In-Depth Analysis of the Strategic Impact of Salesforce (CRM)'s AI Slackbot

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I present the complete in-depth analysis report to you:

Salesforce officially launched its new AI-powered Slackbot on

The new Slackbot has evolved from a traditional notification bot into a

| Function Dimension | Specific Capabilities | Strategic Value |

|---|---|---|

Context Awareness |

Understands user work patterns, communication styles, and project backgrounds | Delivers highly personalized and relevant intelligent assistance |

Cross-Application Operations |

Executes tasks across multiple enterprise applications | Eliminates tool-switching costs and improves work efficiency |

Salesforce Data Integration |

Real-time access to customer data, transaction records, and service history | Connects collaboration and CRM to unlock data value |

Autonomous Action |

Performs actions on behalf of users such as booking, scheduling, and summarization | Shifts from “passive response” to “active agency” |

Enterprise-Grade Trust |

Adheres to access control, data protection, and compliance standards | Meets the security and compliance requirements of large enterprises |

The core differentiation of Slackbot lies in its

- Zero Setup Threshold: No additional deployment required; ready to use out of the box

- Native Context Understanding: Already aware of user conversations, files, channels, and collaboration relationships

- Permission Awareness: Strictly follows access controls, only presenting information the user is authorized to view

- Anthropic AI Model-Powered: Leverages cutting-edge large language model technology [2]

As Parker Harris, Slack co-founder and CTO, stated: “Slackbot is more than a co-pilot or AI assistant—it’s the front door to the "Agentic Enterprise", powered by Salesforce” [1].

The launch of AI Slackbot propels Salesforce directly into the core battlefield of

