In-Depth Analysis of Hengrui Medicine's Multi-Cancer Indication Layout Strategy for HER2 ADC

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the above in-depth research data, I now provide you with a comprehensive analysis report on Hengrui Medicine’s multi-cancer indication layout strategy in the HER2 ADC track.

Hengrui Medicine’s self-developed HER2 ADC drug, Ruikang Trastuzumab (SHR-A1811), was approved for marketing in China in

This milestone marks a significant strategic breakthrough for Hengrui Medicine in the HER2 ADC track.

SHR-A1811 has undergone significant differentiated optimization in its molecular structure[1]:

| Feature | SHR-A1811 | Enhertu (DS-8201) |

|---|---|---|

| Payload | Topoisomerase I inhibitor | Topoisomerase I inhibitor |

| Drug-Antibody Ratio (DAR) | 6 | ~8 |

| Linker Technology | Chiral cyclopropyl technology (enhanced stability) | Cleavable linker |

| Therapeutic Window | Wider | Relatively narrow |

This design aims to

As the “elder statesman” in China’s innovative drug sector, Hengrui Medicine’s R&D strategy in the HER2 ADC track is highly recognizable –

The underlying logic of this strategy is:

- Avoid Enhertu’s edge: Enhertu has built strong market barriers in the field of HER2-positive breast cancer

- Seize niche markets: Establish first-mover advantages in indications where Enhertu has not yet deeply penetrated

- Diversify risks: Do not rely on a single indication, and build diversified revenue sources

To date, SHR-A1811 has accumulated

| Cancer Type | Indication Phase | Urgency of Clinical Demand |

|---|---|---|

Non-Small Cell Lung Cancer (NSCLC) |

Approved for marketing | High |

HER2+ Breast Cancer |

NDA accepted / Under priority review | High |

HER2-Low Expressing Breast Cancer |

Prospective layout in progress | High |

Colorectal Cancer |

Granted breakthrough therapy designation | High |

Gastric Cancer |

In clinical development | High |

Biliary Tract Cancer |

Granted breakthrough therapy designation | High |

Ovarian Cancer |

Granted breakthrough therapy designation | High |

Cervical Cancer |

Granted breakthrough therapy designation | Medium |

Breast Cancer Neoadjuvant Therapy |

Prospective layout in progress | Medium |

Notable differentiated indications include[2]:

- “HER2-positive colorectal cancer that has failed prior treatment with oxaliplatin and fluorouracil”

- “Platinum-resistant recurrent HER2-expressing ovarian cancer”

Hengrui Medicine is advancing the R&D of a

- November 2025: Registered for Phase I trial of the subcutaneous injection version

- Planned enrollment: 107 patients with advanced solid tumors

- Dose groups: Three dose groups of 4.8, 6.4, 8.0 mg/kg

- Head-to-head comparison: Compared with the 4.8 mg/kg intravenous version

- Primary endpoint: PK and safety 21 days after administration

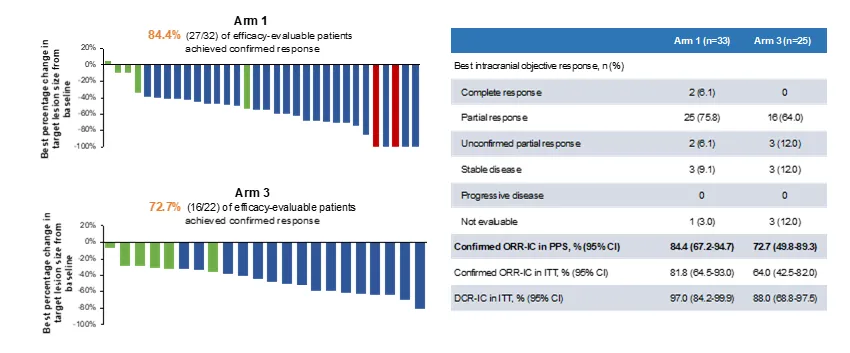

SHR-A1811 demonstrated excellent efficacy in previously treated patients with HER2-mutated advanced NSCLC[1]:

| Index | Data |

|---|---|

| Objective Response Rate (ORR) | 74.5% |

| Confirmed Objective Response Rate (cORR) | 58.3% |

| Disease Control Rate (DCR) | 91.7% |

| ORR in Patients with Baseline Brain Metastases | 87.5% |

Although Hengrui Medicine’s layout in the breast cancer track is “not considered a ‘heavy punch’”, its layout strategy is steady[2]:

| Indication | Development Stage | Status |

|---|---|---|

| HER2+ Breast Cancer Second-Line Therapy | NDA accepted | Under priority review procedure |

| HER2+ Breast Cancer Neoadjuvant Therapy | Clinical exploration | Prospective layout |

| HER2-Low Expressing Breast Cancer | Clinical exploration | Prospective layout |

