In-Depth Analysis of the Differentiated Advantages of Lepu Biopharma's "IO+ADC" Combination Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest collected market data and research materials, I will prepare an in-depth analysis report on the differentiated advantages of Lepu Biopharma’s “IO+ADC” combination strategy in the red-sea HER2 ADC market.

The HER2 ADC sector is rapidly shifting from a “blue ocean” to a “red ocean”. With AstraZeneca/Daiichi Sankyo’s Enhertu (Trastuzumab Deruxtecan) continuing to advance to earlier-line indications, this track is approaching the final round, and the industry is likely to enter a fierce knockout stage [1].

From the perspective of competitive landscape, major domestic players have formed clear strategic divisions:

| Company | Core Product | Differentiation Strategy | Indication Layout |

|---|---|---|---|

| RemeGen | Disitamab Vedotin | Avoid Direct Competition (Tian Ji’s Horse Racing Strategy) | Gastric cancer, urothelial carcinoma, breast cancer liver metastasis |

| Kelun Biotech | Batuzotuzumab (A166) | Replicate Enhertu’s Path | Second-line HER2+ breast cancer (approved) |

| BrightGene | T-Bren (BL-M07D1) | Direct Confrontation | First-line breast cancer, adjuvant/neoadjuvant therapy |

| Hengrui Medicine | SHR-A1811 (Ruiqang Trastuzumab) | Surround the Cities from the Countryside | Multi-cancer layout including NSCLC |

| Lepu Biopharma | MRG002 | IO+ADC Combination Ecosystem | Urothelial carcinoma, breast cancer, etc. |

Enhertu has established strong market barriers:

- Indication Coverage: Advancing from second-line and later-line treatment for HER2+ breast cancer to first-line treatment, and currently making progress in adjuvant and neoadjuvant therapy fields [1]

- Clinical Data Advantages: Demonstrated “efficacy-dominating” clinical data in multiple pivotal Phase III studies

- Global Layout: Approved for marketing in major markets including China, the US, Europe, and Japan, establishing first-mover advantage

Facing such a “boss-level” competitor, the single-product strategy of domestic ADC enterprises is under enormous pressure.

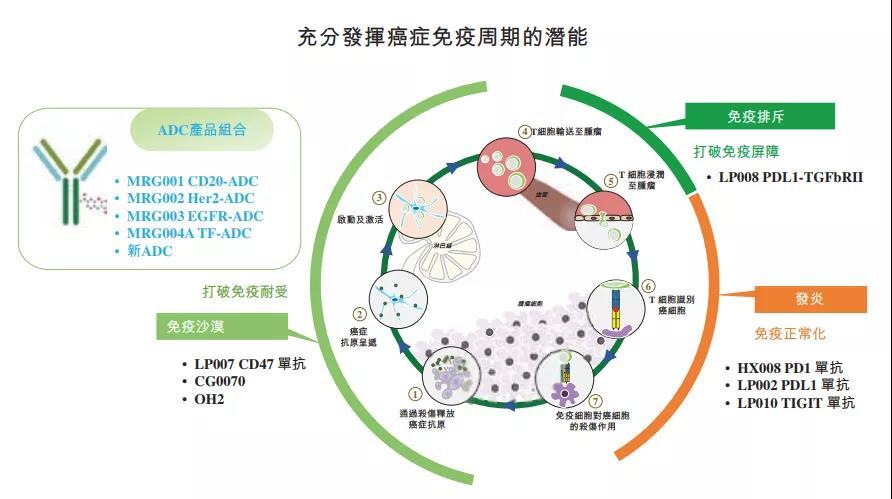

Although Lepu Biopharma is often labeled as an “ADC leader”, an in-depth analysis of its strategic layout reveals that the company’s core competitiveness lies not in a single ADC drug, but in the construction of a

From a revenue logic perspective, the sales growth of Putilizumab (Lepu Biopharma’s self-developed PD-1 inhibitor) is the core revenue driver for Lepu Biopharma. The core value of multiple ADC drugs including MRG002 is to build a solid competitive moat for the PD-1 drug through combination regimens.

Lepu Biopharma has built a multi-level “IO+” combination therapy matrix [2][3]:

- “Putilizumab + MRG002 (HER2 ADC)”

- “Putilizumab + MRG003 (EGFR ADC)”

- “Putilizumab + CG0070 (Oncolytic Virus)”

This combination layout forms a differentiated treatment solution system, enabling Lepu Biopharma to open up a new battlefield beyond the competition of single ADC drugs.