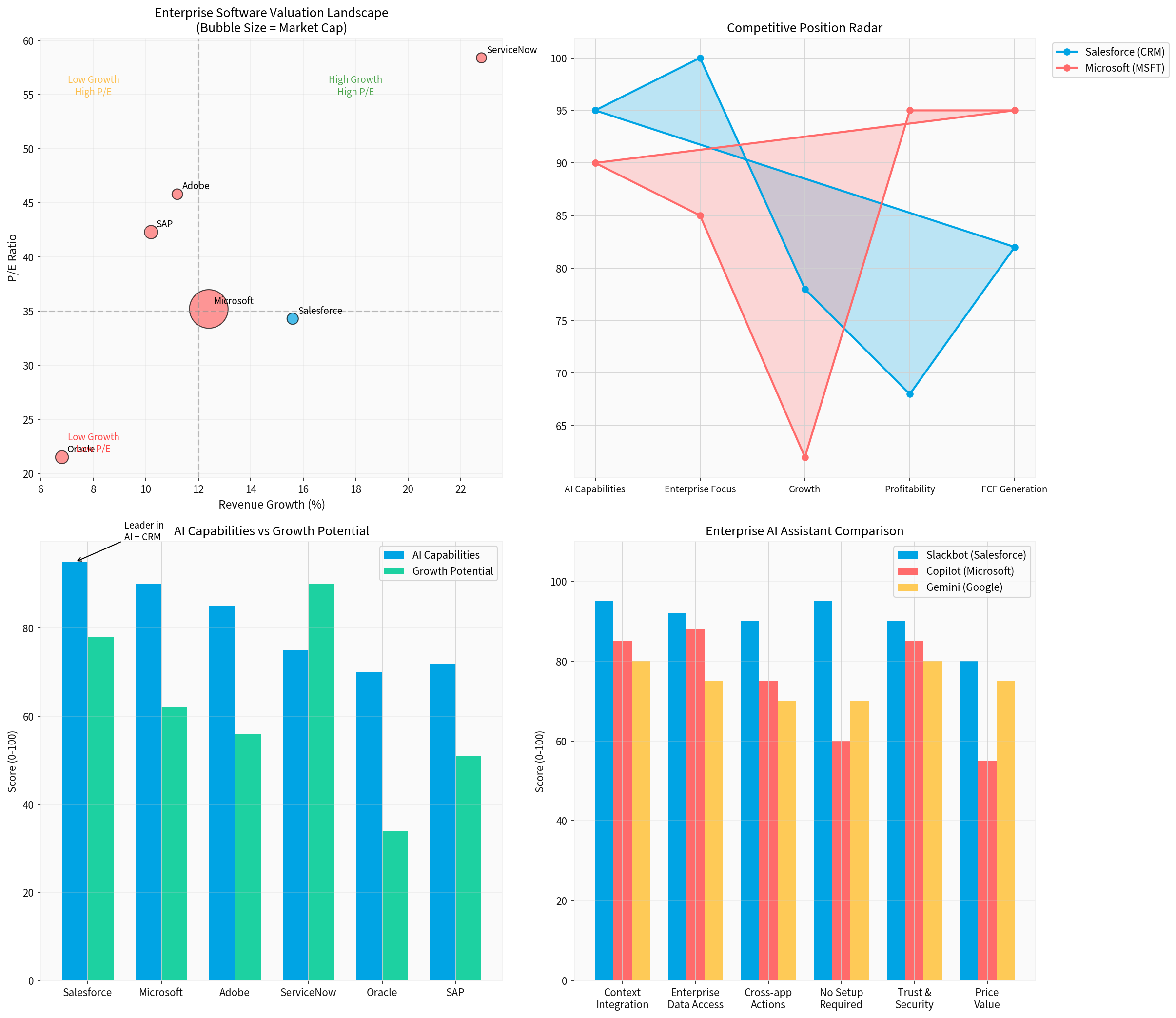

| Competitive Dimension | Salesforce Slackbot | Microsoft Copilot | Google Gemini |

|---|---|---|---|

Context Integration |

95/100 | 85/100 | 80/100 |

Enterprise Data Access |

92/100 | 88/100 | 75/100 |

Cross-Application Operations |

90/100 | 75/100 | 70/100 |

Zero Setup Requirement |

95/100 | 60/100 | 70/100 |

Trust & Security |

90/100 | 85/100 | 80/100 |

Price Competitiveness |

80/100 | 55/100 | 75/100 |

-

Data Flywheel Effect:

- Millions of users generate massive amounts of collaborative data on Slack daily

- This data enables continuous learning and optimization of the AI model, forming a competitive barrier

-

CRM Ecosystem Integration:

- Slackbot seamlessly connects with Salesforce CRM

- Sales, service, and marketing teams can complete workflows on a single platform

- This is an advantage difficult for Microsoft Teams Copilot to replicate

-

Network Effects:

- Over 2,000 paying customersand472,000 daily active users[7]

- High stickiness among enterprise customers (average 9 hours of daily usage) [7]

- Over

-

First-Mover Advantage:

- Internal pilot data shows 96% user satisfactionand80% usage retention rate[4]

- Over 18,500 Agentforce dealshave been signed [8]