Enhertu, co-developed by Daiichi Sankyo/AstraZeneca, has evolved into a “complete form”[2]:

| Achievement | Details |

|---|---|

| Breast Cancer First-Line Therapy | Approved in combination with pertuzumab |

| Adjuvant Therapy | Positive results from Phase III studies such as DESTINY-Breast05 |

| Neoadjuvant Therapy | Actively being pursued |

| Approved Indications | Covers breast cancer, gastric cancer, lung cancer, gastroesophageal junction cancer, colorectal cancer |

| Company | Core Product | Strategic Positioning | Differentiated Advantage |

|---|---|---|---|

Hengrui Medicine |

SHR-A1811 | “Rural Surrounding Cities” across multi-cancer indications | 9 breakthrough therapy designations, strong clinical execution capabilities |

Kelun Biotech |

A166 (Bodu Trastuzumab) | Following in Enhertu’s footsteps | First domestic ADC approved for HER2+ breast cancer second-line therapy; mPFS 11.1 months vs T-DM1 4.4 months |

RemeGen |

Vidutolimab (RC48) | “Tianji’s Horse Racing” | First-mover advantages in gastric cancer and urothelial cancer; $2.6 billion licensing deal with Seagen |

Betalab Therapeutics |

T-Bren (BL-M07D1) | Directly competing with Enhertu | NSCLC ORR 62%, 6-month DoR rate 95.7%; aggressive global layout |

Degree of Differentiation

Low High

┌─────────────────────────────────┐

Mainstream │ Kelun Biotech │ Betalab Therapeutics │

Market │ (Breast Cancer 2L) │ (Breast Cancer 1L) │

Competition │ │ │

Intensity ├─────────────────────┼─────────────────────────┤

Niche │ Hengrui Medicine │ RemeGen │

Market │ (Multi-Cancer Layout)│ (Gastric/Urothelial Cancer) │

└─────────────────────┴─────────────────────────┘

Hengrui Medicine and RemeGen have “quite similar layout ideas, both focusing on the differentiated path of ‘avoiding Enhertu’s edge and seizing niche indications’. However, the core gap between them lies in clinical execution capabilities” – as a leading enterprise deeply engaged in innovative drugs for many years, Hengrui Medicine has advantages in[2]:

- Clinical trial advancement efficiency

- Standardization of data disclosure

- Commercialization capabilities

that have been verified by the industry, significantly outperforming peers such as RemeGen.

“Perhaps SHR-A1811 is not currently the ‘most competitive single-point product’ in the HER2 ADC track, but relying on the breadth of its multi-cancer indication layout, the speed of clinical advancement, and Hengrui Medicine’s commercialization capabilities, this drug has become an unignorable core force in the HER2 ADC industry”[2].

- Sales network: Although streamlined to about 10,000 people, it remains the most powerful commercialization team in China[4]

- Coverage capability: Can quickly cover thousands of grade hospitals across the country

- Medical insurance negotiation capability: Multiple innovative drugs including SHR-A1811 were successfully included in medical insurance in 2024

Hengrui Medicine’s modular ADC innovation platform (HRMAP), built over more than a decade of accumulation, demonstrates strong engineering capabilities[4]. This

- Support rapid iteration of multiple ADC drug candidates

- Ensure quality consistency in manufacturing

- Provide technical endorsement for international cooperation under the NewCo model

As Enhertu extends to areas such as adjuvant therapy and neoadjuvant therapy, it may further compress the market space of domestic ADCs[2].

In core indications such as breast cancer, SHR-A1811 may need to conduct head-to-head comparisons with Enhertu in the future. If it fails to show significant advantages, it will affect peak sales forecasts[4].

