Warrior Met Coal (HCC) Stock Analysis: Record Highs and Demand Sustainability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

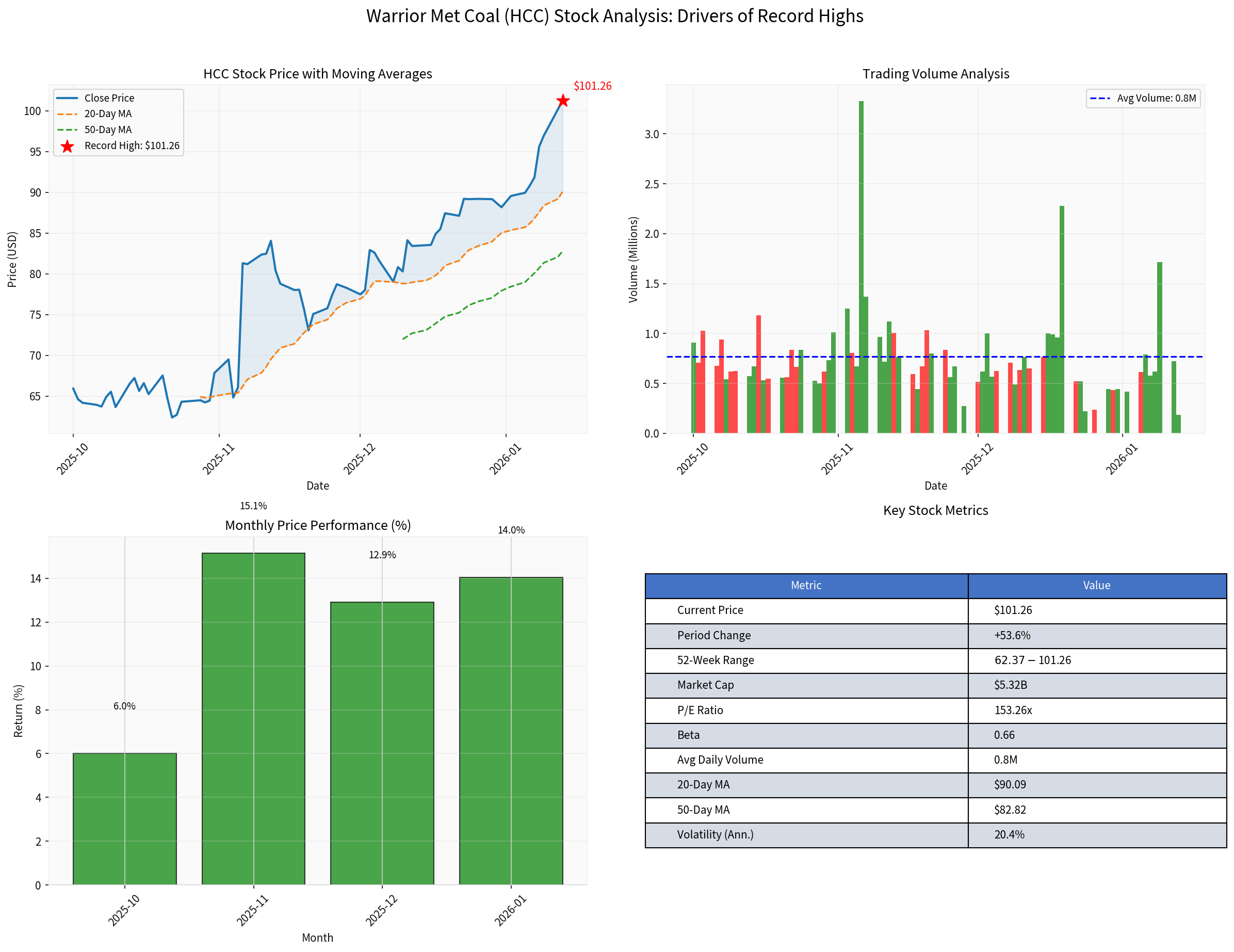

Based on my comprehensive analysis of Warrior Met Coal (HCC), I will now provide a detailed examination of the factors driving the stock to record highs and the sustainability of metallurgical coal demand.

Warrior Met Coal’s stock has reached record levels, closing at

Key Price Metrics |

Value |

|---|---|

| Current Price | $101.26 |

| 52-Week Range | $38.00 - $101.40 |

| 20-Day Moving Average | $90.09 |

| 50-Day Moving Average | $82.82 |

| Market Capitalization | $5.32 billion |

| P/E Ratio | 153.26x |

| Beta (vs SPY) | 0.66 |

The primary driver behind Warrior Met Coal’s stock surge is the

-

Australian Supply Constraints: Queensland, Australia—one of the world’s largest metallurgical coal exporters—has faced production disruptions due to weather events and mining difficulties, reducing export volumes [1].

-

U.S. Production Limitations: While Warrior Met Coal has expanded production capacity through theBlue Creek Mine project(which increases production capacity by approximately 75%), industry-wide U.S. metallurgical coal production remains constrained [2].

-

EIA Forecast: The U.S. Energy Information Administration projects that coal export volumes, particularly metallurgical coal, willimprove in 2026due to increased demand from global steel manufacturers [1].