Lepu Biopharma’s ADC pipeline has clear strategic divisions:

| Product | Target | Monotherapy Positioning | Combination Value |

|---|---|---|---|

| MRG002 | HER2 | Niche scenario of breast cancer liver metastasis | Enhance the efficacy of PD-1 in solid tumors |

| MRG003 | EGFR | The first domestically developed EGFR-ADC in China to be approved imminently | Break through immunotherapy-resistant populations |

| CMG901 | Claudin 18.2 | The world’s most advanced Claudin 18.2 ADC | Breakthrough in gastric cancer |

| MRG004 | TF | The most advanced domestically developed TF-ADC | Refractory tumors such as pancreatic cancer |

| MRG006A | GPC3 | The first domestically developed GPC3 ADC to enter clinical trials | Fields such as liver cancer |

At the 2025 ESMO Congress, Lepu Biopharma released long-term follow-up results of a Phase II study [3]:

- 30 patients with recurrent/metastatic nasopharyngeal carcinoma (R/M-NPC) who previously failed immunotherapy and platinum-based therapy

- 96.7% (29/30) had previously received PD-(L)1 therapy

- 30% (9/30) had received EGFR monoclonal antibody therapy

| Metric | Result | Industry Significance |

|---|---|---|

| Confirmed ORR | 73.3% | Highest in similar studies |

| DCR | 93.3% | Significantly better than historical data |

| Median PFS | 10.9 months | Longest in similar studies |

| Median DoR | 12.1 months | Durable response |

| 12-month OS Rate | 92.8% | Trend of long-term survival benefit |

| 18-month OS Rate | 85.7% | Preliminary indication of OS improvement |

The high-dose treatment group (DL2) showed encouraging efficacy:

- ORR: 60%

- DCR: 100%

- 12-month DoR Rate: 100%—— All patients who achieved response remained in continuous response at the data cutoff [3]

Clinical data from a study involving 43 urothelial carcinoma patients showed [2]:

| Metric | Result |

|---|---|

| Investigator-assessed ORR | 55% |

| CR | 8% |

| DCR | 89% |

| DoR (patients with complete response) | >9.5 months |

Compared with the strategies of other competitors, Lepu Biopharma has chosen a completely different competitive path:

| Competitor Strategy | Lepu Biopharma Strategy |

|---|---|

| Directly challenge Enhertu (BrightGene) | Break through drug-resistant bottlenecks via combination strategy |

| Focus on large indication of breast cancer (Kelun Biotech) | Cover multiple cancers with combination therapies |

| Deeply cultivate a single target (RemeGen) | Multi-target ADC+IO ecosystem |

| Independent global advancement (EOC Pharma) | Maximize synergistic effects |

The strategic positioning of Lepu Biopharma’s MRG002 is not to pursue single-product sales growth, but to act as an “efficacy-enhancing partner” to further amplify the clinical value and market competitiveness of Putilizumab [2]. In the current context where competition in the HER2 ADC monotherapy track is becoming a red sea, this combination layout with “IO as the core and ADC as the auxiliary” is a differentiated survival strategy to avoid direct confrontation.

The synergistic effect of MRG003 and Putilizumab has a clear biological basis [3]:

- MRG003: Achieve direct killing of tumor cells through precise delivery of cytotoxic drugs

- Putilizumab: Enhance the body’s immune response by removing immunosuppression and reactivating T cell activity

- Synergistic Effect: The two act on different pathways of tumor treatment respectively, achieving a dual effect of “internal and external attack”, forming a “1+1>2” synergistic effect, and bringing a deeper and more durable anti-tumor response

Lepu Biopharma has established a significant first-mover advantage in the field of “IO+ADC” combination therapy:

- MRG003’s Leading Progress: BLA application has been submitted, making it the first domestically developed EGFR-ADC in China to apply for marketing [4]

- Regulatory Certifications: MRG003 for nasopharyngeal carcinoma has successively received FDA’s Orphan Drug Designation, Fast Track Designation, and Breakthrough Therapy Designation

- Clinical Data Advantages: It is one of the few regimens with clear combination efficacy data, while most enterprises are still in the layout stage

Lepu Biopharma’s commercialization logic is clear [4]:

- Putilizumabwas commercialized in 2022, and continues to expand new indications through combination with ADC drugs to increase revenue

- The core value of ADC drugsis to build a competitive moat for PD-1 drugs, rather than single-product sales growth

