis depends on Q4 results from non-technology sectors, with technology currently driving approximately 80% of expected earnings growth [4].

The U.S. equity market entered 2026 on firm footing, with the S&P 500 establishing new record highs as investors positioned for the fourth quarter earnings season. Market data from the week of January 6-12, 2026 reveals a constructive but nuanced picture across major indices [0]. The S&P 500 gained 0.48% to reach 6,977, the NASDAQ advanced 0.67% to 23,734, and the Dow Jones increased 0.18% to 49,590. Most significantly, the Russell 2000—often considered a barometer of broader economic health—outperformed with a 0.83% gain to 2,636, aligning with the earnings broadening thesis presented in the Seeking Alpha analysis [0][1].

Sector performance on January 12, 2026 provides additional support for the article’s constructive stance. Consumer Defensive stocks led with a 1.88% advance, followed by Technology at +0.89%, Financial Services at +0.67%, and Industrials at +0.57% [0]. These sector movements align with the article’s emphasis on AI-driven productivity gains and the expectation that artificial intelligence will benefit both technology leaders and the broader economy through industrial applications and financial services innovation.

The Seeking Alpha analysis centers on the narrowing earnings gap between the Magnificent 7 stocks and the remaining S&P 493 constituents [1]. This development represents a meaningful shift from the highly concentrated earnings leadership that characterized much of 2024 and 2025. According to the article, Magnificent 7 stocks are projected to deliver 20% Q4 2026 earnings growth, while the remaining S&P 493 stocks are expected to achieve 6% growth [1]. While the absolute gap remains substantial, the narrowing differential suggests that earnings momentum is becoming more broadly distributed across the index—a constructive development for overall market health.

Individual Magnificent 7 performance during the reference week reveals ongoing differentiation within the group. Apple (AAPL) experienced a slight pullback of 0.42% after approaching the $267 level, Microsoft (MSFT) maintained a steady uptrend toward $480 with a 0.52% gain, and NVIDIA (NVDA) showed continued volatility with a 1.21% decline while trading within the $183-$192 range [0]. NVIDIA’s trading dynamics reflect the ongoing market debate regarding the sustainability of AI infrastructure spending, a topic that will likely receive significant attention during upcoming earnings calls.

FactSet earnings season preview data corroborates several elements of the Seeking Alpha thesis [2]. The consensus expectation for Q4 2025 S&P 500 earnings per share growth stands at 8.3% year-over-year, with revenue growth expected at 7.7%—marking the 21st consecutive quarter of revenue expansion [2]. These figures represent a continuation of the earnings resilience that has characterized U.S. corporate performance despite elevated interest rates and economic uncertainty.

Looking ahead to 2026, analyst consensus projects acceleration in S&P 500 earnings growth to approximately 14.9%, compared to an estimated 12-13% growth rate for 2025 [2]. This projected acceleration provides fundamental support for current equity valuations, though investors should note that forward price-to-earnings ratios have expanded accordingly.

A particularly noteworthy data point supporting the bullish thesis is the behavior of analyst earnings estimate revisions during Q4 2025. On average, analysts

Despite the constructive tone of the Seeking Alpha analysis, important caveats merit consideration. Analyst commentary from Wealth Advisors highlights that approximately 80% of the expected 8% S&P 500 earnings growth for the quarter will be driven by the technology sector [4]. This concentration suggests the “broadening” thesis remains partially unproven and depends heavily on fourth quarter results from non-technology sectors including financials, industrials, and healthcare.

Furthermore, the forward 12-month price-to-earnings ratio of 22.2x exceeds the five-year average of 20.0x, indicating that elevated valuations already price in a significant portion of expected earnings growth [2]. This leaves limited room for multiple expansion and increases the importance of actual earnings delivery in driving future returns.

The Seeking Alpha article positions artificial intelligence as a “mega force” capable of counteracting typical downward earnings revisions and supporting sustained U.S. stock outperformance [1]. This thesis rests on the expectation that AI infrastructure investments will translate into measurable productivity gains across the broader economy, not merely within the technology sector. The current market setup appears to be testing whether AI-driven efficiency improvements can sustain earnings growth at elevated levels while interest rates remain restrictive.

The strength in Consumer Defensive, Financial Services, and Industrials sectors during the reference week may reflect early market anticipation of this productivity thesis materializing outside technology [0]. However, the timeline for AI monetization in non-tech sectors remains uncertain, with some analysts suggesting meaningful productivity gains may not materialize until 2027 [4].

The observed 0.5% increase in earnings estimates during Q4 2025 represents a significant departure from historical patterns [2]. This anomaly suggests either exceptional corporate resilience or elevated investor optimism—possibly both. Understanding which factor dominates will be crucial for assessing the sustainability of current equity valuations. If the positive revision pattern reflects genuine fundamental strength, the market may be undervalued at current levels. If it reflects optimism that corporate results cannot match, downside risk increases.

The Russell 2000’s strong relative performance during the reference week (+0.83% versus +0.48% for the S&P 500) carries important implications for the earnings broadening thesis [0]. Small-cap stocks are generally more sensitive to domestic economic conditions and less exposed to AI-driven technology trends than their large-cap counterparts. Outperformance in this segment could signal market confidence in the breadth of economic strength beyond mega-cap technology leadership.

The analysis presents a data-supported but conditional case for continued U.S. equity outperformance. Key factual findings include:

- Earnings Growth Expectations:Q4 2025 EPS growth consensus stands at 8.3% year-over-year, with 2026 growth projected at 14.9% [2].

