Lifeward's Acquisition of Oramed's Oral Protein Delivery Technology: Analysis of Business Transformation and Valuation Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected detailed information, I will provide you with a systematic and comprehensive analysis report.

According to the official announcement, Lifeward Ltd. (NASDAQ: LFWD) and Oramed Pharmaceuticals Inc. (NASDAQ: ORMP) announced on January 13, 2026 that they had signed a binding strategic transaction agreement [1][2]. The core arrangements of the transaction are as follows:

- Lifeward obtains Oramed’s proprietary Protein Oral Delivery (POD™) technology, which represents years of R&D achievements in converting injectable therapies into oral medications [1]

- Oramed will receive up to 49.99% of Lifeward’s equity, in the form of Lifeward common stock, pre-funded warrants, and warrants that can be used to additionally acquire up to $7 million worth of Lifeward common stock [2]

The transaction involves a strategic investment with a total value of up to approximately $47 million, with the specific composition as follows:

| Financing Component | Amount | Description |

|---|---|---|

| Convertible Note A | $10 million | Oramed invests $9 million, another investor invests $1 million, annual interest rate of 8%, with 100% warrant coverage |

| Convertible Note B | $10 million | Automatically triggered upon milestone achievement, Oramed invests $9 million, annual interest rate of 8% |

| Milestone Financing | Up to $25 million | Additional financing based on specific revenue or stock price targets |

- Oramed will be responsible for the clinical development management of the POD™ platform, including planned clinical trials [1]

- Oramed will earn a 4% net sales royalty from the ReWalk product line over the next 10 years [2]

- Current stock price: $0.63, market capitalization: $11.19 million [3]

- Stock price dropped 59.65% in the past year, 89.61% in three years, and 95.09% in five years [3]

- 52-week trading range: $0.50-$2.95 [3]

- Current stock price: $3.43, market capitalization: $143 million [3]

- Net profit of $65 million in the first three quarters of 2025 (net loss of $6.1 million in the same period last year) [4]

- Total assets increased 42% year-over-year to $220.5 million [4]

This transaction marks Lifeward’s strategic transformation from a manufacturer focused on rehabilitation medical devices to a “diversified biomedical innovation company” [1]. This transformation has the following key characteristics:

- Original Business (MedTech):ReWalk® exoskeleton system and AlterG® anti-gravity treadmill, both of which have obtained FDA approval and achieved commercialization

- New Business (BioTech):POD™ clinical-stage oral protein delivery technology platform, with core pipeline ORMD-0801 expected to become the world’s first commercialized oral insulin drug [5]

Lifeward CEO Mark Grant said: “Oramed is the ideal strategic partner for Lifeward during a critical period of our development. This transaction is expected to provide us with financial resources to drive profitability of our mature ReWalk® and AlterG® product lines while unlocking significant growth opportunities through the acquisition of Oramed’s POD™ technology.” [1]

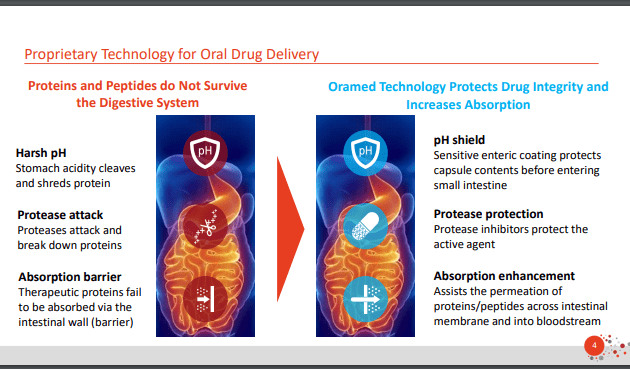

The POD™ technology adopts innovative pH shielding, protease protection, and absorption enhancement mechanisms, which can protect drug integrity and improve absorption efficiency [6]. This technology complements Lifeward’s existing medical device business, expanding the company’s capability boundaries in the field of biologic delivery.

Oramed’s committed direct investment of $18 million (two $9 million convertible notes) plus potential milestone financing of up to $25 million provides Lifeward with a sufficient capital buffer [2]. The company’s trailing four-quarter revenue in 2025 was approximately $26 million [2], and this financing scale is equivalent to about 18 months of operating capital.

According to the announcement, the POD™ technology targets the injectable drug market worth over $60 billion, and the oral insulin market alone has enormous growth potential [5].

The transaction design incorporates an elaborate risk-sharing mechanism:

- Risks borne by Lifeward:Obtains potential benefit rights to the POD™ technology, but does not bear the main costs of current clinical development

- Risks borne by Oramed:Responsible for funding and managing the upcoming clinical trials, while receiving sales royalties from the ReWalk product line as compensation [2]

This structure allows Lifeward to maintain focus on existing business operations while retaining exposure to large-scale biotech opportunities.

After the transaction announcement, Lifeward’s stock price showed a positive reaction:

- Stock price rose 6.56% to $0.67 on the day [7]

- Market capitalization increased by approximately $709,000 [7]

- Relative trading volume reached 1.3 times, indicating increased market attention [7]

However, it should be noted that Lifeward’s stock price had already experienced a sharp decline before the announcement (nearly 60% drop in the past year), so the market reaction needs to be interpreted in this context.

-

Capital Injection Effect:The financing of up to $47 million provides Lifeward with significant financial flexibility. Based on the company’s current market capitalization of approximately $11.19 million, this financing scale is equivalent to 4.2 times the market capitalization, which may significantly improve the company’s capital structure [3].