If the medical insurance reimbursement standard is significantly reduced in the future, or if unfavorable changes occur in the simplified renewal rules for innovative drugs, it will compress the product’s life cycle value[4].

Hengrui Medicine adopts the NewCo model to promote internationalization, relying on the advancement efficiency of partners. If partners encounter problems in financing or clinical operations, it will directly affect milestone revenue[4].

| Time Period | Return |

|---|---|

| 1 Year | +50.71% |

| 6 Months | +13.39% |

| 3 Months | -3.67% |

| YTD | +2.28% |

As of January 13, 2026, Hengrui Medicine’s stock price is

| Index | Value | Industry Status |

|---|---|---|

| ROE | 14.19% | Healthy |

| Net Profit Margin | 24.10% | Excellent |

| Operating Profit Margin | 27.72% | Excellent |

| Current Ratio | 6.55 | Extremely strong liquidity |

| Debt Risk | Low | Financially sound[0] |

The market’s valuation of Hengrui is shifting from

- Traditional business: Given a PE multiple of 15-20x for generics and mature innovative drugs

- Innovative pipeline: For assets in late-stage clinical development with verified commercial value such as SHR-A1811, independent valuation should be given with reference to the DCF model

- Cash and equity: Equity held by NewCo and book cash should be added back separately

As the proportion of innovative drug revenue increases, Hengrui’s reasonable PE multiple is expected to recover from 20-30x at the bottom of volume-based procurement to

- Accelerate approval of breast cancer second-line therapy: Ensure SHR-A1811 is approved as soon as possible for the indication of HER2+ breast cancer second-line therapy

- Deepen penetration of lung cancer market: As the first domestic HER2 ADC approved for this indication, quickly establish market position

- Promote medical insurance negotiation: Strive to include more indications in medical insurance in the next medical insurance negotiation cycle

- Expand multi-cancer indications: Complete NDA for key indications such as colorectal cancer, gastric cancer, and biliary tract cancer

- Commercialize subcutaneous injection formulation: If approved, it will significantly improve patient compliance and market competitiveness

- Internationalization implementation: Achieve overseas commercialization of core products through the NewCo model

- Develop combination therapies: Explore the potential of combined application with PD-1/PD-L1 inhibitors

- Layout drug-resistant scenarios: Conduct prospective layout for treatment needs after drug resistance to mainstream drugs such as Enhertu

- Iterate next-generation ADC platform: Continuously launch more competitive next-generation products relying on the HRMAP platform

Hengrui Medicine’s multi-cancer indication layout strategy in the HER2 ADC track

| Competitive Advantage Dimension | Evaluation |

|---|---|

Strategic Differentiation |

★★★★☆ Avoids Enhertu’s edge and establishes first-mover advantages in niche markets |

Clinical Execution Capabilities |

★★★★★ Leading clinical operation capabilities among leading enterprises in the industry |

Commercialization Capability |

★★★★★ Supported by the most powerful commercialization team in China to drive product scaling |

Platform Capability |

★★★★☆ HRMAP platform provides continuous innovation momentum |

International Layout |

★★★★☆ NewCo model avoids risks while achieving global expansion |

Financial Soundness |

★★★★★ Low debt risk, strong cash flow supports R&D investment |

This strategy is particularly suitable for industry leaders with systematic advantages like Hengrui Medicine –

[1] Liangyihui - “From ‘Raw Stone’ to Clinical Cornerstone: Target Deepening and Treatment Pattern Remodeling of ADC Drugs for Lung Cancer” (http://www.liangyihui.net/doc/161398)

[2] 36Kr - “HER2 ADC Narrowing the Circle: Live or Die for Domestic Players?” (https://www.36kr.com/p/3635886719960325)

[3] Drugtimes - “Betalab Therapeutics, Hengrui, Zhengda Tianqing Simultaneously Advance HER2 ADC Innovative Drugs!” (https://www.drugtimes.cn/kuaixun/)

[4] PharnexCloud - “In-Depth Research Report on Hengrui Medicine: Leading Innovative Drugs, ADC, Chronic Diseases, and Overseas Expansion Engine” (https://www.pharnexcloud.com/zixun/sd_266131)

[0] Jinling API Market Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.