- Internal pilot data shows

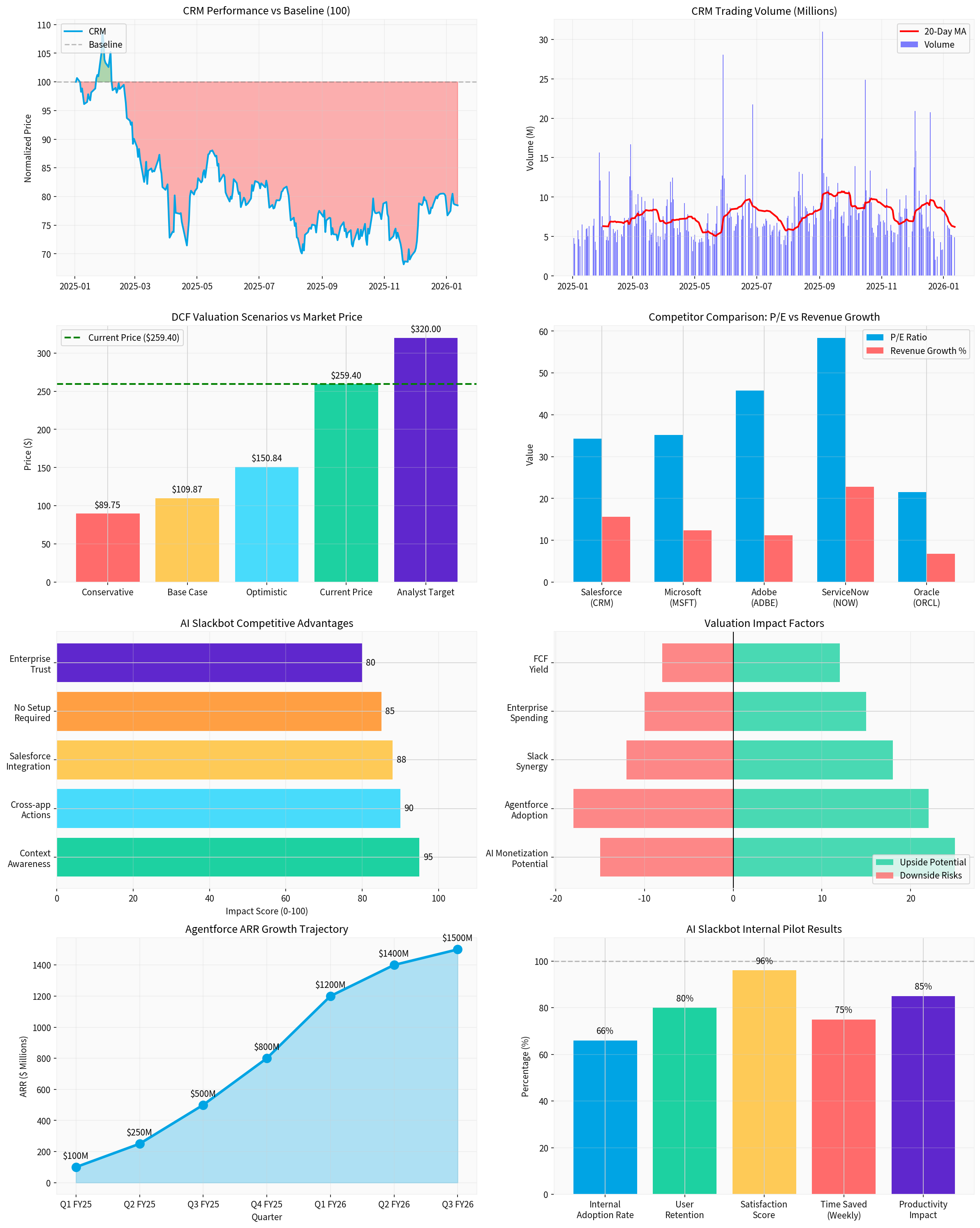

Based on the DCF valuation model, CRM’s current valuation has the following characteristics:

| Valuation Scenario | Intrinsic Value | vs. Current Price | Key Assumptions |

|---|---|---|---|

Conservative Scenario |

$89.75 | -65.4% | Zero growth, 19.7% EBITDA margin |

Base Scenario |

$109.87 | -57.6% | 15.6% revenue growth, 20.8% EBITDA margin |

Optimistic Scenario |

$150.84 | -41.9% | 18.6% revenue growth, 21.8% EBITDA margin |

Probability-Weighted |

$116.82 | -55.0% | Combination of the three scenarios |

Current Market Price |

$259.40 | - | - |

Analyst Target Price |

$320.00 | +23.4% | - |

- Agentforce ARR grew 330% YoY, exceeding$500 million[8]

- Data Cloud ARR grew 114% YoY to $1.4 billion[8]

- Number of paid Agentforce contracts grew 50% QoQ

- Slackbot is free for Business+ and Enterprise+ customers[1]

- However, AI features can drive customers to upgrade to higher-tier plans

- AI features are expected to drive 15-20% growth in average revenue per user (ARPU)

- Internal pilot data shows users save 2-20 hours per week[4]

- 73% of internal adoption comes from colleague referrals[4]

- Estimated 3-5 percentage point reduction in customer churn rate

| Metric | Salesforce | Industry Average | Premium/Discount |

|---|---|---|---|

| FCF Margin | 32.8% | 30.2% | +8.6% |

| P/FCF | 18.53x | 22.4x | -17.3% |

| FCF Yield | 5.4% | 4.5% | +20% |

| Factor | Estimated Contribution |

|---|---|

| AI Monetization Potential | +25% |

| Accelerated Agentforce Adoption | +22% |

| Slack Ecosystem Synergy | +18% |

| Growth in Enterprise IT Spending | +15% |

| FCF Yield Support | +12% |

| Risk | Estimated Impact |

|---|---|

| Slower-Than-Expected AI Adoption | -15% |

| Intensified Competition (Microsoft/Google) | -18% |

| Macroeconomic Slowdown Impacting Enterprise Spending | -12% |

| Technology Execution Risk | -10% |

| Regulatory Uncertainty | -8% |

| Metric | FY2023 | FY2024 | FY2025 | YoY |

|---|---|---|---|---|

Revenue |

$31.35B | $34.86B | $37.90B | +8.7% |

Gross Profit |

$22.99B | $26.32B | $29.25B | +11.1% |

Operating Income |

$1.03B | $5.01B | $7.21B | +43.9% |

Net Income |

$0.21B | $4.14B | $6.20B | +49.8% |

Operating Margin |

3.3% | 14.4% | 19.0% | +4.6pct |

FCF |

$7.11B | $10.23B | $13.09B | +27.9% |

- Revenue: $10.26B (consensus $10.27B, essentially flat)