- Actively seek BD collaborationsto amplify the commercial value of the pipeline (e.g., CMG901 has successfully out-licensed overseas)

According to Pacific Securities’ forecast, Lepu Biopharma’s revenue will show rapid growth:

| Year | Revenue (RMB 100 million) | YoY Growth | Main Driver |

|---|---|---|---|

| 2024E | 3.06 | - | Sales growth of Putilizumab |

| 2025E | 5.04 | 65% | Approval of MRG003 + growth of Putilizumab |

| 2026E | 8.70 | 73% | Harvest period of ADC pipeline |

| 2027E | 16.18 | 86% | Launch of multiple products |

| 2028E | 28.67 | 77% | Synergistic effect of combination therapies |

| Product | 2025E | 2026E | 2027E | 2028E |

|---|---|---|---|---|

| Putilizumab | 3.74 | 5.32 | 6.43 | 8.15 |

| MRG003 | 1.92 | 5.83 | 11.23 | 13.47 |

| MRG002 | 0.36 | 1.80 | 2.73 | 3.86 |

| CMG901 (Revenue Share) | 0.12 | 0.40 | 1.49 | 2.29 |

| CG0070 | 2.00 | 4.21 | 6.64 | 8.37 |

| MRG004A | - | 1.94 | 4.70 | 8.43 |

Total |

4.04 |

7.60 |

16.18 |

28.67 |

According to Pacific Securities’ valuation model [4]:

- Discounted Cash Flow (DCF) Valuation Method: Corresponding market capitalization of HK$10.08 billion

- Pipeline Peak Sales Multiple Method: Corresponding market capitalization of HK$11.41 billion

Initiates coverage with a “Buy” rating.

- R&D progress of drug candidates may fall short of expectations

- The safety of combination therapies requires larger-scale clinical verification

- Technology platforms may face challenges of updating and iteration

- Global giants such as Enhertu continue to squeeze market space

- Intensified competition among domestic ADC enterprises, risk of price wars

- Combination strategy may be imitated by competitors

- Uncertainty in the sales growth rate of Putilizumab

- BD collaboration progress may fall short of expectations

- Medical insurance negotiations may affect product pricing and profitability

Lepu Biopharma’s differentiated advantages in the red-sea HER2 ADC market are mainly reflected in the following aspects:

- Differentiated Strategic Positioning: Break away from single ADC drug competition and build an “IO+ADC” combination therapy ecosystem

- Differentiated Clinical Data: Show breakthrough efficacy in drug-resistant populations, filling clinical gaps

- Differentiated Pipeline Synergy: Multi-target ADCs form synergistic effects with PD-1 to amplify overall value

- Differentiated First-Mover Advantage: MRG003 is expected to become the first domestically approved EGFR-ADC in China

Lepu Biopharma has the following investment highlights:

- High Certainty of Performance Growth: Putilizumab continues to grow in sales, and the ADC pipeline enters the harvest period

- Large Valuation Upside Potential: Multiple drugs with FIC potential are in R&D, driven by both commercialization and BD

- Clear Differentiated Competitive Advantages: The “IO+ADC” strategy avoids direct confrontation and builds a unique ecological moat

It is recommended to pay attention to catalysts such as the approval progress of Lepu Biopharma’s ADC pipeline, updates of clinical data of combination therapies, and progress of BD collaborations.

[1] Jinduan Research Institute - “HER2 ADC Market Shrinks, Domestic Players: Live or Die?” (https://news.pedaily.cn/202601/559755.shtml)

[2] Jinduan Research Institute - “HER2 ADC Market Shrinks, Domestic Players: Live or Die?” Tencent News Version (https://news.qq.com/rain/a/20260112A01DTT00)

[3] Lepu Biopharma Official Website - “ESMO 2025 | Lepu Biopharma ‘Launches Three Arrows’ to Target the Golden Track of ADC+IO” (https://www.lepubiopharma.com/joindetail/220.html)

[4] Pacific Securities - “In-Depth Report on Lepu Biopharma: Commercialization Shows Initial Results, ADC Pipeline Enters Harvest Period” (https://pdf.dfcfw.com/pdf/H3_AP202412231641399207_1.pdf)

[5] Sina Finance - “2025 Biopharmaceuticals: Let True Innovation Receive Deserved Rewards” (https://finance.sina.com.cn/stock/relnews/hk/2026-01-05/doc-inhffwpp2202348.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.