-

Technology Platform Value:The POD™ technology represents years of R&D achievements by Oramed. Although the transaction did not disclose the standalone acquisition price of the POD™ technology, Oramed’s total assets are $220.5 million [4], and as a core asset, the value of the POD™ technology may reach the tens of millions of dollars level.

-

Analyst Expectations:Wall Street analysts have given Lifeward a consensus target price of $10.75, representing a potential upside of 1608% from the current stock price [3]. 4 analysts gave a “Buy” rating, while only 1 gave a “Sell” rating [3].

-

Equity Dilution Risk:The transfer of 49.9% equity means that the interests of existing shareholders will be significantly diluted. If Oramed exercises all warrants, the shareholding ratio of existing shareholders may decline further.

-

Debt Burden:Two $10 million convertible notes with an 8% annual interest rate increase the company’s debt burden. Although the convertible feature provides flexibility, interest expenses will have an impact on cash flow.

-

Business Integration Challenges:Shifting from medical devices to biopharmaceuticals involves completely different regulatory environments, R&D cycles, and business models, which poses new capability requirements for the management team.

Based on the transaction structure, the following changes in financial metrics can be expected:

| Financial Metric | Current Status | Expected Change |

|---|---|---|

| Cash and Cash Equivalents | Low (sustained losses) | Significant increase (up to +$47 million) |

| Debt-to-Asset Ratio | High | Increase (debt financing) |

| R&D Expenditure | Relatively Controllable | May increase (to support POD™ development) |

| Revenue Sources | Single (hardware sales) | Diversified (adding technology licensing/milestone payments) |

| Profitability Path | Sustained Losses | Still loss-making in the short term, but long-term improvement potential increases |

-

Valuation Repair Potential:There is a huge gap between the current market price of $0.63 and the analyst consensus target price of $10.75 [3]. If the transaction is successfully executed and synergies are realized, the stock price may gradually return to a reasonable value.

-

Benefits of Business Diversification:Acquiring the POD™ technology enables Lifeward to enter the $60 billion injectable drug market [5], significantly expanding the company’s Total Addressable Market (TAM).

-

Strategic Endorsement from Oramed:As a leader in the oral protein delivery field, Oramed’s deep involvement with a 49.9% stake demonstrates its confidence in Lifeward’s development prospects.

-

Royalty Mechanism:Oramed receives a 4% sales royalty from the ReWalk product line (10-year term) [2], which ensures long-term alignment of interests between the two parties.

-

Transaction Execution Risk:The completion of the transaction is subject to closing conditions such as shareholder approval [2]. If shareholders vote against it or regulatory obstacles arise, the transaction may not be completed.

-

Clinical Trial Risk:ORMD-0801, the core product of the POD™ technology, is still in the clinical development stage. The risk of clinical trial failure may lead to a significant decline in the value of the technology.

-

Equity Dilution Risk:The transfer of 49.9% equity plus potential conversion of convertible notes may lead to significant dilution of existing shareholders’ interests.

-

Business Transformation Risk:Transforming from a medical device manufacturer to a biopharmaceutical company requires a different set of capabilities, including expertise in clinical development, regulatory affairs, and biopharmaceutical commercialization.

-

Sustained Loss Risk:Lifeward is currently in a state of sustained losses (EPS -$2.91 [3]), and it is difficult to achieve profitability in the short term. Investors need to be prepared for long-term holdings.

| Scenario | Probability | Valuation Impact |

|---|---|---|

Optimistic Scenario - POD™ technology clinical success + commercialization |

20% | Stock price may rise 200-500%, reaching the $3-$5 range |

Base Scenario - Transaction completed smoothly, business develops steadily |

50% | Stock price rises moderately by 50-100%, returning to the $1-$1.5 range |

Pessimistic Scenario - Clinical trial failure or transaction termination |

30% | Stock price may fall to $0.4-$0.5 or lower |

Lifeward’s acquisition of Oramed’s POD™ technology is a strategically significant transaction, with its core value reflected in the following aspects:

Investors should focus on the following key indicators:

- Transaction completion progress (shareholder voting date, regulatory approval status)

- POD™ platform clinical trial progress

- Sales growth trends of Lifeward’s core businesses (ReWalk, AlterG)

- Conversion conditions and timelines of convertible notes

- Management’s specific execution plan for business strategic transformation

[1] PR Newswire - “Oramed and Lifeward Announce Strategic Transaction” (https://www.prnewswire.com/news-releases/oramed-and-lifeward-announce-strategic-transaction-302659575.html)

[2] GlobeNewswire - “Lifeward Enters Transformative Strategic Investment and Partnership Agreement with Oramed” (https://www.globenewswire.com/news-release/2026/01/13/3217760/32993/en/Lifeward-Enters-Transformative-Strategic-Investment-and-Partner)

[3] Jinling API - Lifeward Real-Time Quotes and Company Profile Data

[4] Oramed Pharmaceuticals - “Oramed Reports Fiscal Third Quarter 2025 Financial Results” (https://oramed.com/oramed-reports-fiscal-third-quarter-2025-financial-results/)

[5] Yahoo Finance - “Lifeward Enters Transformative Strategic Investment” (https://finance.yahoo.com/news/lifeward-enters-transformative-strategic-investment-130000323.html)

[6] PharmaSource Global - Analysis of Oramed’s Oral Protein Delivery Technology (https://pharmasource.global/wp-content/uploads/2025/02/image-34.png)

[7] StockTitan - “Oramed and Lifeward Announce Strategic Transaction” (https://www.stocktitan.net/news/LFWD/oramed-and-lifeward-announce-strategic-umdox6fm75zz.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.