- Revenue Sustainability:Revenue growth is expected at 7.7% year-over-year, marking the 21st consecutive quarter of revenue expansion [2].

- Earnings Revision Pattern:The 0.5% increase in estimates during Q4 2025 contrasts with historical averages of -1.6% (5-year) to -3.1% (10-year) [2].

- Valuation Level:Forward P/E of 22.2x exceeds the 5-year average of 20.0x, suggesting elevated but not extreme valuations [2].

- Sector Concentration:Technology sector accounts for approximately 80% of expected Q4 earnings growth [4].

- Market Technical Levels:S&P 500 at 6,977 (near record), NASDAQ at 23,734, Russell 2000 at 2,636 [0].

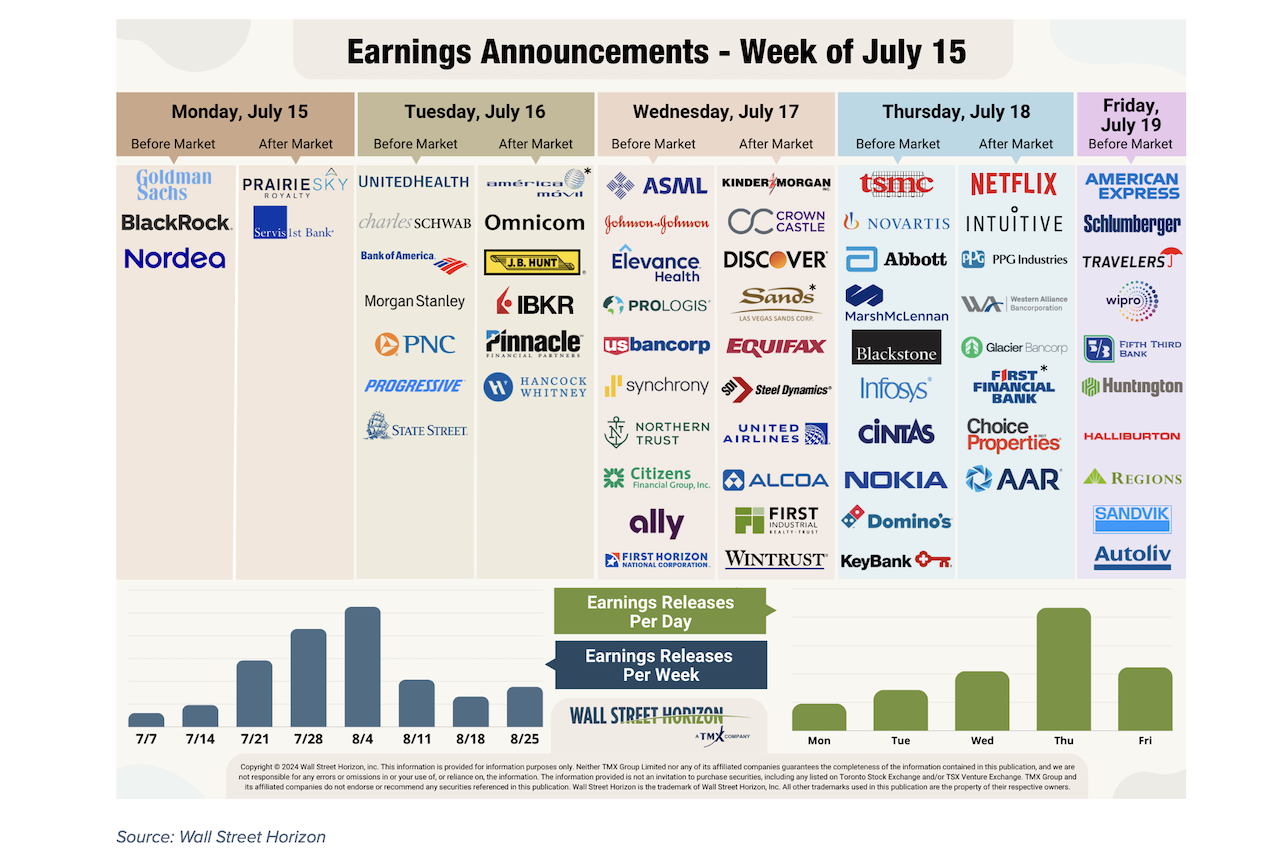

The analysis identifies January 14, 2026 as the start of major bank earnings reports, with peak Q4 earnings season expected between January 14 and February 27, 2026 [3]. December CPI data released January 13, 2026 could influence Federal Reserve policy expectations and equity market direction [3].

[0] Ginlix Analytical Database – Market Indices, Sector Performance, and Stock Price Data (internal)

[1] Seeking Alpha – “U.S. Earnings: Broadening Strength” (https://seekingalpha.com/article/4859070-us-earnings-broadening-strength) – Published January 13, 2026

[2] FactSet – “S&P 500 Earnings Season Preview: Q4 2025” (https://insight.factset.com/sp-500-earnings-season-preview-q4-2025) – Published January 9, 2026

[3] TradingKey – “U.S. December CPI Data Bolster Rate Cut Case” (https://www.tradingkey.com/analysis/stocks/us-stocks/261464959-earning-q4-cpi-rate-tradingkey) – Published January 12, 2026

[4] Wealth Advisors – “Weekly Market Commentary January 12, 2026” (https://www.wealthadvisorsoffice.com/weekly-market-commentary-january-12-2026-9e150)

[5] Betterment – “AI-driven markets and what advisors should watch in 2026” (https://www.betterment.com/advisors/resources/2026-market-outlook)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.