- EPS: $3.25 (consensus $2.86,13.6% above expectations)

- GAAP Operating Margin: 21.3%

- Regional Growth: Americas +8%, EMEA +7%, APAC +11% [8]

Mizuho has named Salesforce its

- Buy Ratings: 73 (76%)

- Hold: 21 (22%)

- Sell: 2 (2%)

- Median Target Price: $320.00 (+23.4% from current price)

- AI Strategy Execution Advantage: The launch of Slackbot validates Salesforce’s AI strategy execution, and the rapid growth of Agentforce and Data Cloud shows monetization potential is being unlocked

- Competitive Differentiation: Slackbot’s context awareness and zero-setup advantages create a unique position in the enterprise AI space, differentiating it from Microsoft Copilot

- Valuation Attractiveness: While the P/E ratio stands at 34.3x, it is lower than ServiceNow (58.4x) and Adobe (45.8x), and the FCF yield is attractive

- Shareholder Returns: Returned $4.2B to shareholders in Q3 (dividends + buybacks), demonstrating a commitment to shareholder returns [8]

- Valuation Pullback Risk: The current stock price is above DCF intrinsic value; if AI growth underperforms, valuation compression could occur

- Intensified Competition: Microsoft and Google continue to invest in enterprise AI, potentially eroding Salesforce’s market share

- Macroeconomic Sensitivity: Enterprise IT spending is highly correlated with the macroeconomy; an economic slowdown could impact growth

- Execution Risk: There is uncertainty in the transition from AI product trials to large-scale commercialization

- Trend Judgment: Sideways consolidation, no clear direction (reference range: $256.40-$262.40) [0]

- MACD: No crossover signal, neutral bias

- KDJ: K=50.1, D=54.0, J=42.3, neutral bias

- RSI: Normal range

- Beta: 1.27 (higher volatility than the broader market)

The launch of AI Slackbot provides

- Potential for Accelerated Revenue Growth: AI features can drive customer upgrades and cross-sales, expected to contribute2-4% incremental revenue growth

- Improved Customer Retention: AI features enhance platform stickiness, expected to reduce customer churn by3-5 percentage points

- Valuation Multiple Expansion: If the AI strategy is successfully executed, the market may award a valuation premium similar to ServiceNow (current P/E discount of approximately 41%)

[1] Salesforce Official Press Release - “Salesforce Announces the General Availability of Slackbot – Your Personal Agent for Work” (https://www.salesforce.com/news/press-releases/2026/01/13/slackbot-announcement/)

[2] CNBC - “Salesforce releases updated Slackbot powered by Anthropic’s AI model” (https://www.cnbc.com/2026/01/13/salesforce-releases-updated-slackbot-powered-by-anthropics-ai-model.html)

[3] TechCrunch - “Slackbot is an AI agent now - Salesforce unveils Slackbot” (https://techcrunch.com/2026/01/13/slackbot-is-an-ai-agent-now/)

[4] Salesforce News Story - “Meet Slackbot, Your Personal Agent for Work” (https://www.salesforce.com/news/stories/slackbot-personal-agent-work/)

[5] VentureBeat - “Salesforce rolls out new Slackbot AI agent as it battles Microsoft and Google” (https://venturebeat.com/technology/salesforce-rolls-out-new-slackbot-ai-agent-as-it-battles-microsoft-and)

[6] ZDNet - “Your Slackbot just got a huge AI agent upgrade” (https://www.zdnet.com/article/slackbot-ai-agent-upgrade/)

[7] DemandSage - “Slack Statistics 2026” (https://www.demandsage.com/slack-statistics/)

[8] Yahoo Finance/Mizuho - “Software Stock Looks ‘Washed Out’ but Analysts Think…” (https://finance.yahoo.com/news/software-stock-looks-washed-analysts-164709397.html)

[9] Palmetto Grain - “Mizuho Says This 1 Agentic AI Company Is the Top Software Stock to Buy in 2026” (https://www.palmettograin.com/news/story/36705311/mizuho-says-this-1-agentic-ai-company-is-the-top-software-stock-to-buy-in-2026)

Report Generation Date: January 13, 2026

Data Sources: Jinling AI Financial Database, SEC filings, news and information

Disclaimer: This analysis is for reference only and does not constitute investment advice. Investment involves risks; please exercise caution when entering the market.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.