Metallurgical coal prices have remained elevated due to:

- Chinese demand resilience: China accounts for approximately67% of global metallurgical coal consumption, projected to reach 742 Mt in 2025 [3]

- Indian steel expansion: India’s metallurgical coal demand is projected torise by 5 Mtin 2025, supported by expanding steelmaking capacity [3]

- Supply disruptions: Ongoing geopolitical tensions and mining challenges in major producing regions have kept prices high

Warrior Met Coal’s financial profile demonstrates strong operational execution [0]:

- Conservative accounting practiceswith high depreciation ratios, indicating potential earnings improvement as investments mature

- Low debt riskclassification, providing financial flexibility

- Flawless balance sheet with high growth potentialaccording to Simply Wall St analysis [2]

The company has adopted a

- Regular dividend distributions

- Share buyback programs

- Disciplined capital allocation

The global steel industry remains

Region |

Steel Production Outlook |

Met Coal Impact |

|---|---|---|

| China | Stable (~742 Mt demand) | Largest consumer, slight increase expected |

| India | Growing (+5 Mt) | Primary growth driver |

| EU/Japan/Korea | Declining | Reduced BF-BOF share, EAF transition |

| Emerging Markets | Marginal growth | Infrastructure-driven demand |

The International Energy Agency (IEA) projects

Metallurgical coal demand is closely tied to:

- Infrastructure developmentin emerging economies

- Urbanizationin Asia and Africa

- Construction activityin developing nations

These drivers are expected to support

The energy transition presents both challenges and opportunities for metallurgical coal demand:

- Global met coal demand is forecast to decline by 53 Mtbetween 2025 and 2030 [3]

- China’s demand could fall by 77 Mt, offset by gains in India (+26 Mt) and Indonesia (+12 Mt)

- EU, Japan, and Korea are projected to see combined declines of 21 Mt[3]

- Hydrogen-based direct reduced iron (DRI) technology remains promising but faces cost barriers[5]

- Green hydrogen steel production (e.g., H2 Green Steel) is targeting commercial scale by 2027-2030 [6]

- Steel decarbonization progress in 2025 was described as “stagnant but far from static”, with conventional blast furnace investments continuing to outpace cleaner alternatives [5]

Technology |

Status |

Timeline to Scale |

|---|---|---|

| Hydrogen DRI | Pilot/early commercial | 2027-2030+ |

| BF-BOF with CCS | Limited deployment | 2030+ |

| Electric Arc Furnace (EAF) | Growing | Ongoing |

| Biomass injection | Emerging | 2030+ |

The IEA notes that

India is positioned to become the

- Expanding steelmaking capacity

- Robust industrial activity

- Limited access to alternative production technologies in the near term

- Production Expansion: Blue Creek Mine completion enhances capacity by~75%, supporting future cash flow growth [2]

- Valuation Opportunity: Some analysts suggest HCC is40.7% undervaluedwith a fair value estimate of $169.05 [2]

- Strong Cash Generation: Focus on shareholder returns and debt reduction

- Near-Term Supply Deficit: Continued supply constraints support elevated pricing

- India Growth Story: Structural demand growth from Indian industrialization

-

Technical Overbought Conditions:

- KDJ indicator at K:90.1, D:83.8, J:102.7 [0]

- RSI indicates overbought risk

- Potential short-term correction

-

Energy Transition Headwinds:

- Long-term demand decline projected by IEA

- Policy pressure in developed markets

- Technology disruption risk

-

Valuation Concerns:

- P/E Ratio of 153.26xis extremely high, implying significant growth expectations

- Current pricing may not be sustainable if coal prices normalize

-

Concentration Risk:

- Exposure to global steel cycles

- Commodity price volatility

Warrior Met Coal is positioned to benefit from:

- Continued metallurgical coal supply deficits

- Export volume improvements projected for 2026

- Strong pricing environment

The stock is in an

The sustainability of current demand levels depends on:

- India’s steel expansion pace(primary growth variable)

- China’s economic trajectory(largest consumer)

- Green steel technology commercialization(key disruptor)

The company’s low-beta profile (0.66) and strong balance sheet provide resilience against market volatility, but

Warrior Met Coal’s record-high stock price reflects a confluence of

- Global decarbonization trends in the steel industry

- Technology transitions toward green steel production

- Structural demand declines in developed economies

While the transition away from coal-based steelmaking is

[0] 金灵AI - 实时股票数据、技术分析与财务分析 (HCC实时报价、技术指标、财务数据)

[1] NASDAQ - “Zacks Industry Outlook Highlights Warrior Met, Peabody Energy and Ramaco” (https://www.nasdaq.com/articles/zacks-industry-outlook-highlights-warrior-met-peabody-energy-and-ramaco)

[2] Simply Wall St - “What Warrior Met Coal (HCC)'s Cash-Generation And Capital Return” (https://simplywall.st/stocks/us/materials/nyse-hcc/warrior-met-coal/news/what-warrior-met-coal-hccs-cash-generation-and-capital-retur)

[3] IEA - “Coal 2025: Demand” (https://www.iea.org/reports/coal-2025/demand)

[4] The Business Research Company - “Metallurgical Coal Market 2025” (https://www.thebusinessresearchcompany.com/graphimages/Metallurgical_Coal_Market_2025_Graph.webp)

[5] SteelWatch - “Steel decarbonisation in 2025: stagnant but far from static” (https://steelwatch.org/commentary/steel-decarbonisation-in-2025-stagnant-but-far-from-static/)

[6] OREACO - “Ferrous Finance: Decarbonization’s $1.4 Trillion Dilemma” (https://www.oreaco.com/news/english/virferrox/steel-industry-decarbonization-funding-green-loans-hydrogen-dri-electric-arc-furnace-climate-finance)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.