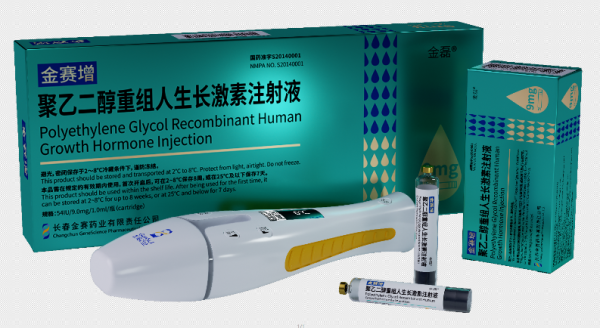

Impact Analysis of Changchun High-Tech's Growth Hormone Inclusion in Medical Insurance: 75% Price Cut Hits Profits

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and in-depth analysis, the following is a detailed analysis report on

Starting from January 1, 2026, the new version of the “National Basic Medical Insurance, Maternity Insurance and Work-Related Injury Insurance Drug Catalogue” was officially implemented, and

| Product Type | Pre-Price Cut (RMB/vial) | Medical Insurance Reimbursement Price (RMB/vial) | Reduction Rate |

|---|---|---|---|

Jinsai Zeng (9mg Long-acting Water Injection) |

~3,500 | ~900 | 74.3% |

| Saizeng (Short-acting Water Injection) | ~1,000 | 300 | 70.0% |

| Short-acting Powder Injection | ~300 | 250 | 16.7% |

| Competitor Yipeisheng (5mg) | 1,798 | 853.2 | 52.6% |

According to the latest financial report data [0]:

- Operating Revenue: RMB 13.466 billion, down 7.55% year-on-year

- Net Profit Attributable to Shareholders: RMB 2.583 billion, down 43.01% year-on-year

- Net Profit Margin: 19.18%, halved compared to 38.57% in 2020

- Estimated Growth Hormone Business Revenue: Approximately RMB 9.426 billion (accounting for about 70% of total revenue)

Based on the above financial data, scenario analysis of the impact of medical insurance price cuts is conducted:

| Scenario | Assumptions | Impact on Revenue | Adjusted Net Profit | Net Profit Reduction |

|---|---|---|---|---|

Baseline |

2024 actual data | - | RMB 2.583 billion | - |

Scenario 1 |

Only long-acting water injection price cut by 75% | -RMB 2.121 billion | RMB 462 million | -82.1% |

Scenario 2 |

All products average price cut by 50% | -RMB 4.713 billion | -RMB 2.130 billion |

-182.5% |

Scenario 3 |

50% price cut + 30% sales volume growth offset | -RMB 1.885 billion | RMB 698 million | -73.0% |

-

Extreme Impact Scenario: If all products are sold at medical insurance prices (Scenario 2), the company will switch from profit toa loss of over RMB 2.1 billion

-

Controllable Actual Impact: Considering:

- Prescription drugs require professional doctor guidance, so hoarding is impossible [1]

- The price reduction rate of short-acting powder injection is only 16.7%, which can serve as a profit buffer

- Sales volume growth is expected to offset part of the price decline (Scenario 3)

-

Inevitable Short-term Pain: Even in the best-case scenario (Scenario 3), net profit will still drop by approximately73%

| Year | Net Profit Attributable to Shareholders (RMB billion) | YoY Growth Rate | Net Profit Margin |

|---|---|---|---|

| 2020 | 33.08 | +71.64% | 38.57% |

| 2021 | 40.52 | +22.49% | 37.70% |

| 2022 | 41.40 | +2.17% | 32.78% |

| 2023 | 45.32 | +9.47% | 31.12% |

| 2024 | 25.83 | -43.01% |

19.18% |

| 2025Q1-Q3 | 11.65 | -58.23% |

10.81% |

- Operating Revenue: RMB 3.204 billion, down 14.55% year-on-year

- Net Profit Attributable to Shareholders: Only RMB 182 million,plunging 82.98%year-on-year

- Net Profit Margin: 5.68%, a decrease of more than 30 percentage points compared to 2020

- May 2025: Yipei Growth Hormone from Tebio Bio (688278.SH) was approved for marketing, becoming the world’s first Y-type 40kD PEGylated long-acting growth hormone

- December 2025: Novo Nordisk’s Pasi Growth Hormone was approved for marketing by the National Medical Products Administration

- Ascendis Pharma: Longpei Growth Hormone has submitted a marketing application

- Changchun High-Tech’s 10-year monopoly positionin the long-acting growth hormone market has been broken [2]

- Jinsai Pharmaceutical holds approximately 75% of the domestic market share and faces pressure from intensified competition [2]

- Multinational giant Novo Nordisk has strong marketing capabilities and channel advantages

- Price War Risk: The medical insurance price reduction exceeds expectations, which may trigger an industry price war

- Continuous Performance Deterioration: If sales volume growth cannot offset the price decline, profits will come under further pressure

- Intensified Competition: Multiple pharmaceutical companies are entering the market, and market share faces dilution

- Valuation Pressure: The current P/E ratio is 43.31 times, which is relatively high [0]

- Demand Release: The annual treatment cost has dropped from RMB 120,000 to approximately RMB 30,000, which will release suppressed rigid demand [1]

- Market Expansion: Medical insurance access is expected to promote the replacement of short-acting products with long-acting products, and the market size may expand by 1-2 times [1]

- Grassroots Market Penetration: The threshold for medication for patients in economically underdeveloped areas has been significantly reduced

[1] Science and Technology Innovation Board Daily - “Price Cut Implemented! Medical Insurance Implementation Reshapes Growth Hormone Market, Long-acting Products Launch New Battle” (https://finance.sina.com.cn/jjxw/2026-01-08/doc-inhfqcav4006546.shtml)

[2] Weikehao - “New Business Benefits Cannot Offset Basic Disk Negative Factors, Changchun High-Tech’s Market Value Drops by 80%” (https://mp.ofweek.com/Internet/a156714180627)

[3] China Times - “After Q3 Net Profit Plunges 83%, Can ‘Northeast Pharmaceutical Leader’ Changchun High-Tech Survive with Its 7th Financing?” (https://news.qq.com/rain/a/20251214A02JLL00)

[4] Jinling AI Financial Database - Corporate Financial Data and Real-time Market Quotes [0]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.